Nutraceuticals Market Size, Share, Trends and Forecast by Product, Indication, and Region, 2025-2033

Nutraceuticals Market Size and Share:

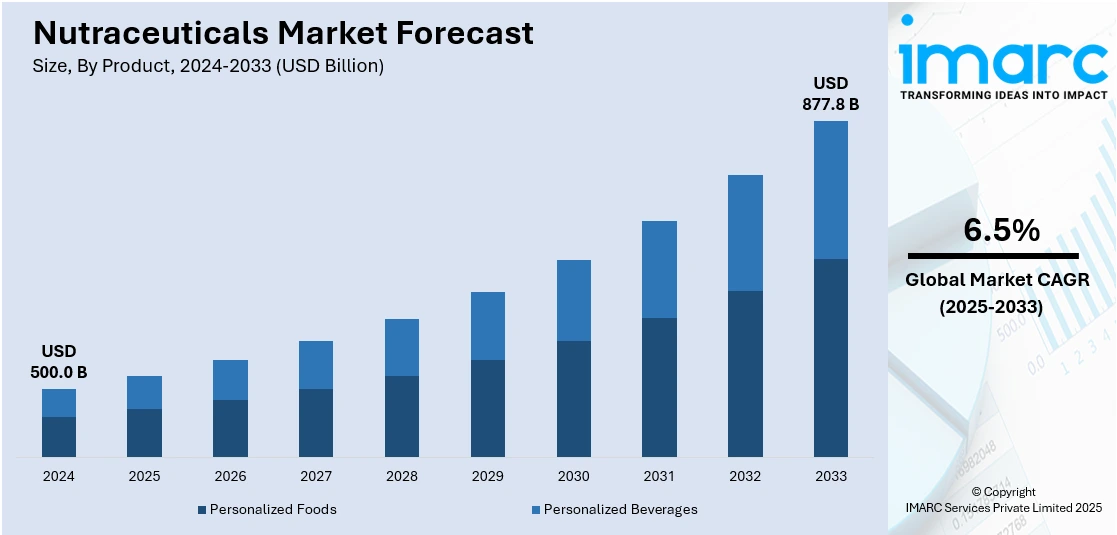

The global nutraceuticals market size was valued at USD 500.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 877.8 Billion by 2033, exhibiting a CAGR of 6.5% from 2025-2033. United States currently dominates the market, holding a market share of 27.9% in 2024. The market is witnessing significant growth due to increasing health awareness and rising demand for preventive healthcare solutions. Consumers increasingly seeking functional foods, dietary supplements, and natural products that support overall well-being, along with the growing demand for targeted wellness products are driving innovation in personalized nutrition, leading to an increase in nutraceuticals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 500.0 Billion |

|

Market Forecast in 2033

|

USD 877.8 Billion |

| Market Growth Rate (2025-2033) | 6.5% |

The expansion of the nutraceuticals market is fueled by growing consumer consciousness for health and well-being. With an emerging emphasis on preventive care, a greater number of consumers are going for nutraceuticals like vitamins, minerals, and herbal supplements to boost their general well-being. The trend toward a healthier way of life, along with rising interest in organic and natural products, has spurred demand. For instance, in May 2025, Expanscience launched Tulsinity Bio, its first nutraceutical active ingredient derived from organic tulsi leaves. Aiming to enhance skin and mental well-being, it leverages Ayurvedic principles. This milestone positions Expanscience to tap into the growing nutraceutical market, aligning with their commitment to natural and pharmaceutical-grade ingredients. Additionally, rising disposable incomes and a shift toward self-care and personal health management have further contributed to the market's expansion.

The heightened awareness about health among consumers represents the primary nutraceuticals market trend in the United States. With a shift toward preventive healthcare, there is a rising interest in dietary supplements, functional foods, and natural healing products. Furthermore, the increasing rates of chronic illnesses and an aging demographic also boost the demand for items that support immunity, heart health, and overall wellness. For instance, in October 2024, Ultisana officially launched in the US, offering innovative supplements tailored for Hispanic Americans, focusing on metabolic and mental health. Featuring products like COGNIFORTE, DIABERINE, and STAMINA, Ultisana aims to empower communities through its “Vive Sano con Ultisana” campaign, promoting accessible and culturally sensitive health solutions. Evolving lifestyles and rising disposable incomes also support the market’s growth, with consumers seeking personalized and science-backed wellness solutions.

Nutraceuticals Market Trends:

Rising Adoption of Clean Label Products

Consumers are progressively looking for nutraceutical products with clean labels, avoiding artificial additives, preservatives, and genetically modified organisms (GMOs). In response, manufacturers are simplifying their ingredient lists and emphasizing natural, easily recognizable components on their packaging. For example, in July 2024, Renewtra made its debut in the Indian market, introducing the first clinically proven, transparent-label nutraceutical products in the country. This is positively influencing the nutraceuticals market outlook.

Growing Focus on Overall Health

The global health crisis has increased consumer awareness regarding the importance toward a strong immune system and overall health, which is leading to a surge in demand for nutraceuticals that claim to boost immunity. For example, in June 2024, the Department of Atomic Energy (DAE) collaborated with IDRS Labs Pvt. Ltd., Bengaluru, to launch the nutraceutical AKTOCYTE, which is approved by the Food Safety and Standards Authority of India (FSSAI). This product is designed to enhance the quality of life for cancer patients undergoing radiotherapy, particularly those with pelvic cancer. This is elevating the nutraceuticals market revenue.

Demand for Personalized Nutrition

Personalized nutrition is becoming increasingly popular as consumers seek products designed to their individual health needs, which is escalating the nutraceutical market demand. Advancements in technology, such as genetic testing and data analytics, allow companies to create customized nutraceuticals that address specific nutritional deficiencies or health goals. For instance, in May 2024, Evonik launched new nutraceutical innovations at Vitafoods Europe, fortifying its commitment to providing evidence-based ingredients for functional food and supplement brands.

Nutraceuticals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nutraceuticals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and indication.

Analysis by Product:

- Personalized Foods

- Bakery Products

- Confectionery

- Dairy Products

- Oil & Fats

- Snack Bars

- Other Foods

- Personalized Beverages

- Chocolate Based FP Drinks

- Bottled Water

- Concentrates

- Energy Drinks

- Fruit Vegetable Juices

- RTD Tea

- Sports Drinks

- Others

Personalized foods stand as the most popular product in 2024, driven by the growing consumer demand for tailored health solutions. These foods are customized to meet individual nutritional needs, taking into account factors like age, lifestyle, health conditions, and genetic predispositions. With advancements in technology, including AI and genetic testing, personalized nutrition has become more accessible. Consumers are showing a growing interest in products designed for particular dietary requirements, including weight control, immune support, and digestive wellness. This trend is boosting the popularity of personalized nutraceutical products, as they offer targeted benefits and align with the rising focus on individual well-being.

Analysis by Indication:

- Digestive and Immune Health

- Energy & Alertness Health

- Heart Health

- Bone & Joint

- Cognitive Health

- Beauty Health

Digestive and immune health leads the market in 2024, highlighting a significant shift in consumer priorities toward holistic well-being. As more consumers seek proactive solutions for digestive issues and immune support, nutraceutical companies are responding with a diverse range of products designed to meet these demands. This is escalating the market opportunities, with innovations in probiotics, prebiotics, and functional foods. The focus on natural ingredients, personalized health solutions, and evidence-based formulations is further boosting nutraceuticals market growth.

Regional Analysis:

- United States

- Germany

- United Kingdom

- France

- Spain

- Italy

- Japan

- China

- Russia

- India

- Brazil

- Mexico

In 2024, United States accounted for the largest market share of 27.9% due to its diverse research and development capabilities, high consumer demand, and established industry leaders. For example, companies like Herbalife and Nature's Bounty drive innovation and offer a wide range of products. The strong regulatory framework provided by the FDA ensures product safety and efficacy, which builds consumer trust. Besides this, significant investments in marketing and a health-conscious population further boost the market. The growth of this sector is also aided by widespread distribution channels, which encompass both brick-and-mortar stores and online shopping platforms.

Key Regional Takeaways:

United States Nutraceuticals Market Analysis

In 2024, the United States accounted for 87.80% of the nutraceuticals market in North America. The United States nutraceuticals market is primarily driven by a growing consumer focus on preventive healthcare and wellness, fueled by the rising incidence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions. For instance, approximately 48.6% of individuals in the United States suffer from some type of cardiovascular condition, such as coronary heart disease and high blood pressure, according to a 2024 report. Growing healthcare costs are also encouraging individuals to seek preventive solutions, such as dietary supplements and functional foods, to maintain overall well-being. According to the Council for Responsible Nutrition (CRN), the usage rate of dietary supplements in the United States reached 75% in 2024. Additionally, technological advancements in product formulation and delivery methods are significantly enhancing efficacy and consumer appeal. The popularity of natural and organic products, combined with clean-label trends, is also boosting industry expansion. Moreover, personalized nutrition, driven by advancements in genomics and data analytics, is gaining popularity, allowing consumers to choose supplements that align with their unique biological needs. Rising fitness trends and the influence of social media are also creating greater demand for sports nutrition and performance-enhancing supplements. Other than this, government initiatives promoting healthier diets and the integration of nutraceuticals in the food service and institutional sectors are further supporting sustained market growth.

Asia Pacific Nutraceuticals Market Analysis

The Asia Pacific nutraceuticals market is expanding due to evolving consumer preferences toward clean-label, plant-based, and organic products. Younger, health-conscious populations are shifting away from synthetic ingredients, prompting companies to innovate with natural and sustainably sourced components. For instance, in August 2024, India-based Denzour Nutrition launched a range of herbal nutraceuticals, developed using completely natural and organic ingredients for both athletes and everyday individuals seeking a comprehensive and natural boost to their health and wellness. Furthermore, the rise of personalized nutrition, powered by advancements in genomics and digital health tools, is gaining popularity, particularly in tech-savvy markets such as South Korea, Japan, and Singapore. Increased investments from both domestic and global players are expediting product development and market penetration, while strategic partnerships between pharmaceutical, biotechnology, and food companies are expanding distribution networks. Rising healthcare costs are also encouraging consumers to adopt nutraceuticals as a cost-effective alternative for long-term wellness and disease prevention.

Europe Nutraceuticals Market Analysis

The Europe nutraceuticals market is experiencing robust growth, fueled by changing consumer preferences, demographic trends, and regulatory developments. A significant driver is the growing awareness about health and wellness among consumers, particularly as geriatric populations seek preventive healthcare solutions to manage chronic diseases such as diabetes, cardiovascular conditions, and osteoporosis. According to Eurostat, in 2018, 72.5% of individuals aged 85 years and above, 66.0% of individuals aged 75-84 years, and 55.8% of individuals aged 65-74 years in the EU-27 reported suffering from a chronic illness. Additionally, the integration of advanced technologies such as AI and biotechnology in product development is fostering innovation in delivery formats, such as gummies, powders, and liquid shots, making nutraceuticals more convenient and appealing. For instance, in February 2025, Freedom International Group (FIG) announced a substantial investment in France-based Elitepharm Laboratories in order to bring AI applications to the nutraceuticals sector to enhance the formulations of dietary supplements. The rise of e-commerce and digital health platforms has also significantly broadened consumer access to nutraceuticals, allowing for targeted marketing and personalized recommendations. Furthermore, growing interest in sports nutrition and active lifestyles, particularly among younger demographics, is driving demand for performance-enhancing supplements and functional snacks. Other than this, sustainability and clean-label trends are prompting companies to adopt natural, organic, and environmentally responsible practices, aligning with evolving consumer values.

Latin America Nutraceuticals Market Analysis

The nutraceuticals market in Latin America is being notably shaped by a growing middle class with higher disposable incomes, resulting in increased demand for premium health products like dietary supplements and functional foods. Consumers are becoming increasingly health-oriented, searching for solutions that enhance overall wellness, such as products that boost immunity, aid digestion, and support weight management. Consequently, the health and wellness market in the region is consistently expanding and is projected to experience a compound annual growth rate (CAGR) of 10.94% from 2025 to 2033 in Brazil, according to the IMARC Group. Additionally, the rise in chronic diseases such as obesity, heart conditions, and diabetes is encouraging people to take proactive health steps, which is further driving market growth. For example, in 2024, about 4.3 million people aged 20-79 in Argentina were reported to have diabetes, as stated by the International Diabetes Federation (IDF). This figure is anticipated to increase to 5.9 million by 2050.

Middle East and Africa Nutraceuticals Market Analysis

The Middle East and Africa (MEA) nutraceuticals market is being increasingly propelled by shifting dietary patterns influenced by globalization and increased Westernization of consumer habits. A growing interest in fitness, particularly among urban youth, is contributing to the popularity of energy drinks, performance-enhancing nutraceuticals, and various dietary supplements. For instance, in Saudi Arabia, the market for dietary supplements reached USD 1.67 Billion in 2024 and is projected to grow at a CAGR of 7.67% during 2025-2033, according to IMARC Group. Moreover, rising awareness around maternal and child nutrition is expanding the demand for fortified foods and prenatal supplements. Governments across the region are also introducing initiatives to combat malnutrition and non-communicable diseases, indirectly supporting nutraceutical uptake.

Competitive Landscape:

The market for nutraceuticals is competitive, featuring a multitude of international and local companies striving to capture market share. Businesses are prioritizing innovation, which includes creating functional foods, dietary supplements, and tailored health solutions to meet the increasing consumer demand for specific wellness products. Strong competition exists in areas like digestive health, immunity boosters, and mental wellness. Brands differentiate themselves through natural ingredients, scientific research, and sustainability. As consumer preferences shift toward holistic health, the market continues to expand. The nutraceuticals market forecast suggests continued growth, driven by technological advancements, increasing health awareness, and a rising focus on preventive healthcare.

The report provides a comprehensive analysis of the competitive landscape in the nutraceuticals market with detailed profiles of all major companies, including:

- Danone

- Kirin Holdings Company Limited

- Mondelez International Inc.

- Morinaga Milk Industry Co. Ltd.

- Nestle

- Otsuka Pharmaceutical Co. Ltd.

- PepsiCo Inc.

- The Coca-Cola Company

- Yakult Honsha Company Limited

Latest News and Developments:

- April 2025: Azelis announced the acquisition of Solchem Natura S.L., strengthening its position in the nutraceuticals sector in Spain. With this acquisition, individuals across Europe will be able to access a wide range of nutraceutical products through the combination of Azelis and Solchem’s established expertise in the field.

- March 2025: SIRIO, a provider of nutraceutical gummy and softgel solutions, launched its latest innovation in high-strength supplements, the XtraGummies. The product enables nutraceutical companies to meet the changing demands of modern supplement consumers.

- February 2025: Nutrify Today launched Dealsphere in India, a novel platform that will revolutionize the way companies find, license, and market nutrition products supported by science. Dealsphere will speed up the generally sluggish and costly procedure for developing products and licensing, helping businesses launch new nutraceutical goods in a matter of days, a substantial decrease from the years it usually takes.

- February 2025: India-based Aayush Wellness Limited secured an export order worth USD 4 million from Tanzanian company Agro Leaf Ltd. for nutraceuticals. This purchase will include herbal remedies, gummies, and effervescent supplements for over a year. This is the company's second significant export deal, following a USD 3 million order from Singapore.

- November 2024: South Korean biotech company Caregen Co., Ltd. and Akums Drugs & Pharmaceuticals Ltd. signed an in-licensing deal to manufacture and market nutraceuticals, pharmaceuticals, and unique topical and injectable cosmeceuticals in India. As per the contract, the two companies will create high-quality nutraceuticals for holistic well-being as well as topical remedies for skin and hair care.

- May 2024: Evonik unveiled its latest nutraceutical innovations, emphasizing scientifically backed, naturally derived ingredients. Highlights include the AvailOm omega-3 powder combined with Boswellia for joint health, IN VIVO BIOTICS synbiotic solutions demonstrating superior gluten-degrading efficacy, and the U.S. expansion of Healthberry anthocyanins. These advancements aim to enhance consumer health and differentiate functional food and supplement brands.

Nutraceuticals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Indications Covered | Digestive and Immune Health, Energy & Alertness Health, Heart Health, Bone & Joint, Cognitive Health, Beauty Health |

| Countries Covered | United States, Germany, United Kingdom, France, Spain, Italy, Japan, China, Russia, India, Brazil, Mexico |

| Companies Covered | Danone, Kirin Holdings Company Limited, Mondelez International Inc., Morinaga Milk Industry Co. Ltd., Nestle, Otsuka Pharmaceutical Co. Ltd., PepsiCo Inc., The Coca-Cola Company, Yakult Honsha Company Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nutraceuticals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global nutraceuticals market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nutraceuticals industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nutraceuticals market was valued at USD 500.0 Billion in 2024.

The nutraceuticals market is projected to exhibit a CAGR of 6.5% during 2025-2033, reaching a value of USD 877.8 Billion by 2033.

Key factors driving the nutraceuticals market include growing health consciousness, rising demand for preventive healthcare, an aging population, and the increasing prevalence of chronic diseases. Additionally, consumer interest in natural, organic, and personalized wellness products, along with advancements in research and technology, further fuel market growth.

The United States leads the nutraceuticals market, holding the largest share. This leadership is fueled by a strong consumer focus on health and wellness, an increasing demand for dietary supplements, and progress in personalized nutrition. Additionally, the presence of major industry players and a robust distribution network further enhance the country's position in the market.

Some of the major players in the nutraceuticals market include Danone, Kirin Holdings Company Limited, Mondelez International Inc., Morinaga Milk Industry Co. Ltd., Nestle, Otsuka Pharmaceutical Co. Ltd., PepsiCo Inc., The Coca-Cola Company, Yakult Honsha Company Limited., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)