Germany Online Grocery Market Size, Share, Trends and Forecast by Product Type, Business Model, Platform, Purchase Type, and Region, 2026-2034

Germany Online Grocery Market Size and Share:

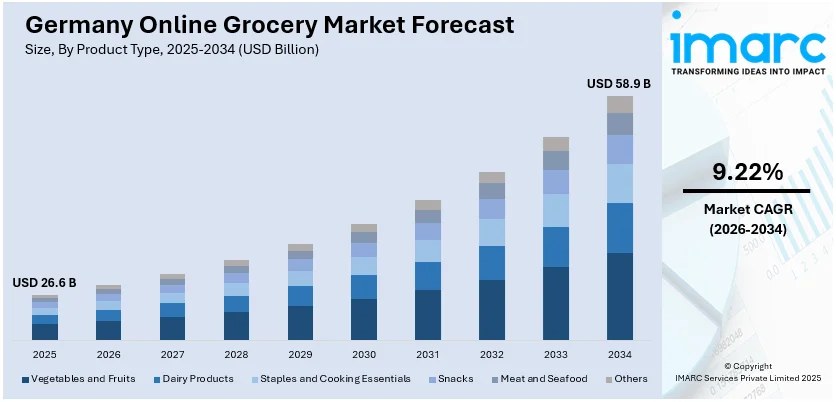

The Germany online grocery market size was valued at USD 26.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 58.9 Billion by 2034, exhibiting a CAGR of 9.22% from 2026-2034. The market involves growing consumer demand for convenience, time savings, and contactless shopping. Increased smartphone and internet penetration, particularly among younger demographics, has fueled digital engagement. Advancements in logistics infrastructure, such as same-day delivery and automated fulfillment, enhance service efficiency. Retailers are also leveraging data for personalized experiences and expanding omni-channel strategies thus surging the Germany online grocery market share. Additionally, competitive pricing and subscription models are encouraging customer retention and repeat purchases.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 26.6 Billion |

| Market Forecast in 2034 | USD 58.9 Billion |

| Market Growth Rate 2026-2034 | 9.22% |

Germany has experienced a dramatic change in consumer behavior, with a high demand for convenience, time-saving products, and contactless solutions, driven by the pandemic. Online grocery shopping has emerged as a top choice for most households in search of safety and convenience. Younger customers are more likely to be digitally active, with 38% of consumers choosing smartphones as their preferred device, compared to 60% in the 30-39age age range. Growth in demand for improved user experience through easy-to-use apps, tailored recommendations, and convenient delivery is fueling ongoing interest. As e-commerce becomes increasingly ubiquitous in everyday life, bricks-and-mortar retailers are investing in online channels and omni-channel strategies to compete.

To get more information on this market Request Sample

Germany's highly advanced logistics infrastructure and investment in last-mile delivery networks are critical in driving the expansion of the online grocery market. Retailers are working with technology startups and logistics companies to provide faster, more secure deliveries, including same-day and bookable slots. Urban locations take advantage of high population density, allowing for cost-effective route planning. Technologies like automated fulfillment centers, electric delivery vans, and click-and-collect schemes enhance efficiency and minimize environmental impact. These supply chain capabilities have increased the viability and scalability of online grocery shopping, thereby enabling customer satisfaction and reduced operational costs to be a primary contributor to maintaining Germany online grocery market growth.

Germany Online Grocery Market Trends:

Increasing adoption of technology

Technological innovations, especially in mobile apps and e-commerce websites, have increased the ease and effectiveness of online grocery shopping. Sophisticated logistics and supply chain technologies guarantee timely and precise delivery, which increases consumer confidence and satisfaction. The widespread use of smartphones and high-speed internet has facilitated consumers to shop online at any time and from anywhere, driving the market's growth. Based on a survey in the industry, 82% of individuals above age 16 in Germany, around 56 million, have a smartphone for private use, and 72% of them already utilize at least one AI feature on their smartphone. Artificial Intelligence (AI) and data analytics are contributing to making the shopping experience more personalized. These technologies study customer behavior to make tailored recommendations, enhancing customer interaction and loyalty. In the same way, the convergence of voice assistants and chatbots makes it easier to interact, which promotes user-friendly experiences. With advancing technology, it can continue to fuel growth through improved user experience, streamlined operations, and addressing the increasing consumer need for ease and efficiency in shopping for groceries.

The shift in consumer behavior towards convenience

Another major Germany online grocery market trend is the modern consumer patterns favoring convenience are fortifying market expansion. With online B2C sales growing at an exponential rate, e-commerce has become an essential component of German retail. Top online stores account for more than 40% of overall German e-commerce revenue. The convenience of shopping at any time and from anywhere, along with home delivery, has turned online grocery shopping into a popular choice for consumers across various demographics, such as busy professionals, parents, and the elderly. Furthermore, subscription-based services and membership clubs providing rewards such as free delivery, special discounts, and personalized shopping lists further encourage consumers to opt for online grocery stores rather than physical stores. Consequently, grocery services online are increasingly being incorporated into people's lives due to the increasing need for convenience.

Expansion of delivery and fulfillment innovations

Effective delivery and fulfillment operations are essential for the success of online grocery shopping. Organizations are putting serious money into building strong logistics networks, including last-mile delivery options, to guarantee timely and precise deliveries. Automated warehouses, robot picking systems, and drone deliveries are among the innovations being tested and adopted to drive operational efficiency. Also, the existence of dark stores retail outlets whose only purpose is to fill up online orders streamlined the order process, shortened lead times, and enhanced inventory tracking. The business is also compelled by the concept of various alternative delivery options which provide consumers flexibility and confidence. These involves curbside pickup, contactless delivery, and same-day delivery.

Germany Online Grocery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Germany online grocery market, along with forecast at the country and regional levels from 2026-2034. The market has been categorized based on product type, business model, platform, and purchase type.

Analysis by Product Type:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Based on the Germany online grocery market forecast, vegetables and fruits increasing demand for fresh fruits and vegetables is a high-demand category, led by daily use requirements and health-oriented consumers. Speed of delivery and freshness guarantee are critical success factors for online shoppers. However, there are problems with consistency of quality and perishability. To meet expectations and reduce spoiling, retailers place a strong emphasis on local sourcing and efficient cold chain operations.

Additionally, the dairy item receives high online support through frequent use and brand faithfulness. Items like cheese, yogurt, and milk are frequently ordered. Timely, temperature-stable delivery is imperative. Bundle deals and subscription plans drive repeat orders. Yet, shelf life management and package integrity are of utmost importance in order to retain product quality and customer confidence.

Moreover, staples and kitchen basics like rice, pasta, oils, and spices, constitutes the foundation of pantry shopping online. Bulk purchases, long storage life, and price insensitivity result in a good fit for e-commerce. Customer loyalty is favored by high repeatability and storage convenience. Price and assortment competitiveness drive consumer preference.

Besides this, the snacks are impulse-based and find favor with the youth segments. Convenience, variety, and visibility of brands drive online shopping. Sales are driven by seasonal debuts, combination packs, and promotions. Shelf life and fewer delivery limitations make snacks logistically easier to manage. Competition is fierce, but constant innovation in flavor and pack can overcome this.

Furthermore, the demand for fresh and high-quality meat and seafood is driving a steady increase in these products. Customers desire speedy delivery, traceability, and cleanliness. Two important factors are cold chain logistics and quality assurance. Subscription boxes and pre-marinated goods are growing in popularity. However, vendors face operational difficulty due to strict rules and perishability.

Also, the others consist of drinks, baby products, frozen goods, and household items. It is fueled by bundled promotions and convenience. They tend to be complementary to larger orders, increasing cart value. Frozen goods gain from enhanced cold chain infrastructures, whereas specialized categories such as organic or allergen-free goods are designed to support specific lifestyle needs.

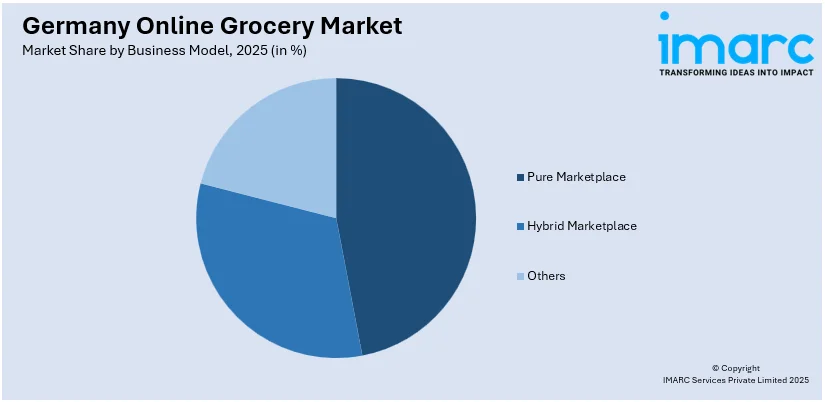

Analysis by Business Model:

Access the comprehensive market breakdown Request Sample

- Pure Marketplace

- Hybrid Marketplace

- Others

Based on the Germany online grocery market report, the pure marketplaces connect third-party sellers with consumers without owning inventory. They offer wide product variety and scalability but face challenges in quality control, delivery consistency, and customer service. Success depends on strong seller networks and robust logistics partnerships to ensure timely, reliable fulfillment in a highly competitive environment.

In line with this, the hybrid models combine owned inventory with third-party sellers, offering more control over product quality, pricing, and delivery. This approach balances scale and reliability, enhancing customer experience. While operationally complex and resource-intensive, it allows greater brand differentiation and margin control. It’s increasingly favored by major players seeking long-term sustainability.

Apart from this, the others includes direct-to-consumer (D2C), subscription-based, and dark store models. These models focus on niche audiences, speed, or personalization. While they often provide better control and customer loyalty, they require high upfront investment and operational precision. Innovation and agility are key for these models to compete effectively in a fragmented market.

Analysis by Platform:

- Web-Based

- App-Based

Web-based platforms cater to a broad user base, especially older consumers who prefer desktop browsing for larger screens and detailed views. They offer comprehensive navigation and are ideal for bulk orders. However, slower mobile responsiveness and less personalized experiences may limit engagement compared to more agile, app-based solutions.

Besides this, the app-based platforms dominate among younger, tech-savvy consumers seeking convenience, speed, and personalization. Push notifications, quick reordering, and mobile payment integration enhance user retention. Apps also enable better data collection for targeted marketing. However, they require constant updates, UX optimization, and strong mobile adoption to remain competitive in a crowded market.

Analysis by Purchase Type:

- One-Time

- Subscription

One-time buys dominate for impulse or occasional needs and provide flexibility at low commitment. Choice and control are what value consumers, particularly for fresh and specialty products. Retailers then have greater acquisition costs and uncertain revenue. Special promotions, user interfaces, and easy checkout drive these shoppers toward repeat purchase loyalty.

Furthermore, the subscription models encourage customer loyalty and stable revenue through regular deliveries of necessities such as dairy, snacks, or baby items. They are attractive to busy consumers who want convenience and cost savings. Retention, however, relies on flexibility, quality of products, and tailored offerings. To guarantee sustained engagement, brands must find a balance between customization and automation.

Regional Analysis:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

Western Germany, particularly high-population states such as North Rhine-Westphalia, dominates the market with elevated urbanization, robust infrastructure, and digital adoption. Densely populated cities are conducive to last-mile delivery and order volumes efficiency. Consumers here are open to innovation, rendering the region highly suitable for expansion in the market and pilot rollouts of the service.

Concurrently, Southern Germany, with affluent areas like Bavaria and Baden-Württemberg, exhibits robust purchasing power and inclination towards premium, organic, and local goods. Strong smartphone penetration and technology-savvy consumers drive app-based adoption. Although rural pockets present logistics challenges, the region presents high-margin opportunities for curated and specialty grocery.

Besides this, the Eastern Germany falls behind somewhat in adoption with lower population densities and average incomes. But growing digital literacy and enhancing infrastructure are bridging the gap. Competitive pricing, bare necessities, and reach by national retailers extending logistics networks to unserved and semi-urban pockets are driving Germany online grocery market outlook.

Similarly, the Northern Germany, which encompasses urban centres like Hamburg and Bremen, enjoys dense port-oriented supply chains as well as urban aggregation. Consumers within this region prefer sustainable and ethical products, shaping assortments on the web. Geographic distribution as well as weather can impact the efficiency of logistics, yet the region still enjoys robust growth across mainstream and niche segments.

Competitive Landscape:

The competitive landscape of Germany's online grocery market is vibrant and increasingly crowded, propelled by increasing consumer demand and digitalization. Pure-play e-grocers, traditional supermarkets, and new tech-enabled players vie for market share based on innovation, price, and convenience. The market is defined by fast service improvements, including quicker delivery times, versatile ordering, and tailoring of the shopping experience. There is competition pressure driving investments in logistics, AI-driven platforms, and environmentally friendly operations. Urban adoption remains high despite low profitability as a result of high operational expenses and price elasticity from consumers. In an increasingly competitive market, customer experience-based differentiation, efficient fulfillment, and loyalty schemes will become critical drivers for long-term sustainability in this shifting digital grocery market.

The report provides a comprehensive analysis of the competitive landscape in the Germany online grocery market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: The German supermarket operator Edeka declared that it would buy the dairy company Uckermärker Milch in order to improve its product offerings and supply chain, including for its online grocery platform. The deal secures local production of quark, butter, and milk powder, which are key items for both in-store and e-commerce sales. The move reflects Edeka’s strategy to boost control over quality and availability, particularly as online grocery demand continues to grow in Germany.

- February 2025: South Africa’s Prosus announced that it would acquire Just Eat Takeaway.com in a EUR 4.1 billion deal, gaining control of the food delivery firm with operations in Germany, the UK, and the Netherlands. The move aligns with Prosus’s strategy to build a European tech leader and expand its AI-driven food delivery portfolio.

- November 2024: The Rohlik Group's German division, Knuspr, teamed up with Amazon to introduce "Knuspr on Amazon" in Berlin, providing Prime members with quick delivery on over 15,000 grocery goods. The alliance will also expand to other cities, intensifying competition with rivals like Picnic in Germany’s online grocery market.

- June 2024: Velivery, an online vegan retailer, helped Redefine Meat introduce its plant-based New Meat brand in Germany. Previously, these products were available in the UK, France, and the Netherlands via online retailers like Ocado and Monoprix.

- April 2024: Rohlik Group, a leading European online grocery retailer, launched Knuspr.de in Berlin. The strategic growth of Rohlik Group, which aims to achieve €10 billion in revenue by 2030 and expand into 15 more German cities, included this crucial launch.

Germany Online Grocery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | Web-Based, App-Based |

| Purchase Types Covered | One-Time, Subscription |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany Online Grocery market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Germany online grocery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany Online Grocery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Germany online grocery market was valued at USD 26.6 Billion in 2025.

The Germany online grocery market is projected to exhibit a CAGR of 9.22% during 2026-2034, reaching a value of USD 58.9 Billion by 2034.

Key factors driving Germany's online grocery market include growing consumer demand for convenience, time efficiency, and contactless shopping, especially post-pandemic. Advances in digital technology, improved delivery logistics, and increasing urbanization also contribute, alongside changing lifestyles and the rising acceptance of e-commerce across various age groups and income segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)