Green Coffee Market Report by Type (Arabica, Robusta), Product (Roasted Coffee, Instant/Soluble Coffee, Green Coffee Bean Extract), Distribution Channel (Hypermarkets and Supermarkets, Departmental Stores, Specialty Stores, Online, and Others), End User (Retail, Coffee cafes, and Others), and Region 2026-2034

Green Coffee Market Size:

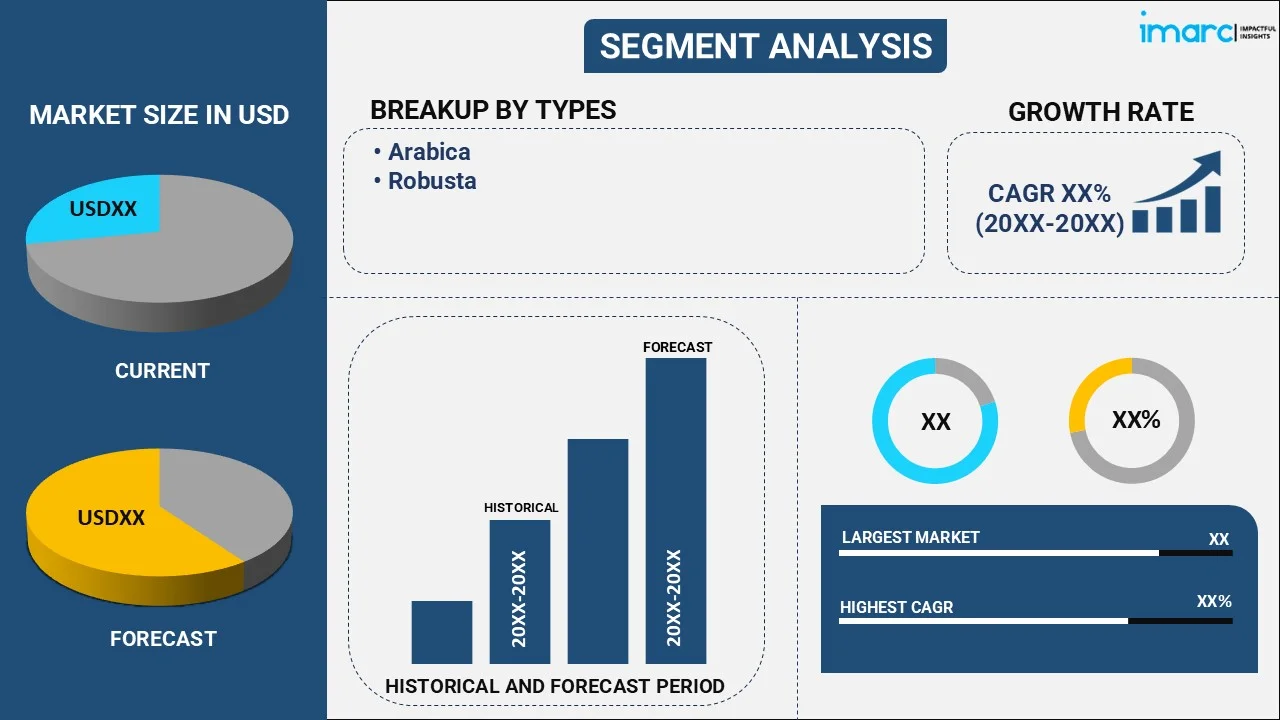

The global green coffee market size reached USD 39.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 54.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.48% during 2026-2034. The market is primarily driven by rising coffee consumption, significant expansion of the e-commerce sector, and the growing specialty coffee industry, which reflects consumer preferences for premium, sustainable, and unique coffee products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 39.7 Billion |

|

Market Forecast in 2034

|

USD 54.5 Billion |

| Market Growth Rate 2026-2034 | 3.48% |

Green Coffee Market Analysis:

- Major Market Drivers: The rising demand for premium quality green coffee beans and changing consumer taste for specialty and gourmet coffee are influencing the green coffee market growth. Additionally, the growing popularity of single-origin and micro-lot green coffee beans is meeting consumer demand for distinctive flavor profiles and product traceability.

- Key Trends: The ideal climate conditions and growing investments in coffee farming are leading the supply chain side of the industry, which is influencing changes in production capacity. Additionally, the growing popularity of single-origin and micro-lot green coffee beans is meeting consumer demand for distinctive flavor profiles and product traceability.

- Geographical Trends: The green coffee market recent developments include the changing production capacity with several countries like Brazil, Colombia, and Ethiopia which is dominating the supply chain side owing to favorable climate conditions and growing investments in coffee cultivation. Moreover, the increasing cultivation of specialty green coffee in regions such as East Africa and Central America, offering distinct flavor profiles are contributing to market diversification.

- Competitive Landscape: Some of the major green coffee companies include Atlantica Coffee (Montesanto Tavares Group), Belco S.A., Golden Bean Trade, Merchants of Green Coffee, Neumann Kaffee Gruppe, Nordic Approach AS, The Bean Coffee Company, The Green Coffee Brazil (Group MAGNUS BRAZIL), WSCafe, etc. among many others.

- Challenges and Opportunities: Supply chain management and profit margins are facing some challenges with coffee pricing due to weather variations, currency exchange rates, and geopolitical unrest. According to the green coffee market, recent opportunity lies in the escalating demand for ready-to-drink (RTE) and cold brew coffee products, opening avenues for market expansion and product innovation in the green coffee space.

To get more information on this market Request Sample

Green Coffee Market Trends:

Increasing Coffee Consumption

The rising number of coffee consumers across the globe is influencing the market growth. As worldwide consumption increases continuously so does the demand for green coffee beans. In line with this, with the expansion of coffee culture, numerous individuals are employing coffee in their daily lifestyles, thus accelerating the sales of high-quality green coffee beans. The International Coffee Organization (ICO) projects that worldwide coffee consumption will increase by more than 3.0% in 2023–2024. Furthermore, it is predicted that worldwide consumption will rise by 2.2% to 177.0 million bags during the same period, with non-producing countries projected to contribute the most significantly to the total increase in consumption. This tendency is especially noticeable in developing nations where coffee consumption is rising quickly. Hence, the demand for green coffee beans is increasing which is widely adopted as a main ingredient to make roasted coffee products, thus positively impacting the green coffee market revenue.

E-Commerce Growth

The market for green coffee is expanding significantly due to the significant expansion in the e-commerce channels. Additionally, the emerging online marketplace is transforming the coffee sector to facilitate direct commerce between buyers and producers. Moreover, this direct trading mode aids customers in obtaining green coffee beans of superior quality with price transparency and ensures equitable pay to farmers. For instance, the global e-commerce market was valued at US$ 21.1 Trillion in 2023. IMARC Group projections also indicate a spectacular rise, with the market expected to reach US$ 183.8 Trillion by 2032. Based on this trajectory, there will be a strong compound annual growth rate (CAGR) of 27.16% from 2024 to 2032. Therefore, the e-commerce platforms are user-friendly and easily accessible, allowing producers and buyers to adopt e-commerce, grow their consumer base, and participate in the market. Thus, the market for green coffee continues to expand due to the advantages that online shopping offers to all parties involved in the supply chain.

Expanding Specialty Coffee Market

The green coffee market is driven by the rise of the specialty coffee industry. In addition, specialty coffee distinguished by its premium beans, distinctive tastes, and sustainable sourcing methods is influencing the market growth. There is a growing demand for green coffee beans of the highest caliber due to changing consumers' tastes toward specialty coffee owing to its unique flavor and sustainable production practices. As per the consumer survey conducted by the National Coffee Association of America nearly half (48%) of the coffee cups consumed in the United States are perceived as specialty. The U.S. coffee market holds an estimated retail value of $48 billion, with specialty coffee constituting approximately 55% of this value share. Moreover, as per the patterns of consumption, 31% percent of individuals aged 18 years old said they had specialty coffee the day before the survey. As a result, this expansion is demonstrated by the rise in specialty coffee shops, the increase in consumer expenditure on high-end coffee goods, and the expanding recognition of artisanal coffee culture throughout the world.

Green Coffee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, product, distribution channel, and end user.

Breakup by Type:

To get detailed segment analysis of this market Request Sample

- Arabica

- Robusta

Arabica accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes arabica and robusta. According to the report, arabica represented the largest segment.

Arabica coffee beans are well known for their smooth taste profile, which is frequently highlighted by subtle notes of sweetness and acidity. Additionally, customers who value exceptional quality and unique flavor sensations find it appealing. For instance, in 2023, the International Coffee Organization (ICO) released research that states that the global output of Arabica coffee is expected to be 57.4%, or 102.2 Million bags, with 75.8 Million of those bags expected to be Robustas in 2023–2024. Thus, robusta coffee beans are prized for having a higher caffeine content and a strong, and rich flavor which is often employed in espresso mixtures.

Breakup by Product:

- Roasted Coffee

- Instant/Soluble Coffee

- Green Coffee Bean Extract

Roasted coffee holds the largest share of the industry

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes roasted coffee, instant/soluble coffee, and green coffee bean extract. According to the report, roasted coffee accounted for the largest market share.

Roasted coffee is typically divided into green coffee beans and roasted coffee beans. Green coffee beans are versatility and highly prized by a variety of consumers, including home roasters who desire control over the roasting process and specialty coffee roasters. Roasted beans are also convenient and easy to use, and the market for roasted coffee serves a larger spectrum of customers, including grocery stores, online retailers, and coffee cafes. It highlights the dynamic relationship between raw ingredients and finished products while satisfying the diverse preferences of coffee connoisseurs and experts. For instance, in 2022/23, the European Union imports a modest 1.4 million bags of roasted coffee. The primary contributors were Switzerland, accounting for 77%, and the United Kingdom, contributing 13%. As the rapid loss of flavor and aroma in roasted coffee, these imports primarily cater to neighboring non-producing nations.

Besides this, imports of soluble coffee experienced a significant uptick, rising by 300,000 bags to reach 3.7 million in the same period with contributors such as the United Kingdom at 34%, Vietnam at 12%, India at 12%, and Ecuador at 10%. While imports from the United Kingdom remained relatively stable at 1.3 million bags over the past ten years, those from India and Vietnam saw notable increases of around 300,000 bags each, surpassing the 400,000 marks.

Breakup By Distribution Channel:

- Hypermarkets and Supermarkets

- Departmental Stores

- Specialty Stores

- Online

- Others

Hypermarkets and supermarkets represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, departmental stores, specialty stores, online, and others. According to the report, hypermarkets and supermarkets represented the largest segment.

As per the green coffee market forecast, hypermarkets and supermarkets offer a wide array of green coffee options, attracting a diverse consumer base seeking convenience and variety in their coffee choices. Additionally, hypermarkets and supermarkets effectively cater to regular coffee drinkers and occasional buyers, making green coffee easily accessible to a broad demographic with expansive shelf space and strategic placement. It offers competitive pricing, coupled with promotional activities and bundled deals, further solidifying its dominance in the market segment. Additionally, the convenience of one-stop shopping and the assurance of quality associated with established brands often drive consumers to opt for green coffee purchases from these retail outlets, thus positively changing the green coffee market outlook.

Breakup by End User:

- Retail

- Coffee cafes

- Others

Retail exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes retail, coffee cafes, and others. According to the report, retail accounted for the largest market share.

The green coffee market overview also presents valued insights into the emerging retail sector. It encompasses a diverse array of entities, including supermarkets, specialty stores, and online platforms catering to individual consumers seeking quality green coffee beans for home brewing. It thrives on the growing trend of at-home coffee consumption, due to the increasing popularity of specialty coffee culture and the desire for artisanal, customizable coffee experiences. Additionally, cafes and coffeehouses serve as key intermediaries between green coffee suppliers and end consumers by providing freshly brewed coffee produced from green beans sourced globally. Furthermore, the hospitality sector, comprising hotels, restaurants, and catering services, is escalating the premium green coffee demand due to the desire for offering guests high-quality beverages to enhance the overall dining experience, which is influencing the market growth.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest green coffee market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represents the largest regional market for green coffee.

Europe's prominence in the green coffee market can be attributed to its rich coffee culture, widespread café culture, and increasing preference for specialty and premium coffee varieties. Additionally, in Europe, countries like Germany, Italy, and France stand out as significant consumers of green coffee due to their appreciation for high-quality coffee beverages and the growing popularity of artisanal coffee shops. According to the International Coffee Organization (ISO )report, the consumption of coffee in Europe serves as a significant indicator of the overall trend in the European coffee market. As of 2022-2023, the European Union (EU) accounted for 74.1% of coffee consumption within Europe. According to the USDA report released in December 2023, unroasted green coffee beans dominate the imports of the European Union, constituting approximately 90% of the trade. Brazil led the list of top suppliers for the period of 2022-2023 October through September, contributing 32%, followed by Vietnam at 26%, Uganda at 7%, and Honduras at 6%. Besides this, factors such as rising disposable income, changing lifestyles, and a growing trend toward sustainable and ethically sourced products further contribute to the market growth. Consequently, diverse culinary landscape and penchant for gourmet experiences in Europe continue to drive the demand for premium green coffee beans across the continent.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the green coffee industry include Atlantica Coffee (Montesanto Tavares Group), Belco S.A., Golden Bean Trade, Merchants of Green Coffee, Neumann Kaffee Gruppe, Nordic Approach AS, The Bean Coffee Company, The Green Coffee Brazil (Group MAGNUS BRAZIL), WSCafe, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The key players in the global market are implementing various strategies to strengthen their market positions and provide green coffee market recent opportunities. These strategies often include expanding their product portfolios to cater to evolving consumer preferences, investing in research and development to innovate new coffee varieties or processing methods, and focusing on sustainable and ethical sourcing practices to appeal to conscientious consumers. Additionally, key players are actively engaging in marketing and branding efforts to create strong brand identities and enhance consumer awareness and loyalty. Furthermore, strategic partnerships and collaborations with coffee growers, suppliers, and distributors help streamline the supply chain and ensure a steady and reliable source of high-quality green coffee beans.

Green Coffee Market News:

- March 2023: Primavera Green Coffee was honored with the 2023 Specialty Coffee Association Sustainability Award for its innovative business model. This recognition celebrates their 10 years of commitment to sustainability within the coffee sector.

- November 2023: Root Capital, a nonprofit organization dedicated to empowering agricultural enterprises in Latin America, Africa, and Southeast Asia, announces a significant collaboration between Green Mountain Coffee Roasters and renowned actor Kevin Costner. This partnership sees the beloved coffee company and acclaimed actor joining forces to create a line of exclusive coffee blends. The inaugural blend, titled Horizon Blend by Kevin Costner, offers a bold and smoky dark roast. Root Capital has been chosen as the nonprofit partner for this venture and will be the recipient of a $100,000 donation from Green Mountain Coffee Roasters.

Green Coffee Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Arabica, Robusta |

| Products Covered | Roasted Coffee, Instant/Soluble Coffee, Green Coffee Bean Extract |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Departmental Stores, Specialty Stores, Online, Others |

| End Users Covered | Retail, Coffee cafes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlantica Coffee (Montesanto Tavares Group), Belco S.A., Golden Bean Trade, Merchants of Green Coffee, Neumann Kaffee Gruppe, Nordic Approach AS, The Bean Coffee Company, The Green Coffee Brazil (Group MAGNUS BRAZIL), WSCafe |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global green coffee market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global green coffee market?

- What is the impact of each driver, restraint, and opportunity on the global green coffee market?

- What are the key regional markets?

- Which countries represent the most attractive green coffee market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the green coffee market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the green coffee market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the green coffee market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the green coffee market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global green coffee market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the green coffee market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global green coffee market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the green coffee industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)