Glycomics Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Glycomics Market Size and Share:

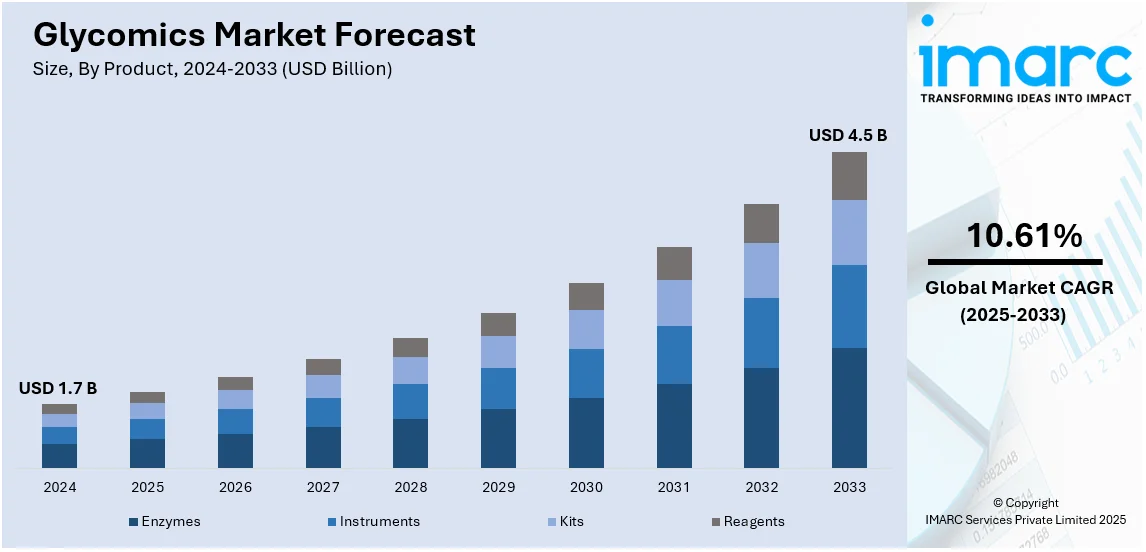

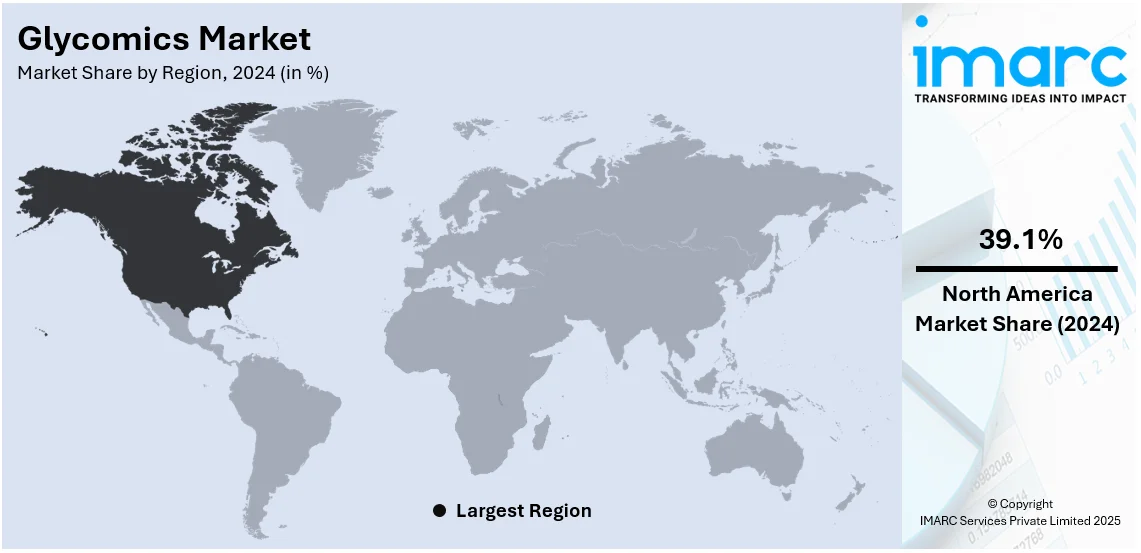

The global glycomics market size was valued at USD 1.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.5 Billion by 2033, exhibiting a CAGR of 10.61% from 2025-2033. North America currently dominates the market, holding a market share of over 39.1% in 2024. The glycomics market share is rising due to the growing incidence of chronic diseases, rising focus on glycoengineering techniques, and increasing number of contract research organizations (CROs) involved in drug and biologics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Market Growth Rate (2025-2033) | 10.61% |

The glycomics market is growing rapidly, driven by advancements in biotechnology and the adding recognition of glycans' part in health and disease. As researchers uncover how glycans impact cancer, contagious diseases, and neurological diseases, demand for glycomics tools and technologies is surging. Pharmaceutical and biotech companies are making investments heavily in glycan- based drug development and personalized medicine, further accelerating the glycomics market growth. The rise of biologics, similar as monoclonal antibodies and glycoprotein therapies, has also fueled the need for glycan analysis in medicine development and quality control. Also, technological advancements, like high- throughput glycan profiling and enhanced mass spectrometry approaches, are making glycomics research briskly and more accessible. Government and private funding for glycobiology research is also expanding, supporting invention in the field.

The United States has emerged as a key regional market for glycomics, driven by advancements in biotechnology and a growing focus on individualized drug. Researchers and pharmaceutical companies are investing heavily in glycomics to more understand the part of glycans in conditions like cancer, autoimmune diseases, and contagious diseases. This knowledge is paving the way for innovative diagnostics and targeted therapies. Government backing and academic exploration enterprises farther propel the growth, with institutions like the NIH supporting glycomics studies. The adding demand for biologics and biosimilars also plays a crucial apart, as glycan analysis is essential for icing medicine safety and efficacity. Also, technological inventions, similar as high- throughput glycan analysis and mass spectrometry, are making exploration briskly and more precise.

Glycomics Market Trends:

Increasing Research and Development Activities

The market is experiencing a significant boost in research and development (R&D) activities. As per National Science Board, according to data that's presently accessible for each nation, R&D spending worldwide in 2021 was$ 2.6 trillion in current PPP currency. The growing understanding of the pivotal roles played by glycans in various biological processes has increased interest in studying and manipulating these molecules. Researchers and pharmaceutical companies are investing in exploration to explore the implicit operations of glycans in medicine discovery, personalized drug, and diagnostics. Also, the expanding amplitude of the exploration is driven by nonstop advancements in logical techniques and technologies. Likewise, collaborations between academia, industry, and research institutions have fueled the growth of glycomics R&D. These collaborations bring together different expertise and finances, fostering invention and accelerating the development of glycomics- grounded products. also, the cooperative efforts between various stakeholders contribute to the expansion of knowledge, development of new technologies, and translation of exploration findings into practical operations.

Rising Demand for Personalized Medicine

Personalized drug, which aims to conform medical treatments to individual cases based on their genetic makeup and specific characteristics, is gaining elevation. For instance, with the US government’s unveiling of the Precision Medicine Initiative in 2015 and investing USD 215 Million in the National Institutes of Health (NIH)’s 2016 budget, with a fresh USD 54 Million announced in 2023. It plays a vital part in individualized drug as glycans have been implicated in various conditions and can serve as potential biomarkers for diagnostics and prognostics. The capability to dissect and understand the glycome of patients can enable the development of targeted curatives and more precise medical interventions. In addition, the advancements in glycomics profiling technologies, similar as glycan microarrays and glycan sequencing, have eased the identification of disease-specific glycan signatures. These discoveries hold pledge for the development of glycan- grounded diagnostics, personalized therapeutics, and companion diagnostics, further fueling the glycomics market demand for research and products.

Increasing Focus on Biomarker Discovery

Glycomics has gained significant attention in the field of biomarker discovery. Glycans have shown promising eventuality as biomarkers for various conditions, including cancer, cardiovascular diseases, and contagious conditions. The IMARC's 2022 study states that 20 million new cases of cancer exist across the nation and 9.7 million deaths have been witnessed from the disease. Biomarkers play a pivotal part in disease judgment, prognostic, and monitoring treatment efficacity. Also, the growing focus on biomarker discovery has propelled the demand for exploration, as the identification of dependable and specific biomarkers is pivotal for perfecting disease discovery, patient position, and treatment selection. Likewise, the integration of glycomics into biomarker discovery channels has the implicit to revise diagnostics and enable early intervention, driving the growth of the overall market. Also, the research offers a unique opportunity to identify specific glycan patterns or alterations associated with different diseases. By studying the glycome of individuals or patient cohorts, researchers can unveil disease-specific glycan signatures that can serve as diagnostic or prognostic biomarkers.

Glycomics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global glycomics market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Enzymes

- Glycosidases

- Glycosyltransferases

- Neuraminidases

- Sialyltransferases

- Others

- Instruments

- Mass Spectrometers

- HPLC

- MALDI-TOF

- Array systems

- Others

- Kits

- Glycan Labeling Kits

- Glycan Purification Kits

- Glycan Release Kits

- Others

- Reagents

- Glycoproteins

- Monosaccharides

- Oligosaccharides

- Others

Enzymes dominate the market with 29.6% share as they play a crucial role in research and applications by facilitating the analysis and manipulation of glycans. Enzymes, such as glycosidases, glycosyltransferases, and glycosyl hydrolases, are utilized in various workflows, including glycan release, structural analysis, and glycan modification. Moreover, enzymes are essential for the enzymatic cleavage of glycans from glycoproteins or glycolipids, enabling the analysis of liberated glycans. The demand for enzymes in research and applications is driven by the growing need for robust and efficient enzymatic tools. Researchers and scientists rely on enzymes to accurately and selectively manipulate glycans, enabling comprehensive glycomics analysis and the development of glycan-based products. Additionally, advancements in enzyme engineering and optimization have led to the development of highly specific and efficient enzymes, further enhancing their utility in glycomics research.

Analysis by Application:

- Drug Discovery and Development

- Diagnostics

- Others

Drug discovery and development holds the largest market share with 43.6% as it plays a crucial role in advancing drug discovery and development processes by providing insights into the role of glycans in disease mechanisms, drug efficacy, and safety. Glycans are involved in various biological processes and have been linked to numerous diseases, including cancer, cardiovascular disorders, and infectious diseases. Understanding the glycan profiles and their interactions with proteins and cells is essential for identifying potential therapeutic targets and designing effective drugs. Moreover, the integration with drug discovery and development processes has led to the development of glycan-based therapies, companion diagnostics, and improved drug screening platforms. Also, the focus on targeting glycans in drug discovery and development has driven the demand for research and technologies.

Analysis by End User:

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

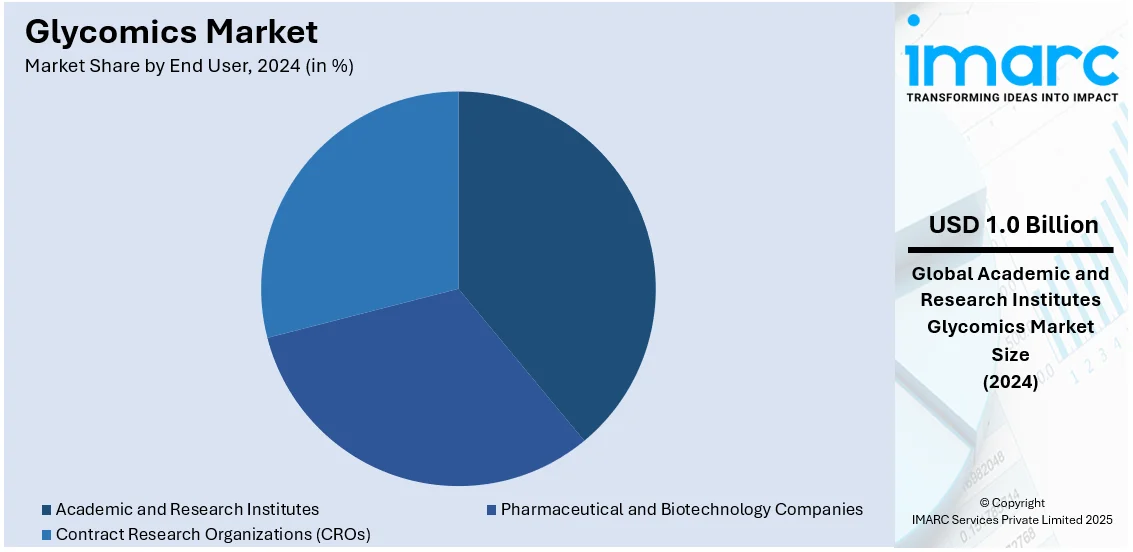

Academic and research institutes hold 38.7% share as they play a vital role in driving research and advancements in the field. These institutions serve as the primary hubs for scientific research, knowledge generation, and innovation in the field. They are home to leading scientists, researchers, and experts who are actively involved in studying and exploring the complexities of glycans. These institutions also provide the necessary infrastructure, funding, and collaborative opportunities to support the research. They often house state-of-the-art laboratories equipped with advanced analytical instruments and technologies, enabling comprehensive glycan analysis and profiling. Furthermore, academic and research institutes contribute significantly to expanding the knowledge base through publications, scientific conferences, and collaborations. They foster interdisciplinary research collaborations, bringing together experts from various fields such as chemistry, biology, bioinformatics, and medicine.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market with 39.1% share as it is home to several renowned academic institutions, research organizations, and biotechnology companies that have made significant contributions to the research. These institutions have robust research infrastructure, state-of-the-art laboratories, and well-established collaborations, facilitating cutting-edge studies and innovation. Moreover, the region has a well-developed healthcare and biopharmaceutical sector, which drives the demand for research and applications. The presence of major pharmaceutical companies and biotech firms in North America leads to significant investments in the research for drug discovery, personalized medicine, and the development of glycan-based therapeutics. Furthermore, the region has a favorable regulatory environment and strong intellectual property protections that encourage innovation and commercialization of glycomics-based products. The region's well-defined regulatory frameworks provide clarity and guidance for research, ensuring the safety and efficacy of glycan-based diagnostics and therapeutics.

Key Regional Takeaways:

United States Glycomics Market Analysis

The United States accounts for 89.50% of glycomics market in United States. increasing focus on glycomics within pharmaceutical and biotechnology sectors in the United States is a major catalyst for its broader adoption. Reports state that in the first half of 2024, 105 rounds of seed and series A funding were made into U.S. biopharma companies, totaling USD 5.1 Billion. These sectors' emphasis on developing new therapeutic solutions, particularly those targeting complex diseases like cancer and autoimmune disorders, has elevated the role of glycomics in drug discovery and development. By understanding the glycosylation patterns of proteins, researchers can identify biomarkers for diseases, improve drug efficacy, and reduce side effects. As pharmaceutical and biotechnology firms intensify their research efforts, collaborations with research organizations and an expansion of infrastructure that supports glycomics research further accelerate its integration. This shift toward glycomic-based studies has led to enhanced funding, innovation in drug development pipelines, and deeper understanding of cellular processes, all contributing to greater uptake in the healthcare industry.

Asia Pacific Glycomics Market Analysis

In the Asia-Pacific region, there is a noticeable surge in the adoption of glycomics driven by substantial investments in academic and research institutions. For example, India's Gross Expenditure on R&D (GERD) has more than doubled over the years, from over USD 7.25 billion in 2010–11 to roughly USD 15.33 billion in 2020–21. These institutions are focusing on the development of advanced glycomics technologies and their application to diseases prevalent in the region, such as infectious diseases and metabolic disorders. As governments and private entities increase funding for research and development, the expansion of specialized facilities for glycomic research has made glycomics more accessible. Additionally, the growing number of collaborative efforts between academia, industry, and government bodies has facilitated rapid advancements in glycomics technologies. These factors, combined with an increasing number of skilled professionals and researchers in the field, have accelerated glycomics adoption across various healthcare applications.

Europe Glycomics Market Analysis

The rising demand for tailored healthcare solutions in Europe is driving the increased adoption of glycomics, particularly in the field of personalized medicine. According to reports, the European precision medicine market size is estimated to be worth USD 38.26 Billion by 2032 from USD 16.72 Billion in 2024. As healthcare systems evolve to provide more individualized treatment plans, understanding the genetic and glycomic makeup of patients has become critical. This growing emphasis on patient-centric healthcare is spurring innovation in glycomics, particularly in areas related to drug efficacy, biomarker discovery, and precision therapies. The ability to better diagnose and treat diseases based on a patient’s unique glycosylation profiles offers tremendous potential for improving therapeutic outcomes. Moreover, increasing government initiatives and collaborations between healthcare providers and biotech companies have resulted in the wider integration of glycomics into clinical settings, further promoting its role in personalized medicine.

Latin America Glycomics Market Analysis

In Latin America, the healthcare sector’s rapid expansion is significantly boosting the adoption of glycomics technologies. Brazil has 7,191 hospitals, 62% of which are private, making it the largest healthcare market in Latin America, according to data released by the International Trade Administration in 2023. As healthcare infrastructure continues to improve, there is a growing emphasis on developing more accurate diagnostic and therapeutic solutions. This shift is enhancing the demand for cutting-edge technologies like glycomics, which plays a crucial role in understanding diseases at the molecular level. Healthcare facilities are increasingly investing in specialized technologies to better treat chronic conditions such as diabetes and heart disease, where glycomics applications hold promise. As the healthcare sector matures, the need for advanced research and clinical capabilities is expected to further drive the utilization of glycomics for improved disease management.

Middle East and Africa Glycomics Market Analysis

In the Middle East and Africa, the expanding healthcare facilities are fostering the adoption of glycomics, particularly in glycan-based diagnostics and therapeutics. According to a research by the Dubai Healthcare City Authority, 4,482 private medical facilities and 55,208 licensed professionals were there in Dubai's healthcare sector by 2022, which is anticipated to grow by 3-6% in facilities and 10-15% in professionals in 2023. As the region’s healthcare infrastructure develops, there is a stronger emphasis on integrating advanced technologies to improve diagnostic capabilities and treatment outcomes. Glycomics plays a key role in understanding disease mechanisms and discovering new biomarkers that can lead to more effective treatments. The growing availability of healthcare services, coupled with investments in medical research, is promoting the use of glycomics in both diagnostics and therapeutics. As healthcare access expands, the potential for glycomics to play a significant role in personalized care becomes increasingly evident.

Competitive Landscape:

The glycomics market in the United States is expanding rapidly, driven by advancements in biotechnology and a growing focus on personalized medicine. Researchers and pharmaceutical companies are investing heavily in glycomics to better understand the role of glycans in diseases like cancer, autoimmune disorders, and infectious diseases. This knowledge is paving the way for innovative diagnostics and targeted therapies. Government funding and academic research initiatives further fuel market growth, with institutions like the NIH supporting glycomics studies. The increasing demand for biologics and biosimilars also plays a key role, as glycan analysis is essential for ensuring drug safety and efficacy. Additionally, technological innovations, such as high-throughput glycan analysis and mass spectrometry, are making research faster and more precise. These efforts are creating a favorable glycomics market outlook.

The report provides a comprehensive analysis of the competitive landscape in the glycomics market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- Asparia Glycomics

- Bruker Corporation

- Danaher Corporation

- Dextra Laboratories Limited (New Zealand Pharmaceuticals Limited)

- Merck KGaA

- New England Biolabs

- RayBiotech Life Inc.

- Shimadzu Corporation

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- Waters Corporation.

Latest News and Developments:

- December 2024: GlycoNet, a pioneer in glycomics research, has teamed up with Michael Smith Health Research BC to investigate complex sugars in living things in order to address health issues. With USD 2.3 million going to teams based in British Columbia, GlycoNet's USD 12 million financing supports 21 research teams across Canada. These initiatives concentrate on chronic illnesses, cancer treatments, and vaccination reactions. This partnership seeks to advance our knowledge of glycans and provide novel therapeutic instruments.

- March 2024, Bruker Corporation emphasized significant development in immunopeptidomics, glycoproteomics, and other Collision Cross Section (CCS)-enabled 4D proteomics workflows. Their advancements in glycomics and deep proteomics research solutions complement their broader life-science technologies, offering crucial insights into disease biology, biomarkers, and the development of molecular diagnostics and medications.

- March 2024, The 20th US HUPO Congress 2024 saw Bruker Corporation present developments in CCS-enabled 4D-proteomics, glycoproteomics, and immunopeptidomics. In glycopeptide analysis, the new glyco-PASEF® approach improves ultra-high sensitivity, and new machine learning algorithms boost immunopeptidome identification. Advanced studies in drug discovery, disease biology, and glycomics are aided by these developments.

- February 2024: Led by LAUNCHub Ventures and Kadmos Capital, GlycanAge, a biotech business with a focus on glycomics, raised about USD 4.2 million in seed funding. Its goal of using glycan biomarkers to transform individualized preventative healthcare will be aided by this financing. Due to technological breakthroughs, Glycobiology's potential is expanding, thanks to Gordan Lauc, co-founder of GlycanAge. Precision medicine is being advanced by the high throughput glycomic analysis work his team is doing.

- January 2024, Navinci Diagnostics and Vector Laboratories announced a ground-breaking collaboration to create novel biomarker finding techniques. This partnership will significantly advance the field of molecular diagnostics by using state-of-the-art glycomic research to detect particular protein glycosylation in tissue samples.

Glycomics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Drug discovery and Development, Diagnostics, Others |

| End Users Covered | Academic And Research Institutes, Pharmaceutical and Biotechnology Companies, Contract Research Organizations (CROs) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Asparia Glycomics, Bruker Corporation, Danaher Corporation, Dextra Laboratories Limited (New Zealand Pharmaceuticals Limited), Merck KGaA, New England Biolabs, RayBiotech Life Inc., Shimadzu Corporation, Takara Bio Inc., Thermo Fisher Scientific Inc., Waters Corporation. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the glycomics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global glycomics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the glycomics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The glycomics market was valued at USD 1.7 Billion in 2024.

The glycomics market share is estimated to exhibit a CAGR of 10.61% during 2025-2033.

The glycomics market is propelled by the growing prevalence of chronic diseases among the masses, rising focus on glycoengineering techniques, and increasing number of contract research organizations (CROs) involved in drug and biologics.

North America currently dominates the market due to robust research infrastructure, state-of-the-art laboratories, and well-established collaborations, facilitating cutting-edge studies and innovation.

Some of the major players in the glycomics market include Agilent Technologies Inc., Asparia Glycomics, Bruker Corporation, Danaher Corporation, Dextra Laboratories Limited (New Zealand Pharmaceuticals Limited), Merck KGaA, New England Biolabs, RayBiotech Life Inc., Shimadzu Corporation, Takara Bio Inc., Thermo Fisher Scientific Inc., Waters Corporation. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)