GMP Testing Service Market Size, Share, Trends and Forecast by Service Type, End User, and Region, 2025-2033

GMP Testing Service Market Size and Share:

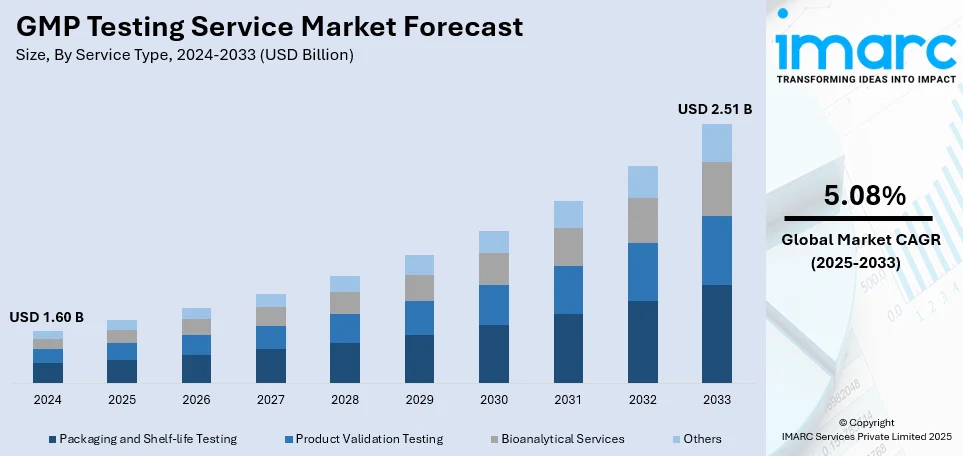

The global GMP testing service market size was valued at USD 1.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.51 Billion by 2033, exhibiting a CAGR of 5.08% from 2025-2033. North America currently dominates the market, holding a GMP testing service market share of over 36.7% in 2024. The market is experiencing steady growth driven by the increasing level of regulatory scrutiny across various industries, the stringent regulatory environment compelling businesses to invest in GMP testing services, and the rise in contract manufacturing and outsourcing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.60 Billion |

|

Market Forecast in 2033

|

USD 2.51 Billion |

| Market Growth Rate (2025-2033) | 5.08% |

Rising sophistication in software applications and increasing use of digital solutions in industries has heightened the necessity of rigorous quality assurance and testing services. In pursuit of fluid user experiences, security, and industry standards, business houses push demand for total testing. The methodologies of agile and DevOps promote continuous testing, thereby significantly enhancing the necessity of automated as well as manual testing solutions. Regulatory requirements within healthcare, finance, and automobile sectors require tests to be rigorously conducted in these sectors. Testing services prove to be inevitable for organizations since they try to reduce defects while improving performance as well as dependability.

The United States testing services market is growing due to technological advancements and strict regulatory requirements in the various industries. To adapt and incorporate digital transformation, cloud computing, and AI-based applications quickly into core operations, an all-encompassing kind of software, cybersecurity, and regulatory testing has become highly necessary. Industries such as healthcare, finance, and automotive require robust testing to keep with federal standards, such as HIPAA and FDA guidelines. Second, Agile and DevOps practices increasingly rely on automating testing needs. This demand goes hand-in-hand with organizations that have already begun adopting these Agile and DevOps methodologies-the practice is embraced by 42% of enterprises who adopt these approaches in their hybrid models. Therefore, based on the concerns over user experiences and risk control for enterprise groups, the future outlook for modernized testing remains significant for such companies in the U.S.

GMP Testing Service Market Trends:

Increased Consumer Awareness and Expectations

The latest GMP testing service forecast indicates that consumer behavior has evolved significantly with the advent of digital technologies that facilitate easy access to information. Along with this, consumers are informed about the products they use, from their ingredients to the ethical considerations surrounding their production. This increased awareness has set high expectations for product quality, safety, and efficacy, especially in sectors like healthcare and food production. The pressure on manufacturers to comply with quality standards is therefore enhanced by the will of consumers to pay a premium for products that guarantee the above attributes. According to reports, 61% of consumers are willing to pay at least 5% more if they know that they will get outstanding customer experience. In such a market scenario, GMP testing services provide a verifiable means for companies to demonstrate their commitment to quality and safety. Third-party GMP certification can be a significant factor in purchasing decisions. Therefore, the increase in consumer awareness and expectations thus aiding the GMP testing service market growth.

Continuous Technological Advancements

The continuous advancements in technology, particularly in analytical methodologies and equipment, serve as a major driving force in this market. Innovations such as High-Performance Liquid Chromatography (HPLC), Mass Spectrometry, and Next-Generation Sequencing have introduced highly precise, efficient, and comprehensive testing solutions, significantly enhancing analytical capabilities. According to the GMP testing service market overview, these technologies provide a more in-depth understanding of product composition and potential contaminants, which is essential for ensuring quality and safety. Along with this, the utilization of these advanced technologies enables GMP testing service companies to offer more precise and timely results. This efficiency accelerates the time-to-market for products and enables manufacturers to quickly discover and correct quality problems, which minimizes risks of product recall or legal actions. In addition, companies increasingly use GMP testing services, equipped with advanced technologies, to achieve the escalating quality standards.

Globalization of Supply Chains

In the contemporary globalized world, supply chains have become significantly globalized. The reports state that about 80% of all international trade depends on global supply chains today. Ingredients and parts originate from countries around the world. Each country has its own regulations and quality standards governing such components and ingredients, which makes things complicated and increases several challenges in guaranteeing uniform quality and safety in all products. More importantly, global supply chains are vulnerable to various risks like contamination, adulteration, and fraudulent practices that impair the quality of the product. GMP testing service market insight defines the role these services play to ensure products meet quality and safety criteria, regardless of the country of origin. Auditing and testing can take place in any stage of the supply chain to meet international standards. This is an area where companies exporting products are extra careful because they will need to adhere to the regulations of both the place of origin and the destination markets, which makes the globalization of supply chains highly impactful for GMP testing services.

GMP Testing Service Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global GMP testing service market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service type and end user.

Analysis by Service Type:

- Packaging and Shelf-life Testing

- Product Validation Testing

- Bioanalytical Services

- Others

Product validation testing holds the largest market share due to its critical role in ensuring product reliability, safety, and compliance with industry standards. Manufacturers across sectors such as healthcare, automotive, electronics, and aerospace prioritize rigorous validation to meet regulatory requirements and enhance customer trust. The growing complexity of smart devices, IoT integration, and AI-powered systems necessitates extensive testing to verify performance, durability, and interoperability. Additionally, stringent quality control measures and consumer demand for defect-free products further drive reliance on validation testing. As industries advance and integrate cutting-edge technologies, the demand for rigorous validation processes remains crucial, solidifying its dominance in the GMP testing service market share.

Analysis by End User:

- Pharmaceutical and Biopharmaceutical Companies

- Medical Device Companies

According to the GMP testing service market forecast, pharmaceutical and biopharmaceutical companies lead the testing services market due to stringent regulatory requirements and the need for rigorous product safety and efficacy assessments. Compliance with guidelines from agencies such as the FDA, EMA, and ICH necessitates extensive testing, including stability, sterility, and bioequivalence studies. The rising demand for biologics, personalized medicine, and advanced drug formulations further amplifies the need for specialized testing. Additionally, the increasing number of clinical trials, coupled with strict quality control measures, fuels reliance on outsourced testing services. As these companies strive to accelerate drug development while ensuring safety and regulatory adherence, their significant investment in comprehensive validation and testing solutions drives their dominant position in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the testing services market, accounting for 36.7% GMP testing service market share, due to its advanced technological infrastructure, stringent regulatory landscape, and strong presence of key industries. The region’s pharmaceutical, automotive, aerospace, and IT sectors require rigorous testing to meet compliance standards set by agencies such as the FDA, EPA, and ISO. The widespread adoption of automation, AI-driven testing, and cloud-based solutions further accelerates market growth. Additionally, the region’s emphasis on cybersecurity testing, fueled by rising cyber threats, drives demand for advanced testing services. The growing focus on quality assurance in software development and increasing investments in R&D further solidify North America’s GMP testing service market demand.

Key Regional Takeaways:

United States GMP Testing Service Market Analysis

The growth of the GMP testing service market in the United States is largely fueled by the rising demand for high-quality pharmaceuticals and medical devices, backed by stringent regulatory standards. With regulatory bodies like the Food and Drug Administration (FDA) overseeing pharmaceutical production and ensuring compliance with stringent quality standards, companies are required to consistently adhere to GMP guidelines. According to reports, the U.S. pharmaceutical industry was valued at approximately USD 574.37 Billion in 2023. This robust figure positions the U.S. as a leader in the global pharmaceutical landscape, accounting for about 45% of worldwide pharmaceutical sales. In addition, the growth of the biopharmaceutical industry, including biologics and biosimilars, further fuels the need for comprehensive GMP testing services. Apart from this, the rise in healthcare investments, coupled with advancements in biotechnology, is spurring innovation in drug development, thereby amplifying the demand for GMP testing to ensure product safety and efficacy. The United States also has a large base of contract research organizations (CROs) and contract manufacturing organizations (CMOs) that require GMP testing services for both early-stage clinical trials and large-scale production. In line with this, increasing concerns over counterfeit drugs and global drug safety are making compliance and testing services critical. Furthermore, the trend towards personalized medicine and the growing adoption of advanced technologies like artificial intelligence and automation in drug production further emphasize the need for GMP testing services.

Asia Pacific GMP Testing Service Market Analysis

The Asia Pacific GMP testing service market is witnessing significant growth, fueled by the expanding pharmaceutical industry, rapid economic development, and improving healthcare infrastructure across countries like China, India, and Japan. As of March 31, 2023, data from the Ministry of Health and Family Welfare indicates that India has 1,69,615 sub-centres (SCs), 31,882 primary health centres (PHCs), 6,359 community health centres (CHCs), 1,340 sub-divisional/district hospitals (SDHs), 714 district hospitals (DHs), and 362 medical colleges (MCs), catering to both rural and urban populations. As the region becomes a hub for pharmaceutical manufacturing and outsourcing, the demand for GMP testing services is on the rise. India and China, with their large-scale manufacturing capabilities and cost advantages, are attracting pharmaceutical companies from around the globe to establish production bases, resulting in an increasing need for GMP certification and testing. Besides this, as these countries strive to align with international standards to enhance their export potential, GMP testing becomes essential in maintaining quality and regulatory compliance. Furthermore, the region is also witnessing significant investments in biotech, biologics, and generic drug development, all of which are highly dependent on stringent GMP testing to ensure efficacy, safety, and regulatory approval. These investments are fueling the need for comprehensive GMP testing services to meet the growing regulatory scrutiny, guarantee product consistency, and ensure the drugs are safe and effective for patients. This ensures broader market access and consumer trust.

Europe GMP Testing Service Market Analysis

The region’s well-established pharmaceutical and biotech industries, where compliance with strict regulations is mandatory is impelling the market growth. The European Medicines Agency (EMA) ensures that all pharmaceutical and biopharmaceutical products undergo rigorous quality control and GMP testing before they are made available to the public. Europe’s aging population is leading to increased demand for healthcare products, which in turn drives the pharmaceutical industry’s need for robust GMP testing services. As of January 1, 2023, the population of the European Union was estimated at 448.8 million, with over one-fifth (21.3%) aged 65 years and older, according to reports. Moreover, the region’s focus on innovation in drug discovery and biologics is expanding the scope for GMP testing services to cover advanced therapeutics, such as gene therapies and cell-based treatments. The prevalence of stringent regulations, such as the EU Good Manufacturing Practice (EU GMP) guidelines, requires continuous monitoring and testing to ensure drug quality and patient safety, contributing to the expansion of the GMP testing services market. Additionally, the region’s increasing focus on sustainability and environmental safety also requires pharmaceutical manufacturers to adopt more responsible practices in compliance with GMP standards, further boosting the demand for GMP testing services.

Latin America GMP Testing Service Market Analysis

The growing demand for GMP testing service due to a rising population as well as healthcare needs is offering a favorable market outlook. Countries like Brazil and Mexico are leading the charge in drug production and exports, requiring manufacturers to comply with GMP guidelines to meet both local and international regulatory standards. The demand for generics, biologics, and vaccines is on the rise, prompting a need for rigorous quality control and testing services. Furthermore, the expansion of the region’s pharmaceutical manufacturing sector, particularly in emerging markets, is driving demand for GMP certification and testing services, as these countries seek to improve drug safety, meet export requirements, and support their healthcare systems. The Brazilian Drug Market Regulation System (CMED) published a report in which the country’s pharmaceutical market peaked at a turnover of around USD 28.49 Billion in 2023.

Middle East and Africa GMP Testing Service Market Analysis

The Middle East and Africa GMP testing service market is impelled by increasing investments in healthcare infrastructure, especially in countries like Saudi Arabia, the UAE, and South Africa. As per reports, healthcare expenditure in the Gulf Cooperation Council (GCC) is predicted to reach USD 135.5 Billion by 2027. These nations are focusing on developing local pharmaceutical manufacturing capabilities to reduce dependency on imports, resulting in a growing need for GMP testing services. The region is also seeing an increase in the demand for high-quality medicines, particularly in response to rising chronic disease rates. To meet international standards and ensure the safety and efficacy of drugs, pharmaceutical manufacturers are increasingly relying on GMP testing services. Moreover, improving regulatory frameworks across several countries in the region are reinforcing the need for consistent GMP compliance and testing.

Competitive Landscape:

The testing services market is highly competitive, featuring a wide range of providers that offer both automated and manual testing solutions. Competition is driven by innovation, service differentiation, and technological advancements in AI-driven testing, cybersecurity assessments, and cloud-based testing platforms. Market players focus on expanding their service portfolios, integrating advanced analytics, and enhancing automation capabilities to meet the rising demand for faster and more accurate testing. Pricing strategies, regulatory compliance expertise, and industry-specific solutions also contribute to market positioning. Additionally, partnerships with software developers, cloud service providers, and enterprises strengthen market reach. The growing emphasis on Agile and DevOps methodologies intensifies competition, compelling service providers to continuously enhance efficiency, scalability, and security in their testing frameworks.

The report provides a comprehensive analysis of the competitive landscape in the GMP testing service market with detailed profiles of all major companies, including:

- Almac Group

- Charles River Laboratories International Inc.

- Eurofins Scientific SE

- ICON plc

- Intertek Group plc

- Merck KgaA

- Nelson Laboratories LLC (Sotera Health Company)

- North American Science Associates LLC

- Pace Analytical Services LLC

- PPD Inc. (Thermo Fisher Scientific Inc.)

- Sartorius AG

- Wuxi Apptec Co. Ltd.

Latest News and Developments:

- January 2025: Eurofins Healthcare Assurance launched an innovative Good Manufacturing Practice (GMP) certification programme for dietary and food supplements. It is an initiative to increase compliance, safety, and quality in global supply chains, particularly for manufacturers, brands, agents, and retailers to easily understand and traverse the increasingly complicated US regulatory environment in the rapidly expanding health and wellness market.

- February 2024: Thermo Fisher Scientific Inc., a global leader in serving science, expanded its service portfolio at its GMP lab in Middleton, Wisconsin, by adding mycoplasma and additional biosafety testing capabilities. This newly launched service comes from the clinical research business's analytical testing service, and biopharmaceutical products will remain free of contamination to enable clients to administer drug products to the patients.

- April 2023: Svar Life Science announced the expansion of its biologics testing capacity with a GMP certification. Independent audit by an auditor from the Swedish Medical Products Agency has been made on Svar's QC labs and approved for starting QC analysis according to GMP regulations relevant to potency testing of biologics. The company said it has recently been awarded the Good Manufacturing Practice (GMP) certification and announced that customers will be availed with the QC Testing Services in line with the international quality assurance guidelines immediately.

- April 2023: Thermo Fisher Scientific expanded its Bourgoin, France facility by adding early development capabilities for oral solid dose therapeutics. This enhancement allows the site to better support customers throughout their workflow, from early drug development to commercial manufacturing, further solidifying Thermo Fisher's commitment to helping customers deliver medicines to patients more quickly. Along with the expanded GMP facilities, the early development hub includes a 430 square meter (4,600 sq. ft.) research and development space.

GMP Testing Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Packaging and Shelf-life Testing, Product Validation Testing, Bioanalytical Services, Others |

| End Users Covered | Pharmaceutical and Biopharmaceutical Companies, Medical Device Companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Almac Group, Charles River Laboratories International Inc., Eurofins Scientific SE, ICON plc, Intertek Group plc, Merck KgaA, Nelson Laboratories LLC (Sotera Health Company), North American Science Associates LLC, Pace Analytical Services LLC, PPD Inc. (Thermo Fisher Scientific Inc.), Sartorius AG, Wuxi Apptec Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GMP testing service market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global GMP testing service market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GMP testing service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GMP testing service market was valued at USD 1.60 Billion in 2024.

The GMP testing service market was valued at USD 2.51 Billion in 2033exhibiting a CAGR of 5.08% during 2025-2033.

The GMP testing service market is driven by stringent regulatory requirements, rising pharmaceutical and biopharmaceutical production, and increasing demand for quality assurance. Growth in biologics, personalized medicine, and contract manufacturing further fuels demand. Compliance with FDA, EMA, and ICH guidelines makes rigorous product testing essential for safety, efficacy, and market approval.

North America leads the testing services market with 36.7% share due to strict regulatory standards, advanced technological adoption, and strong demand from pharmaceutical, IT, and automotive industries. The region’s focus on AI-driven testing, cybersecurity, and quality assurance, along with high R&D investments, further strengthens its market dominance.

Some of the major players in the GMP testing service market include Almac Group, Charles River Laboratories International Inc., Eurofins Scientific SE, ICON plc, Intertek Group plc, Merck KgaA, Nelson Laboratories LLC (Sotera Health Company), North American Science Associates LLC, Pace Analytical Services LLC, PPD Inc. (Thermo Fisher Scientific Inc.), Sartorius AG, Wuxi Apptec Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)