Glucosamine Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Glucosamine Price Trend, Index and Forecast

Track the latest insights on glucosamine price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Glucosamine Prices Outlook Q3 2025:

- USA: USD 9253/MT

- China: USD 3126/MT

- Germany: USD 8510/MT

- India: USD 6586/MT

- Vietnam: USD 6974/MT

Glucosamine Prices Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the glucosamine prices in the USA reached 9253 USD/MT in September. The decline in prices this quarter was influenced by stabilized raw material availability, easing pressure on supply chains, and moderate inventory levels among key distributors. Weak domestic demand in the pharmaceutical and nutraceutical segments further contributed to the downward pricing trend. Additionally, fluctuations in transportation costs and competitive pricing from alternative suppliers reinforced the slight reduction, even as production costs remained steady.

During the third quarter of 2025, the glucosamine prices in China reached 3126 USD/MT in September. The sharp decline in prices was primarily driven by excess domestic supply and lower export demand. Local manufacturers faced pressure due to increased production capacity, which, coupled with weaker downstream pharmaceutical orders, contributed to price softness. Currency stability and lower logistics costs only partially offset the market downturn.

During the third quarter of 2025, the glucosamine prices in Germany reached 8510 USD/MT in September. Prices decreased due to constrained consumer demand and inventory corrections in the wholesale and pharmaceutical sectors. Supply-side adjustments, including improved raw material logistics, resulted in moderate price reductions. Regulatory compliance costs remained stable, but overall cautious purchasing behaviors by healthcare and supplement manufacturers exerted downward pressure.

During the third quarter of 2025, the glucosamine prices in India reached 6586 USD/MT in September. The slight upward movement in prices reflected steady demand from the pharmaceutical and nutraceutical sectors and constrained local supply. Suppliers leveraged limited production volumes to maintain margins, while increasing raw material costs contributed to price firmness. Moreover, domestic manufacturers adopted strategic pricing to balance competitive pressures with profitability objectives, which supported the modest increase.

During the third quarter of 2025, the glucosamine prices in Vietnam reached 6974 USD/MT in September. Prices reflected moderate demand and consistent production output. While export demand fluctuated, domestic orders provided steady support. Additionally, operational efficiencies in local manufacturing and stable logistics costs prevented significant price volatility. Suppliers maintained cautious pricing strategies to mitigate risks associated with external market uncertainties.

Glucosamine Prices Outlook Q2 2025:

- United States: USD 9500/MT

- Germany: USD 9200/MT

- China: USD 3500/MT

- Brazil: USD 4600/MT

- India: USD 6470/MT

During the second quarter of 2025, the glucosamine prices in the United States reached 9500 USD/MT in June. Prices strengthened due to robust demand from nutraceutical manufacturers and increased procurement by pharmaceutical companies. Supply chain constraints, particularly limited availability of high-purity raw materials, contributed to higher pricing. Additionally, logistical cost pressures and seasonal demand surges for joint health supplements supported the upward trend. Market sentiment remained optimistic as buyers secured volumes in anticipation of future price increases.

During the second quarter of 2025, the glucosamine prices in Germany reached 9200 USD/MT in June. Prices declined sharply as a result of softened pharmaceutical orders and high stock levels at distribution points. Regulatory scrutiny and cautious purchasing by healthcare manufacturers limited upward price momentum. European market competition further constrained pricing, compelling sellers to adopt more competitive strategies. Despite stable production costs, overall market sentiment favored buyers, leading to notable price corrections.

During the second quarter of 2025, the glucosamine prices in China reached 3500 USD/MT in June. The decline in prices was driven by an oversupply of locally produced glucosamine and weaker export demand. Domestic manufacturers faced reduced profit margins, encouraging aggressive pricing adjustments to sustain sales. Improved transportation efficiencies provided limited support but could not offset the downward pressure. Moreover, competitive pricing from regional players contributed to overall market softness.

During the second quarter of 2025, the glucosamine prices in Brazil reached 4600 USD/MT in June. The sharp price reduction was due to declining pharmaceutical and nutraceutical consumption, combined with oversupply from local manufacturers. Logistics and import cost reductions provided minimal relief, while sellers implemented discount strategies to move excess stock. Market activity remained sluggish, reflecting cautious procurement behaviors among distributors.

During the second quarter of 2025, the glucosamine prices in India reached 6470 USD/MT in June. Prices were fluctuating as local demand continued to support domestic production levels. Slight fluctuations in raw material costs and moderate growth in the pharmaceutical and supplement sectors helped maintain equilibrium. Suppliers maintained consistent pricing policies, balancing inventory levels with market requirements.

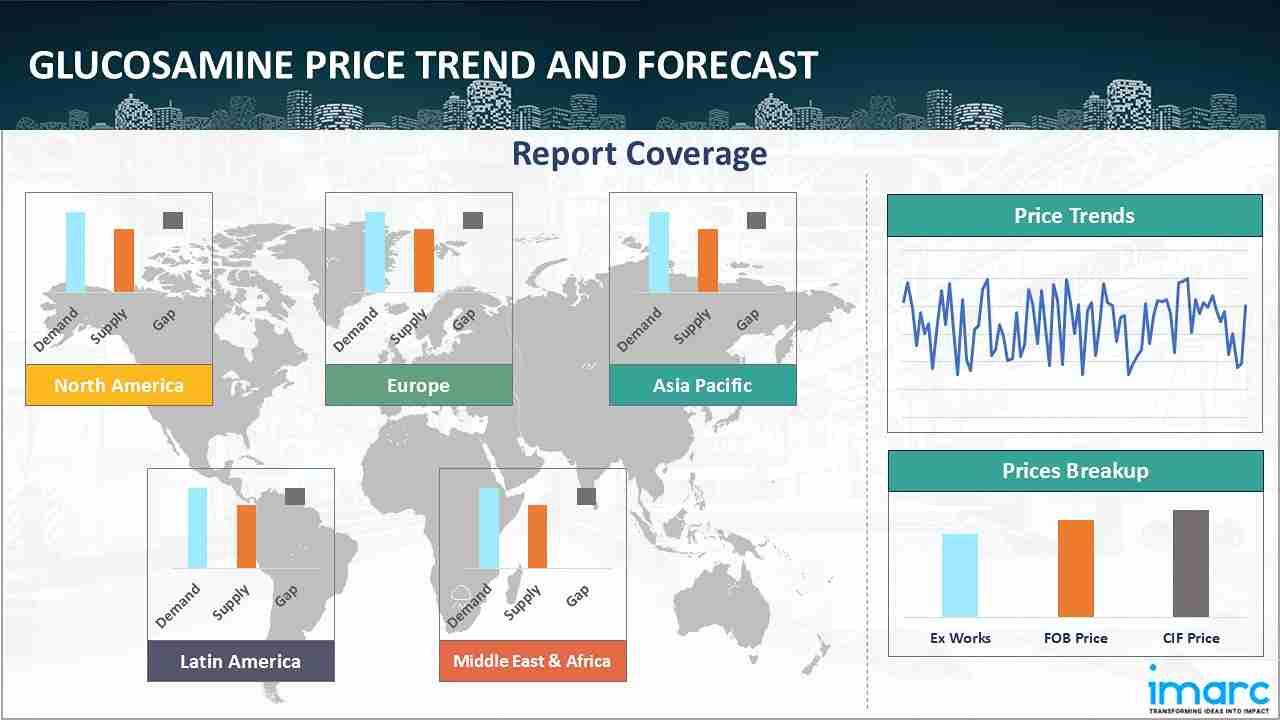

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing glucosamine prices.

Europe Glucosamine Price Trend

Q3 2025:

During the third quarter of 2025, the glucosamine price index in Europe reflected moderate softness. Declining demand in pharmaceutical and nutraceutical sectors, coupled with high inventory levels among distributors, led to downward price adjustments. Supply chain efficiencies and stable raw material availability contributed to a controlled reduction in prices. Competitive pressures among European producers reinforced price moderation, while end-user demand remained steady but not sufficient to offset the general market softness.

Q2 2025:

During the second quarter of 2025, the glucosamine price index in Europe showed notable softness. The decline was primarily driven by elevated inventory levels across major distribution hubs, which reduced the urgency for fresh procurement and placed downward pressure on supplier pricing strategies. Pharmaceutical and nutraceutical manufacturers adopted conservative purchasing patterns due to subdued end-user consumption, leading to slower order cycles. Competitive pressures intensified as both regional producers and importers attempted to secure market share in an oversupplied environment, prompting flexible pricing and promotional incentives.

This analysis can be extended to include detailed glucosamine price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Glucosamine Price Trend

Q3 2025:

In Q3, the glucosamine price index in North America experienced a mild contraction. Supply stabilization and eased logistics costs contributed to a reduction in prices, while cautious purchasing behavior by manufacturers further reinforced softness. Inventory management strategies and competitive pressures among distributors led to moderate downward adjustments. Despite steady domestic demand in healthcare and nutraceutical markets, pricing remained under pressure due to market correction trends.

Q2 2025:

In Q2, the glucosamine price index in North America strengthened due to robust demand and constrained supply conditions. Nutraceutical manufacturers increased their procurement activity, driven by steady consumer interest in joint-health supplements and supportive retail channel performance. Pharmaceutical producers also expanded purchasing volumes, maintaining consistent formulation schedules across therapeutic categories. On the supply side, limited availability of key raw materials and tight manufacturing capacities created upward pressure on pricing, as producers prioritized essential orders.

Specific glucosamine historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Glucosamine Price Trend

Q3 2025:

The report explores the glucosamine trends and glucosamine price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q2 2025:

As per the glucosamine price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

In addition to region-wise data, information on glucosamine prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Glucosamine Price Trend

Q3 2025:

During the third quarter of 2025, glucosamine prices in the Asia Pacific were largely shaped by regional supply surpluses and moderate demand from the pharmaceutical and supplement sectors. Competitive dynamics among suppliers encouraged flexible pricing, while operational efficiencies maintained price stability. The combination of limited external demand and cautious domestic buying contributed to minimal volatility in pricing.

Q2 2025:

During Q2 2025, glucosamine prices in the Asia Pacific were influenced by oversupply conditions and subdued demand growth. Expanded production capacity across key manufacturing hubs, particularly in China and Southeast Asia, contributed to abundant supply, creating downward pressure on market sentiment. Domestic demand within the nutraceutical and pharmaceutical sectors grew only gradually, limiting the absorption of available stocks. Manufacturers responded to the imbalanced supply environment by adopting competitive pricing strategies aimed at sustaining sales volumes and retaining long-standing buyers.

This glucosamine price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Glucosamine Price Trend

Q3 2025

Latin America's glucosamine market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in glucosamine prices.

Q2 2025:

During the second quarter of 2025, glucosamine prices in Latin America experienced a downturn due to weak consumption and oversupply from local producers. Demand from pharmaceutical and nutraceutical manufacturers remained muted as buyers prioritized inventory consolidation and delayed new procurement cycles. The oversupplied market encouraged producers to adopt aggressive pricing strategies, including broad discounting to maintain sales volumes.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Glucosamine Pricing Report, Market Analysis, and News

IMARC's latest publication, “Glucosamine Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the glucosamine market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of glucosamine at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed glucosamine prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting glucosamine pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Glucosamine Industry Analysis

The global glucosamine market size reached USD 991.2 Million in 2025. By 2034, IMARC Group expects the market to reach USD 1,486.1 Million, at a projected CAGR of 4.60% during 2026-2034. The market is primarily driven by the increasing demand from pharmaceutical and nutraceutical sectors, growing awareness of joint health, and rising prevalence of osteoarthritis.

Latest News and Developments:

- June 2025: A systematic review examined the safety and efficacy of glucosamine and chondroitin in humans. Conducted by researchers from Cedarville University, the analysis reviewed 146 studies, most of which focused on osteoarthritis and joint pain. The majority of trials reported positive outcomes, with minimal safety concerns. Commonly evaluated together, glucosamine and chondroitin were typically administered at daily doses of 1500 mg and 1200 mg. Overall findings suggested both supplements are effective and well-tolerated, though further research was recommended.

Product Description

Glucosamine is a natural sugar that exists in liquid form around the joints. This amino sugar is also used by the body to make other chemicals that build tendons, ligaments, and cartilage. It is available in the form of N-acetyl glucosamine, glucosamine hydrochloride, and glucosamine sulfate. On an industrial scale, glucosamine is obtained from chitin, which is found in crabs, lobsters, and shrimp. There are several steps in the production process, such as raw material processing, chitin deacetylation, hydrolysis, purification, concentration, and packaging. Glucosamine is used to treat osteoarthritis, glaucoma, joint pain, jaw pain, interstitial cystitis, and multiple sclerosis. It inhibits the onset of joint issues, encourages normal bone formation, lowers inflammation, and helps the body produce more cartilage and fluids around joints.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Glucosamine |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Glucosamine Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of glucosamine price index, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting glucosamine price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The glucosamine price chart ensures our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)