Glass Curtain Wall Market Size, Share, Trends and Forecast by System Type, End Use, and Region, 2025-2033

Glass Curtain Wall Market Size and Share:

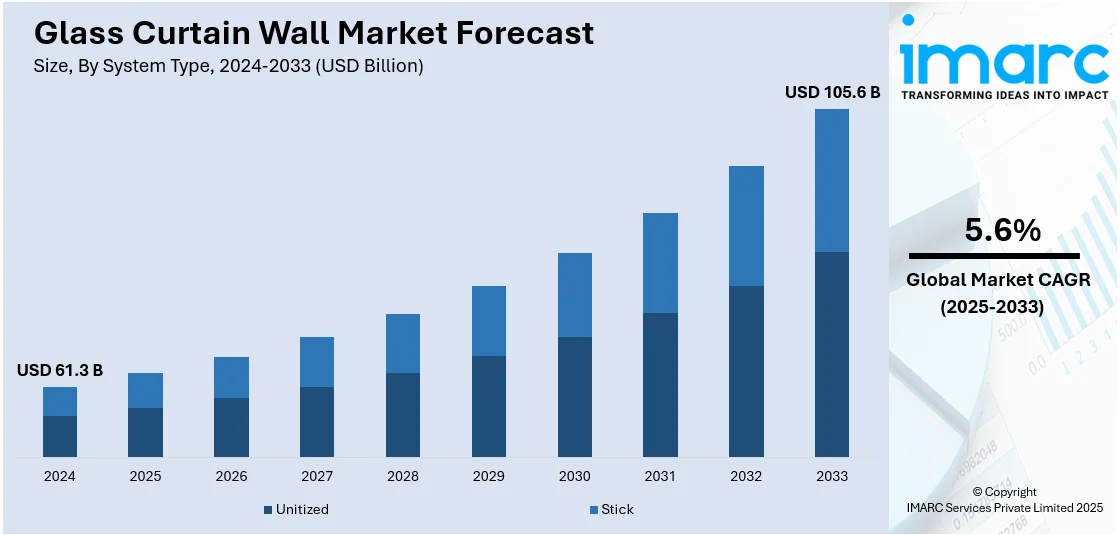

The global glass curtain wall market size was valued at USD 61.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 105.6 Billion by 2033, exhibiting a CAGR of 5.6% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 37.6% in 2024. The market is experiencing robust growth, driven by escalating demand for energy-efficient buildings, rapid technological advancements in glass, expansion in the global construction sector, implementation of various government regulations, growing preference for aesthetic and naturally lit spaces, and innovations in installation and maintenance techniques.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 61.3 Billion |

|

Market Forecast in 2033

|

USD 105.6 Billion |

| Market Growth Rate 2025-2033 | 5.6% |

The market is primarily driven by increasing demand for energy-efficient building solutions, influenced by stringent environmental regulations supporting sustainable construction practices. Rapid urbanization and expanding infrastructure development, particularly in emerging economies, further fuel market growth. For instance, according to the United Nations Population Fund, currently, over half of the global population resides in urban areas, a figure projected to reach approximately 5 billion by 2030. Moreover, advancements in architectural design trends emphasizing aesthetics and modernity enhance the adoption of glass curtain walls in commercial and residential projects. Additionally, innovations in construction technologies, such as unitized systems offering cost and time efficiency, contribute to market expansion. Growing awareness of climate control benefits and natural light optimization in buildings also boosts the demand for glass curtain walls.

The United States plays a pivotal role in the global glass curtain wall market, driven by robust commercial construction, increasing urbanization, and a strong focus on energy-efficient building solutions. For instance, as per industry reports, nearly 80% of the U.S. population resides in urban areas. Besides this, 90% of the residents in seven states, including California, Utah Nevada, Florida, New Jersey, Massachusetts, and Rhode Island, dwell in cities. These states typically feature sizable urban centers with populations exceeding 250,000. Furthermore, the country’s stringent environmental regulations and emphasis on sustainable architecture have accelerated the adoption of glass curtain walls, particularly in high-rise buildings. Advancements in construction technologies and growing investments in infrastructure further support market expansion. Additionally, the U.S. architectural industry’s preference for innovative, aesthetic designs continues to fuel demand. With ongoing urban development and sustainability trends, the United States remains a key contributor to the growth of the global market.

Glass Curtain Wall Market Trends:

Increasing Demand for Energy-efficient Buildings

The growing focus on energy efficiency and sustainability, which prioritizes energy-saving solutions in both renovation and new construction projects, is a key driver propelling the growth of the glass curtain wall market. The construction industry accounts for 37% of global energy-related CO2 emissions, highlighting the urgent need for sustainable practices to mitigate climate change and limit global warming to 1.5 degrees Celsius. This need becomes even more critical as global construction activity is projected to increase by 42% by 2030.Top of FormBottom of Form In accordance with this, the accelerating need for glass curtain walls, mainly because of their capability to foster natural light penetration while providing insulation attributes, is bolstering the market expansion. For instance, the launch of solar glass curtain walls, like Sunjoule by AGC Inc., which has the structure resembling ordinary laminated glass and can be deployed in a wide range of applications, such as railings, facades, walls, and skylights, without changing design, is changing the glass wall curtain market dynamics.

Implementation of Various Regulations

According to the glass curtain wall market research report, the rigorous implementation of various government guidelines and policies for energy utilization in buildings is bolstering the market expansion. For instance, the introduction of the Energy Conservation (Amendment) Bill in 2022, mandating the adoption of the Energy Conservation Building Code-Residential or Eco-Niwas Sahmita (ENS) in India, is supporting the glass wall curtain market demand. This bill is estimated to avoid between 135-178Mt C02 building emissions by 2030. Along with this, the growing commitment of the Government of India (GoI) to build 8 Million new affordable homes, boosting the need for efficient housing solutions that help reduce carbon dioxide emissions, is strengthening the market growth. Additionally, the widespread adoption of certification programs, like Leadership in Energy and Environmental Design (LEED) and Building Research Establishment Environmental Assessment Method (BREEAM) to incentivize the adoption of energy-efficient technologies, including glass curtain walls, is favoring the market growth.

Rapid technological advancements

Technological advancements in the glass industry have enhanced the functionality and versatility of glass curtain walls. Innovations such as low-emissivity (low-E) coatings, double and triple glazing, and dynamic or smart glass technologies are driving market growth by promoting energy efficiency, better thermal insulation, and superior acoustic properties. For instance, Guardian Glass unveiled two new products in its commercial range of double silver coated glass, SunGuard SNR 35 and SunGuard SNR 50 glasses. They provide several benefits and are lauded for their energy efficiency. SNR 35 offers a sharper, more reflective appearance with a reduced solar heat gain coefficient of 0.17, ensuring superior energy efficiency. Meanwhile, SNR 50 provides a neutral aesthetic and medium reflectivity, featuring a 48% visible light transmission and a solar heat gain coefficient of 0.25. These advancements enhance both the functional performance of glass curtain walls and the design versatility of modern buildings. These technological enhancements not only improve the functional attributes of glass curtain walls but also contribute to the aesthetic and design flexibility of buildings.

Glass Curtain Wall Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global glass curtain wall market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on system type and end use.

Analysis by System Type:

- Unitized

- Stick

Unitized stand as the largest component in 2024, holding around 65.3% of the market. It consists of large, pre-assembled panels that are fabricated and glazed in the factory and then shipped to the construction site for installation. Unitized glass curtain wall systems streamline the construction process and help in reducing on-site labor and installation time. Moreover, they are lauded for their ability to accommodate the high thermal and acoustic insulation requirements of modern buildings. Their modular nature allows for a high degree of quality control, as the majority of the assembly is completed in controlled factory conditions. Furthermore, unitized systems offer excellent durability and are adaptable to various architectural aesthetics.

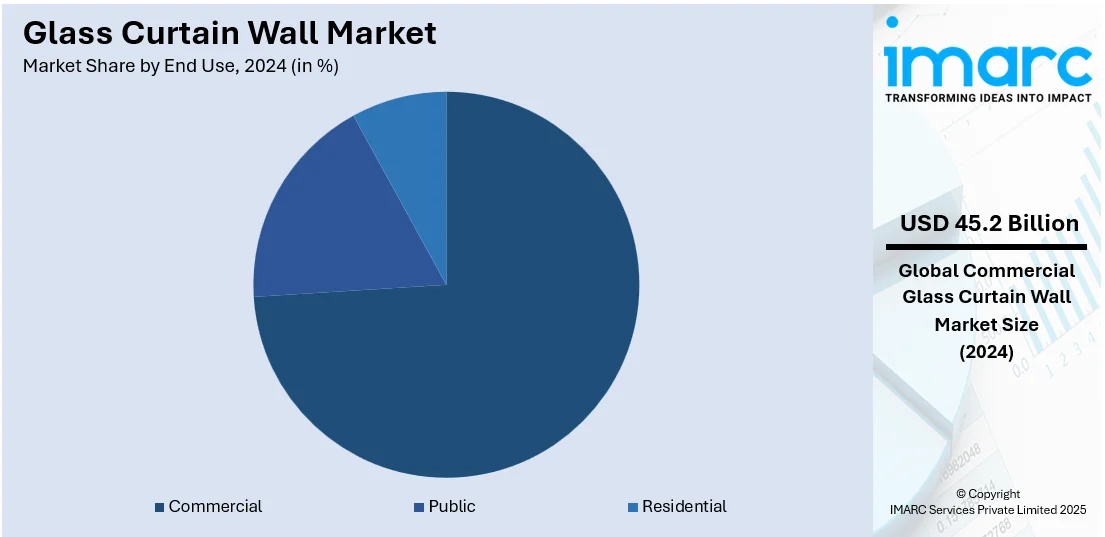

Analysis by End Use:

- Commercial

- Public

- Residential

Commercial leads the market with around 73.8% of market share in 2024.This is attributed to the increasing construction of commercial buildings, such as office towers, shopping malls, hotels, and other business complexes, where glass curtain walls are extensively utilized for their aesthetic appeal and functional benefits. According to the IMARC Group report, the market for the commercial real estate industry is expected to reach US$ 9.6 Trillion by 2032. In line with this, the increasing utilization of glass wall curtains to elevate a property's value and attract tenants is enhancing the market growth. Furthermore, the ongoing shift towards green and sustainable building practices in the commercial sector, driving the adoption of glass curtain walls, as they align with the goals of reducing energy consumption and minimizing environmental impact, is bolstering the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 37.6%. This region’s glass curtain wall market is experiencing significant growth due to rapid urbanization, particularly in countries like India, China, and Japan. According to a UN report, by 2035, the urban population of India is projected to reach 675 Million, the second-largest globally after China. This surge in urban population, coupled with the post-pandemic recovery, is driving demand for modern and energy-efficient buildings. As more cities expand, the need for high-performance glass curtain walls, known for their aesthetic appeal and energy efficiency, is increasing. Technological advancements in glazing materials are also contributing to the market’s growth, enhancing thermal insulation and soundproofing. Additionally, the region’s focus on sustainable construction, including government initiatives for green buildings, further supports market demand. The rise of smart cities and eco-friendly infrastructures is fueling the adoption of glass facades, making the APAC region a key driver in the global glass curtain wall market.

Key Regional Takeaways:

United States Glass Curtain Wall Market Analysis

In 2024, United States accounted for 70.50% of market share in North America. The glass curtain wall market in the United States is being significantly propelled by architectural innovation, urbanization, and the magnifying need for energy-saving building materials. A key factor contributing to this growth is the Infrastructure Investment and Jobs Act (IIJA), a USD 1.2 Trillion federal initiative that includes USD 550 Billion in new funding. The IIJA is fueling thousands of infrastructure projects across the country, creating a substantial increase in construction employment. This surge in construction activity, particularly in commercial and residential sectors, is amplifying the demand for modern, energy-efficient building materials like glass curtain walls. Additionally, the growing focus on sustainable construction practices, coupled with stringent environmental regulations such as LEED certification, is pushing developers to adopt high-performance glass facades. Technological advancements in glazing, such as low-emissivity (Low-E) coatings, offer improved thermal insulation, reducing energy consumption. These factors, alongside a strong preference for aesthetic and sustainable building designs, are expected to continue driving the U.S. glass curtain wall market. With ongoing infrastructure investments and a booming real estate sector, the market is poised for sustained growth in the coming years.

Europe Glass Curtain Wall Market Analysis

Europe’s glass curtain wall market is propelled by rapid urbanization, with the European Union being one of the most urbanized regions globally. Approximately 75% of the EU’s 447 Million inhabitants reside in urban areas, including cities, towns, and suburbs, which significantly contributes to the demand for modern, energy-efficient buildings. As cities expand and modernize, the need for advanced building materials, such as glass curtain walls, has surged. These facades not only provide aesthetic appeal but also meet the growing emphasis on sustainability and energy efficiency in building design. In response to this demand, companies like Guardian Glass have strengthened their presence in Europe. For example, in 2018, Guardian Glass launched its second float glass facility in Częstochowa, Poland, to cater to the increasing need for exceptional-performance fabricated and coated glass products in Eastern Europe. This facility, equipped with a technologically advanced glass coater, supports Europe’s focus on sustainable construction and energy-efficient glazing solutions, further driving the glass curtain wall market.

Latin America Glass Curtain Wall Market Analysis

In Latin America, the glass curtain wall market is growing due to urbanization and the demand for modern building materials. Brazil, with an urban population of 189,992,937 in 2023, a 0.78% increase from 2022, is driving this trend. As cities expand, there is a rising need for energy-efficient, aesthetically appealing buildings, pushing demand for glass curtain walls. Stricter environmental regulations and a focus on sustainable construction further fuel this growth. The region’s ongoing urban development and investments in commercial and residential projects support the adoption of advanced glass facades, driving the market towards greater expansion.

Middle East and Africa Glass Curtain Wall Market Analysis

The glass curtain wall market in the Middle East is fueled by rapid urbanization, with more than 80% of the population living in urban areas. This high concentration of urban dwellers drives the demand for modern, energy-efficient buildings, including the adoption of glass curtain walls. The region’s focus on sustainable construction, coupled with significant investments in commercial and residential developments, supports the growth of advanced glazing solutions. As cities expand and prioritize eco-friendly infrastructure, the demand for high-performance glass facades continues to rise, making the Middle East a key player in the global glass curtain wall market.

Competitive Landscape:

The global glass curtain wall market is characterized by intense competition among key players focusing on innovation, sustainability, and technological advancements. Prominent companies dominate the market by offering high-performance systems tailored to energy-efficient and aesthetically appealing building designs. The competitive landscape is further shaped by regional players catering to local construction requirements and cost efficiencies. Moreover, partnerships, mergers, and acquisitions are common strategies to expand market presence and enhance product portfolios. For instance, in December 2023, YKK AP Inc. announced strategic acquisition of YHS International Ltd., a Thailand-based glass curtain wall company. This acquisition will expand YKK AP's foothold in Asia Pacific and boosts its efforts to develop steady global supply chain. In addition, increasing demand for unitized systems and sustainable construction solutions drives innovation, while strict regulatory compliance on energy efficiency standards intensifies competition. Furthermore, as urbanization rises globally, market players continue to invest in research and development projects and advanced manufacturing capabilities to maintain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the glass curtain wall market with detailed profiles of all major companies, including:

- AGC Inc.

- Apogee Enterprises Inc.

- AvicSanxin Co. Ltd

- Central Glass Co. Ltd.

- China Glass Holdings Limited

- Guardian Industries (Koch Industries Inc)

- Hansen Group Ltd.

- Kawneer

- Nippon Sheet Glass Co. Ltd

- Schott AG

- Vitro

- Xinyi Glass Holdings Limited

Latest News and Developments:

- November 2024: The NorthGlass High-End Equipment Industrial Park project has successfully installed the "Super Glass" curtain wall on its landmark R&D Center Building. This oversized, ultra-thick glass facade combines aesthetic appeal with advanced technology, featuring a one-way perspective and highly reflective surface that gives the building a unique, brilliant sparkle.

- May 2024: Dow Chemical and Glass Wall Systems India have partnered to supply DOWSIL™ Facade Sealants for glass curtain walls, utilizing Dow's Decarbia™ portfolio to reduce embodied carbon. Dow’s carbon-neutral silicone sealants, verified by PAS 2060, enhance the sustainability of curtain wall systems by lowering both operational and embedded carbon emissions.

- March 2024: Giroux Glass Inc. has launched the Giroux Unitized Curtain Wall System, a prefabricated, high-performance façade solution. Produced at its 75,000-square-foot Phoenix facility, the system offers water resistance, thermal efficiency, structural integrity, and acoustical performance. With customizable finishes and options for both captured and SSG configurations, it supports next-day delivery across California and the Southwest.

- March 2024: Innovation Glass, in partnership with Thiele Glas, hosted a workshop in New York City titled "Deconstructing the Curtain Wall for Modern Architecture: Aesthetics vs. Sustainability." The session focused on discussing how to improve curtain wall design, balancing aesthetics and sustainability.

- October 2023: Oldcastle BuildingEnvelope, based in Dallas and a global supplier of architectural glass, metal, and hardware, has launched the Reliance-TC LT, an extension of its Reliance curtain wall solutions range. The company’s curtain walls have been featured in prominent projects, including The Star in Frisco. Additionally, Oldcastle's curtain walls will be showcased at Globe Life Field in Arlington during Game 1 of the Texas Rangers vs. Arizona Diamondbacks World Series.

Glass Curtain Wall Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Unitized, Stick |

| End Uses Covered | Commercial, Public, Residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGC Inc., Apogee Enterprises Inc., AvicSanxin Co. Ltd, Central Glass Co. Ltd., China Glass Holdings Limited, Guardian Industries (Koch Industries Inc), Hansen Group Ltd., Kawneer, Nippon Sheet Glass Co. Ltd, Schott AG, Vitro, Xinyi Glass Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the glass curtain wall market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global glass curtain wall market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the glass curtain wall industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

A glass curtain wall is a non-structural outer covering of a building, typically made of lightweight, aluminum-framed glass panels. Designed to resist weather and protect the interior, it enhances energy efficiency and aesthetics without bearing structural loads, as these are supported by the building's frame.

The global glass curtain wall market was valued at USD 61.3 Billion in 2024.

IMARC estimates the global glass curtain wall market to exhibit a CAGR of 5.6% during 2025-2033.

Key factors driving the market include increasing demand for energy-efficient building solutions, rising urbanization, advancements in construction technologies, and growing preferences for aesthetic architectural designs. Additionally, strict environmental regulations and the need for sustainable materials further propel market growth.

In 2024, unitized represented the largest segment by system type, driven by faster installation, reduced labor costs, and enhanced performance.

Commercial leads the market by end use, driven by rising demand for modern aesthetics, energy efficiency, and large-scale urban construction projects.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global glass curtain wall market include AGC Inc., Apogee Enterprises Inc., AvicSanxin Co. Ltd, Central Glass Co. Ltd., China Glass Holdings Limited, Guardian Industries (Koch Industries Inc), Hansen Group Ltd., Kawneer, Nippon Sheet Glass Co. Ltd, Schott AG, Vitro, Xinyi Glass Holdings Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)