Germany Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2025-2033

Germany Toys Market Outlook 2025-2033:

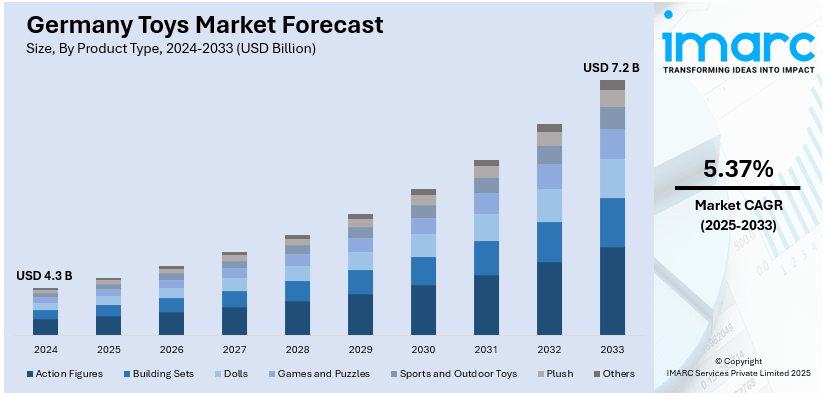

The Germany toys market size was valued at USD 4.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.2 Billion by 2033, exhibiting a CAGR of 5.37% from 2025-2033. The market is thriving on rising demand for science, technology, engineering, and mathematics (STEM) and eco-friendly toys, strict adherence to stringent safety standards, the growth of online retail, increasing cultural preferences for traditional toys, and the heightened influence of licensed products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.3 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Market Growth Rate (2025-2033) | 5.37% |

Germany has always placed a strong emphasis on education, and this cultural mindset is now reflected in the toy market. Parents are widely looking for toys that combine fun with learning. Science, technology, engineering, and mathematics (STEM) toys are particularly popular as they encourage problem-solving, creativity, and critical thinking, making them a favorite among both parents and educators. Toy companies are capitalizing on this demand by offering innovative products that appeal to different age groups. For instance, Ravensburger launched a new series for babies and toddlers called “Play+”. It includes 35 toys, puzzles and playful books for the overall and holistic early development of young children. Additionally, Haba's basic multicolored building blocks is being recognized by parents of toddlers between zero to three years for its high quality and ability to introduce young children to geometric shapes, thus enhancing their motor, sensory, and creative skills.

With sustainability becoming a central concern for German consumers, eco-friendly toys are also gaining significant traction. Parents prefer toys made from natural, non-toxic materials like wood, bamboo, or recycled plastics. Many brands are now marketing themselves as environmentally conscious by offering products with minimal packaging or using renewable resources. For instance, Ravensburger introduced "GraviTrax Junior", which is the company’s first product with materials made from bio-plastic. The company has been making sure that a high proportion of recycled materials are used, and it has also been using FSC-certified paper and wood for over a decade. This trend aligns with Germany’s broader push towards eco-conscious living, as parents aim to instill these values in their children.

Germany Toys Market Trends:

Shift Towards Online Shopping and Customization

The digital shopping landscape has expanded dramatically in Germany, changing how toys are purchased. Parents appreciate the convenience of browsing and comparing products online, while children enjoy customized options that reflect their unique preferences. It has been revealed that some 42 per cent of German parents buy gifts for their children online that includes toys. E-commerce platforms often provide exclusive deals and detailed reviews, making them an attractive choice for busy families. Some toy companies have taken this a step further by offering personalization options, such as engraving names on toys or creating customized doll designs. This blend of convenience and personalization is appealing to modern consumers, giving online retailers and innovative brands an edge in the competitive toy market.

Impact of Digitalization on Smart and Interactive Toys

The integration of technology into toys is reshaping the industry in Germany. Smart toys, which use apps, sensors, or artificial intelligence (AI), are highly appealing to tech-savvy parents and kids. These toys can talk, interact, or adapt based on a child’s behavior, creating a unique play experience. Products like robotic pets, programmable vehicles, and augmented reality (AR)-based games are becoming increasingly popular. While screen time for children is a debated topic, many parents see these toys as a way to combine technology with active engagement, making them a valuable addition to the market.

Strong Focus on Quality and Safety Standards

Germany is renowned for its stringent safety standards, and this directly impacts the toy market. Parents are cautious when purchasing toys, prioritizing products that meet rigorous safety and quality benchmarks. The "Made in Germany" label carries a reputation for reliability, and domestic brands like Playmobil and Schleich benefit from this trust. European Union (EU) toy safety regulations also play a role in ensuring that products in the German market are free from harmful chemicals, have no sharp edges, and undergo thorough testing. This high demand for safe and durable toys not only boosts sales of local products but also encourages international brands to meet these standards to compete effectively in Germany. For example, in the year 2023, EU Safety Gate report flagged dangerous products that were sold in the EU that placed toys in second position behind cosmetics. 467 notifications were made about toys and over 97% of these toy alerts concern traders who do not have connection with reputable brands or reputable retailers.

Germany Toys Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Germany toys market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, age group and sales channel.

Analysis by Product Type:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The action figures segment is fueled by the popularity of superhero franchises, movies, and television series in Germany. These toys appeal to children and collectors, with brands like Marvel, Star Wars, and DC driving significant sales. Limited-edition figures and collaboration with entertainment companies boost the segment. As demand for immersive and character-driven play grows, this segment continues to expand its footprint in the German toy market.

Building sets are highly valued for their educational and entertainment aspects, making them a staple in German households. Brands offer products that foster creativity, motor skills, and problem-solving abilities. The demand is further driven by themed sets that align with popular franchises as well as eco-friendly innovations like biodegradable building blocks.

Dolls remain a classic choice in Germany, catering to young children and collectors alike. Traditional dolls, such as Barbie and Baby Born, hold a strong position, while modern, inclusive designs reflecting diverse cultural and body representations are driving new interest. Customizable doll options and tie-ins with popular franchises further enhance the segment's growth, appealing to evolving consumer preferences.

Games and puzzles are a favored category in Germany, especially for families seeking interactive entertainment. This segment is bolstered by a preference for board games like memory-enhancing puzzles, which encourage group activities and cognitive development. The rise of digital board game adaptations and augmented reality-based puzzles is also contributing to this segment’s sustained growth.

The strong demand for sports and outdoor toys in Germany is fueled by the country's emphasis on playing outdoors and physical fitness. Both parents and kids prefer products like bicycles, soccer sets, and trampolines. Seasonal demand is highest during the summer, while novel toys that mix physical activity with technology, such as smart sports equipment, are gaining popularity.

Plush toys thrive on emotional connection and memories, making them appealing among both children and adults. This market is recognized for its high-end, character-based plush toys that are associated with animated films and television series. In line with Germany's environmentally concerned customer base, sustainable products manufactured from recycled materials are becoming increasingly popular.

Analysis by Age Group:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

The segment for children aged 5 years and below focuses on toys that aid early development and sensory engagement. Products such as soft toys, stacking blocks, and educational playsets are highly sought after for this age group. Parents prioritize safety, with non-toxic materials and durable designs being essential. Brands catering to this segment emphasize toys that foster motor skills, color recognition, and basic problem-solving abilities.

Toys for children aged 5 to 10 years are centered around interactive and skill-building activities. This group shows a strong preference for building sets, action figures, and games that encourage creativity and social play. STEM toys and board games are particularly popular, offering educational benefits alongside entertainment. Franchised toys tied to movies, cartoons, and books also resonate strongly with this age group, fueling consistent demand.

The above 10 years segment includes toys that cater to advanced skills, hobbies, and entertainment. Interactive toys, such as programmable robots and advanced puzzles, appeal to this demographic. Collectibles, gaming accessories, and strategy-based board games are prominent, reflecting the shift toward more complex and technology-driven play. This group also leans toward digital and hybrid toys that blend traditional play with innovative tech features.

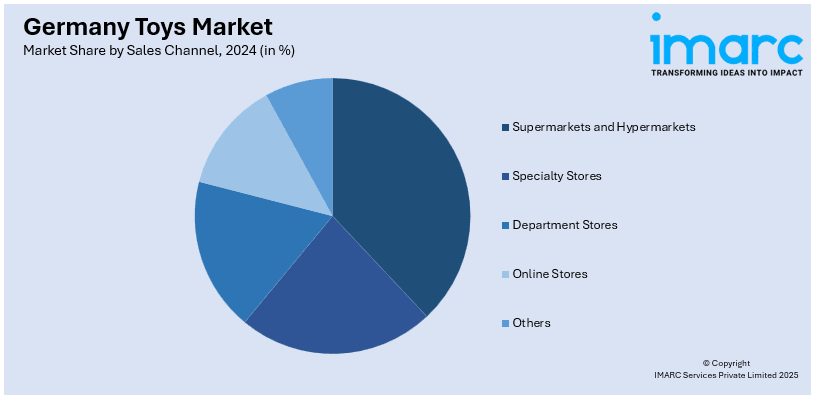

Analysis by Sales Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

Supermarkets and hypermarkets are important toy sales channels because they provide customers with convenience and choice. These shops are well-liked by parents seeking a one-stop shopping experience since they frequently provide toy-specific areas at affordable prices. Sales through these channels are further boosted by seasonal promotions and holiday discounts.

Specialty stores cater to a niche market by offering a curated selection of high-quality and unique toys. These stores are preferred for premium products, such as educational toys, handcrafted items, and eco-friendly options. Smaller boutique shops are notable players, providing personalized service and expert recommendations that attract discerning customers seeking specific toys.

Department stores combine the appeal of variety with a premium shopping experience, often featuring exclusive collaborations and high-end toy collections. These stores attract both gift buyers and collectors. Strategically located in urban centers, department stores benefit from high foot traffic, especially during the holiday season, when customers prioritize convenience and accessibility.

Online stores are the fastest-growing sales channel for toys in Germany, driven by the convenience of home delivery and a wide range of options. They offer competitive pricing, customer reviews, and customization options. The growing trend of digital shopping is further supported by exclusive online discounts, flash sales, and tailored recommendations, making this channel increasingly preferred by tech-savvy parents.

Regional Analysis:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

Western Germany represents a significant portion of the toy market due to its high population density and robust retail infrastructure. This region boasts a mix of traditional toy stores and modern retail outlets, catering to diverse consumer preferences. Economic prosperity in the region supports strong purchasing power, making Western Germany a key market for premium and innovative toys.

Southern Germany is known for its affluent population and cultural appreciation for traditional craftsmanship. This region shows high demand for premium toys, including wooden and handcrafted options. The presence of globally recognized brands that are headquartered in the region, further bolsters the toy market. Seasonal festivals like Christmas also drive significant sales in Southern Germany.

Eastern Germany is an emerging market for toys, driven by increasing urbanization and improving economic conditions. The region has a growing demand for affordable and educational toys, appealing to its price-sensitive but quality-conscious population. Government initiatives supporting early childhood education also contribute to the popularity of educational and developmental toys in this area.

Northern Germany benefits from its strategic location and strong retail network. The region shows a preference for sustainable and eco-friendly toys, aligning with its environmentally conscious consumer base. Northern Germany also sees a high volume of online toy sales, supported by advanced logistics infrastructure, making it a critical region for e-commerce-driven growth in the toy market.

Competitive Landscape:

Key players in the market are actively adapting to evolving consumer preferences and technological advancements. They are integrating digital elements into traditional toys to enhance interactive play experiences. Some are expanding their product lines to include licensed characters, appealing to a broader audience. Additionally, there is a significant shift towards sustainability, with manufacturers introducing eco-friendly materials and production methods to meet rising demand for environmentally conscious products among consumers. The rise of e-commerce has also prompted these companies to strengthen their online presence, offering direct-to-consumer (DTC) sales channels and engaging digital content to enhance customer engagement. Collaborations with popular franchises and investment in innovative toy designs are also prevalent strategies, aiming to capture the interest of both children and adult collectors.

The report provides a comprehensive analysis of the competitive landscape in the Germany toys market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Spin Master expanded Unicorn Academy into a number of businesses, including publishing, board games, and trading cards. Its German-language audio rights have been signed to Sony Music Entertainment.

- In August 2024, Simba Dickie Group announced that a jury of kids and adults had chosen their climbing tower, "BIG Kraxxl - The Giant," as the winner of the "German Toy Award 2024" in the "for my friends and me" category. The children will have fun together in the garden, while it challenges them to be physically active and promote their motor skills. Due to the flexible poles, multiple assembly options are possible. This click system allows for a very fast assembly without requiring any tool.

- In May 2024, the German manufacturers of the Playmobil range of plastic toys have launched a line of 95% sugarcane-based figures to be included with McDonald’s Happy Meals in Germany. It was produced by the Horst Brandstätter Group in collaboration with McDonald’s. This Wiltopia range comprises 14 animal figures and will be available in 70 countries.

Germany Toys Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany toys market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Germany toys market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The toys market in Germany as valued at USD 4.3 Billion in 2024.

The key factors driving the market are the rising demand for educational toys, a growing preference for eco-friendly and sustainable products, rapid technological advancements in interactive toys, strong adherence to safety standards, cultural appreciation for traditional toys, and the expansion of online retail channels.

The toys market in Germany is projected to exhibit a CAGR of 5.37% during 2025-2033, reaching a value of USD 7.2 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)