Glider Aircraft Market Size, Share, Trends and Forecast by Type, Propulsion, Application, and Region, 2025-2033

Glider Aircraft Market Size and Share:

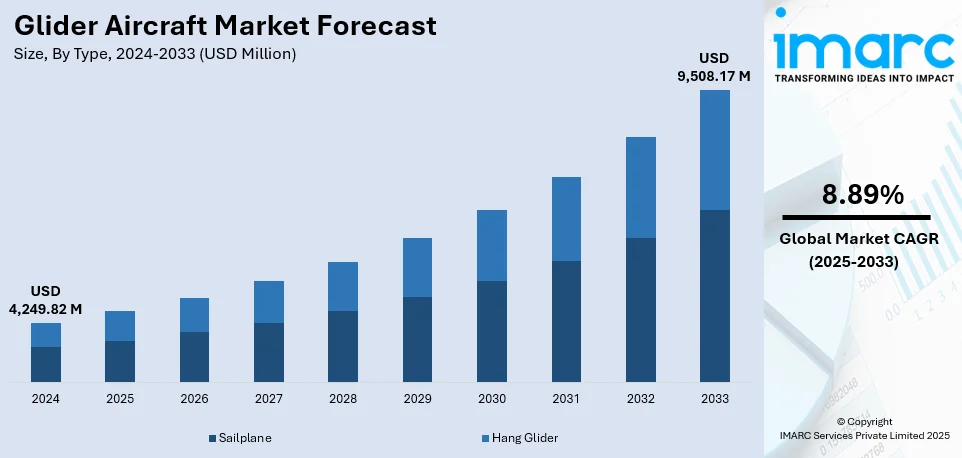

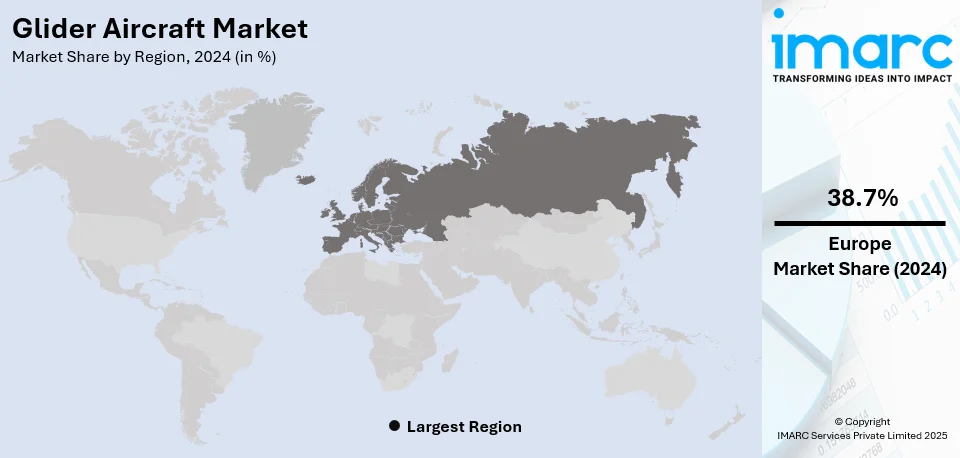

The global glider aircraft market size was valued at USD 4,249.82 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 9,508.17 Million by 2033, exhibiting a CAGR of 8.89% during 2025-2033. Europe currently dominates the market, holding a significant market share of 38.7% in 2024. The rising product demand from the military sector and the surging demand of gliding as a recreational sport is propelling market growth. Besides this, glider aircraft market share is also driven by growing demand for sustainable aviation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,249.82 Million |

| Market Forecast in 2033 | USD 9,508.17 Million |

| Market Growth Rate (2025-2033) | 8.89% |

Gliders are essential training tools, teaching aspiring pilots basic flight skills and aerodynamics. Flight schools across the globe increasingly use gliders to provide affordable, hands-on experience for beginner pilots. The lower operational costs of gliders compared to powered aircraft make them ideal for flight training. Many flight schools offer glider training as part of their curriculum, attracting a broader customer base. Gliders also serve as an introduction to aviation, allowing students to build foundational skills before progressing to powered aircraft. With a focus on sustainability and environmental responsibility, many trainees opt for non-powered gliders to reduce carbon footprints. The rising interest in gliding as a sport further contributes to flight training demand, as new pilots enter the industry. In addition, military and commercial aviation sectors use gliders for specialized pilot training, influencing market demand. The emphasis on pilot safety and skill development also encourages more flight schools to incorporate glider training. As more individuals pursue aviation careers, the demand for glider aircraft in training programs continues to grow, consequently strengthening the market growth.

The rising number of international gliding events and tournaments significantly influence the United States glider aircraft market demand. These events attract a global audience, showcasing the performance and capabilities of advanced gliders. Competitions, such as the World Gliding Championships, inspire interest in gliding as a recreational activity. The 38th FAI World Gliding Championships took place in Uvalde, Texas, from August 14 to 31, 2024. Pilots from around the world competed in the Open, 18-meter, and multi-seat classes. The event was hosted by the Uvalde Soaring Association and organized with support from the Soaring Society of America. As the number of international tournaments grows, US manufacturers experience heightened demand for high-performance aircraft. The competitive spirit fosters technological innovations, with manufacturers striving to build faster, more efficient gliders. These events also highlight the importance of flight training, encouraging the establishment of new flight schools. As US pilots and enthusiasts aim to compete internationally, they seek specialized gliders for training and participation. The influx of international competitors influences the local market by introducing new products and technologies. Increased media coverage of gliding tournaments contributes to greater public awareness about the sport.

Glider Aircraft Market Trends:

Growing Adoption of Electric-Powered Gliders

Electric-powered gliders are gaining traction in the market as manufacturers work to make their products more sustainable and energy-efficient. Traditional gliders, which rely on tow planes or self-launching engines, are being replaced by innovative battery technology that offers electric propulsion. This decreases dependence on fossil fuels, which reduces operating costs, and minimizes noise, increasing their adoption among recreational pilots and flight schools. Manufacturers are investing in lithium-ion and solid-state batteries to improve endurance and flight safety. With energy densities reaching 250–300 Wh/kg, lithium-ion batteries are significantly enhanced efficiency, allowing for longer flight times. Key companies are leading the way in developing electric gliders that can fly for up to 2 hours on a single charge. The reduced noise levels—30–40 dB lower than combustion engines—make electric gliders ideal for use in eco-sensitive areas. Regulatory bodies including the European Union Aviation Safety Agency (EASA), are encouraging the development of electric aviation to meet carbon neutrality goals by 2050. Green aviation initiatives are accelerating the adoption of electric-powered gliders. Modern airframes made from lightweight materials improve aerodynamics, further extending flight durations. Aerospace startups and research institutions are also exploring hybrid-electric solutions, which is set to shape the future of the global glider aircraft market.

Rising Demand for Recreational and Sport Aviation

The growing interest in adventure tourism and outdoor recreational activities is driving demand for glider aircraft. As of 2020, over 111,000 civilian glider pilots were active worldwide, with 19,753 in the United States alone, reflecting strong participation. Germany continues to be a key hub for air sports, with the German Hang-Gliding Association (DHV) reporting approximately 40,000 members, including both paragliding and hang-gliding pilots. Gliding offers a unique, environmentally friendly experience, with silent aircraft free from engine noise, making it appeal to people of all ages. This growing interest is leading to more enrollments in flight schools, as gliders provide an affordable introduction to aviation. Government and private aviation organizations are also supporting air sports events, further driving the trend of gliding competitions. Gliders are less expensive than powered aircraft, attracting aviation enthusiasts seeking a flight experience without high fuel or maintenance costs. Manufacturers are responding by developing more user-friendly, high-performance gliders with enhanced aerodynamics and safety features. As disposable incomes rise and interest in adventure sports grows, the recreational and sport aviation sectors are expected to be major drivers of the global glider aircraft market.

Integration of Advanced Avionics and Automation

Advanced avionics and automation technologies are being integrated into glider manufacturing to enhance safety and flight efficiency. Modern gliders now feature digital flight displays, real-time weather tracking, and autopilot systems, assisting pilots with navigation and altitude control. These innovations make gliding more accessible to a broader audience, including beginners and commercial operators in training programs. Real-time data transmission helps monitor flights, predict maintenance needs, and reduce in-flight issues. Technologies, such as fly-by-wire systems and electronic variometers improve aerodynamic efficiency and energy management, offering a better flying experience. Artificial intelligence (AI)-driven flight optimization tools are also being tested to maximize glide performance based on environmental conditions. The integration of smart avionics is expected to become standard in high-performance gliders as technology advances. This shift is set to drive greater adoption among flight schools, sports aviation, and research applications.

Glider Aircraft Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global glider aircraft market, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, propulsion, and application.

Analysis by Type:

- Sailplane

- Hang Glider

Sailplanes leads the market with 70.2% of market share in 2024. They are designed for efficient, long-distance gliding, driving their demand in the market. These aircraft offer superior performance, with their lightweight structure and aerodynamically optimized wings, providing extended flight duration. They are the preferred choice for recreational pilots and competitive gliders due to their versatile capabilities. Sailplanes also serve as training aircraft for flight schools, as they teach fundamental flight control skills. Manufacturers focus heavily on improving sailplane designs with cutting-edge materials, making them more durable and energy efficient. This segment benefits from technological advancements in lightweight composites and carbon fiber, enhancing glide ratios and aerodynamic efficiency. The growing trend of competitive gliding events further influence the demand for sailplanes, as they are built for speed and precision. Additionally, they are ideal for cross-country gliding due to their ability to cover long distances without using engines. The market is also driven by the growing interest in sustainable aviation, with sailplanes being environmentally friendly, relying solely on wind for propulsion. As flight enthusiasts increasingly embrace non-motorized aviation, the sailplane segment continues to dominate the market.

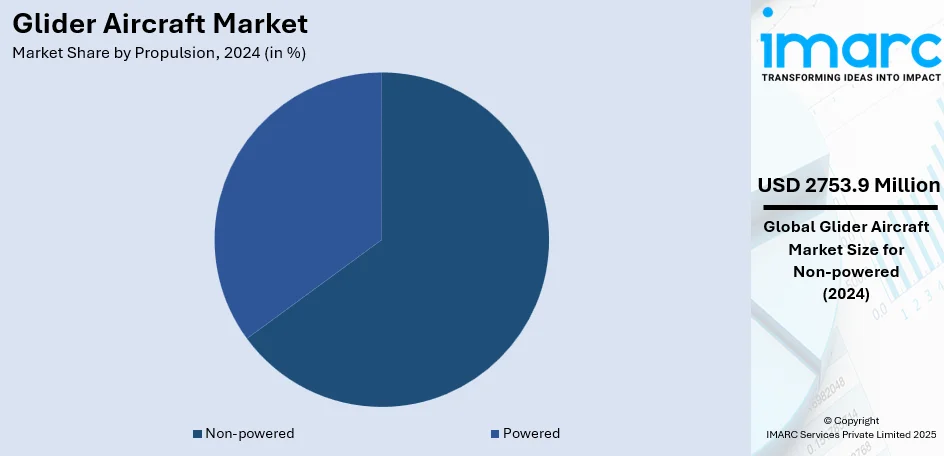

Analysis by Propulsion:

- Powered

- Non-powered

Non-powered gliders dominate the market with 64.8% of market share in 2024. They are driven solely by wind currents, offering significant advantages in sustainability and cost-effectiveness. These aircraft do not require fuel, significantly reducing operational costs compared to powered gliders. Non-powered gliders also leave a minimal environmental footprint, which appeals to environmentally conscious individuals and flight schools. Their simplicity makes them more affordable for both private pilots and aviation organizations. These aircraft rely on thermal updrafts and wind currents to stay aloft, providing a unique challenge for pilots. Non-powered gliders are preferred for recreational flying and flight training due to their ease of handling. Additionally, they are widely used in gliding competitions, where skill and strategy determine flight performance. The market share of non-powered gliders is also driven by government and private investment in air sports and aviation education programs. Non-powered gliders are ideal for training beginner pilots because they provide hands-on experience with flight dynamics and aerodynamics. As fuel prices continue to rise, non-powered gliders offer a cost-effective alternative, which enhances their appeal. The increasing emphasis on green aviation technologies and sustainable practices further catalyzes the demand for non-powered gliders.

Analysis by Application:

- Commercial

- Military

- Others

The military sector relies heavily on gliders for training, reconnaissance, and airborne operations, driving market dominance. Gliders provide a unique advantage in military operations due to their stealth and low operational costs. Military applications focus on the ability to transport personnel and equipment in a quiet, energy-efficient manner. These gliders are designed to operate in various terrains, providing flexibility for a wide range of missions. The military uses gliders for specialized training, teaching soldiers flight control and emergency landing techniques. Military gliders are also used for surveillance, offering long-range capabilities without the need for fuel-powered engines. Additionally, these aircraft are crucial for combat zone operations, where stealth and efficiency are essential. The strategic advantages of gliders in military applications include enhanced maneuverability, ease of deployment, and reduced logistical support requirements. As military forces continue to emphasize cost-effective and versatile equipment, the demand for gliders remains high. The military sector’s dominance in the market is also fueled by ongoing investments in research and development (R&D). These investments aim to improve glider capabilities including range, payload, and aerodynamic performance.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of 38.7%. The region is home to a rich history of gliding, with many of the world’s most renowned glider clubs, events, and manufacturers. For example, in March 2024, Belgium based JMB Aircraft launched the Phoenix motor glider, a cross-country aircraft ideal for both pilots and sailplane enthusiasts. With a glide ratio of 32:1, it can reach over 900 miles and achieve speeds of 115 knots. Powered by a 100hp Rotax 912 ULS engine, the is being manufactured at the facility in Czech Republic. The region has a strong cultural connection to aviation, which continues to drive glider aircraft demand. Several European countries including Germany, the UK, and Switzerland, have well-established gliding communities and infrastructure. These countries also host major gliding competitions that attract enthusiasts worldwide, fueling market growth. Government policies in Europe often support air sports and recreational aviation, providing funding and facilities. The region’s regulatory environment is conducive to the development of glider aircraft, fostering innovation and market expansion. Europe’s focus on sustainability and reducing carbon emissions aligns with the growing popularity of non-powered gliders. The demand for gliders in Europe is also influenced by flight schools and military applications, where gliders are commonly used for training. As technology continues to advance, Europe’s market share is expected to maintain its dominance, positioning the region as a global leader in the glider aircraft industry.

Key Regional Takeaways:

United States Glider Aircraft Market Analysis

The United States hold 86.80% of the market share in North America. The US market for glider aircrafts is experiencing steady growth, driven by increasing demand for recreational flying, training, and events. As of October 2024, the US Federal Aviation Administration reported approximately 32,920 registered gliders within the country. This growth is bolstered by a strong network of flight schools and active gliding clubs, ensuring consistent interest from both new pilots and experienced fliers. Technological advancements, such as the use of advanced composite materials and aerodynamic improvements, are further fueling market growth. Leading manufacturers are spearheading these innovations, setting new standards in glider performance. Additionally, US manufacturers are increasingly focusing on exporting gliders to tap into the growing international market. Government-backed aviation programs and the rising demand for eco-friendly flying solutions are also contributing to the market’s growth. As the demand for sustainable and cost-effective aviation continues to rise, the region is poised to play a crucial role in the global glider aircraft industry, further strengthening its position as a key market player.

Asia Pacific Glider Aircraft Market Analysis

The Asia Pacific region is showing increasing interest in recreational aviation, supported by government initiatives for general aviation. China's general aviation sector, which includes gliders, is experiencing significant growth. A 2022 report indicated that by the end of the 14th Five-Year Plan (2021-2025), China is expected to register over 3,500 general aviation aircraft, up from 2,892 in 2020, reflecting steady progress. Australia and Japan also demonstrate rising participation in gliding, bolstered by active aviation clubs and flight training centers. Investments in lightweight composite materials and electric-powered gliders are driving innovation and market growth. Additionally, regional collaboration between manufacturers and aviation authorities is advancing technological developments and ensuring regulatory compliance. These combined efforts are contributing to the rapid growth and expansion of the glider aircraft market in the Asia-Pacific region.

Latin America Glider Aircraft Market Analysis

The Latin American market is steadily growing, driven by increasing interest in aviation and regional training programs. According to Aeroflap, Brazil had around 10,042 active aircraft, including planes and helicopters, in 2023, making it a key market. Brazil benefits from a strong aviation infrastructure and active participation in air sports. Countries like Argentina and Chile are also seeing rising interest in gliding, supported by favorable weather conditions and local aeroclubs. Technological advancements in aerodynamics, lightweight materials, and fuel efficiency are improving glider performance. Government initiatives are further promoting pilot training and aviation education, contributing to market expansion. As international partnerships and investments in recreational aviation grow, Latin America is poised to increase its share in the global market.

Middle East and Africa Glider Aircraft Market Analysis

The market for glider aircraft in the Middle East and Africa is expanding, fueled by rising interest in recreational aviation and club-based initiatives. South Africa is the regional leader, with a strong gliding infrastructure. The Cape Gliding Club, located at Worcester Airfield, is the second largest in the country, featuring over 100 members and 35 high-performance gliders. The Soaring Society of South Africa oversees gliding activities, with several clubs across the country, ensuring a well-organized structure for both recreational and competitive flying. Countries like the UAE and Saudi Arabia are also witnessing growing interest, as governments promote air sports through aviation initiatives. Market growth is further supported by investments in pilot training programs and technological improvements in glider design. As more enthusiasts take up the sport, the Middle East and Africa are positioned to play a larger role in the global market.

Competitive Landscape:

Key players are focusing on enhancing aircraft designs with advanced materials, improving performance and safety. They invest in research and development (R&D) to improve aerodynamics, reducing drag and increasing flight efficiency. Several players are expanding their portfolios with electric-powered gliders, aligning with sustainable aviation trends. For instance, in April 2024, Schempp-Hirth Flugzeug-Vertriebs GmbH announced to launch the Ventus-3E, a self-launching electric glider equipped with a retractable 39 kW propulsion system for independent takeoffs. Designed for efficiency and sustainability, it combines environmental friendliness with advanced performance features. The glider offers easy battery access and user-friendly controls. The first series models are set for launch in early 2025, advancing glider technology. Moreover, leading companies are introducing cutting-edge technologies that advance fuel efficiency. Through collaborations with research institutions, they drive technological advancements, creating gliders with extended flight times and better maneuverability. Many manufacturers actively participate in competitive gliding events, promoting their products to a wider audience. Additionally, they support training programs, helping to grow the community of glider pilots. Their global presence ensures widespread distribution and accessibility to a broader customer base. Strategic partnerships with flight schools and aviation organizations contribute to increased adoption and awareness. Key players also advocate for favorable regulations and policies that support the gliding industry.

The report provides a comprehensive analysis of the competitive landscape in the glider aircraft market with detailed profiles of all major companies, including:

- AirBorne Australia

- Albatross Flying Systems (opc) Private Limited

- Alexander Schleicher GmbH

- AMS - FLIGHT, d.o.o.

- Bautek Fluggeräte GmbH

- DG Aviation GmbH

- HPH Spol S R.O.

- Lange Aviation GmbH

- Moyes Delta Gliders

- North Wing

- Pipistrel d.o.o. (Textron Inc.)

- Schempp-Hirth Flugzeug-Vertriebs GmbH

- Wills Wing Inc.

Latest News and Developments:

- May 2024: The Antares 21E, an electric self-launch glider developed in collaboration with Lange Aviation. It boasts a retractable motor for self-launch, a 57.5 glide ratio, flaperons, and a sophisticated cockpit display with real-time wind indicators. The simulation experience is further enhanced with realistic audio outputs.

- May 2023: Airbus initiated the final flight-test campaign for the Perlan 2 glider, targeting a record altitude of 90,000 feet. The tests, taking place in Argentina, will utilize "stratospheric mountain waves" to help the engine-free glider surpass its previous 76,000-foot record set in 2018.

Glider Aircraft Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sailplane, Hang Glider |

| Propulsions Covered | Powered, Non-powered |

| Applications Covered | Commercial, Military, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AirBorne Australia, Albatross Flying Systems (opc) Private Limited, Alexander Schleicher GmbH, AMS - FLIGHT, d.o.o., Bautek Fluggeräte GmbH, DG Aviation GmbH, HPH Spol S R.O., Lange Aviation GmbH, Moyes Delta Gliders, North Wing, Pipistrel d.o.o. (Textron Inc.), Schempp-Hirth Flugzeug-Vertriebs GmbH, Wills Wing Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, glider aircraft market outlook, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global glider aircraft market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the glider aircraft industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The glider aircraft market was valued at USD 4,249.82 Million in 2024.

The glider aircraft market is projected to exhibit a CAGR of 8.89% during 2025-2033, reaching a value of USD 9,508.17 Million by 2033.

The glider aircraft market growth is driven by rising interest in recreational aviation and air sports, supported by growing participation in gliding events and competitions. Advancements in glider technology, such as improved aerodynamics, lightweight materials, and electric propulsion, enhance performance and efficiency. Increased demand for flight training programs and government-backed aviation initiatives further supports market growth.

Europe currently dominates the glider aircraft market, accounting for a share of 38.7% in 2024. The region currently dominates the market, driven by its strong aviation culture and infrastructure. The region has numerous established gliding clubs, flight schools, and competitive events, fostering widespread participation in gliding. Countries like Germany, the UK, and France have a long history of gliding, with supportive government policies and investments in aviation training, which is strengthening market growth in the region.

Some of the major players in the glider aircraft market include AirBorne Australia, Albatross Flying Systems (opc) Private Limited, Alexander Schleicher GmbH, AMS - FLIGHT, d.o.o., Bautek Fluggeräte GmbH, DG Aviation GmbH, HPH Spol S R.O., Lange Aviation GmbH, Moyes Delta Gliders, North Wing, Pipistrel d.o.o. (Textron Inc.), Schempp-Hirth Flugzeug-Vertriebs GmbH, Wills Wing Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)