Government Cloud Market Size, Share, Trends and Forecast by Component, Deployment Model, Service Model, Application, and Region, 2026-2034

Government Cloud Market Size and Share:

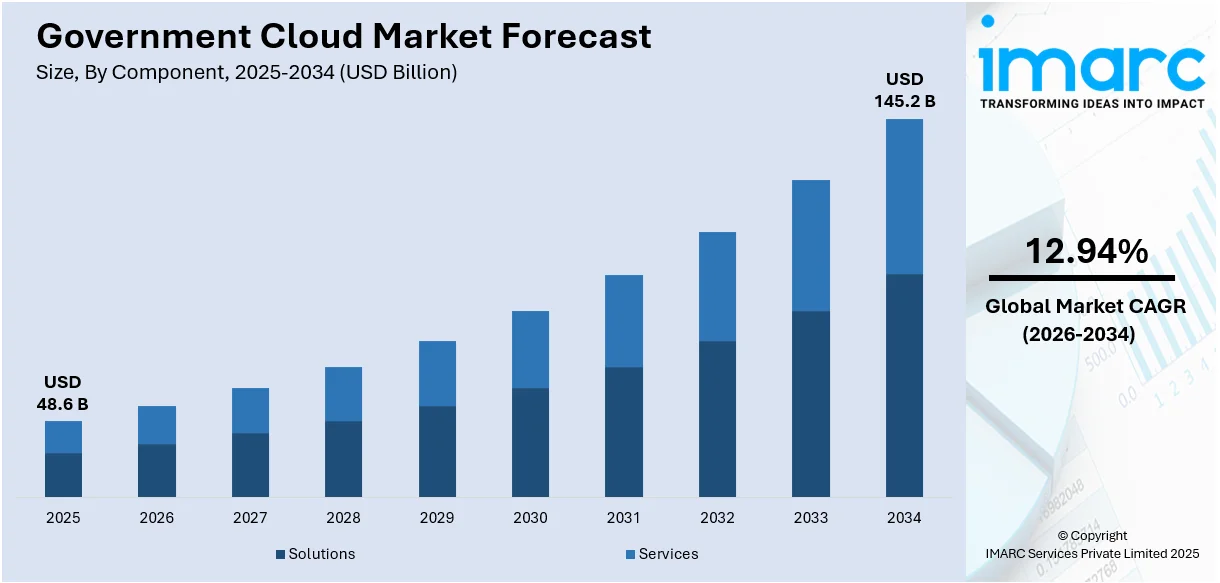

The global government cloud market size was valued at USD 48.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 145.2 Billion by 2034, exhibiting a CAGR of 12.94% from 2026-2034. North America currently dominates the market, holding a market share of over 34.7% in 2025. The increased security requirements, information technology (IT) transformation needs, cost-effectiveness requirements, disaster recovery factors, and customized solution for specific needs like analytics and content management are some of the key drivers accelerating the government cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 48.6 Billion |

| Market Forecast in 2034 | USD 145.2 Billion |

| Market Growth Rate 2026-2034 | 12.94% |

One major driver in the government cloud market is the increasing demand for data sovereignty and security compliance. Governments are prioritizing cloud solutions that adhere to stringent data protection regulations, ensuring that sensitive information remains within national borders and is safeguarded against cyber threats. Cloud providers are tailoring services to meet specific regulatory frameworks such as FedRAMP, GDPR, and ISO standards, making it easier for public sector organizations to adopt cloud technologies confidently. This shift enhances operational resilience, supports digital governance initiatives, and fosters trust in cloud adoption while ensuring control over data access, storage, and management within governmental jurisdictions.

To get more information on this market Request Sample

The U.S. dominates the government cloud market with a 90.60% share, driven by federal initiatives and cloud-first strategies. Agencies like the Department of Defense and the General Services Administration are expanding secure cloud adoption to improve efficiency and data security. FedRAMP plays a key role in standardizing cloud security, with 337 cloud services achieving authorization across various impact levels. This ensures compliance and fosters trust in cloud solutions. Major providers such as Amazon Web Services, Microsoft, and Google deliver tailored cloud services for government operations. The U.S. benefits from advanced digital infrastructure, strong cybersecurity frameworks, and a growing focus on scalable, cost-effective, and resilient government IT systems. This emphasis on secure cloud adoption continues to shape the modernization of federal and state-level digital services.

Government Cloud Market Trends:

Increasing demand for secure data management

Governments across the globe manage enormous volumes of sensitive information, from citizens' records to national security data. This requires secure mechanisms to safeguard against cyber attacks and maintain data integrity, driving the growth for government cloud. According to an industry report, in 2023, government entities ranked among the top 5 targets for ransomware and business email compromise (BEC) attacks. The FBI reported them as the 3rd most-targeted sector for ransomware, while an industry report found the average ransom for government organizations exceeded USD 1 million USD. Along with this, government clouds also provide higher-level security options and compliance certifications designed to cater to the robust needs of public sector organizations. These include features like encryption, identity and access management, regular security scanning, and compliance with industry standards like FedRAMP in the U.S. While cyberattacks increasingly become more subtle, the improved security of government clouds makes a strong case for their implementation.

Digital transformation and remote work trends

The global government's digital transformation initiatives were expedited by the COVID-19 pandemic, which improved the market's development prospects. Moreover, with remote work becoming the norm, governments needed agile and scalable IT infrastructure to support their operations. As of today, 37% of employers have implemented a hybrid working model, an increase from 20% in January 2023. On the other hand, remote job postings are on a soar by 40% since 2022. Government clouds provide the ability to scale resources up or down at will, which means that government agencies can continue to deliver services without interruptions even in times of crisis. This flexibility enables governments to deploy digital solutions quickly for citizen outreach, online service provision, and data analytics. As governments continue to invest in modernization, the demand for government cloud services remains robust.

Cost efficiency and resource optimization

Governments frequently operate with limited budgets and a mandate to accomplish more with fewer resources. Conventional information technology (IT) infrastructure is often expensive to manage and does not necessarily possess the necessary flexibility to accommodate the governance demands of today. Government clouds ensure cost-effectiveness in a pay-as-you-go format, freeing agencies from substantial capital investments up front. Furthermore, shared infrastructure and pooled resources mean lower operating costs. Governments are able to better allocate resources, maximizing their IT budgets while still enjoying the most advanced technology and services. The UK government invested EUR 366 Million (USD 461 Million) in upgrading legacy software in central departments. This cost savings has been a major driver of government cloud adoption, allowing public sector organizations to attain higher operational efficiency.

Government Cloud Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global government cloud market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, deployment model, service model, and application.

Analysis by Component:

- Solutions

- Services

Solutions account for the majority share of 77.0% in the government cloud market, driven by the growing demand for comprehensive, integrated services that address specific government operational needs. These solutions encompass cloud infrastructure, platform services, and specialized applications tailored for public sector functions such as data management, citizen services, and administrative automation. Governments increasingly seek end-to-end cloud solutions to enhance efficiency, ensure data security, and streamline workflows. The emphasis on digital transformation, legacy system modernization, and improved public service delivery accelerates the adoption of these solution-based offerings. Additionally, the need for scalable and customizable systems that comply with regulatory standards makes solutions more attractive than standalone services, reinforcing their dominance in the overall government cloud ecosystem.

Analysis by Deployment Model:

- Hybrid Cloud

- Private Cloud

- Public Cloud

Public cloud represents the majority share of 46.8% in the government cloud market owing to its flexibility, scalability, and cost-efficiency. Government agencies increasingly adopt public cloud models to reduce capital expenditure and enhance operational agility. The public cloud offers rapid deployment of services, streamlined access to computing resources, and simplified IT management without the need for extensive on-premise infrastructure. It supports dynamic workload demands and facilitates digital transformation initiatives across public sector departments. Additionally, public cloud providers offer robust security protocols, compliance frameworks, and disaster recovery solutions tailored to government requirements. The ability to access cutting-edge technologies like artificial intelligence (AI), analytics, and data storage at lower costs further strengthens public cloud adoption, making it a preferred choice for modern governance.

Analysis by Service Model:

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

According to the government cloud market forecast, the Software as a Service (SaaS) holds the largest market share of 53.9% in the Government Cloud market due to its cost-effectiveness, scalability, and ease of deployment. Government agencies increasingly prefer SaaS solutions to streamline operations, enhance service delivery, and reduce reliance on traditional IT infrastructure. SaaS enables rapid access to updated software, eliminates the need for extensive hardware investments, and simplifies maintenance through centralized management. Additionally, it supports remote collaboration, data integration, and workflow automation across departments. The flexibility to scale services according to demand makes it ideal for both small and large public sector entities. Furthermore, compliance-ready SaaS platforms ensure security and regulatory adherence, accelerating adoption and solidifying its dominance in cloud-based government services.

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Server and Storage

- Disaster Recovery/Data Backup

- Security and Compliance

- Analytics

- Content Management

- Others

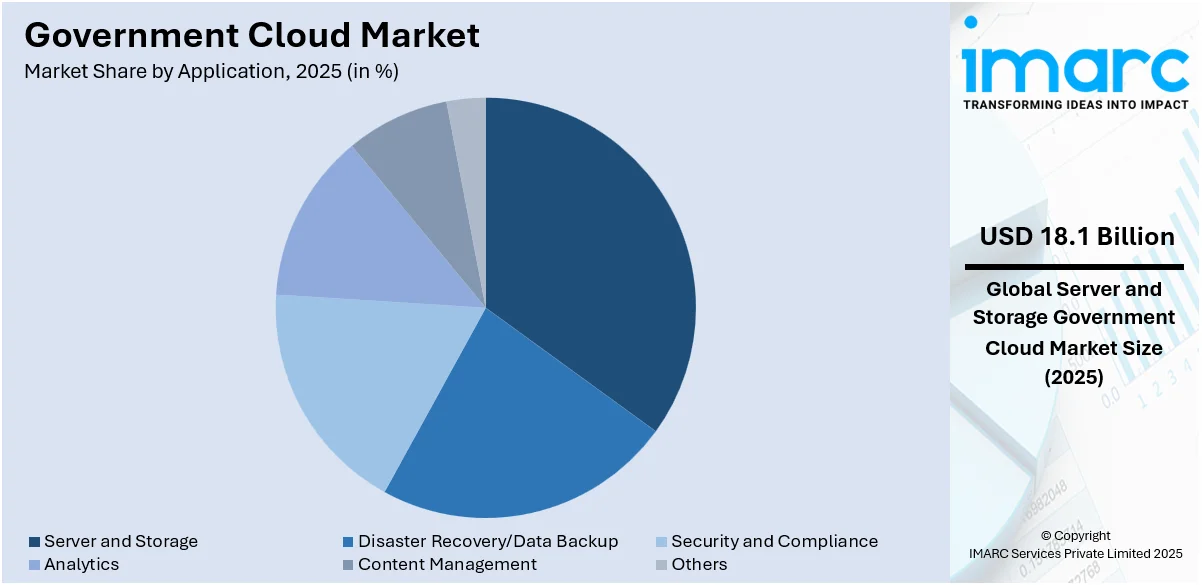

Based on the government cloud market outlook, the server and storage segments dominate the government cloud market demand, accounting for a substantial 42.1% share, primarily due to the growing need for secure, scalable infrastructure to manage expanding volumes of government data. As public sector agencies increasingly adopt digital platforms and data-driven operations, the demand for robust server capabilities and high-capacity storage solutions intensifies. These components are critical for ensuring reliable data processing, efficient storage management, and seamless access across departments. The rise in applications involving real-time data analytics, disaster recovery, and secure archiving further reinforces the importance of server and storage infrastructure. Moreover, the integration of advanced technologies such as virtualization and software-defined storage enhances performance, supporting the growing reliance on cloud systems in government operations.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is the leading region accounting for a significant 34.7% government cloud market share, driven by early cloud adoption and strong digital transformation initiatives across federal and local government agencies. The region benefits from advanced IT infrastructure, well-established cybersecurity frameworks, and stringent regulatory compliance standards that support secure cloud deployment. Government-backed programs promoting cloud-first strategies and modernization of legacy systems further bolstering the government cloud market growth. The widespread implementation of cloud services for data storage, disaster recovery, and collaborative tools enhances operational efficiency and scalability. Additionally, increasing investments in emerging technologies such as artificial intelligence, big data analytics, and edge computing contribute to the expanding role of cloud services in public sector digital ecosystems across North America.

Key Regional Takeaways:

United States Government Cloud Market Analysis

The U.S. government cloud market is growing rapidly, driven by federal digital transformation initiatives, stringent security requirements, and increasing cloud adoption across agencies. The Bureau of the Fiscal Service’s FIT Office identified USD 1.4 to USD 3.0 Billion in potential cost savings through process transformation and developed the Digital End-to-End Efficiency (DEEE) Framework to streamline operations by eliminating redundancies, leveraging automation, and fostering innovation. Furthermore, cloud migration is accelerating as agencies seek to enhance operational efficiency, scalability, and data security. The Federal Risk and Authorization Management Program (FedRAMP) further catalyzed adoption by ensuring compliance with federal security and privacy regulations. Additionally, expansion of leading cloud providers, AI-powered services, edge computing, and hybrid cloud solutions to meet government needs is impelling the market. The U.S. Department of Defense, intelligence agencies, and civilian departments are increasingly adopting multi-cloud strategies to mitigate reliance on single providers. With rising cybersecurity threats, cloud providers are enhancing Zero-Trust Architecture (ZTA), end-to-end encryption, and AI-driven threat detection. Moreover, growing demand for classified and unclassified cloud services, with initiatives like JWCC (Joint Warfighter Cloud Capability) leading innovation in secure, mission-critical cloud infrastructure is supporting the government cloud market demand.

Europe Government Cloud Market Analysis

The European government cloud market is changing due to strict data sovereignty laws, compliance regulations, and the increasing need for secure cloud environments. The EU’s Gaia-X initiative is driving efforts to establish a federated and secure data infrastructure, ensuring European digital autonomy for government and enterprise cloud services. Countries like Germany, France, and the UK are leading sovereign cloud adoption, focusing on AI integration, secure public services, and regulatory compliance. For example, in 2024, AWS announced a EUR 7.8 Billion investment in the AWS European Sovereign Cloud in Germany through 2040, launching its first AWS Region in Brandenburg by 2025. This investment is expected to contribute EUR 17.2 Billion to Germany’s GDP and create 2,800 jobs annually, ensuring EU-based control, security, and compliance for public sector and regulated industry customers. Additionally, expansion of cloud providers’ European presence, aligning with GDPR, the European Cybersecurity Act, and national security laws is supporting the market demand. The EU’s Digital Strategy is accelerating migration from legacy IT systems to cloud-based government platforms, benefiting public administration, healthcare, and citizen services. Moreover, initiatives like European Digital Identity and secure cloud frameworks are strengthening interoperability, cybersecurity, and cross-border digital services, enhancing Europe’s digital infrastructure.

Asia Pacific Government Cloud Market Analysis

The Asia Pacific market is undergoing rapid digital transformation, propelled by smart city initiatives, cybersecurity mandates, and increasing cloud adoption across government sectors. The Smart Cities Mission, launched, aims to enhance 100 cities with ₹1.6 lakh crore in projects, of which 90% of 7,244 projects (INR 1,45,312 Crore) are completed, including 52 lakh solar/LED streetlights, 4,700 km of smart roads, 49,300 housing units, 7,654 smart classrooms, and 172 e-health centers. The mission is extended to March 31, 2025. Countries like China, India, Japan, South Korea, and Australia are heavily investing in secure, sovereign, and AI-powered cloud infrastructures to modernize public services. Additionally, initiatives like India’s MeghRaj Cloud and China’s e-Government Cloud Strategy emphasizing scalability, data localization, and AI-driven analytics are propelling the market growth. Apart from this, major cloud providers, are expanding regional data centers, meeting data sovereignty requirements and driving cloud adoption across Asia-Pacific governments.

Latin America Government Cloud Market Analysis

The Latin American government cloud market is expanding as Brazil, Mexico, Argentina, and Chile invest in sovereign cloud solutions for data security, compliance, and efficiency. As of November 2024, Microsoft is negotiating to join Brazil’s sovereign cloud initiative, alongside AWS, Huawei, Google, and Oracle. In September 2024, Microsoft pledged USD 2.7 billion for AI and cloud investments and is planning a datacenter in Limeira, São Paulo. Brazil’s Digital Government Strategy and Mexico’s Cloud-First Policy are accelerating cloud adoption in public administration, healthcare, and digital identity services. Furthermore, expansion of key players in regional data centers, while hybrid and multi-cloud strategies help governments balance security, cost, and flexibility are supporting the market demand. Moreover, increasing investments in AI-driven governance, smart city projects, and blockchain services are driving cloud adoption across Latin America.

Middle East and Africa Government Cloud Market Analysis

The market in the Middle East and Africa is experiencing growth propelled by national digital transformation strategies, rising cybersecurity concerns, and increasing cloud adoption. The Ministry of Commerce reported a 36% growth in cloud computing services application development registrations, reaching 15,800 by Q4 2024, up from 11,600 in 2023, with Riyadh (9,700), Makkah (3,200), and the Eastern Province (1,600) leading. This reflects Saudi Arabia’s expanding tech sector and investment in digital innovation. Additionally, the UAE, Saudi Arabia, and Israel are leading cloud investments, with UAE’s Smart Government Strategy and Saudi Vision 2030 accelerating adoption. Besides this, Africa’s cloud market is expanding, with South Africa, Nigeria, and Kenya investing in e-government, AI services, and secure digital identity frameworks. Moreover, global companies and regional providers are scaling services to meet sovereign cloud requirements and cybersecurity regulations, supporting cloud-based healthcare, education, and financial services.

Competitive Landscape:

The competitive landscape of the government cloud market is characterized by intense innovation and strategic differentiation. Providers focus on offering highly secure, scalable, and compliant cloud solutions tailored to government requirements. Competition centers around meeting strict regulatory standards, ensuring data sovereignty, and delivering hybrid and multi-cloud capabilities. Market players invest heavily in developing advanced technologies such as artificial intelligence integration, edge computing, and enhanced encryption to gain a competitive edge. Additionally, partnerships with public sector agencies and the ability to offer flexible deployment models influence market positioning. The landscape also features frequent contract bidding and long-term service agreements, making technical expertise, reliability, and compliance support critical factors that shape provider selection and customer retention in this evolving sector.

The report provides a comprehensive analysis of the competitive landscape in the government cloud market with detailed profiles of all major companies, including:

- Amazon Web Services Inc.

- CGI Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- NetApp Inc.

- Oracle Corporation

- Salesforce.com Inc.

- Verizon Communications Inc.

- VMware Inc.

Latest News and Developments:

- February 2025: Oracle announced the general availability of Oracle Interconnect for Microsoft Azure in US Government Cloud, enabling FedRAMP High-authorized workloads with low-latency, high-performance multicloud integration. The partnership enhances government agencies' flexibility, leveraging Oracle and Azure’s cloud technologies for AI, security, and advanced analytics.

- January 2025: The UP government and Google Cloud (India) launched the AI-powered Uttar Pradesh Open Network for Agriculture, integrating Gemini and Beacon technologies. The initiative provides farmers with advisory services, credit, mechanization, and market access, leveraging real-time microclimate data to enhance digital agriculture and income growth.

- October 2024: Salesforce launched Government Cloud Premium, a Top-Secret authorized SaaS and PaaS offering for U.S. national security and intelligence agencies. Hosted on AWS Top Secret Cloud, it enables secure data integration, rapid application development, workflow automation, and AI-powered insights, enhancing mission speed, security, and operational agility.

- July 2024: C3 AI launched C3 Generative AI for Government Programs, an AI-powered application to help federal, state, and local agencies provide accurate, real-time information on public services. Running on Google Cloud, it improves citizen access, reduces service delays, and supports 130+ languages with secure, precise responses.

- June 2024: OpenText achieved FedRAMP authorization for its Cloud for Government solution, enhancing federal agencies' digital transformation. The solution integrates Extended ECM and AppWorks for secure content management and process automation, strengthening cybersecurity and compliance while improving citizen services and cloud migration in the U.S. government sector.

Government Cloud Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Solutions, Services |

| Deployment Models Covered | Hybrid Cloud, Private Cloud, Public Cloud |

| Service Models Covered | Infrastructure as a Service, Platform as a Service, Software as a Service |

| Applications Covered | Server and Storage, Disaster Recovery/Data Backup, Security and Compliance, Analytics, Content Management, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services Inc., CGI Inc., Cisco Systems Inc., Dell Technologies Inc., Google LLC (Alphabet Inc.), Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, NetApp Inc., Oracle Corporation, Salesforce.com Inc., Verizon Communications Inc., VMware Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the government cloud market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global government cloud market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the government cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The government cloud market was valued at USD 48.6 Billion in 2025.

The government cloud market was valued at USD 145.2 Billion in 2034, exhibiting a CAGR of 12.94% during 2026-2034.

Key factors driving the government cloud market include increasing demand for data security, regulatory compliance, cost efficiency, and scalable infrastructure. The shift toward digital governance, cloud-first policies, and enhanced disaster recovery capabilities further accelerates adoption. Advanced technologies like AI integration and edge computing also contribute to market growth and innovation.

North America currently dominates the government cloud market due to strong digital infrastructure, early adoption of cloud-first policies, and robust cybersecurity frameworks. Government initiatives, regulatory compliance standards, and high investments in cloud technologies support widespread adoption. The region’s advanced IT ecosystem further accelerates public sector cloud deployment and modernization efforts.

Some of the major players in the government cloud market include Amazon Web Services Inc., CGI Inc., Cisco Systems Inc., Dell Technologies Inc., Google LLC (Alphabet Inc.), Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, NetApp Inc., Oracle Corporation, Salesforce.com Inc., Verizon Communications Inc., VMware Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)