Graphite Electrodes Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Graphite Electrodes Market Size and Share:

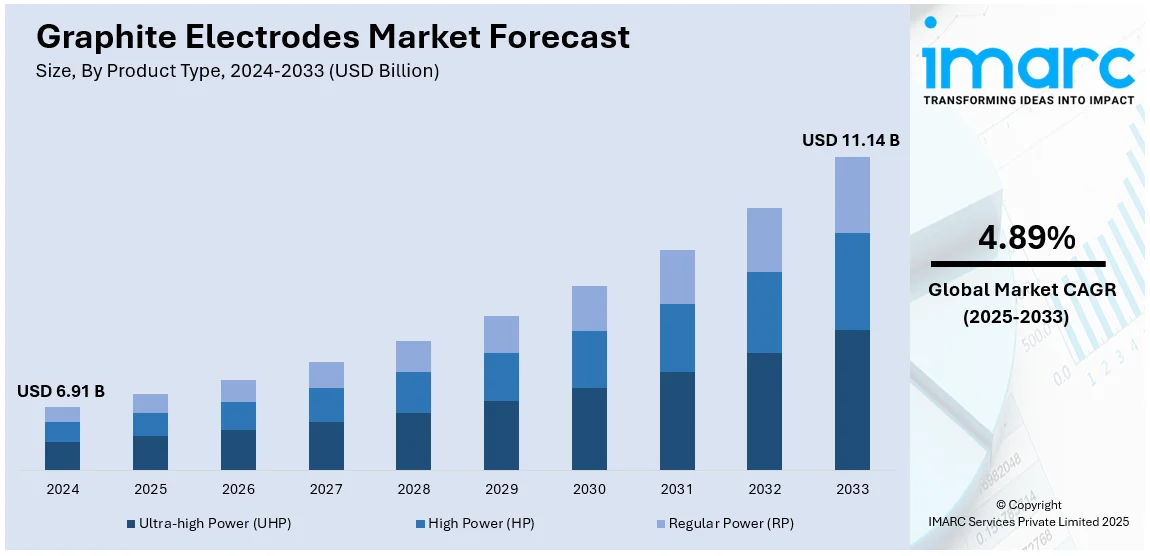

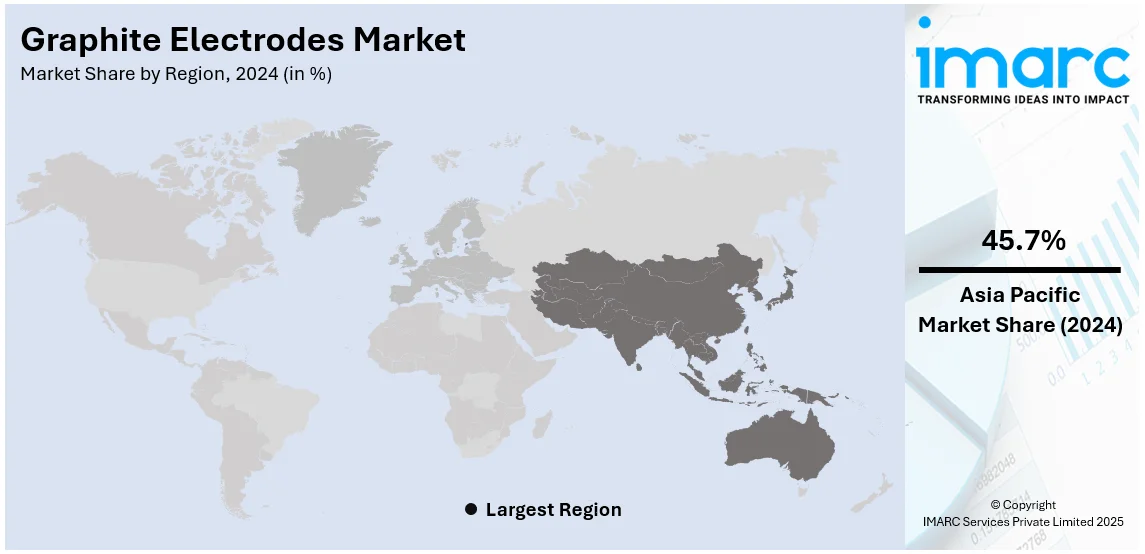

The global graphite electrodes market size was valued at USD 6.91 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.14 Billion by 2033, exhibiting a CAGR of 4.89% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 45.7% in 2024. An increase in steel production, surge in the adoption of electric arc furnaces (EAF), improvement in electric vehicle (EV) batteries, growing demand in the aerospace sector, ongoing technological innovation, expansion in manufacturing sectors, and environment-related favorable laws for electric steelmaking processes are some of the key factors influencing market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.91 Billion |

|

Market Forecast in 2033

|

USD 11.14 Billion |

| Market Growth Rate (2025-2033) | 4.89% |

The graphite electrodes market is primarily driven by the increasing demand for steel production using electric arc furnaces, which rely on graphite electrodes for efficient operation. Increased urbanization and industrialization boost construction and infrastructure development, which increases the demand for steel and graphite electrodes. This, along with increasing adoption of the EAF technology, which is energy-efficient and emits lower carbon when compared with other processes, is driving the market toward growth. The demand from electric vehicles and lithium-ion battery production would spur the industry even further with increased graphite use due to superior quality. Expanding the application range of sustainable steel production has brought on technological breakthroughs in manufacturing electrodes, which is driving the market growth further.

In the United States, widespread adoption of EAF technology in steel production, mainly due to the increasing demand for sustainable and energy-efficient manufacturing, drives the graphite electrodes market growth. Steady growth of the construction and automotive sectors fuel the demand for steel, thus in turn raising the demand for graphite electrodes. Furthermore, government policies toward reducing carbon emission and encouraging environmental-friendly practices promote the use of EAF-based steelmaking. For example, in August 2024, in Portage, Indiana, the U.S. steel manufacturer NLMK Indiana commissioned a 118-ton electric arc furnace renovated by Primetals Technologies. The entire closure period before the first heat took six weeks. Since producing an impressive 21 heats in just four days, the furnace has exhibited consistent performance metrics, now nearing the 5,000 heats threshold. The demand for high-quality graphite continues to rise with the growth of electric vehicles and lithium-ion battery production. Technological advancements and the presence of key steel producers in the U.S. also support the growth of the graphite electrodes market.

Graphite Electrodes Market Trends:

Rise in Steel Production and Higher Adoption of EAF

The steel industry is the primary consumer of graphite electrodes heavily utilizing them in the EAF method of steel production. According to the World Steel Association, the share of electric arc furnace (EAF)-based steel production accounted for 30 percent of the global steel output in 2021. The growing adoption of EAF technology is driving a shift toward more sustainable steel production methods using graphite electrode. Unlike the traditional processes of steelmaking by the blast furnace, the EAF process melts scrap steel through electricity, making it energy-effective and environment-friendly. This process requires high-quality graphite electrodes for conducting electricity and withstanding high temperatures. Consequently, with increasing global production of steel and urbanization and industrialization in developing economies, the demand for EAF technology also grows. The flexibility in production and scrap steel recycling ability provided by EAFs conform to the goals of sustainability. Hence, the growing application of EAFs will propel the demand for graphite electrodes, fostering market expansion.

Growth in EV Production

The EV market is continuously on the rise as governments and consumers are now turning toward green and eco-friendly transportation solutions. According to reports, electric vehicles made up 18.6% of global sales in 2023. Graphite plays a very central role in the manufacturing of lithium-ion batteries, which can run EVs. The anode in these batteries is made from high-purity graphite, which makes them efficient and long-lasting. Consequently, as the demand for EVs rises, so does the need for high-quality graphite. As a result, the graphite electrode industry is drastically building up its capacity and working on research and development (R&D) to produce high-purity graphite for state-of-the-art battery technologies.

Technological Innovations and Advancements

The market is also driven by the technological innovations and developments that are taking place in the industry. The companies are investing in R&D to come up with electrodes that can be more efficient, durable, and have a higher temperature-handling capability and performance. This includes UHP electrodes with superior conductivity and longevity; thus, they find increasing applications in modern steelmaking and other industrial sectors. Furthermore, advancements in production techniques cellular processes of needle coke production, which is one of the main raw materials for graphite electrodes are enhancing the quality and improving the availability of graphite electrodes. These technological steps in terms of product quality not only improve it but also bring down production costs, hence making graphite electrodes accessible to a wider range of industries.

Graphite Electrode Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global graphite electrodes market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- Ultra-high Power (UHP)

- High Power (HP)

- Regular Power (RP)

Ultra-high power (UHP) stands as the largest component in 2024, holding around 65% of the market. According to the graphite electrodes market research report, the demand for UHP product variants is driven by their superior performance characteristics necessary in high-intensity applications. This is because a UHP electrode has a bigger capacity in terms of electrical load with significantly improved thermal resistance compared to standard and high-power electrodes. This makes them ideal for modern methods of steel production that call for consistent and efficient energy transfer so that the elevated temperatures required to melt scrap metal are maintained. Moreover, growing interest in UHP electrodes due to the longer service life and lower electrode consumption rates, which result in cost savings and productivity enhancement for steel producers is creating a positive outlook for market expansion.

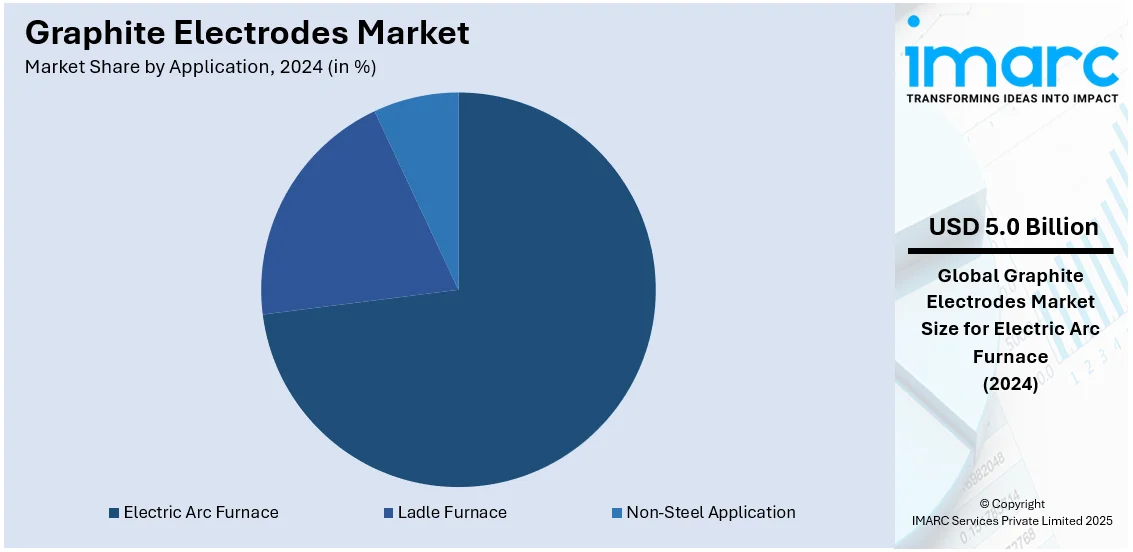

Analysis by Application:

- Electric Arc Furnace

- Ladle Furnace

- Non-Steel Application

Electric Arc Furnace leads the market with around 72.9% of market share in 2024. The requirement for graphite electrodes in EAF applications has been increased by the worldwide movement toward greener and more sustainable methods of steel production. The electric arc is developed by graphite electrodes in the EAF, thereby providing the high temperature necessary for melting scrap steel. It results in lower emissions than the widely known blast furnace method of making steel. The increasing availability of recyclable and scrap steel, which is a viable and less expensive alternative to raw iron ore, has been a significant factor in the adoption of EAF. New EAF facilities are rapidly being constructed due to continual industrialization in developing countries, which enhances the demand for graphite electrodes.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 45.7%. The market demand for graphite electrodes is mainly derived from rapid industrialization and urbanization in the Asia Pacific countries, specifically China and India, where the main steel-producing hubs are located. In a region where booming construction and infrastructure require larger quantities of steel, the demand pushes for more efficient, sustainable electric arc furnaces (EAFs) to produce steel. Such developments also come in handy as environmental sustainability and regulations push steel manufacturers to EAF technology that heavily relies on the use of graphite electrodes. Furthermore, with the growing popularity of EVs, the automotive industry is driving increased demand for superior steel, which automatically increases revenue from graphite electrodes market. It is also due to the rising government projects and investments related to the expansion of manufacturing capacities and modernization of existing facilities.

Key Regional Takeaways:

North America Graphite Electrodes Market Analysis

The increasing use of electric arc furnace technology to manufacture steel is accounted for the market demand for graphite electrodes in North America. The strong emphasis on sustainable and energy-efficient manufacturing increases demand in region’s construction, automation, and infrastructure domains for the need for steel, thus increasing the consumptions of graphite electrodes. Stringent environmental regulations encouraging low-emission steelmaking further accelerate the shift to EAF technology. Additionally, the rise of electric vehicles and the growing production of lithium-ion batteries in North America increase demand for high-grade graphite. Technological advancements in electrode manufacturing, coupled with the presence of major steel producers and EAF facilities in the region, further strengthen the market's growth prospects.

United States Graphite Electrodes Market Analysis

In 2024, the United States accounted for the largest market share of over 78.80% in North America. The increasing industrialization in the United States has played a pivotal role in the growing demand for graphite electrodes. For instance, in November 2024, manufacturing output in the United States rose by 0.2 percent, driven by a 3.5 percent increase in motor vehicles and parts. This growth reflects the ongoing trend of increasing industrialization in the country. The rapid expansion of manufacturing sectors, particularly in automotive, electronics, and heavy industries, has created a surge in demand for electric arc furnace (EAF) steelmaking, which heavily relies on graphite electrodes. As industries modernize and upgrade their production capabilities, the need for high-quality electrodes to support energy-efficient and cost-effective steel production has become more critical. This trend is further intensified by significant technological advancements that require precision in manufacturing processes. Moreover, the growing focus on infrastructure and construction activities has further bolstered the demand for steel, subsequently driving the use of graphite electrodes in EAFs for increased productivity and output in steelmaking processes.

Asia Pacific Graphite Electrodes Market Analysis

Urbanization in the Asia-Pacific region, coupled with rising steel production, has significantly contributed to the adoption of graphite electrodes. According to China Iron and Steel Association (CISA) (2024), China's steel exports rose year-on-year by 36.2% in 2023, boosts the demand for graphite electrode for steel production, enhancing its role in the industry. As cities expand and urban infrastructure projects increase, the need for steel to support construction, transportation, and other industrial developments rises. The region's strong growth in steel production, particularly through electric arc furnaces, is directly linked to the rising demand for graphite electrodes. The adoption of electric steelmaking, driven by the need for sustainable and environmentally friendly production methods, has seen accelerated growth in the region. Furthermore, increased industrial activities, including the manufacturing of consumer goods and electronics, further boost the requirement for high-quality electrodes in various sectors.

Europe Graphite Electrodes Market Analysis

In Europe, the increasing adoption of electric vehicles (EVs) is a major factor driving the demand for graphite electrodes. According to International Energy Agency, the electric vehicle market in Europe is rapidly growing, with new electric car registrations reaching nearly 3.2 Million in 2023, marking a nearly 20% increase compared to 2022. This surge highlights the growing demand and adoption of electric vehicles across the region. EV manufacturing relies on advanced electric arc furnaces (EAF) for producing components such as battery casings, motors, and other critical parts, requiring high-quality graphite electrodes. The shift towards electric vehicles in response to environmental concerns and sustainability goals has resulted in an increasing need for graphite electrodes in the production of high-performance materials used in EVs. With the automotive industry transitioning towards greener alternatives, more investments are directed toward the production of steel for EV components, creating a robust market for graphite electrodes. Furthermore, the growth of renewable energy infrastructure to support electric vehicle charging stations also strengthens the demand for graphite electrodes, driving a shift in manufacturing technologies to meet these demands.

Latin America Graphite Electrodes Market Analysis

In Latin America, the rise of new manufacturing facilities is significantly contributing to the growing demand for graphite electrodes. As the region experiences growth in various manufacturing sectors, such as automotive, construction, and energy, there is a notable increase in steel production through electric arc furnaces (EAF). For instance, Brazil's industrial production grew 4.2% year-on-year in October 2024, following a 4.8% increase in the previous month. This growth reflects continued expansion in the country's manufacturing sector. This shift towards modernized production facilities requires high-quality graphite electrodes to maintain efficient operations. As more industries are establishing manufacturing plants to meet the needs of an expanding population and increasing industrial output, the demand for graphite electrodes is expected to rise. Additionally, local production of steel and other essential materials promotes regional economic development, driving the adoption of graphite electrodes in these manufacturing facilities.

Middle East and Africa Graphite Electrodes Market Analysis

In the Middle East and Africa, the growing real estate and construction sectors are driving the adoption of graphite electrodes. For instance, the construction industry in Saudi Arabia is witnessing significant growth, with over 5,200 ongoing projects valued at USD 819 Billion. These projects represent about 35% of the total value of active construction initiatives in the Gulf Cooperation Council region. As the region is experiencing rapid urban development, the demand for steel to support infrastructure projects such as bridges, high-rise buildings, and transportation networks rises. Graphite electrodes are vital in the steel production process, especially through electric arc furnaces. As construction activities continue to increase, the need for efficient and high-quality materials rises, pushing the demand for graphite electrodes to support the robust construction projects in these regions.

Competitive Landscape:

The graphite electrodes market is highly competitive, with major players focusing on innovation, capacity expansion, and strategic partnerships to gain a competitive edge. Key companies such as GrafTech International Ltd., and HEG Limited dominate the market, leveraging advanced manufacturing technologies and strong supply chain networks. Rising demand for high-performance electrodes has driven investments in R&D and product enhancement. Companies also focus on securing raw material supplies, particularly needle coke, to maintain production stability. Regional players are expanding their presence to cater to growing EAF adoption globally. Increasing consolidation, joint ventures, and geographical diversification characterize the market's competitive dynamics.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Fangda Carbon New Materials Technology Co., Ltd.

- GrafTech International Ltd.

- Graphite India Limited

- HEG Limited

- Nantong Yangzi Carbon Co. Ltd

- Nippon Carbon Co. Ltd

- Resonac Graphite Japan Corporation

- Sangraf International

- SEC Carbon Limited

- Sigri New Material Technology (Tianjin) Co., Ltd.

- Tokai Carbon Co. Ltd

Latest News and Developments:

- December 2024: HEG has recently expanded its graphite electrode plant capacity to 100,000 tonnes, making it the largest single plant in the entire western world. This expansion positions HEG as a leader in the global graphite electrodes market. The increased production capacity will enhance its ability to meet rising demand. HEG's strategic growth strengthens its competitive edge in the industry.

- December 2024: POSCO Future M has successfully localized the manufacturing technology for graphite electrodes, crucial for electric arc furnace steel production. This breakthrough, announced on Dec. 12, addresses South Korea's long-standing dependence on imports for these high-value carbon materials. POSCO Future M led the project, which was started in 2020 as a part of a nationwide initiative to create artificial graphite electrodes. After more than four years of research and development, the nation's steel sector achieved a major milestone.

- December 2024: Norge Mining acquired Skaland Graphite AS, Europe's largest natural graphite producer, from Mineral Commodities Ltd. The fourth-largest flake graphite mine outside of China and the highest-grade operational mine in the world is the Skaland mine in northern Norway. It boosts Norge Mining's standing in the international market by producing about 10,500 tonnes of graphite a year. The supply of premium graphite electrodes for a range of sectors is strengthened by this acquisition.

- November 2024: GrafTech International Ltd. has announced an agreement to secure new capital aimed at improving liquidity. This transaction is designed to provide financial support to navigate near-term industrywide challenges. The company entered into a commitment and consent letter with its lenders, including Barclays Bank plc, to offer new debt financing and extend the maturities of its existing debt. This move will bolster the company's position in the graphite electrodes market.

- November 2023: HEG Limited, India's top graphite electrode producer, announced the completion of an expansion project that increased its capacity from 80,000 tons to 100,000 tons per year.

Graphite Electrodes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Ultra-high Power (UHP), High Power (HP), Regular Power (RP) |

| Applications Covered | Electric Arc Furnace, Ladle Furnace, Non-Steel Application |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Fangda Carbon New Materials Technology Co., Ltd., GrafTech International Ltd., Graphite India Limited, HEG Limited, Nantong Yangzi Carbon Co. Ltd, Nippon Carbon Co. Ltd, Resonac Graphite Japan Corporation, Sangraf International, SEC Carbon Limited, Sigri New Material Technology (Tianjin) Co., Ltd., Tokai Carbon Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the graphite electrodes market from 2019-2033.

- The graphite electrodes market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the graphite electrodes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The graphite electrodes market was valued at USD 6.91 Billion in 2024.

IMARC estimates the graphite electrodes market to exhibit a CAGR of 4.89% during 2025-2033.

The global graphite electrodes market is driven by the widespread adoption of electric arc furnace (EAF) technology for steel production, rising infrastructure and automotive demand, and growing environmental regulations promoting sustainable practices. Additionally, advancements in electrode technology and expanding electric vehicle and battery production boost market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the graphite electrodes market include Fangda Carbon New Materials Technology Co., Ltd., GrafTech International Ltd., Graphite India Limited, HEG Limited, Nantong Yangzi Carbon Co. Ltd, Nippon Carbon Co. Ltd, Resonac Graphite Japan Corporation, Sangraf International, SEC Carbon Limited, Sigri New Material Technology (Tianjin) Co., Ltd., Tokai Carbon Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)