Golf Ball Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Golf Ball Market Size and Share:

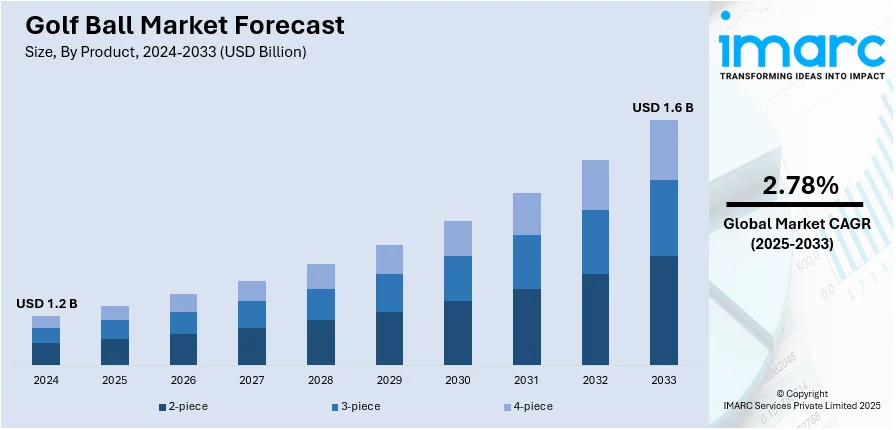

The global golf ball market size was valued at USD 1.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.6 Billion by 2033, exhibiting a CAGR of 2.78% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.6% in 2024. The increasing participation in golf, growing popularity of golf tournaments, rising disposable income, development of high-performance balls, growing preference for recycled balls, and sponsorships and endorsements by professional players are some of the major factors fueling the golf ball market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.6 Billion |

| Market Growth Rate (2025-2033) | 2.78% |

The market for golf balls is driven by the growing popularity of golf worldwide, fueled by increasing participation in professional tournaments, corporate golf events, and recreational play. Golf course expansion in emerging markets along with other market developments has increased demand. The golf ball industry advances through technological developments that produce multi-layer structures, enhanced aerodynamic properties, and soft-core components thus drawing participation from amateur alongside professional golfers. The market trends are being shaped by the growing consumer interest in green and environmentally degradable golf balls. Additionally, the influence of celebrity endorsements, sponsorships, and televised golf events drives sales. E-commerce growth and direct-to-consumer sales strategies have made golf balls more accessible, further propelling market expansion. The increasing adoption of golf as a leisure and fitness activity supports steady golf ball demand.

The United States golf ball market is driven by the sport’s strong presence, with many golf courses, professional tournaments, and recreational players. The rise in golf participation, especially among younger and female players, has expanded the market. Technological advancements in golf ball design, including distance-enhancing materials and soft-core construction, attract both amateurs and professionals. The growth of indoor golf simulators and driving ranges has also boosted demand. Additionally, increased e-commerce sales, brand sponsorships, and sustainability trends (such as biodegradable golf balls) are shaping consumer preferences, thus supporting steady market growth in the United States. For instance, in October 2024, a 25-year legacy of golf ball innovation continues with the launch of the 2025 Titleist Pro V1 and Pro V1x golf balls on the PGA TOUR, signifying the beginning of the 25th year for the sport's most reliable and top-selling golf ball models in Las Vegas.

Golf Ball Market Trends:

Increasing Participation in Golf

The game's attraction crosses age categories and demographics, drawing in both experienced players and beginners. The expansion of golf courses and driving ranges globally has enhanced the sport's accessibility, leading to a rise in participation. For instance, Among the countries associated with the R&A (The Royal & Ancient Golf Club of St Andrews), there are currently 39.6 million golfers participating on both 9 and 18 hole courses. Moreover, golf's reputation as a social sport that fosters networking and business connections has attracted corporate professionals to take up the game. As the number of golfers continues to grow, so does the demand for golf balls. Players often require multiple balls during a game due to the risk of losing them on the course, driving the sales of golf balls in the market.

Growing Golf Tourism

Many travelers seek out destinations known for their golf courses, combining their love for the sport with leisure travel. According to a report by KPMG, the UAE alone attracting over 20,000 golf tourists annually. Popular golfing destinations like Scotland, the United States, Spain, and Thailand have witnessed a substantial increase in inbound golf tourists. These tourists frequently purchase golf balls as souvenirs, or they may need extra balls to play during their golfing vacation. The rising trend of golf tourism has boosted golf ball sales in traditional golfing hubs and contributed to the growth of the market in emerging tourist destinations that are investing in golf infrastructure to attract visitors.

Rising Disposable Income

As consumers' financial capacities increase, they are more willing to spend on leisure and recreational activities like golf which is creating a positive golf ball market outlook. For instance, global disposable income rose by 3.4% in real terms in 2023. Golf is perceived as an aspirational sport and is often associated with a certain lifestyle. With higher discretionary spending, individuals are more likely to take up golf and are also willing to invest in high-quality golf balls to enhance their game. The willingness to invest in premium and technologically advanced golf balls has encouraged manufacturers to innovate and offer products that cater to the demands of this growing consumer segment.

Golf Ball Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global golf ball market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- 2-piece

- 3-piece

- 4-piece

4-piece stands as the largest product in 2024, holding around 37.6% of the market. A 4-piece ball typically consists of a dual-core surrounded by two mantle layers and a soft cover. This construction allows for a combination of distance, control, and spin, making it a preferred choice among golfers seeking optimal performance on the course. Furthermore, advancements in golf ball technology have led to the development of 4-piece balls with improved aerodynamics and reduced drag, resulting in longer distances off the tee. Additionally, the multi-layer design provides enhanced greenside control and spin, making it suitable for skilled players and professionals. While 4-piece golf balls may be relatively higher in price compared to 2-piece or 3-piece balls, however, there are a growing number of golfers willing to invest in their game and seek the best possible performance due to the benefits offered by 4-piece balls.

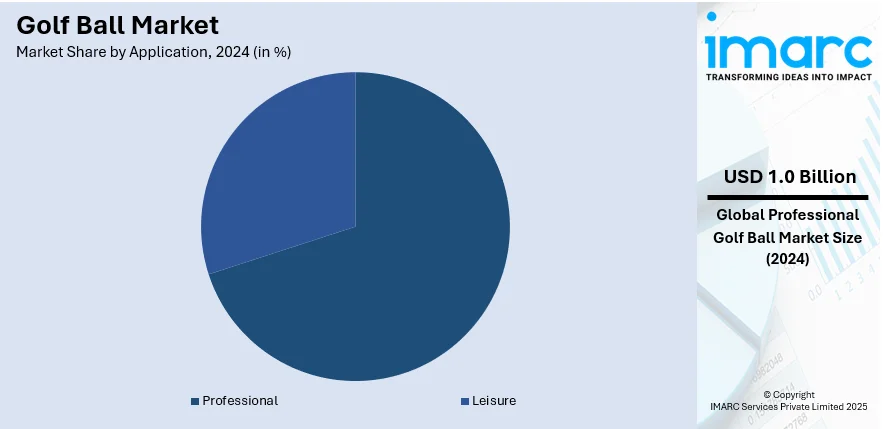

Analysis by Application:

- Leisure

- Professional

Professional leads the market with around 65.8% of the market share in 2024. Professional golfers, including tour players and competitive athletes, have specific performance requirements and demands when it comes to golf balls. They often opt for premium and high-performance golf balls, which contribute significantly to this segment's prominence in the market. Professional golfers seek golf balls that offer exceptional control, distance, and spin to optimize their game. They rely on golf balls with advanced multi-layer constructions that can provide them with the necessary attributes for various shots, including long drives and precise approaches. Furthermore, professional players often have brand endorsements and sponsorship deals, which may drive their preference for a specific golf ball brand. These endorsements not only influence their choice but also act as a form of advertising to the wider golfing community, encouraging recreational golfers to try the same balls used by their favorite professional players.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.6%. Golf has a long-standing and deeply-rooted cultural significance in the region. The sport has been popular in North America for over a century, with numerous golf courses, clubs, and tournaments spread across the United States and Canada. This rich golfing heritage has fostered a large and dedicated base of golfers who consistently contribute to the demand for golf balls. Additionally, North America boasts a high level of disposable income among its population, which enables golfers to invest in premium and technologically advanced golf balls. As a result, there is a steady demand for higher-priced golf ball models that offer enhanced performance and features. Other than this, the region hosts numerous professional golf tours, including the PGA and LPGA tours, which attract widespread attention and media coverage. As professional golfers endorse specific brands and golf ball models, it influences consumer preferences and prompts aspiring golfers to emulate their idols by purchasing the same equipment. Moreover, the presence of major golf ball manufacturers and retailers in North America contributes to the market size. These companies strategically position themselves to cater to the region's substantial golfing population, ensuring accessibility and availability of golf balls.

Key Regional Takeaways:

United States Golf Ball Market Analysis

In 2024, the United States accounted for the largest market share of over 95.70% of the golf ball market in North America. The growing trend of sports activity is driving the increasing golf ball adoption, as more individuals seek to engage in recreational pursuits. For instance, in 2023, the overall count of active sports and fitness participants in the U.S. reached a record high of 242 million, marking a 12.1% increase from 215.8 million in 2016. Golf ball manufacturers are benefiting from rising participation in sports, prompting advancements in golf ball technology to cater to varying skill levels. The growing emphasis on fitness and outdoor activities has encouraged players to invest in high-quality golf balls, boosting overall demand. Golf clubs and recreational centres are witnessing higher footfall, further accelerating sales. The rising number of amateur and professional golf events contributes to sustained golf ball adoption, as players seek to refine their skills. The availability of customized golf balls has gained traction among enthusiasts, aligning with the growing trend of sports activity. Golf tourism has also expanded, leading to increased golf ball sales as travelers explore new courses. Media coverage and endorsements from professional players influence purchasing decisions, contributing to the segment's expansion. The growing influence of training programs and golf academies has further supported market growth, with new players consistently entering the sport and requiring premium golf balls.

Asia Pacific Golf Ball Market Analysis

The proliferation of e-commerce platforms and online retail channels has significantly enhanced golf ball accessibility, leading to growing golf ball adoption. As per the India Brand Equity Foundation, e-commerce platforms in India reached a notable landmark, attaining a GMV of USD 60 Billion in the fiscal year 2023, representing a 22% rise from the year before. The availability of diverse golf ball options on digital platforms enables consumers to make informed purchasing decisions, contributing to higher sales. Online retail channels provide convenience, allowing golfers to explore various brands, compare prices, and access exclusive deals. Promotional campaigns and digital marketing efforts by golf ball manufacturers have increased brand visibility, attracting a broader audience. The expansion of online payment options and seamless delivery services has further encouraged purchases. Golf ball customization options available through online platforms have gained popularity, aligning with consumer preferences. Subscription-based models for golf ball supply have emerged, offering convenience for frequent players. The accessibility of product reviews and expert recommendations online has influenced purchasing patterns, reinforcing the appeal of e-commerce. Social media and digital content featuring golf ball innovations have contributed to market expansion. This growing digital presence has accelerated consumer engagement, further supporting golf ball sales.

Europe Golf Ball Market Analysis

The growing popularity of golf tournaments is fuelling golf ball adoption, with more players investing in high-performance options. Research by IAGTO shows that 8 of the 10 fastest expanding golf tourism spots hold European Tour events. Among European golfers, 27% are more inclined to travel to a destination that has held a European Tour event (increasing to 52% for those under 45). The increased number of competitive events has led to higher demand for durable and technologically advanced golf balls. Golf ball manufacturers are introducing specialized products to cater to the needs of professional and amateur players participating in tournaments. Packaging advancements have gained attention, enhancing product appeal and convenience for buyers. The focus on premium packaging solutions aligns with the growing popularity of golf tournaments, as consumers seek visually appealing and well-preserved products. Tournaments create opportunities for brand endorsements and sponsorships, increasing awareness about innovative golf ball features. The rise of golf academies and training facilities has encouraged players to invest in premium golf balls, supporting market growth. Retailers and sporting goods stores are capitalizing on tournament enthusiasm by offering tournament-specific golf ball collections. Enhanced marketing strategies around packaging and design further strengthen golf ball appeal.

Latin America Golf Ball Market Analysis

The rise in disposable income is driving growing golf ball adoption, as consumers allocate more spending toward leisure and sports activities. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. Higher purchasing power has encouraged investment in premium golf balls, supporting market growth. The availability of advanced golf ball options caters to varying skill levels, attracting both casual and professional players. Golf clubs and recreational facilities are witnessing increased membership, leading to higher golf ball sales. The demand for performance-enhancing golf balls has risen, aligning with consumers’ willingness to invest in quality products. The influence of global golf trends has further shaped buying preferences, reinforcing market expansion. The presence of golf training programs has contributed to increased golf ball purchases. Golf tourism and travel-related sports activities have supported market demand, as players seek specialized golf balls suited to different courses. The growing trend of personalized golf ball designs has also gained traction, further influencing purchasing decisions.

Middle East and Africa Golf Ball Market Analysis

The increasing participation in golf is driving growing golf ball adoption, as more individuals engage in the sport. For instance, since 2012, participation in nine and 18-hole golf has increased by 62% compared to 2020, with 16,000 registered participants in the Middle East. Golf courses and practice ranges are witnessing higher attendance, leading to greater demand for specialized golf balls. The presence of golf training academies has contributed to market growth, as new players require suitable golf balls for skill development. The expansion of corporate golf events has encouraged professionals to invest in high-quality golf balls. The rise of private golf clubs and membership-based facilities has supported consistent market expansion. The availability of diverse golf ball options has enabled players to experiment with different models, fostering higher purchase frequency. The role of golf as a networking activity has further influenced golf ball demand, as business professionals engage in the sport. Increased awareness of golf-related fitness benefits has driven participation, reinforcing golf ball sales.

Competitive Landscape:

The golf ball market is highly competitive, with key players focusing on innovation, performance enhancement, and brand differentiation. Major companies like Titleist, Callaway, TaylorMade, Bridgestone, and Srixon dominate the market, leveraging advanced material technology to improve distance, spin, and durability. Premium golf balls cater to professional and avid golfers, while budget-friendly options target casual players. Companies invest heavily in R&D, sponsorships, and marketing, partnering with professional golfers and tournaments to enhance brand visibility. The rise of customization and eco-friendly golf balls is shaping market trends. Additionally, the increasing popularity of golf in emerging markets and the growth of online retail channels are expanding opportunities for both established brands and new entrants.

The report provides a comprehensive analysis of the competitive landscape in the golf ball market with detailed profiles of all major companies, including:

- Acushnet Company (FILA)

- Bridgestone Golf Inc.

- Dixon Golf

- Dunlop Srixon Sports Asia Sdn Bhd

- Honma Golf Co. Ltd.

- Mizuno Corporation

- OnCore Golf Technology Inc.

- Snell Golf

- TaylorMade Golf Company

- Topgolf Callaway Brands Corp.

- Toppoint Marketing Co. Ltd.

- Volvik USA

Latest News and Developments:

- February 2025: Callaway has launched the Chrome Tour X, a high-performance golf ball designed to rival the Titleist Pro V1x. The company claims it surpasses its competitor in ball speed and distance, with independent tests confirming its impressive performance. Golfers can expect enhanced precision and power with this latest innovation.

- February 2025: Wilson has introduced the DUO Soft TRK360, featuring a two-color alignment design to enhance accuracy on the green. Maintaining its ultra-soft feel and low-spin performance, the ball now aids in precise aiming and putting consistency. This innovation expands Wilson’s DUO Soft franchise, reinforcing its position in golf ball technology.

- February 2025: TaylorMade has introduced its latest Tour Response and Tour Response Stripe™ golf balls, featuring advanced Tour-proven technology and enhanced visibility. Available in multiple vibrant colors, these balls offer a soft feel and Tour-level performance for all golfers. Priced from £37.99 per dozen, they launch online on Feb. 7 and in retail on Feb. 13.

- January 2025: Titleist launches next-generation Pro V1 golf ball range, marking 25 years of its iconic series. The new Pro V1 features a faster high-gradient core for more speed, control, and spin. Its 388-dimple design enhances distance and consistency, while the Pro V1x’s 348-dimple design offers higher flight. Both models deliver improved performance for golfers seeking precision and power.

- February 2024: TaylorMade has introduced the 2024 TP5 and TP5x golf balls, now available in Australia. The new models feature an all-new Speed Wrapped Core for improved sound, feel, and performance. The TP5x is TaylorMade’s fastest tour ball, while the TP5 offers the softest feel. Since 2017, the TP5/TP5x franchise has continually advanced with cutting-edge 5-layer construction.

Golf Ball Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | 2-piece, 3-piece, 4-piece |

| Applications Covered | Leisure, Professional |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acushnet Company (FILA), Bridgestone Golf Inc., Dixon Golf, Dunlop Srixon Sports Asia Sdn Bhd, Honma Golf Co. Ltd., Mizuno Corporation, OnCore Golf Technology Inc., Snell Golf, TaylorMade Golf Company, Topgolf Callaway Brands Corp., Toppoint Marketing Co. Ltd., Volvik USA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the golf ball market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global golf ball market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the golf ball industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The golf ball market was valued at USD 1.2 Billion in 2024.

The golf ball market is projected to exhibit a CAGR of 2.78% during 2025-2033, reaching a value of USD 1.6 Billion by 2033.

The market is driven by rising golf participation, technological advancements in distance, spin, and durability, increasing professional tournaments and sponsorships, and growing demand for eco-friendly golf balls. Additionally, the expansion of online sales and customization options enhances accessibility, while emerging markets further contribute to industry growth.

North America currently dominates the golf ball market, accounting for a share of 37.6%. The market is driven by rising golf participation, technological advancements, professional tournaments, sponsorships, e-commerce growth, and increasing demand for eco-friendly and premium golf balls.

Some of the major players in the golf ball market include Acushnet Company (FILA), Bridgestone Golf Inc., Dixon Golf, Dunlop Srixon Sports Asia Sdn Bhd, Honma Golf Co. Ltd., Mizuno Corporation, OnCore Golf Technology Inc., Snell Golf, TaylorMade Golf Company, Topgolf Callaway Brands Corp., Toppoint Marketing Co. Ltd., Volvik USA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)