Germany Online Food Delivery Market Report by Platform Type (Mobile Applications, Website), Business Model (Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System), Payment Method (Online Payment, Cash on Delivery), and Region 2026-2034

Germany Online Food Delivery Market Overview:

The Germany online food delivery market size reached USD 14.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 31.3 Billion by 2034, exhibiting a growth rate (CAGR) of 8.74% during 2026-2034. The expansion of same day delivery services, fast and efficient delivery systems, influence of new customer preferences and lifestyle, and the rising demand of digital services from the younger generation represent some of the key factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.7 Billion |

| Market Forecast in 2034 | USD 31.3 Billion |

| Market Growth Rate (2026-2034) | 8.74% |

Access the full market insights report Request Sample

Germany Online Food Delivery Market Trends:

Expansion of Same Day Delivery Services

Same day delivery services are one of the key factors that have been observed to enhance the growth of the online food delivery market in Germany. Orders are delivered more quickly, and customers now expect prompt service; therefore, the ability to receive orders within a few hours significantly enhances customer satisfaction. This is achieved through improved supply chain management, tracking technology for monitoring the exact location of delivery vehicles, and partnership with restaurants and delivery service providers. Same-day services reduce waiting times and ensure food freshness, thus increasing customer numbers and loyalty. This fast and efficient delivery system makes online food delivery platforms a necessity in the busy and hustle-free lifestyle of today’s consumers. Same-day grocery delivery is a key factor driving the growth of the online food delivery market. For instance, the German retailer REWE expanded its grocery delivery services to Nuremberg in 2022, specifically for same-day delivery services. Also, Flink, a Germany-based grocery delivery startup, raised USD 240 million in 2021 to expand services of on-demand and instant deliveries of groceries in the country.

Influence of New Consumer Preferences and Lifestyle

Other factors influencing the growth of the online food delivery market include shifting consumer preferences and lifestyle trends in Germany. As urban living increases and work-life balance becomes more critical, consumers prefer convenient meal options. The demand for diverse, healthy, organic, and gourmet meals that are delivered to customers’ doorsteps caters to these evolving needs. Whether vegan, vegetarian or meat-eater: 72 percent of Germans eat fruit and vegetables on a daily basis. Women lead healthier lives than men. 81 percent of female respondents eat fruit and vegetables every day. This only applies to 63 percent of male respondents. Also, the increasing demand for digital services among the younger population and attractive offers in the form of bonuses and loyalty programs contribute to customer loyalty and new customer attraction. This change in the culture of consuming food, which is characterized by convenience, variety, and quality, is one of the primary drivers of growth and development of the online food delivery market in Germany.

Germany Online Food Delivery Market News:

- In April 2024, REWE opened its first purely plant-based supermarket in Berlin. The "REWE fully plant-based" store on Warschauer Brücke in the Friedrichshain district has more than 2,700 vegan products. After more than 3,800 stores in which the food retailer offers everything from organic vegetables to cheese to meat, this is the company's first vegan store.

- In April 2024, German grocery delivery startup Flink reportedly received another 100 million euros ($106.7 million) from investors to extend its runway and try to outlast its competitors.

Germany Online Food Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on platform type, business model, and payment method.

Platform Type Insights:

To get detailed segment analysis of this market Request Sample

- Mobile Applications

- Website

The report has provided a detailed breakup and analysis of the market based on the platform type. This includes mobile applications and website.

Business Model Insights:

- Order Focused Food Delivery System

- Logistics Based Food Delivery System

- Full-Service Food Delivery System

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes order focused food delivery system, logistics based food delivery system, and full-service food delivery system.

Payment Method Insights:

- Online Payment

- Cash on Delivery

The report has provided a detailed breakup and analysis of the market based on the payment method. This includes online payment and cash on delivery.

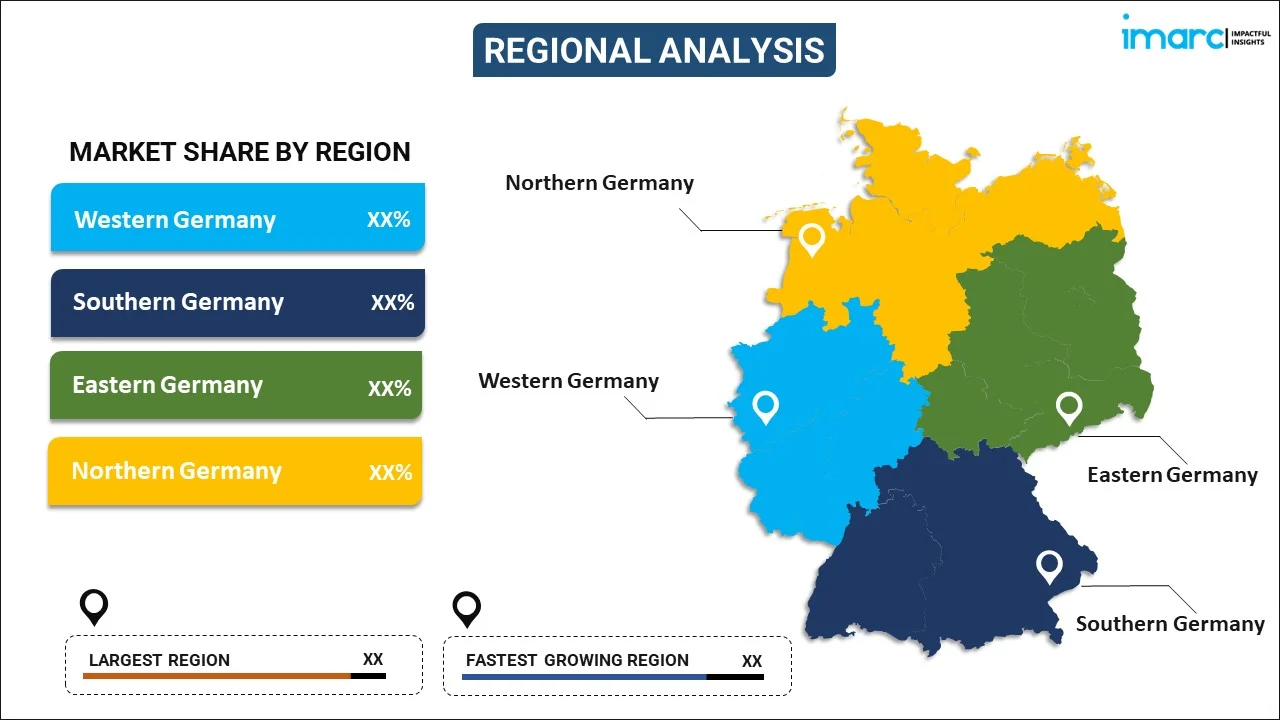

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Delivery Hero SE

- Lieferando.de

- Uber Technologies Inc.

- Wolt Enterprises Oy

- DoorDash

- Flink SE

- Gorillas Technologies GmbH

- Getir

- REWE Markt GmbH

Germany Online Food Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Platform Types Covered | Mobile Applications, Website |

| Business Models Covered | Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System |

| Payment Methods Covered | Online Payment, Cash on Delivery |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Companies Covered | Delivery Hero SE, Lieferando.de, Uber Technologies Inc., Wolt Enterprises Oy, DoorDash, Flink SE, Gorillas Technologies GmbH, Getir, REWE Markt GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany online food delivery market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Germany online food delivery market?

- What is the breakup of the Germany online food delivery market on the basis of platform type?

- What is the breakup of the Germany online food delivery market on the basis of business model?

- What is the breakup of the Germany online food delivery market on the basis of payment method?

- What are the various stages in the value chain of the Germany online food delivery market?

- What are the key driving factors and challenges in the Germany online food delivery?

- What is the structure of the Germany online food delivery market and who are the key players?

- What is the degree of competition in the Germany online food delivery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany online food delivery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany online food delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany online food delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)