Glamping Market Size, Share, Trends and Forecast by Type, Age Group, Size, and Region, 2026-2034

Glamping Market Size and Share Analysis:

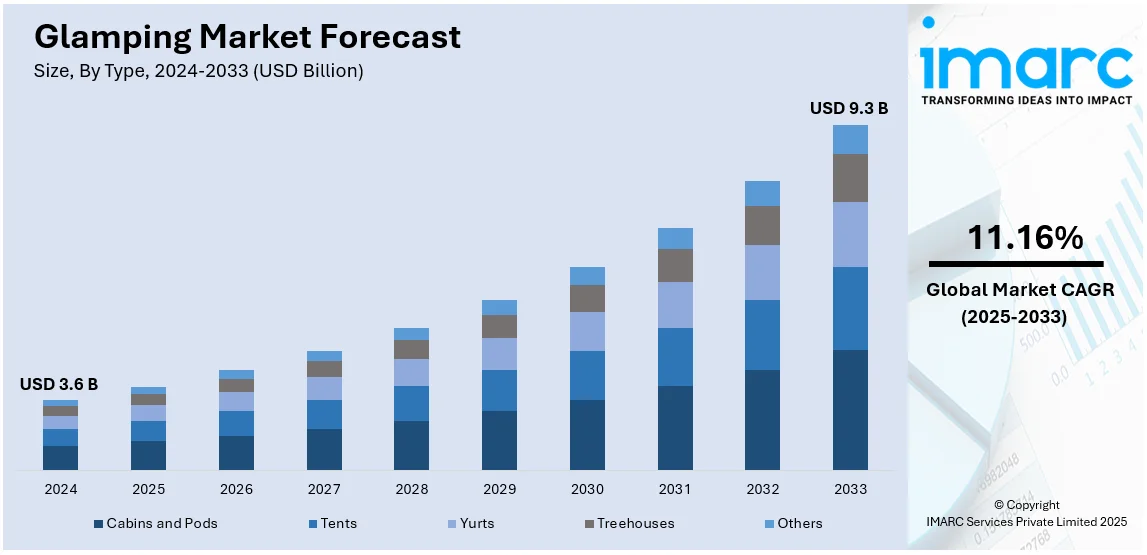

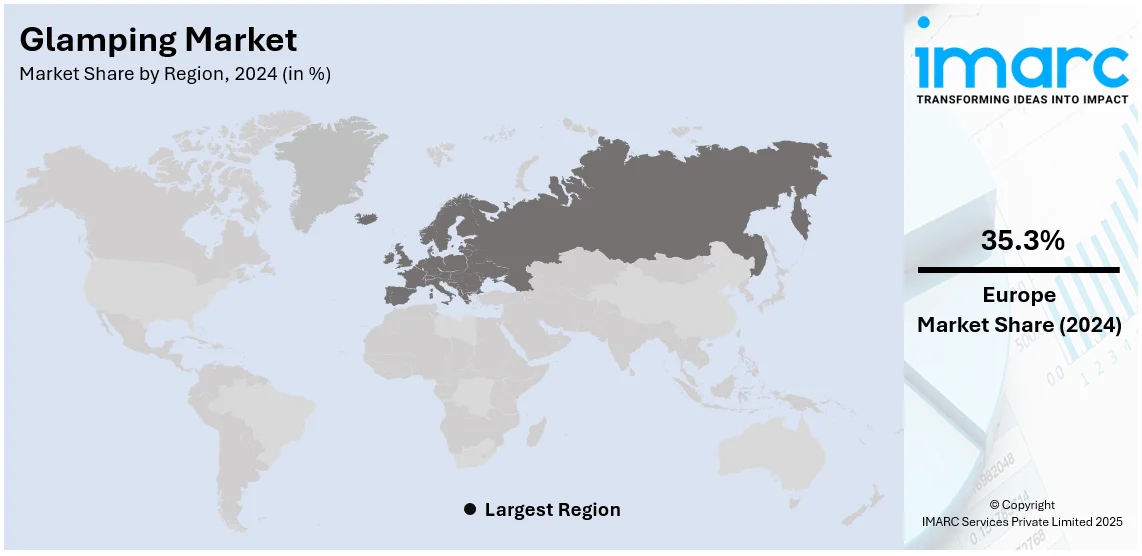

The global glamping market size was valued at USD 3.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 9.3 Billion by 2034, exhibiting a CAGR of 11.16% during 2026-2034. Europe currently dominates the market, holding a significant market share of over 35.3% in 2024. This leadership in glamping market growth is driven by a strong demand for eco-friendly travel, diverse landscapes, and established glamping infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.6 Billion |

|

Market Forecast in 2034

|

USD 9.3 Billion |

| Market Growth Rate 2026-2034 | 11.16% |

A major driver of the glamping market is the rising consumer demand for unique, experiential travel options that combine luxury and nature. Modern travelers are increasingly seeking outdoor experiences without compromising comfort, fueling the popularity of glamping accommodations such as luxury tents, cabins, and treehouses. This trend is further supported by growing awareness of sustainable tourism, as glamping often incorporates eco-friendly designs and practices. Additionally, the increasing disposable income among millennials and their preference for Instagram-worthy travel destinations amplify glamping market growth. For instance, in 2024, a survey found that individuals aged 18-41 want more technology at campgrounds, emphasizing the need to stay connected while enjoying a break from daily life. Advances in amenities, such as Wi-Fi and climate control, enhance the appeal of glamping, attracting a broader demographic.

The United States is a significant contributor to the glamping market, offering diverse landscapes and a wide range of luxury outdoor accommodations. Renowned for its national parks, forests, and scenic coastal regions, the U.S. provides an ideal backdrop for glamping experiences that appeal to both domestic and international travelers. For instance, in 2024, Under Canvas will open an 80-acre camp near Yosemite National Park in 2025, featuring safari-inspired tents with king-size beds, private decks, ensuite bathrooms, daily events, and nightly s’mores. Glamping operators in the U.S. focus on integrating high-end amenities, including gourmet dining, Wi-Fi connectivity, and climate-controlled accommodations, to cater to modern preferences. Additionally, the market benefits from strong consumer interest in eco-tourism and sustainable travel. Strategic marketing campaigns and the rise of digital booking platforms further enhance accessibility and glamping market share.

Glamping Market Trends:

Increased desire for unique and luxurious outdoor experiences

The market is primarily driven by the growing consumer desire for unique and luxurious outdoor experiences. Unlike traditional camping, glamping offers a blend of wilderness exposure with modern luxury and comfort, attracting a wider audience who might not ordinarily consider camping. This trend is especially prevalent among millennials and Gen Z, who seek experiential travel over conventional vacation styles. According to the government of UK, millennials account for 13.9% of the overall population in the United Kingdom. Glamping sites often feature high-end amenities such as comfortable beds, en-suite bathrooms, gourmet dining, and sometimes even spa services, all set in remote and scenic locations. This allows travelers to connect with nature without sacrificing the comforts and luxuries they are accustomed to. The increasing popularity of sustainable and eco-friendly tourism also plays a significant role, as many sites are designed with a low environmental impact in mind, appealing to environmentally conscious travelers.

Rise of social media influence and digital marketing

Social media influence and digital marketing significantly boost the market by showcasing picturesque sites and experiences to a broad audience. According to a survey conducted by the government of UK, in the 2019/20 period, 87% of respondents reported utilizing social networking websites or applications within the past 12 months, reflecting an increase from 84% recorded in 2018/19. This visibility has turned glamping into a trend that symbolizes both adventure and elegance, catering to the aspirations of a digitally connected generation. Influencers and travel bloggers play a key role in this trend, as their posts and stories depicting experiences inspire followers to seek similar adventures. Additionally, the ease of online bookings and the presence of dedicated platforms and websites for glamorous camping have made it more accessible for potential customers. This digital approach not only markets the experience but also simplifies the process of finding and booking these unique accommodations, further driving the market's growth.

Expansion of glamping accommodation types and destinations

The diversification in types of accommodations and expansion into new and unique destinations are significant drivers of the market. Traditional tents have evolved into a variety of luxury accommodations, including yurts, treehouses, safari tents, pod cabins, and even air-streams, each offering a distinct experience. This variety caters to a range of preferences and budgets, making glamorous camping appealing to a broader demographic. Furthermore, the global expansion of destinations into diverse natural environments – from mountains and forests to beaches and deserts – provides a wide array of experiences for travelers. This geographic diversity not only caters to local tourism but also attracts international travelers looking for unique experiences in different parts of the world. According to the government of Spain, in the first ten months of 2024, Spain welcomed over 82.8 Million international visitors, reflecting a 10.8% increase compared to the same period in the year 2023.

Glamping Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global glamping market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, age group, and size.

Analysis by Type:

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

Cabins and pods stand as the largest type in 2024, holding around 44.3% of the market. The cabins and pods represent the largest share in the market, appealing to a wide audience because of the perfect blend of comfort and immersion in nature. These structures are usually designed with eco-friendly materials and modern amenities that give a home-like feel amidst natural surroundings. Their popularity lies in their versatility, appealing both to adventure-seekers and those seeking a tranquil retreat. This segment caters to a clientele that is so diverse, covering families, couples, and also solo travelers looking for the delicate balance of being rustic and possessing contemporary luxury. As such, investments in high-quality, durable cabins and pods and year-round accommodations are increasing; this further supports the growth within this segment.

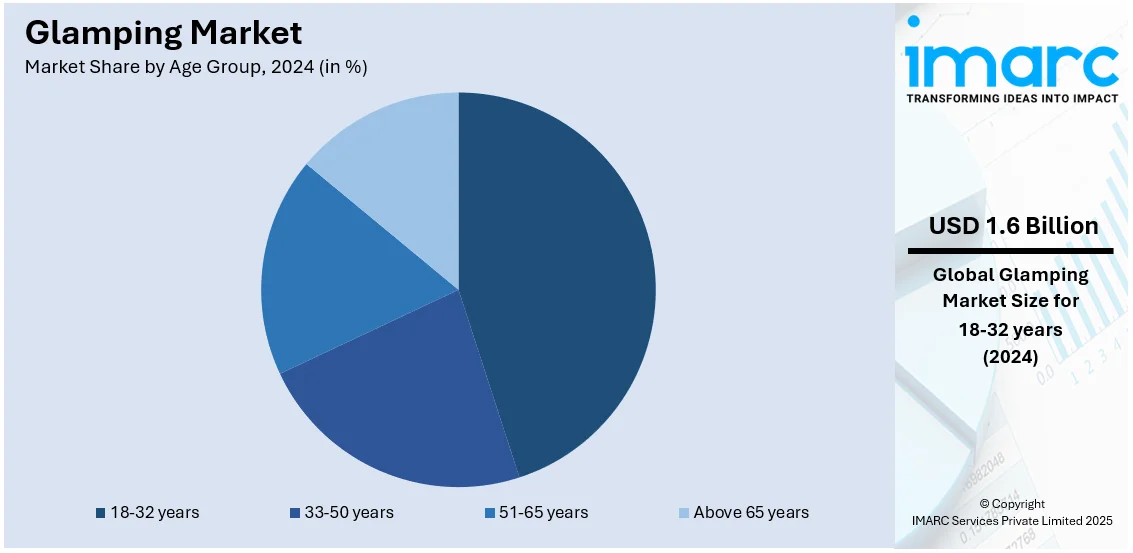

Analysis by Age Group:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

18-32 years leads the market with around 45.3% of market share in 2024. The 18-32 age group constitutes the majority of the market. This group, mostly consisting of millennials and younger Gen Xers, seeks experiential travel and one-of-a-kind accommodations that bring together adventure and comfort. Social media influence plays a significant role in this group's travel decisions as many look for picturesque destinations not only as a break from routine but also opportunities for digital storytelling. Glamping appeals to this age group because it combines the excitement of outdoor activities with the luxury and exclusivity of a place, making it an extremely attractive option for young adults seeking novel and Instagram-worthy travel experiences.

Analysis by Size:

- 4-Person

- 2-Person

- Others

4-person leads the market with around 37.7% of market share in 2024. The 4-person segment dominates the market, catering primarily to families and small groups. This popularity is driven by the growing trend of family vacations and group travels where participants seek shared experiences in unique settings. Glamping accommodations for four people are designed to offer enough space and amenities to comfortably house a family or a small group, providing a communal and cozy atmosphere. This segment's success is also bolstered by the variety of options available, from spacious tents to large cabins and pods, all equipped with facilities that allow for a comfortable and enjoyable stay.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 35.3%. Europe holds the largest share in the market, mainly because of its diverse natural landscapes and rich cultural heritage, which provide a perfect backdrop for unique glamping experiences. Countries like France, Italy, the UK, and Spain are at the forefront, offering a variety of accommodations from luxury treehouses to elegant yurts and eco-pods. The region's focus on sustainable tourism and the need for authentic, culture-drenched experiences does much to enhance its appeal. Moreover, Europe's long-established tourism infrastructure and multiple providers make it a destination of choice for luxury outdoor enthusiasts. Such a requirement in Europe is also fueled by a strong influx of domestic and international tourists seeking distinctive holiday options that bring the splendor of nature together with comfort and luxury.

Glamping Market Regional Takeaways:

United States Glamping Market Analysis

High disposable incomes and a growing preference for unique vacation experiences are fueling the demand for luxurious glamping accommodations such as yurts, treehouses, and safari tents. According to the Bureau of Economic Analysis (BEA), the disposable income in October 2024 was 0.4% whereas that of September 2024 was 0.1%. In line with this, the growing trend of glamping is providing an eco-friendly and comfortable way for visitors to explore wilderness areas like Yellowstone and the Grand Canyon, capitalizing on the abundance of national parks and outdoor recreational spaces. Additionally, the rising interest in wellness tourism across the United States, including yoga retreats and digital detox vacations, is aligning with glamping offerings in serene and natural environments. Furthermore, the use of glamping setups is gaining traction for festivals, weddings, and corporate retreats across the United States, particularly in scenic outdoor settings. Moreover, this trend is driven by the increasing demand for unique, immersive experiences that combine luxury and nature.

North America Glamping Market Analysis

Glamping in North America has experienced huge growth because people have increasingly become interested in experiences that bring them luxury and the great outdoors together. This, in addition to rising interest in sustainable tourism and ecotourism-friendly accommodations, has boosted glamping, making it popular with the green tourist. Contemporary glamping has facilities such as Wi-Fi, private bathrooms, and gourmet dining to make the alternative experience even more attractive compared to camping. Key destinations in the U.S. and Canada include national parks and remote wilderness areas, offering safari tents, treehouses, and other forms of glamping. The market also benefits from an increasing millennial and Gen Z demographic seeking experiential travel. For instance, in 2024, Hilton Trends Report revealed that nearly half of travelers prioritize exploration, with over half of Gen Z and Millennials allocating more budget to adventurous experiences than other generations. Additionally, partnerships with travel agencies and the integration of online booking platforms have further propelled the market’s expansion in recent years.

Asia Pacific Glamping Market Analysis

The growing demand among affluent middle-class travelers across Asia-Pacific countries for high-end camping experiences is proliferating the market, as these travelers seek modern amenities while immersing themselves in natural settings. According to the India Brand Equity Foundation (IBEF), wealthy households of India are earning over ₹2 crore (around USD 242,709) per year. This increased from USD 1.06 Million in 2016 to 1.8 Million in 2021. Additionally, glamping is becoming an increasingly popular choice among Asia-Pacific residents for exploring remote locations, including rainforests, mountains, and coastal areas. Furthermore, in densely populated Asia-Pacific regions, glamping is providing families with a unique way to reconnect with nature in a safe and controlled environment. According to the government of China, as of the end of 2021, the population of mainland China has reached 1.4126 Billion.

Europe Glamping Market Analysis

European consumers are increasingly focusing on sustainability and eco-friendly travel, propelling the demand for glamping solutions that emphasize minimal environmental impact. In addition to this, glamping is currently being integrated into historical and cultural tourism, offering unique accommodations in countryside locations or near historical landmarks. Furthermore, in regions like the Alps or the Mediterranean coastline, glamping is appealing to adventure seekers who are combining comfort with activities like hiking, biking, or water sports. Moreover, glamping sites in Europe are capitalizing on seasonal travel, such as attracting visitors for summer vacations in Southern Europe or offering winter glamping experiences in Nordic countries. According to the European Commission, the European Union experienced an increase of 18.9 Million overnight stays (+2.6%) in hotels and similar accommodations during the 2018-2019 winter season, compared to the same period the previous year. Moreover, the most significant growth was recorded in Romania, with an increase of 8.6%, followed by Croatia at 7.4% and Poland at 7.3%.

Latin America Glamping Market Analysis

The glamping market in Latin America is experiencing significant growth as more travelers are seeking unique, immersive outdoor experiences. Consumers are increasingly prioritizing eco-tourism, sustainability, and luxury, driving demand for high-end camping accommodations. Resorts and operators are offering customizable, comfortable stays with modern amenities, appealing to affluent travelers. Additionally, the region’s natural landscapes are attracting international tourists, while governments are supporting tourism development. According to the government of Brazil, from January to May 2024, Brazil achieved its highest revenue from international tourism in the past decade, with 1.9 Million international visitors contributing to this record-breaking performance.

Middle East and Africa Glamping Market Analysis

The glamping market in the Middle East and Africa is experiencing rapid growth due to increasing demand for luxury outdoor experiences, with travelers seeking unique and eco-friendly accommodations. The rising popularity of adventure tourism is driving more people to explore nature while enjoying modern amenities. Additionally, the region's growing focus on sustainability, high disposable incomes, and the expansion of luxury travel infrastructure are fueling market expansion. Investors are capitalizing on the trend by developing innovative glamping sites across various destinations. According to the U.S. Energy Information Administration (EIA), the disposable income across the Middle East is USD 5,155.

Top Glamping Companies:

The glamping market's competitive landscape is characterized by a mix of established hospitality brands, boutique operators, and startups focusing on luxury outdoor accommodations. Leading players differentiate themselves through unique offerings such as eco-friendly designs, premium amenities, and immersive nature-based experiences. Technology integration, including online booking platforms and virtual tours, enhances customer engagement and accessibility. Collaborations with travel agencies and local communities are also common strategies to expand market reach. The increasing focus on sustainable tourism and customization has intensified competition, with operators continuously innovating to meet evolving consumer preferences, driving growth and diversification in the glamping market. For instance, in 2024, Hyatt has teamed up with Under Canvas to offer glamping at 13 U.S. locations, including the ULUM Moab resort, providing World of Hyatt members access to unique camping experiences near national parks.

The report provides a comprehensive analysis of the competitive landscape in the glamping market with detailed profiles of all major companies, including:

- BIGHEAD glamping tents

- Collective Hotels & Retreats Inc.

- Eco Retreats Ltd

- Getaway House Inc.

- GlamXperience

- Glitzcamp Glamping Tent (Shelter Tent Manufacturing Co. Ltd)

- Nightfall Camp Pty Ltd.

- Paper Bark Camp

- Tanja Lagoon Camp

- Teapot Lane Glamping

- Tentrr Inc.

- Under Canvas Inc.

Latest News and Developments:

- July 2024: Hyatt had formed a partnership with Under Canvas to introduce glamping at 13 locations throughout the U.S., including Under Canvas' newly launched outdoor resort, ULUM Moab. This collaboration has granted World of Hyatt members exclusive access to unique camping experiences across various U.S. national parks and other prominent outdoor destinations.

- September 2024: The Northern Powerhouse Investment Fund II (NPIF II) completed its inaugural transaction in West Yorkshire following the launch of the £660 Million (USD 820 Million) funds in March. A family-run farm on the Yorkshire moors secured a £100,000 investment from NPIF II – Mercia Debt Finance, which is managed by Mercia and operates as part of NPIF II, to establish a glamping site.

- November 2024: Vaksana Farms introduced a unique addition in 2025: an A-Frame Glamping House, set in tranquil, natural surroundings. This eco-friendly accommodation enhances the farm's offerings, providing guests with an exceptional blend of comfort and nature.

- August 2023: Kite Beach in Umm Al Quwain has introduced a new glamping site, offering an elevated beachside living experience in the UAE. This initiative caters to those seeking a luxurious weekend getaway by the beach, eliminating the need for traditional camping gear.

- May 2022: Dubai-based Glampitect, a consultancy specializing in glamping site design, had partnered with Rescom, a prominent UAE engineering firm, to introduce the region's first portable luxury glamping pod.

Glamping Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Sizes Covered | 4-Person, 2-Person, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BIGHEAD glamping tents, Collective Hotels & Retreats Inc., Eco Retreats Ltd, Getaway House Inc., GlamXperience, Glitzcamp Glamping Tent (Shelter Tent Manufacturing Co. Ltd), Nightfall Camp Pty Ltd., Paper Bark Camp, Tanja Lagoon Camp, Teapot Lane Glamping, Tentrr Inc., Under Canvas Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the glamping market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global glamping market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The glamping market was valued at USD 3.6 Billion in 2024.

The glamping market is projected to exhibit a CAGR of 11.16% during 2025-2033, reaching a value of USD 9.3 Billion by 2033.

The glamping market is majorly driven by the increasing demand for unique travel experiences, growing interest in sustainable tourism, rising disposable incomes, and a shift towards outdoor and nature-based vacations, the appeal of luxury, comfort, and privacy offered by glamping accommodations.

Europe currently dominates the market, accounting for a share of around 35.3%. The dominance is driven by the increasing demand for luxury outdoor experiences, rising disposable incomes, a preference for sustainable tourism, diverse landscapes, and growing interest in unique, eco-friendly accommodations.

Some of the major players in the glamping market include BIGHEAD glamping tents, Collective Hotels & Retreats Inc., Eco Retreats Ltd, Getaway House Inc., GlamXperience, Glitzcamp Glamping Tent (Shelter Tent Manufacturing Co. Ltd), Nightfall Camp Pty Ltd., Paper Bark Camp, Tanja Lagoon Camp, Teapot Lane Glamping, Tentrr Inc., and Under Canvas Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)