Glomerulonephritis Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

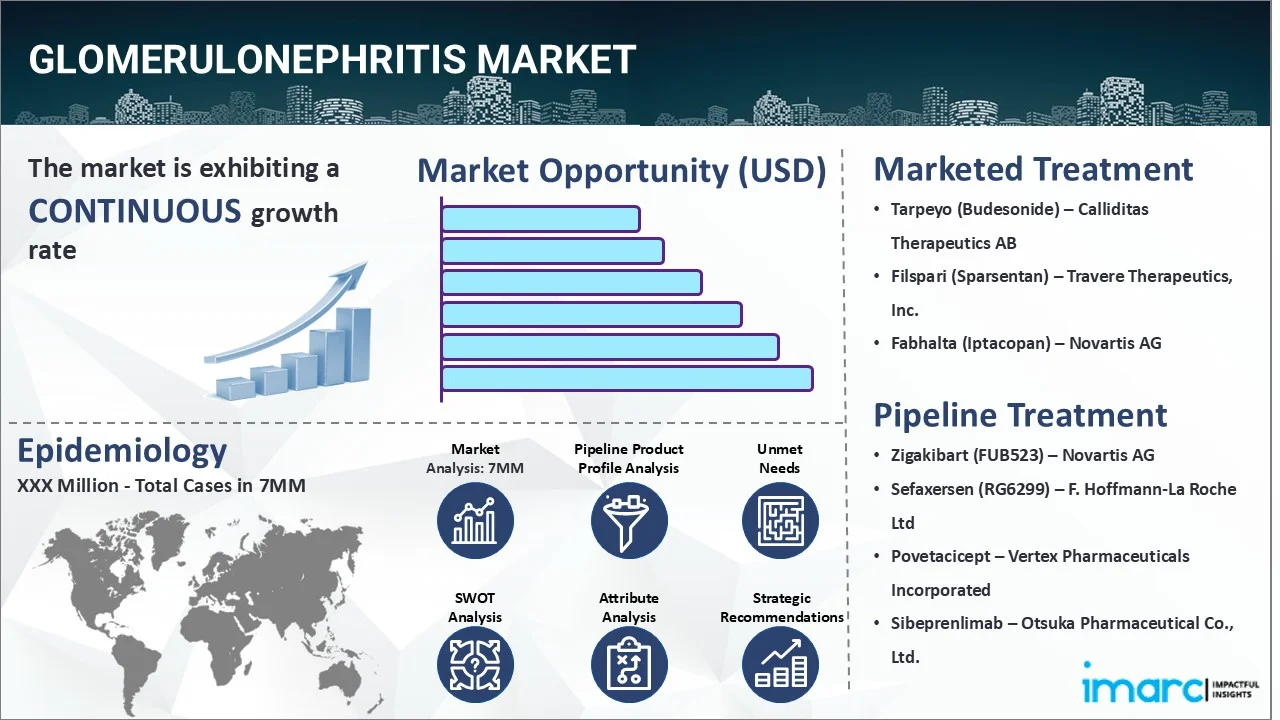

The glomerulonephritis market reached a value of USD 775.1 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 1,158.9 Million by 2035, exhibiting a growth rate (CAGR) of 3.74% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 775.1 Million |

|

Market Forecast in 2035

|

USD 1,158.9 Million |

|

Market Growth Rate (2025-2035)

|

3.74% |

The Glomerulonephritis market has been comprehensively analyzed in IMARC's new report titled "Glomerulonephritis Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Glomerulonephritis is a medical condition characterized by inflammation of the glomeruli, which are the tiny filters in the kidneys responsible for filtering waste and excess fluid from the blood. This disease can impair the normal functioning of the kidneys, leading to the buildup of toxins in the body. Individuals suffering from glomerulonephritis usually have no obvious signs of the illness. But in some cases, the most common indications include blood in the urine, which may make the urine look pink, brown, or red, fatigue, nausea, rashes, high blood pressure, shortness of breath, pain in the joints or abdomen, urinary inconsistency, swelling in the legs or face, etc. The diagnosis of this ailment typically involves several steps, such as a medical history, physical examination, imaging tests, blood workups, and a kidney biopsy. During the medical investigation, a healthcare practitioner will check for signs of kidney diseases, like high blood pressure and fluid retention. Additionally, blood workups and imaging studies are utilized to detect abnormalities and assess the structure and size of the kidneys.

To get more information on this market, Request Sample

The increasing incidences of diabetes and chronic high blood pressure that can damage the blood vessels and nephrons within the kidneys are primarily driving the glomerulonephritis market. In addition to this, the rising cases of autoimmune diseases, in which the immune system mistakenly attacks the body's own tissues, are also bolstering the market growth. Furthermore, the inflating utilization of effective medications, like angiotensin-converting enzyme (ACE) inhibitors, diuretics, antihypertensive agents, etc., to manage the underlying indications of the ailment is acting as another significant growth-inducing factor. Besides this, the escalating application of intravenous immunoglobulin therapy, owing to its numerous benefits over conventional treatments, such as regulating the immune system, preserving renal function, and decreasing inflammation in patients, is further creating a positive outlook for the market. Moreover, the widespread adoption of plasmapheresis techniques, which help to remove harmful autoantibodies from the bloodstream, thereby reducing the burden on the kidneys and slowing down the progression of glomerular damage, is expected to drive the glomerulonephritis market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the Glomerulonephritis market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for Glomerulonephritis and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the Glomerulonephritis market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the Glomerulonephritis market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the Glomerulonephritis market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current glomerulonephritis marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Tarpeyo (Budesonide) | Calliditas Therapeutics AB |

| Filspari (Sparsentan) | Travere Therapeutics, Inc. |

| Fabhalta (Iptacopan) | Novartis AG |

| Zigakibart (FUB523) | Novartis AG |

| Sefaxersen (RG6299) | F. Hoffmann-La Roche Ltd |

| Povetacicept | Vertex Pharmaceuticals Incorporated |

| Sibeprenlimab | Otsuka Pharmaceutical Co., Ltd. |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Glomerulonephritis market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Glomerulonephritis across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Glomerulonephritis across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of Glomerulonephritis across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Glomerulonephritis by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Glomerulonephritis by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Glomerulonephritis by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with Glomerulonephritis across the seven major markets?

- What is the size of the Glomerulonephritis’ patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend Glomerulonephritis of?

- What will be the growth rate of patients across the seven major markets?

Glomerulonephritis: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for Glomerulonephritis drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the Glomerulonephritis market?

- What are the key regulatory events related to the Glomerulonephritis market?

- What is the structure of clinical trial landscape by status related to the Glomerulonephritis market?

- What is the structure of clinical trial landscape by phase related to the Glomerulonephritis market?

- What is the structure of clinical trial landscape by route of administration related to the Glomerulonephritis market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)