Germany Veterinary Healthcare Market Report by Product (Therapeutics, Diagnostics), Animal Type (Dogs and Cats, Horses, Ruminants, Swine, Poultry, and Others), End User (Veterinary Hospitals, Veterinary Clinics, Veterinary Laboratory Testing Services, and Others), and Region 2025-2033

Germany Veterinary Healthcare Market Overview:

The Germany veterinary healthcare market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6% during 2025-2033. The rising pet ownership, increasing awareness of animal health, advancements in veterinary technology, growth in livestock farming, and the expanding availability of pet insurance are some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.1 Billion |

|

Market Forecast in 2033

|

USD 3.5 Billion |

| Market Growth Rate 2025-2033 | 6% |

Germany Veterinary Healthcare Market Trends:

Increasing pet ownership and the humanization of pets:

In 2020, Germany saw a notable increase in pet ownership, with over 15 million cats and 10 million dogs kept as pets. This trend mirrors a global rise in considering pets as integral family members. Consequently, there's a growing emphasis on pet health and well-being for human family members. The demand for superior veterinary care, including routine checkups, vaccinations, and cutting-edge medical treatments, has surged as a result of this change, aiding in market expansion. Moreover, the burgeoning growth of sectors like pet nutrition, grooming, and overall wellness services, reflecting the need for comprehensive veterinary healthcare solutions to cater to evolving pet owner expectations and ensure the well-being of furry companions is providing an impetus to the market growth.

Advancements in veterinary medical technology:

Continuous technological innovations have led to the development of more effective diagnostic tools, treatment methods, and medical devices specifically designed for animal health. For example, the advent of modern imaging technologies like computed tomography (CT) scans and magnetic resonance imaging (MRI) as well as sophisticated laboratory testing, allowing veterinarians to diagnose and treat conditions more accurately and quickly is creating a positive outlook for market expansion. Furthermore, the advancement of telemedicine in veterinary care has also allowed pet owners to receive consultations and advice from veterinarians from a distance, particularly beneficial in rural or underserved areas, thereby propelling the market forward. Apart from this, innovations in wearable technology for pets, such as GPS trackers and health monitors, provide real-time data on an animal’s location, activity levels, and vital signs, enabling proactive health management and swift response to potential issues. These devices contribute to a more comprehensive approach to animal health, further driving market growth.

Growing emphasis on preventive care and wellness:

Preventive healthcare involves regular monitoring and maintenance of an animal’s health to prevent diseases before they occur rather than solely treating them after they develop. This approach includes routine vaccinations, parasite control, dental care, and nutritional management. Increasing awareness among pet owners about the importance of preventive care is driving demand for regular veterinary visits and wellness programs. Furthermore, the prevalence of long-term illnesses in pets, like diabetes and obesity, has brought attention to the necessity of continuous health monitoring and preventative measures. Veterinary healthcare providers are responding to this trend by offering tailored wellness plans and educational initiatives to promote preventive care practices. The focus on preventive care helps maintain the long-term health of animals and reduces the overall cost of veterinary treatment by avoiding expensive emergency interventions, thus aiding in market expansion.

Germany Veterinary Healthcare Market News:

- In May 2024, Boehringer Ingelheim launched BULTAVO 3™, an inactivated vaccine against bluetongue virus (BTV) serotype 3 in sheep cattle. The vaccine is an inactivated vaccine, injected subcutaneously in sheep and intramuscularly in cattle, and is the first to prevent mortality and clinical signs of BTV-3.

Germany Veterinary Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, animal type, and end user.

Product Insights:

- Therapeutics

- Vaccines

- Parasiticides

- Anti-Infectives

- Medical Feed Additives

- Others

- Diagnostics

- Immunodiagnostic Tests

- Molecular Diagnostics

- Diagnostic Imaging

- Clinical Chemistry

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes therapeutics (vaccines, parasiticides, anti-infectives, medical feed additives, and others) and diagnostics (immunodiagnostic tests, molecular diagnostics, diagnostic imaging, clinical chemistry, and others).

Animal Type Insights:

- Dogs and Cats

- Horses

- Ruminants

- Swine

- Poultry

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes dogs and cats, horses, ruminants, swine, poultry, and others.

End User Insights:

- Veterinary Hospitals

- Veterinary Clinics

- Veterinary Laboratory Testing Services

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes veterinary hospitals, veterinary clinics, veterinary laboratory testing services, and others.

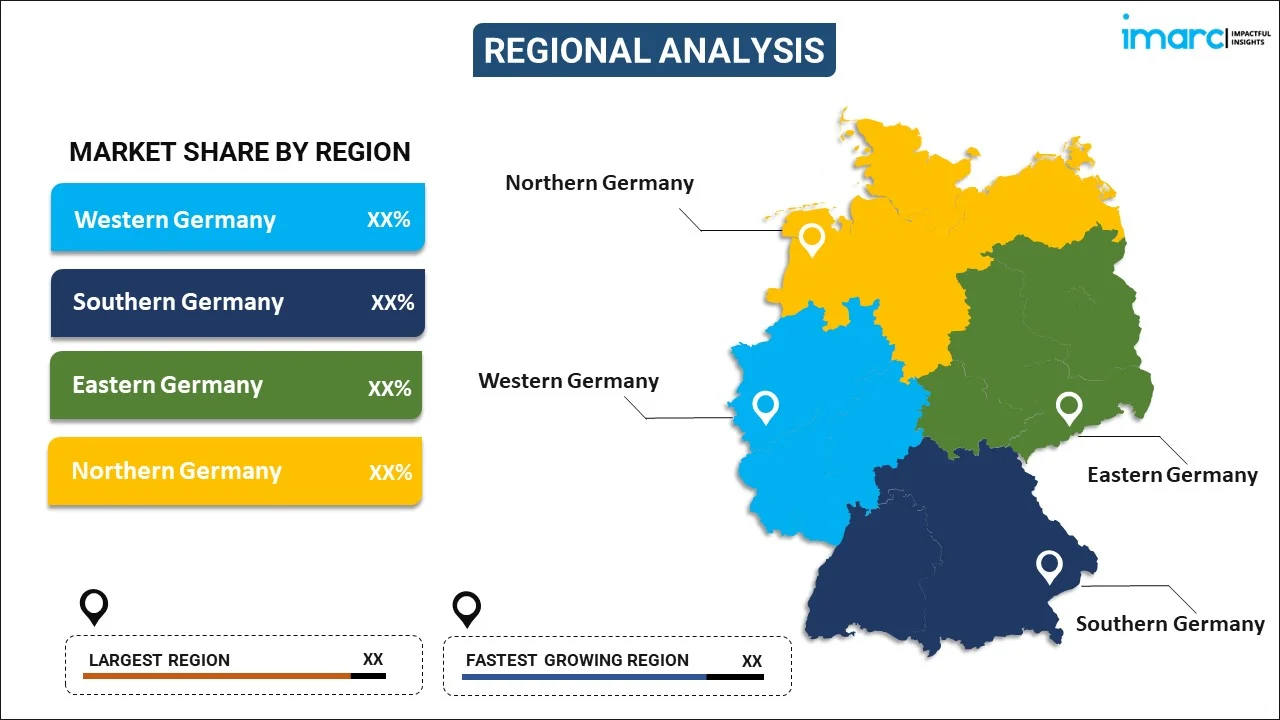

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Veterinary Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Animal Types Covered | Dogs and Cats, Horses, Ruminants, Swine, Poultry, Others |

| End Users Covered | Veterinary Hospitals, Veterinary Clinics, Veterinary Laboratory Testing Services, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany veterinary healthcare market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Germany veterinary healthcare market?

- What is the breakup of the Germany veterinary healthcare market on the basis of product?

- What is the breakup of the Germany veterinary healthcare market on the basis of animal type?

- What is the breakup of the Germany veterinary healthcare market on the basis of end user?

- What are the various stages in the value chain of the Germany veterinary healthcare market?

- What are the key driving factors and challenges in the Germany veterinary healthcare?

- What is the structure of the Germany veterinary healthcare market and who are the key players?

- What is the degree of competition in the Germany veterinary healthcare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany veterinary healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany veterinary healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany veterinary healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)