Graphic Film Market Size, Share, Trends and Forecast by Polymer, Film Type, Printing Technology, End Use, and Region, 2025-2033

Graphic Film Market Size and Share:

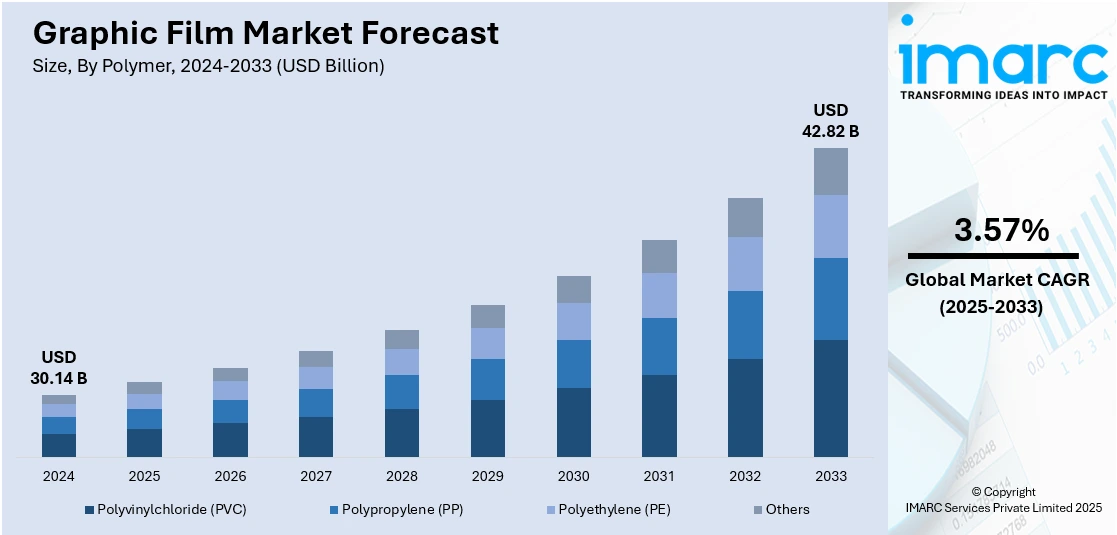

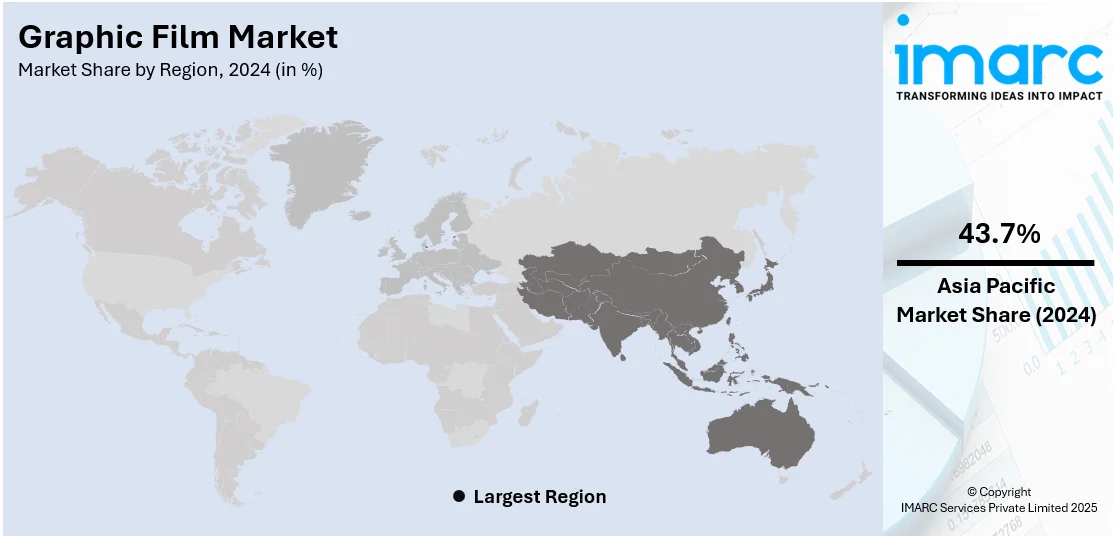

The global graphic film market size was valued at USD 30.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 42.82 Billion by 2033, exhibiting a CAGR of 3.57% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of around 43.7% in 2024. The market is driven by robust demand from advertising, automotive, and construction sectors, where graphic films enhance branding, vehicle wraps, and architectural aesthetics. Advancements in digital printing and eco-friendly materials improve performance and sustainability, thereby broadening application scope. Rising infrastructure investments and rapid urbanization amplify the need for durable signage, further augmenting the graphic film market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 30.14 Billion |

|

Market Forecast in 2033

|

USD 42.82 Billion |

| Market Growth Rate 2025-2033 | 3.57% |

The market is driven by increasing demand from advertising, automotive, and construction industries, where these films are used for branding, decoration, and protection. The US advertising industry is projected to grow to USD 455.9 Billion in 2025, with digital advertising set to dominate, accounting for 80% of total advertising spend by 2029. Influencer marketing is also growing large, set to reach USD 6.24 Billion by 2025 at an annual growth rate of 8.79%. This rise in advertising expenditure marks a shift towards creative and visually potent solutions, such as graphic films, which are increasingly used for bespoke signage and car wraps, offering businesses a robust and efficient way to reach consumers. Technological advancements in digital printing and adhesive films enhance durability and customization, enhancing adoption. Rising urbanization and infrastructure development fuel the demand for aesthetic and durable signage. Additionally, the growing preference for lightweight, cost-effective, and eco-friendly films supports market expansion. The automotive sector's need for wraps and protective coatings further propels the graphic film market growth. Emerging economies with expanding retail and advertising sectors also contribute significantly. Innovations in sustainable materials and UV-resistant films are key trends shaping the market expansion in the coming years.

The United States stands out as a key regional market, primarily driven by rising demand from the entertainment and sports industries, where films are used for event branding and stadium graphics. The e-commerce growth has increased the need for high-quality packaging films with vibrant prints. According to industry reports, e-commerce sale in the United States is anticipated to reach USD 1.29 Trillion by the end of the year 2025, reflecting 8.9% growth from the year 2024. This surge in e-commerce activity is driving the need for innovative packaging solutions that are both functional and visually striking, which is positively impacting the market. Apart from this, government regulations promoting reflective safety films in transportation infrastructure also drive growth. Additionally, the healthcare sector utilizes graphic films for medical device labeling and facility signage. The shift toward energy-efficient window films in commercial buildings further stimulates demand. With advancements in 3D printing films and augmented reality applications, innovation remains a key driver, supporting the market's steady growth.

Graphic Film Market Trends:

Rise of Digital Marketing and Social Media Driving Graphic Film Demand

The growing demand for branding and marketing is a significant factor propelling market expansion, especially with the increasing popularity of digital marketing. As businesses seek eye-catching and compelling graphics for advertising materials, graphic films have become a preferred choice. Industry reports indicate that global digital ad spending is projected to exceed USD 700 Billion by 2025, making up over 65% of total ad spend. This rise in digital advertising highlights the need for high-quality graphics, further driving the adoption of graphic films for use in digital promotional strategies. The rise of social media and online platforms for advertising also emphasizes the importance of creating attention-grabbing graphics and creating a positive graphic film market outlook. As more brands prioritize digital presence, the utilization of graphic films in advertising materials, including banners, digital screens, and vehicle wraps, continues to expand globally.

Widespread Use of Graphic Films in Custom Signage and Vehicle Wraps

The versatility of graphic films has contributed to their widespread adoption across various industries, particularly for custom signage and vehicle wraps. This market is seeing significant growth due to the increasing demand for personalized and visually appealing graphics. Graphic films are highly durable, making them ideal for vehicle wraps, storefront displays, and custom signs, which are essential for businesses looking to stand out in competitive markets. Custom vehicle decals are a prime example, as businesses seek unique ways to advertise their brands on the move. The automotive sector is embracing graphic films for their ease of use, customization options, and longevity. According to the graphic film market forecast, this trend is evident as the demand for vehicle wraps continues to rise, with more businesses using graphic films to advertise on cars, buses, and trucks. As per industry reports, vehicle wraps can generate between 30,000 and 70,000 impressions daily, capturing the attention of a large audience as the vehicle navigates through the city. The market is poised for further growth as industries prioritize the use of graphic films for both functionality and aesthetic appeal.

Energy-Efficient Building Solutions and Sustainable Graphic Film Products

Graphic films are also gaining popularity in the construction and architecture sectors, particularly for enhancing energy efficiency in both commercial and residential buildings. These films are widely used to reduce solar heat gain and glare while allowing natural light to pass through, which is vital for maintaining comfortable indoor temperatures. The growing awareness of energy conservation and the adoption of eco-friendly building practices are further fueling the demand for these products. As building owners seek sustainable solutions, the ability of graphic films to improve energy efficiency by blocking excessive heat while still allowing light penetration makes them an attractive choice. In addition to this, manufacturers in the graphic film market are focusing on developing sustainable and eco-friendly products. The production of biodegradable and recyclable films from renewable materials is gaining traction, responding to the increasing demand for environmentally responsible solutions. This trend aligns with global efforts to reduce carbon footprints and promote sustainability across industries. Additionally, the global building and construction industry is responsible for around 40% of total energy consumption, further underscoring the need for energy-efficient solutions such as graphic films.

Graphic Film Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global graphic film market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on polymer, film type, printing technology, and end use.

Analysis by Polymer:

- Polyvinylchloride (PVC)

- Polypropylene (PP)

- Polyethylene (PE)

- Others

Polyvinylchloride (PVC) stands as the largest component in 2024, holding around 65.0% of the market share due to its versatility, durability, and cost-effectiveness. Widely used in advertising, automotive wraps, and industrial applications, PVC films offer excellent printability, weather resistance, and adhesive compatibility, making them ideal for indoor and outdoor signage. Their flexibility allows for easy application on curved surfaces, while flame-retardant and UV-stable variants enhance performance in demanding environments. Additionally, PVC's recyclability aligns with growing sustainability initiatives, though environmental concerns have spurred innovation in bio-based alternatives. The material's ability to combine vibrant graphics with long-term durability ensures strong demand across retail, transportation, and construction sectors. Emerging economies, with expanding advertising and infrastructure needs, further drive PVC film consumption. Despite competition from polyethylene and polypropylene films, PVC maintains its lead due to proven reliability and adaptability. Ongoing advancements in eco-friendly formulations and digital printing technologies are expected to sustain PVC's dominance, reinforcing its pivotal role in the graphic film industry's growth.

Analysis by Film Type:

- Reflective

- Opaque

- Transparent

- Translucent

Opaque leads the market with around 43.8% of market share in 2024, driven by their superior opacity, vibrant color reproduction, and ability to block underlying surfaces completely. These films are widely used in advertising, vehicle wraps, and architectural applications where bold, high-impact visuals are essential. Their excellent light-blocking properties ensure consistent print quality, even on dark substrates, while UV-resistant variants enhance outdoor durability. The growing demand for eye-catching signage, especially in retail and transportation sectors, fuels the adoption of opaque films. Additionally, advancements in adhesive technologies improve conformability and longevity, making them ideal for complex surfaces. Despite competition from translucent and transparent films, opaque variants dominate due to their versatility in backlit displays, wall graphics, and promotional branding. Emerging markets, with expanding urban infrastructure and advertising needs, further propel demand. Innovations in eco-friendly materials and digital printing compatibility continue to strengthen their market position, ensuring opaque films remain indispensable in the market development.

Analysis by Printing Technology:

- Rotogravure

- Flexography

- Offset

- Digital

Flexography leads the market in 2024 due to its cost-efficiency, high-speed production, and versatility across substrates. Widely adopted for large-scale packaging, labels, and promotional graphics, flexographic printing delivers consistent quality with vibrant colors, even on flexible films such as PVC and polyethylene. Its ability to use water-based and UV-curable inks aligns with sustainability trends while maintaining durability for outdoor applications. The technology's compatibility with roll-to-roll processes enhances productivity for bulk orders, making it ideal for retail and industrial signage. Emerging economies, with expanding packaging and advertising industries, further drive demand for flexographic solutions. Despite competition from digital and screen printing, flexography retains its lead due to lower per-unit costs for long runs and advancements in plate-making technologies that improve fine-detail reproduction. Ongoing innovations in ink formulations and automated press systems continue to solidify flexography's pivotal role in shaping the market's future.

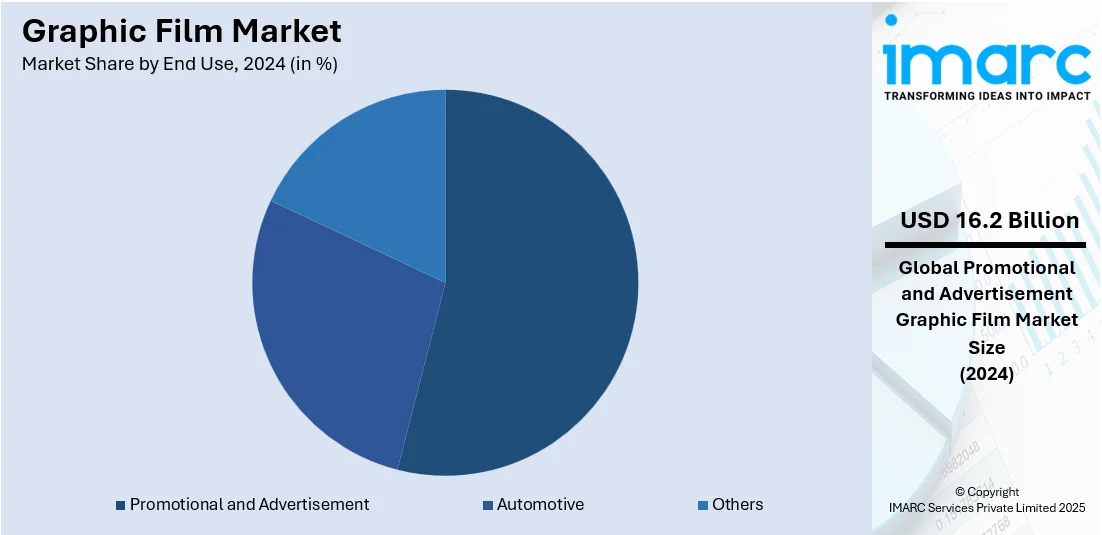

Analysis by End Use:

- Promotional and Advertisement

- Automotive

- Others

Promotional and advertisement lead the market with around 53.7% of the market share in 2024, fueled by the relentless demand for visually compelling branding across retail, events, and outdoor media. These films enable high-impact displays, including vehicle wraps, billboards, and point-of-sale graphics, leveraging their durability, color vibrancy, and weather resistance. The retail sector's expansion, coupled with rising competition for consumer attention, drives the adoption of cost-effective yet eye-catching graphic solutions. Technological advancements in digital printing have further enhanced customization, allowing for short runs and personalized campaigns. Urbanization and infrastructure development amplify the need for outdoor advertising, while events and sports sponsorships create sustained demand for temporary and reusable graphics. Despite growth in other segments, such as industrial labeling, promotional applications maintain leadership due to their unmatched versatility and ROI in brand visibility. Innovations in eco-friendly films and adhesive technologies continue to support this segment's expansion, ensuring its pivotal role in the market development.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 43.7%, driven by rapid urbanization, infrastructural development, and booming retail and advertising sectors. Countries including China, India, and Japan are major contributors, leveraging cost-effective production capabilities and expanding domestic demand. The region's thriving e-commerce industry fuels the need for innovative packaging solutions while increasing investments in outdoor advertising and vehicle branding further propel market growth. Government initiatives promoting smart cities and digital signage in emerging economies enhance adoption rates. Additionally, the availability of low-cost raw materials and labor fosters a competitive manufacturing landscape. Technological advancements in digital printing and sustainable film solutions cater to changing consumer preferences. Despite challenges such as environmental regulations, the region's strong industrial base and growing middle-class population ensure sustained demand. With continuous innovations and strategic investments by key players, Asia-Pacific is poised to maintain its dominance, shaping the future trajectory of the global market.

Key Regional Takeaways:

United States Graphic Film Market Analysis

In 2024, the United States holds a substantial share of around 87.90% of the market share in North America. The market in the United States is experiencing robust growth, driven primarily by the increasing demand for visually appealing promotional signage across retail, entertainment, and transportation sectors. High consumer engagement with digital and outdoor media has led to the widespread adoption of advanced printing technologies and customizable substrates. Reports state that in 2025, U.S. local advertising revenue will reach USD 171 Billion, underscoring the expanding opportunities for graphic films in localized marketing campaigns. Innovations in UV-curable inks and eco-friendly film formulations are further enhancing market expansion. Moreover, the rise of smart cities and urban beautification projects has amplified the integration of graphic films into architectural applications. The shift toward personalized consumer experiences is also encouraging the use of decorative wraps in automobiles and interiors. A growing preference for short-term promotional graphics in events and seasonal marketing campaigns is generating consistent demand. Additionally, the popularity of experiential marketing, where graphics are used to create immersive environments, is fostering broader applications. The market is also benefiting from technological convergence with digital signage, allowing hybrid installations that blend static and dynamic visuals. Increased awareness about brand identity and environmental consciousness among end-users is influencing product development toward recyclable and PVC-free films.

Europe Graphic Film Market Analysis

In Europe, the market is changing steadily, shaped by strong environmental regulations and a growing shift toward sustainable advertising solutions. The region's emphasis on circular economy practices has encouraged innovation in biodegradable and repulpable graphic films, particularly for packaging and labeling. Aesthetic upgrades in commercial architecture, especially in retail spaces, have created a demand for frosted and translucent films that offer both branding and privacy. The increasing popularity of public art initiatives and cultural exhibitions has led to a rise in custom-designed films for temporary installations. Notably, the European Commission states that with a budget of almost €340 Million in 2025, Creative Europe will continue supporting the creative and cultural sectors, including audiovisual, which is expected to further increase demand for innovative graphic film applications in artistic and media projects. The fashion and design industries are incorporating graphic films into product displays while technological advancements in print resolution and durability enhance their appeal. Digital transformation in logistics promotes efficient supply chain use.

Asia Pacific Graphic Film Market Analysis

The graphic film market in the Asia Pacific is witnessing rapid growth due to expanding urban infrastructure and the rise in consumer-centric branding. A booming real estate sector is fueling the adoption of films in interior décor and façade enhancements. The retail display market in India is expected to grow at a CAGR of over 8% between 2023 and 2025. Meanwhile, the entertainment and sports industries are increasingly using graphic wraps for venue branding and fan engagement. The proliferation of digital printing hubs across metropolitan regions is supporting high-volume customization, catering to small and mid-sized businesses. Rapid growth in e-commerce is also increasing demand for attractive packaging solutions, where graphic films play a critical role in visual branding. Additionally, there is a growing interest in anti-graffiti and protective films for public transport and communal facilities, reflecting rising investments in urban maintenance.

Latin America Graphic Film Market Analysis

In Latin America, the market is expanding, supported by increased spending on promotional campaigns and urban revitalization projects. Regional governments and private enterprises are investing in beautification efforts, leading to greater use of films for wall graphics, window displays, and street art. Furthermore, investment in digital ads by the gaming and betting sector increased 192% in 2024 compared to 2023. Total digital media spending in Brazil reached BR 37.9 Billion (about USD 6.7 Billion). This e-commerce dominance is driving demand for attractive, durable packaging and branding solutions, further propelling the graphic film industry. Tourism, hospitality, cultural festivals, and sports events demand aesthetically appealing wayfinding and graphics, while digital printing technologies enable localized branding using vibrant, weather-resistant films.

Middle East and Africa Graphic Film Market Analysis

The graphic film market in the Middle East and Africa is growing steadily, driven by the expansion of retail and exhibition sectors. The increasing construction of shopping malls, business centers, and leisure venues is stimulating demand for dynamic indoor and outdoor visual displays. Religious and cultural events also contribute to periodic rises in demand for decorative and promotional graphics. Furthermore, the Saudi Arabia digital printing market size reached USD 283.07 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 458.71 Million by 2033, exhibiting a growth rate (CAGR) of 5.51% during 2025-2033. Graphic films are gaining popularity in luxury real estate projects for environmental design, offering aesthetic flexibility without permanent changes, and the trend of visual storytelling in commercial spaces is expanding.

Competitive Landscape:

The competitive landscape of the market is characterized by intense rivalry as key players focus on innovation, sustainability, and geographic expansion. Leading manufacturers are investing heavily in research and development (R&D) activities to develop advanced materials with enhanced durability, eco-friendly properties, and superior printability. Strategic partnerships with technology providers are enabling the integration of digital printing solutions for high-quality, customized outputs. Many competitors are expanding production capacities in emerging markets to capitalize on cost advantages and growing demand. Sustainability initiatives, such as recyclable and bio-based films, are becoming a key differentiator to meet regulatory and consumer preferences. Additionally, companies are strengthening distribution networks and offering value-added services such as design support to gain market share. The focus remains on product diversification, with specialized films for automotive, advertising, and industrial applications driving competition. This dynamic environment fosters continuous advancements, ensuring robust market growth.

The report provides a comprehensive analysis of the competitive landscape in the graphic film market with detailed profiles of all major companies, including:

- 3M Company

- Achilles Corporation

- Arlon Graphics LLC (FLEXcon Company Inc.)

- Avery Dennison Corporation

- CCL Industries Inc.

- Constantia Flexibles Group

- Drytac Corporation

- DUNMORE Corporation (API Group)

- DuPont de Nemours Inc.

- FDC Graphic Films Inc.

- Hexis S.A.

- Kay Premium Marking Films Ltd. (ORAFOL Europe GmbH)

Latest News and Developments:

- April 2025: Innovia Films UK launched its 40-meter Rayoart coating line at its Wigton plant to produce PVC-free graphic films using water-based coatings. The new equipment enables industrial-scale production of recyclable PP-based Rayoart films, offering an eco-friendly alternative to traditional PVC, aligning with sustainability goals, and enhancing recyclability for graphic applications.

- February 2025: Shiva Polymers launched a 3.5-micron PVC lamination film for kela patta printing and dona plate making. The film, made from recycled materials, offers competitive strength and length, reinforcing India's growing demand for sustainable graphic and packaging applications.

- May 2024: Avery Dennison announced the launch of the SP 3522 Opaque Matte, a sustainable digital print film designed for mid-term promotions and temporary installations. This PVC-free film offers up to three years of durability, high opacity, and is compatible with Latex and UV inkjet printers.

Graphic Film Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Polymers Covered | Polyvinylchloride (PVC), Polypropylene (PP), Polyethylene (PE), Others |

| Film Types Covered | Reflective, Opaque, Transparent, Translucent |

| Printing Technologies Covered | Rotogravure, Flexography, Offset, Digital |

| End Uses Covered | Promotional and Advertisement, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Achilles Corporation, Arlon Graphics LLC (FLEXcon Company Inc.), Avery Dennison Corporation, CCL Industries Inc., Constantia Flexibles Group, Drytac Corporation, DUNMORE Corporation (API Group), DuPont de Nemours Inc., FDC Graphic Films Inc., Hexis S.A., Kay Premium Marking Films Ltd. (ORAFOL Europe GmbH) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the graphic film market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global graphic film market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the graphic film industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The graphic film market was valued at USD 30.14 Billion in 2024.

IMARC estimates the graphic film market to exhibit a CAGR of 3.57% during 2025-2033, reaching a value of USD 42.82 Billion by 2033.

The graphic film market is driven by robust demand from industries including advertising, automotive, and construction. Key drivers include increasing investments in digital marketing, the rise of vehicle wraps, custom signage, and urbanization, as well as advancements in eco-friendly, durable films.

Asia-Pacific currently dominates the graphic film market, accounting for a share exceeding 43.7%. This dominance is fueled by rapid urbanization, booming retail sectors, and cost-effective production capabilities, particularly in countries such as China, India, and Japan.

Some of the major players in the graphic film market include 3M Company, Achilles Corporation, Arlon Graphics LLC (FLEXcon Company Inc.), Avery Dennison Corporation, CCL Industries Inc., Constantia Flexibles Group, Drytac Corporation, DUNMORE Corporation (API Group), DuPont de Nemours Inc., FDC Graphic Films Inc., Hexis S.A., and Kay Premium Marking Films Ltd. (ORAFOL Europe GmbH), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)