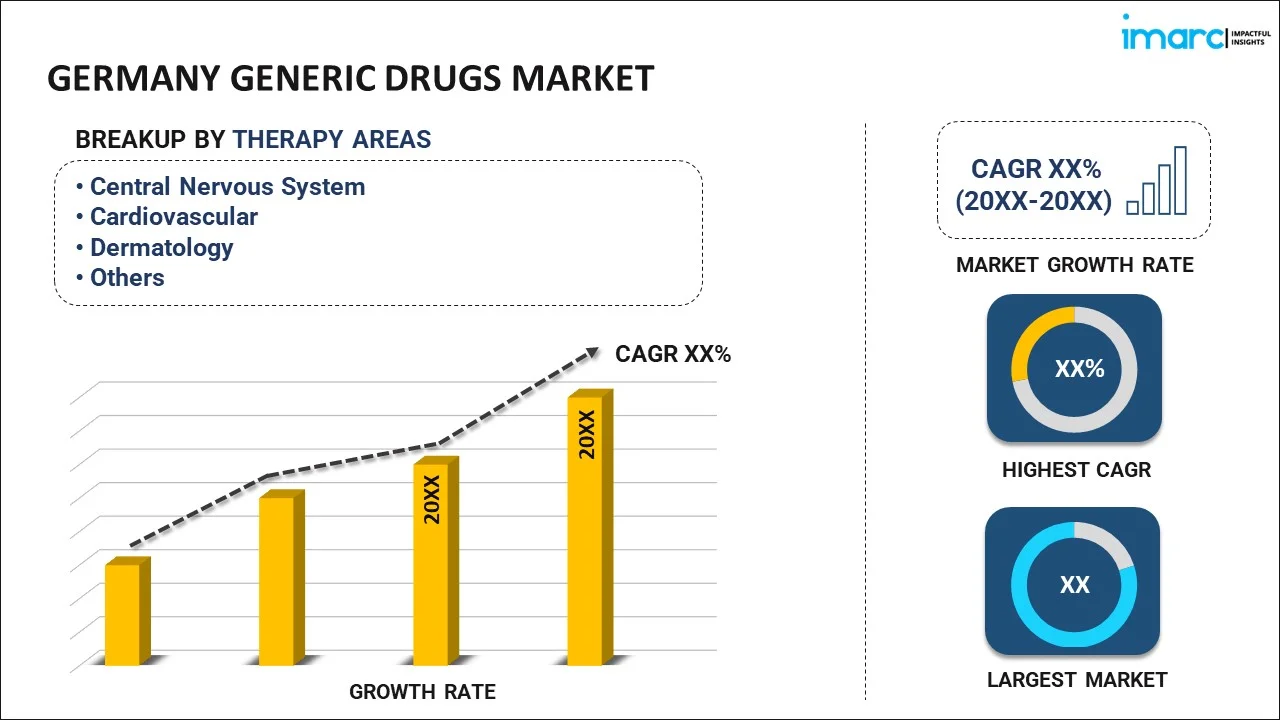

Germany Generic Drugs Market Report by Therapy Area (Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, and Others), Drug Delivery (Oral, Injectables, Dermal/Topical, Inhalers), Distribution Channel (Retail Pharmacies, Hospital Pharmacies), and Region 2026-2034

Germany Generic Drugs Market Overview:

The Germany generic drugs market size reached USD 18.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 31.1 Billion by 2034, exhibiting a growth rate (CAGR) of 5.94% during 2026-2034. The rising healthcare costs, patent expirations of major branded drugs, supportive government policies, increasing prevalence of chronic diseases, growing focus on cost-effective treatment options, and the aging population are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2034 | USD 31.1 Billion |

| Market Growth Rate (2026-2034) | 5.94% |

Access the full market insights report Request Sample

Germany Generic Drugs Market Trends:

Rising Healthcare Costs

The rising cost of healthcare is driving demand for cost-effective treatments, significantly influencing market growth. Consumers and healthcare providers seek affordable solutions, leading to a preference for generic drugs. These drugs offer the same therapeutic benefits as branded medications at lower prices, making them attractive to cost-conscious individuals and systems. The expiration of patents on branded drugs is increasing the availability of generics, enhancing competition, reducing prices, and improving accessibility, thus propelling market expansion. According to the Germany Trade and Invest, healthcare spending in Germany exceeded EUR 457 billion in 2021, not including expenditure for wellness and fitness. The market has grown at a rate of 5.4% over the past five years. With 7.7 million employees and exports over EUR 158 billion, healthcare is one of the largest economic sectors in Germany.

Growing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, necessitates long-term medication which is acting as a major growth-inducing factor in the market. Generic drugs provide a cost-effective solution for managing these conditions, which is leading to higher demand, thus contributing to the growth of the market. According to the National Institute of Health (NIH), the prevalence of diabetes is increasing worldwide. The number of people with diabetes in Germany, which has been recently estimated as 6.2 million (about 10%), is expected to reach more than 10 million people by 2040. According to Eurostat, 37,200 heart bypasses were conducted in Germany in 2021; this was more than double the number in any of the other EU Member States (17,400 were conducted in France). For instance, the ZfKD estimates that in 2020, around 493,200 new cancer cases were diagnosed in Germany. Of these, approximately 261,800 cases occurred in men and 231,400 in women. About half of the cases were diagnosed in the breast (71,300), the prostate (65,800), the colon (54,800), or the lung (56,700).

Germany Generic Drugs Market News:

- In November 2023, STADA Arzneimittel AG, headquartered in Bad Vilbel, Germany, announced an expansion and enhancement of its distribution and promotion of cough and cold brands in China through a partnership with leading locally listed pharmaceuticals company CR Sanjiu. This cooperation was formalized during a signing ceremony in Shenzhen on November 22.

- In January 2023, Novartis won an important victory against the generic drug industry over the MS drug fingolimod in one of Europe's biggest pharmaceutical disputes. Through a preliminary injunction, the Düsseldorf Regional Court has prohibited eight companies from selling the drug in Germany. Attention now shifts to the opposition proceedings at the European Patent Office, where 16 companies have filed oppositions against the second medical use patent.

Germany Generic Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on therapy area, drug delivery, and distribution channel.

Therapy Area Insights:

To get detailed segment analysis of this market Request Sample

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

The report has provided a detailed breakup and analysis of the market based on the therapy area. This includes central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others.

Drug Delivery Insights:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

A detailed breakup and analysis of the market based on the drug delivery have also been provided in the report. This includes oral, injectables, dermal/topical, and inhalers.

Distribution Channel Insights:

- Retail Pharmacies

- Hospital Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies and hospital pharmacies.

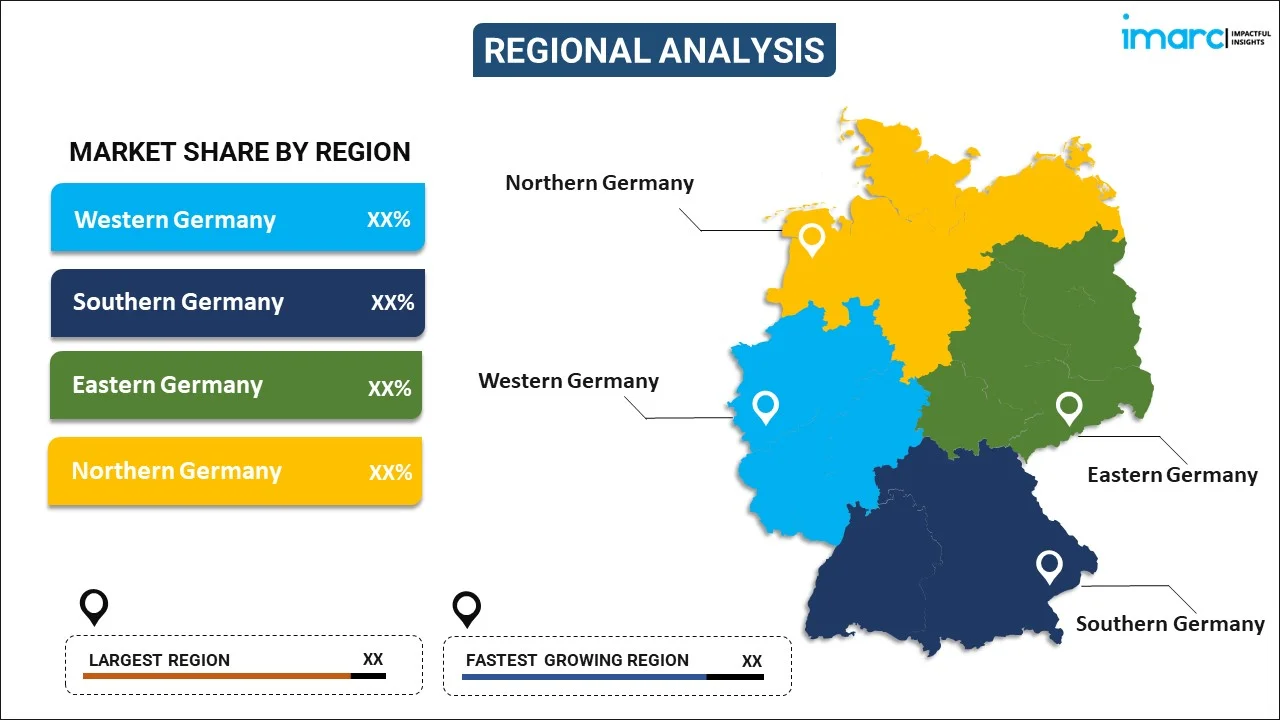

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Generic Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Areas Covered | Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, Others |

| Drug Deliveries Covered | Oral, Injectables, Dermal/Topical, Inhalers |

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany generic drugs market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Germany generic drugs market?

- What is the breakup of the Germany generic drugs market on the basis of therapy area?

- What is the breakup of the Germany generic drugs market on the basis of drug delivery?

- What is the breakup of the Germany generic drugs market on the basis of distribution channel?

- What are the various stages in the value chain of the Germany generic drugs market?

- What are the key driving factors and challenges in the Germany generic drugs?

- What is the structure of the Germany generic drugs market and who are the key players?

- What is the degree of competition in the Germany generic drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany generic drugs market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany generic drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany generic drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)