Greek yogurt Market Size, Share, Trends and Forecast by Product Type, Flavor and Distribution channel, and Region, 2025-2033

Greek Yogurt Market Size and Share:

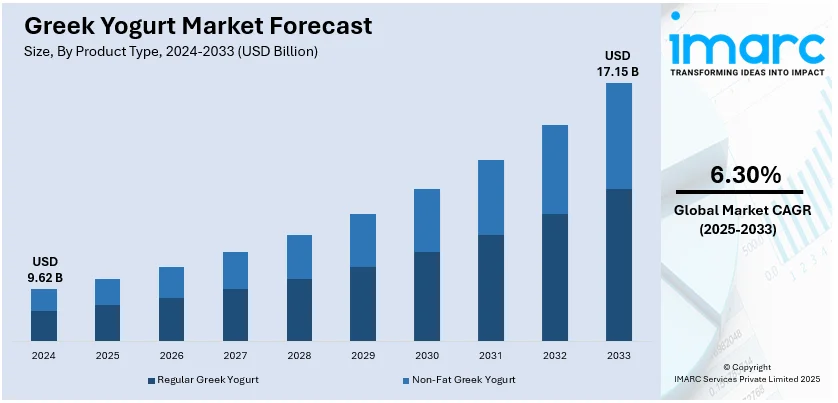

The global Greek yogurt market size was valued at USD 9.62 Billion in 2024. The market is projected to reach USD 17.15 Billion by 2033, exhibiting a CAGR of 6.30% from 2025-2033. North America currently dominates the market, holding a market share of over 36.4% in 2024. Th market is driven by strong consumer demand for high-protein dairy, increasing health consciousness, widespread probiotic benefits awareness, diverse product innovations, and extensive retail and e-commerce distribution networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.62 Billion |

|

Market Forecast in 2033

|

USD 17.15 Billion |

| Market Growth Rate (2025-2033) | 6.30% |

One of the key factors driving the global Greek yogurt market share is the increase in health consciousness among consumers and change in dietary preference towards healthy and nutrient-rich food products. According to reports, 50 percent of Americans believe they are eating healthy. Indeed, 62 percent say that healthfulness influences their food and beverage (F&B) purchases. Owing to the boosting consumption of fat-free and weight management products, Greek yogurt has gained immense popularity among consumers. In countries, such as the US, Mexico, Canada, etc., Greek yogurt is used extensively for meal preparation and is also consumed as a sweet snack mixed with fruits. It is also used as a substitute product for sour cream, smoothies, cream cheese and butter that has amplified its application in the F&B industry. According to reports, India is one of the largest F&B industries in the world, accounting for 3% of the country's GDP. The rise in Greek yogurt with natural and organic ingredients has been the primary driver behind market expansion. Consumers are broadly moving towards gluten-free, chemical-free, and food that is produced naturally. Moreover, other factors that are stimulating the growth of the market are an increase in urbanization, an upsurge in the population in the middle class, and substantial growth seen in online sales.

The U.S. Greek yogurt market is expanding with the share of 82.50%, due to the burgeoning demand for plant-based and dairy-free alternatives that respond to vegan, lactose-intolerant, and healthy conscious consumers. Moreover, heightened awareness of dairy sensitivities and ethical concerns surrounding animal-based products is forcing manufacturers to develop Greek-style yogurt using almond, coconut, cashew, and oat milk bases. Demand for sustainable, cruelty-free food products is rapidly driving innovation in dairy alternatives. For instance, in September 2024, Greek dairy company Kri-Kri expanded into the U.S. market, launching its Greek Frozen Yogurt in Texas supermarkets, emphasizing authenticity, digestive health benefits, and a healthier alternative to traditional ice cream. Furthermore, brands are developing fortified plant-based Greek yogurts with higher protein, probiotics, and essential nutrients. Retailers expand shelf space to these offerings like foodservice outlets include plant-based Greek yogurt in smoothies, breakfast bowls, and desserts. Consumer preference towards clean-label, allergen-free, and sustainable products is building up the portfolios of both big players and emergent brands. Further, boosting popularity of flexitarian diets support the growth. Many non-vegans opt for the alternatives to promote dairy-free offerings because of gut health, environmentalism, or menu diversity.

Greek Yogurt Market Trends:

Rise of High-Protein and Low-Sugar Preferences

Consumer priorities have shifted toward nutrient-dense products that align with fitness and weight management goals. Greek yogurt, already known for its high protein content, has become a preferred option among those seeking to increase protein intake without excess sugar. As per industry reports, as of 2025, about 11.1% of adults aged 20 to 79—equivalent to approximately one in every nine individuals in that age group—are currently living with diabetes. The rise of diabetes awareness and clean eating movements has made low-sugar dairy an area of growth. To meet this demand, manufacturers have introduced lines with higher protein-per-serving and reduced or zero-added sugar. Also, popular brands now emphasize functional benefits such as muscle recovery, satiety, and gut health. New product development is increasingly influenced by consumer segments like athletes, dieters, and health-conscious individuals. These trends have pressured companies to invest in filtration technologies and alternative sweeteners to maintain flavor while delivering on nutritional promises.

Growth of Plant-Based Greek-style Yogurts

An industry survey reported that around 25.8 million individuals worldwide tried a vegan diet in January 2025. With plant-based eating expanding beyond vegan consumers, Greek-style non-dairy yogurts have emerged as a significant category. These alternatives aim to replicate the texture, tartness, and nutritional profile of traditional Greek yogurt using plant sources such as almonds, coconuts, oats, and soy. While early versions often lacked the protein density of dairy-based products, recent formulations have improved through the use of pea and soy protein isolates. These products cater to lactose-intolerant individuals, ethical consumers, and those with dairy allergies. This, in turn, is significantly enhancing the Greek yogurt market outlook. Branding often focuses on sustainability and natural ingredient sourcing, appealing to environmentally-conscious buyers. The Greek yogurt market is expected to experience strong growth over the next few years, fueled by rising interest in nutritious food options and greater public recognition of its health-supporting properties.

Premiumization and Diversified Flavor Innovation

The Greek yogurt category has seen a push toward premium positioning, driven by consumer willingness to pay more for elevated taste, origin-based sourcing, and gourmet inclusions. Small-batch production methods, regionally sourced milk, and high butterfat content are marketed as luxury traits. Artisanal branding, recyclable glass packaging, and limited-edition flavors contribute to a premium image. Flavor innovation has also expanded beyond conventional fruit blends into globally inspired profiles like cardamom pear, lemon basil, and chili mango. For example, on June 16, 2025, Britannia Industries officially entered the Greek yogurt category with the launch of an authentic, high-protein range, representing a significant innovation in its dairy portfolio. The initiative, described as “game‑changing,” reflects a concerted effort by cross‑functional teams in research and development (R&D), marketing, logistics, and brand development. Britannia emphasized that the offering blends robust flavor profiles with functional nutrition, underscoring its strategic expansion into premium dairy segments. As brand differentiation becomes harder at the commodity level, premiumization has become a key strategy for maintaining margins and consumer interest.

Greek Yogurt Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Greek yogurt market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, flavor, and distribution channel.

Analysis by Product Type:

- Regular Greek Yogurt

- Non-Fat Greek Yogurt

The regular Greek yogurt dominates the market, capturing a 58.7% share in 2024, attributed to high protein content, a thick texture, and suitability for both direct consumption and various food preparation processes. Consumers highly favor traditional Greek yogurt because of its rich nutritional profile, comprising necessary probiotics, calcium, and low sugar. The product has the added advantage of being widely available in various fat content options, which caters to different diet preferences. Greek yogurt is used as a base for smoothies, breakfast bowls, and cooking, which continues to drive consistent demand. Consumers who are health-conscious and into fitness are incorporating it into their diets, supporting Greek yogurt market growth. Manufacturers are also improving their production techniques to maintain texture and quality while complying with clean-label and organic trends. Additionally, the presence of private-label brands and affordability relative to premium varieties is also promoting its market expansion, thereby offering strong dominance within the Greek yogurt sector.

Analysis by Flavor:

- Flavored

- Unflavored

Flavored yogurt is the most popular with 55.3% market share in 2024, since consumers are getting more and more attracted to diverse and taste-enriched flavors. Consumers have a growing preference for fruit-flavored, honey-sweetened, and dessert-inspired flavors with nutritional benefits but also indulgence. Product innovation in terms of natural sweeteners, exotic fruit blends, and functional ingredients, such as superfoods and plant-based proteins, is expanding this segment's appeal. Flavored Greek yogurt caters to children and younger demographics who prefer palatable alternatives to plain varieties. The segment is further fueled by marketing strategies emphasizing natural flavors, low-sugar formulations, and the absence of artificial additives. Retailers are responding by expanding shelf space for flavored options in both dairy and alternative yogurt categories. The limited-edition seasonal flavors, as well as collaborations with prominent food brands, drive consumer interest; lactose-free and plant-based flavored Greek yogurt availability further expands the target market to allow it to sustain its market leadership.

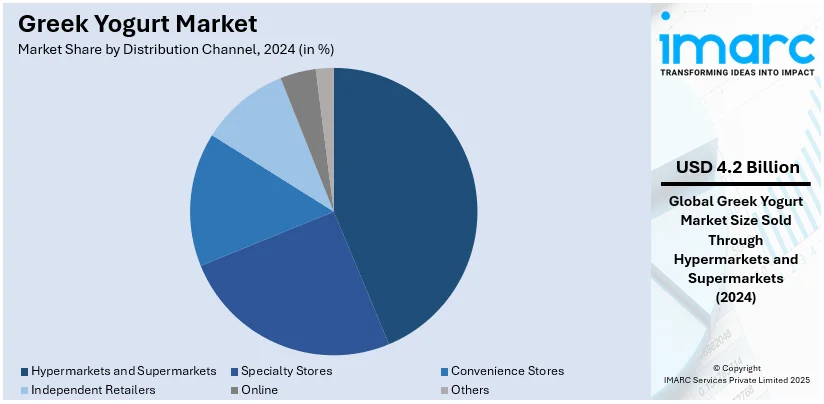

Analysis by Distribution Channel:

- Hypermarkets and Supermarkets

- Specialty Stores

- Convenience Stores

- Independent Retailers

- Online

- Others

The most prominent distribution channel is supermarkets and hypermarkets, which hold a 43.5% market share in the Greek yogurt market in 2024. Supermarkets and hypermarkets have large product offerings, low prices, and convenience. One-stop shopping experiences allow consumers to compare different brands, flavors, and options, which promotes impulse buying. The private-label brands are quite strong, and the in-store promotions are often held, thereby enhancing sales. Optimized refrigeration sections in supermarkets enable better storability, therefore maintaining the quality of Greek yogurt for extended shelf life. Increasing urbanization and boosting disposable incomes are nudging consumers to shop in supermarkets with high volume purchases, which is influenced by exclusive discounts and bundled offers. Furthermore, supermarkets are also emphasizing premium, organic, and plant-based Greek yogurt products for changing consumer preferences. Click-and-collect and in-store pickup offerings are strengthening sales, while a partnership with Greek yogurt brands is augmenting in-store marketing campaigns, thus perpetuating a position of dominance in the landscape of distribution.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America dominates the global Greek yogurt market, accounting for 36.4% of the market share in 2024, driven by strong consumer preference for high-protein dairy products, widespread health consciousness, and extensive retail distribution. As per yogurt market research, the demand in the region is further being driven by the heightening awareness of probiotics and gut health benefits, which boosts consumption. Product innovation in low-fat, organic, and lactose-free varieties caters to diverse dietary needs, ensuring sustained market expansion. Availability and affordability are further enhanced with the existence of both leading yogurt brands and private-label options in major supermarket chains. Diversification from the market's growth aspect is also occurring through plant-based Greek yogurt, to attract more vegan and lactose-intolerant consumers. The increase in the café and quick-service restaurant industry infuses Greek yogurt into their respective menus, boosting consumption out-of-home. High digital retail penetration and subscription-based dairy delivery services are further driving accessibility, while health-focused marketing campaigns continue to shape consumer preferences, reinforcing North America's leadership.

Key Regional Takeaways:

United States Greek Yogurt Market Analysis

In the United States, a strongly growing demand for Greek yogurt is due to high-protein, low-sugar dairy items and consumer preference. According to the surveys, social media is the biggest influence for 60% of Americans in eating healthy diets that ultimately fuel the demand for Greek yogurt as a healthy, plant-based food. Greek yogurt, being thick and full of probiotics, has become a favorite in the health-conscious category. Leading brands such as Chobani, FAGE, and Danone dominate the regional market, leveraging innovation in flavors, packaging, and functional ingredients. In addition to this, the demand is fueled by accelerating adoption in breakfast meals, snacks, and even as an ingredient in cooking, which is positively impacting the Greek yogurt market outlook.

Asia Pacific Greek Yogurt Market Analysis

In the Asia-Pacific region, the adoption of Greek yogurt continues to rise and is fueled by growing hypermarkets and supermarkets. Now that Greek yogurt has become more readily available in the retail channels, such as more hypermarkets and supermarkets, it can now reach more customers. Hypermarkets and supermarkets are a diverse channel for Greek yogurt, and its product availability in hypermarkets and supermarkets add to its visibility. As of January 23, 2025, it is stated that in India, 66,225 Supermarkets exist. This is up 3.88% from 2023. As these retail formats keep growing in emerging markets, Greek yogurt reaches more and more people, pushing the adoption rates higher. The ease with which it can be purchased in such establishments, in addition to increasing health awareness, leads to amplified consumption of Greek yogurt. With a larger choice of Greek yogurt products at consumers' disposal, the trend is expected to be accelerated in the coming years.

Europe Greek Yogurt Market Analysis

Processing is driving the rise of Greek yogurt in Europe. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages (F&B). As consumers are shifting their preference to healthier alternatives that are more nutritious, Greek yogurt has been promoted for its rich protein contents and low fat. Processed food manufacturers add Greek yogurt to everything from smoothies and snack bars to ready-to-eat meals, pushing the boundaries of what traditional yogurt-eating consumers can do. Interest in health and wellness is growing among European consumers, which further heightens the demand for Greek yogurt: It's associated with gut health and can support so many different diets. As the processed food sector continues to grow, Greek yogurt’s popularity in europe is expected to rise as a key ingredient in health-conscious food formulations.

Latin America Greek Yogurt Market Analysis

This product is growing within Latin America. The adoption of Greek yogurt parallels the growth in online e-commerce ordering. Over 300 Million digital buyers have been reported within the Latin America market. Consumers are highly making grocery purchases through online channels. Greek yogurt's convenience and versatility make it an attractive product for home delivery services. The increase in online grocery shopping means consumers can now readily access Greek yogurt from various brands and flavors. Online ordering for Greek yogurt has also allowed consumers to experiment with different product offerings and try various flavors, further accelerating the demand for it. This is highly appealing in urban areas where time and lifestyle constraints have forced people to spend more time on the road and thus, shopping online becomes the most viable option. With the progression of the online grocery market, uptake of Greek yogurt in Latin America is anticipated to gain penetration.

Middle East and Africa Greek Yogurt Market Analysis

In the Middle East and Africa, the amplified demand for Greek yogurt is contributed by the boosted tourism. The increased tourism continues to lead to the demand for healthy and nutritious food, among them Greek yogurt. For example, Dubai hosted 14.96 Million overnight visitors from January to October 2024, up 8% from the same period in 2023, indicating strong growth in tourism. During travels, tourists are always looking for familiar and popular products. Greek yogurt is more in demand within the foodservice and retail sectors of the region. The penetration of Greek yogurt in hotels, restaurants, and local stores targeting international visitors has contributed to its intensified adoption. As tourism fosters cultural exchange, consumers within these regions become more open to trying diverse foods, including Greek yogurt. As the tourism sector continues to grow, the consumption of Greek yogurt is expected to continue rising in the region.

Competitive Landscape:

The market is extremely competitive, with hundreds of players all focusing on the innovation of product lines, formulations that are based on health attributes, and channel expansion. To meet changing preferences, companies launched high-protein, low-fat, and probiotic-enriched variants in the market. The market continues to witness growth in investments within plant-based and lactose-free Greek yogurt alternatives, as part of catering towards the vegan and lactose intolerant segments. Strong branding and marketing strategies with clean-label claims and sustainability initiatives shape competitive positioning. Players have utilized the internet for more convenient accessibility and better reach to consumers. Private labels have emerged in terms of low cost and availability exclusively from specific retailers. According to yogurt market research, mergers and acquisitions as well as strategic alliances with dairy suppliers and retailers will be helpful for building up their supply chain and further expanding market presence. Intense price competition and promotional campaigns are influencing consumer choices, while regulatory compliance and ingredient transparency remain crucial for maintaining brand loyalty and market differentiation in the evolving Greek yogurt industry.

The report provides a comprehensive analysis of the competitive landscape in the Greek yogurt market with detailed profiles of all major companies, including:

- Chobani LLC

- Stonyfield Farm, Inc

- Fage International S.A.

- General Mills, Inc.

- Dannon

- Alpina Foods

- Auburn Dairy

- Delta Food (Vivartia)

- EasiYo

- Ehrmann

- Emmi Group

- Glenisk

- Kalypso Farms Dairy

- Kri Kri

- Mevgal

- Muller UK & Ireland

- Olympus

Latest News and Developments:

- May 2025: Forager Project introduced its new Unsweetened Plain Greek‑Style Yogurt, a dairy‑free, USDA‑certified organic alternative that delivers 10 grams of plant‑based protein per 5.3 oz serving, using a coconut‑cashew base and six live cultures with no added sugar, oils, starches, gluten, or soy. The product is now available across the U.S. in 24 oz tubs at Sprouts Farmers Market and Whole Foods, positioned as a high‑protein, clean‑ingredient choice in the plant‑based yogurt category.

- May 2025: Nounós Creamery expanded its portfolio with the launch of its A2 Greek Yogurt, claiming to be the first of its kind in the U.S. market and crafted from 100% A2/A2 non‑GMO milk sourced through regenerative farming practices. The new line, available in Plain, Vanilla Bean, Coconut Mango, and Mixed berries, delivers 16 grams of protein per serving, is cold‑strained using traditional methods, and comes in reusable glass jars. Nounós emphasizes that A2 milk may be easier to digest for some consumers and aligns with its sustainability and wellness-driven brand values.

- February 2025: Go Greek Yogurt officially launched its first locations in Saudi Arabia, opening outlets at The Esplanade, Panorama Mall, Al‑Faisal University, 1364 Mall, and Al Faisaliah Mall. The brand, founded in California in 2012, offers fresh and frozen Greek yogurt with premium toppings, positioning itself as a wellness-oriented dessert option that reflects Mediterranean authenticity. This expansion aligns with Go Greek’s broader GCC growth strategy, driven by franchise agreements, streamlined supply chain partnerships, and a capital-efficient operational model.

- January 2025: Little Spoon, Inc. is introduced a new line of YoGos yogurt, which includes whole milk Greek yogurt with 4 grams of protein, fruit, vegetables, and probiotics. The snacks are available in four zero added sugar flavors: Strawberry Bananza, Apple Berry Blast, Peachy Pearadise, and Tropical Mango Twist. The expansion expands the company's portfolio to include healthier snack options.

- October 2024: Chobani launched its new line of high-protein Greek yogurt, with 20 grams of protein in every yogurt cup and drink options available at 15, 20, and 30 grams of protein. This strategically matches the amplified demand for functional foods that also boast protein content over calorie deprivation. According to Chief Innovation Officer Niel Sandfort, consumers now favor mainstream strength and positive nutrition. High-protein products from Chobani are therefore an affordable option, tasty and rich in natural ingredients.

- June 2024: Sweetkiwi has partnered with The Smurfs to create a magical frozen Greek yogurt line. These products consist of Frozen Greek Yogurt Bars, Single-Serve Cups, and Variety Packs, which will be available in Smurf Berry and Smurf Blue Cookie Crunch flavors. With the healthy, frozen indulgence combining with the playful world of The Smurfs, the product range is expected to drive in the fun and nutritious offers for any and all ages.

- February 2024: The epigamia Greek yogurts add yet another popular and delicious entry called "Greek Yogurt + Oats & Seed Mix". Oats with Chia Seeds and Flax with Amaranth Seeds in sweet honey & date syrup, with no sugar, offering and health option. This supports one of biggest personalized bowls which trends on its way as convenient, super protein, all natural, super-healthy for on-the-go yogurt to snack healthy. The mix is perfect for breakfast or as an on-the-go snack, adding a crunchy texture to the creamy yogurt.

- January 2024: Chobani has unveiled a new line of dessert-inspired Greek yogurt called Creations. The six indulgent flavors that are part of the lineup include Mocha Tiramisu, Apple Pie à la Mode, Cherry Cheesecake, Orange Cream Pop, Bananas Foster, and Caramel Sundae, with the idea of delivering an experience of luxurious, delicious, and nutritious yogurt.

Greek Yogurt Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Regular Greek Yogurt, Non-Fat Greek Yogurt |

| Flavors Covered | Flavored, Unflavored |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Stores, Convenience Stores, Independent Retailers, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Chobani LLC, Stonyfield Farm, Inc, Fage International S.A., General Mills, Inc., Dannon, Alpina Foods, Auburn Dairy, Delta Food (Vivartia), EasiYo, Ehrmann, Emmi Group, Glenisk, Kalypso Farms Dairy, Kri Kri, Mevgal, Muller UK & Ireland, Olympus, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Greek yogurt market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global Greek yogurt market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Greek yogurt industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Greek yogurt market was valued at USD 9.62 Billion in 2024.

The Greek yogurt market is projected to exhibit a CAGR of 6.30% during 2025-2033, reaching a value of USD 17.15 Billion by 2033.

The rising consumer awareness towards numerous benefits of Greek yogurt, such as improving bone and mental health, reducing hunger and appetite, boosting metabolism, and lowering the risk of developing type 2 diabetes is primarily driving the global Greek yogurt market.

North America currently dominates the Greek yogurt market, accounting for a share of 36.4%. The market is driven by rising high-protein demand, growing health awareness, increasing probiotic consumption, expanding flavor varieties, clean-label preferences, strong retail distribution networks, and evolving dietary trends favoring nutritious dairy products.

Some of the major players in the Greek yogurt market include Chobani LLC, Stonyfield Farm, Inc., Fage International S.A., General Mills, Inc., Dannon, Alpina Foods, Auburn Dairy, Delta Food (Vivartia), EasiYo, Ehrmann, Emmi Group, Glenisk, Kalypso Farms Dairy, Kri Kri, Mevgal, Muller UK & Ireland, Olympus, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)