Germany Alcoholic Drinks Market Size, Share, Trends and Forecast by Category, Alcoholic Content, Flavor, Packaging Type, Packaging Type, Distribution Channel, and Region, 2026-2034

Germany Alcoholic Drinks Market Size and Share:

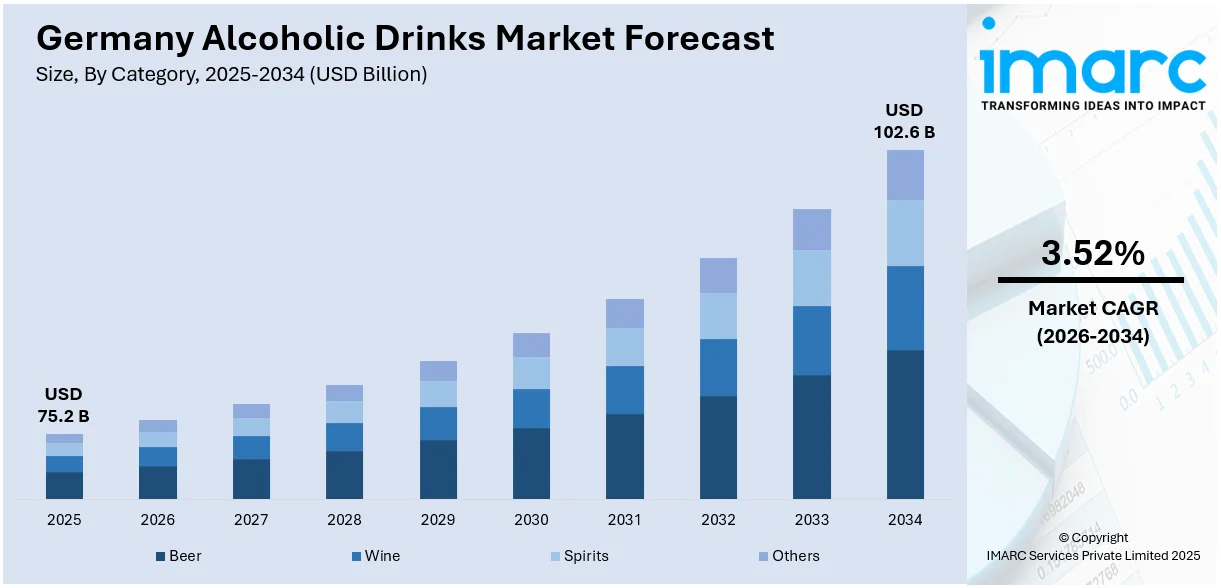

The Germany alcoholic drinks market size was valued at USD 75.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 102.6 Billion by 2034, exhibiting a CAGR of 3.52% from 2026-2034. The market is fueled by its rich beer culture, diverse domestic wine production, and a rising interest in craft spirits. Consumers are increasingly drawn to premium products that offer authenticity and quality. Health-conscious trends are shaping demand for low- and non-alcoholic options, while sustainability and eco-friendly packaging gain importance. E-commerce is expanding, offering convenience and variety, especially among younger demographics. Innovation in flavors and formats continues to drive competition, resulting in rising Germany alcoholic drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 75.2 Billion |

| Market Forecast in 2034 | USD 102.6 Billion |

| Market Growth Rate (2026-2034) | 3.52% |

An increasing health-oriented culture within Germany is playing a profound influence in transforming the alcoholic beverages market. Germany produced around 556 million liters of alcohol-free beer in 2023, selling for €548 million, a glaring sign of the rising popularity of beers without alcohol. People are increasingly becoming conscious about their life habits, opting for beers with less alcohol content, fewer calories, and natural composition. This change is inspired by wellness trends and shifting societal attitudes, specifically among younger adults who want to drink in moderation without sacrificing social life. Developments in manufacturing technology have also been important, enhancing the flavor and quality of low-alcohol and alcohol-free beverages, thus making them attractive to mainstream drinkers. Consequently, the market for alcohol-free and low-alcohol versions of beer, wine, and spirits continues to grow, mirroring wider health-aware trends in the marketplace.

To get more information on this market Request Sample

Growing demand for premium and craft alcoholic beverages is a key driver in Germany's market. Consumers are showing a penchant for artisanal and high-quality offerings that offer unique flavor and brand stories. This trend is strongly reflected in beer and spirits categories, where microbreweries and small-batch distilleries are on the rise. Premiumization reflects willingness to pay more for perceived value, authenticity, and exclusivity. It is supported by increasing disposable income and a matured taste on the part of German consumers. Such a trend also encourages experimentation with international influences, heritage dishes, and domestic ingredients, diversifying the alcoholic drinks market outlook in Germany.

Germany Alcoholic Drinks Market Trends:

Digitalization in Online Sales

Continued digital changes in the German alcoholic beverage market are thoroughly transforming the selling strategies. Fueled by the recent international occurrences that restricted physical retailing activities, alcoholic beverage brands are quick to embrace web-based selling avenues to engage the consumers directly. This transformation has fueled improvement in digital marketing, e-commerce sites, and mobile applications, through which brands are able to deliver personalized shopping experience, real time customer support, and customized offers. Germany is among the biggest e-commerce markets in Europe, as per a report released by International Trade Administration, due to high average annual expenditure and strong internet penetration. In 2022, overall sales were projected at 141.2 billion U.S. dollar, showing an 11% boost from year 2021. Germany's online population will increase from 62.4 million in 2020 to 68.4 million in 2025. Penetration of e-commerce was 80% in 2022, making Germany third highest in the world. This shift towards digitalization not only addresses the increasing consumer demand for convenience, but also creates new opportunities for brands to increase their market reach and customer interaction.

Sustainability and Local Sourcing

Sustainability and local sourcing have become central to the alcoholic drinks industry in Germany, reflecting a strong consumer shift toward environmentally conscious choices. Over half (57%) of German consumers prioritize buying from sustainable and ethical businesses, with 41% valuing local production and 38% focusing on low waste and pollution in April 2024. This change is driven by rising awareness of climate change and environmental degradation. Eco-friendly packaging such as recyclable bottles and biodegradable labels is now widely expected. Additionally, 37% of consumers support recycling initiatives, and 28% prefer ethically sourced ingredients. Local sourcing reduces the carbon footprint and supports regional farmers, appealing to 24% who are drawn to artisanal products. Many brands are responding with carbon-neutral production, organic ingredients, and fair trade practices. These sustainability-driven efforts align with evolving consumer values, particularly among younger generations, and foster stronger brand loyalty by appealing to those who seek products that reflect their commitment to environmental and social responsibility.

Premiumization and Craft Beverages

Alcoholic beverage in Germany is experiencing an upsurge in demand for premium and craft beverages, mirroring a global trend towards better quality and distinctive local products. The movement is fueled by consumers' increasing appreciation of distinctive taste and the art of beverage production. Almost half (49%) of Germany's consumers like to drink beer in restaurants and bars, and they are precious in the gastronomy market of the country. Most are men, over 55, and they also earn more than the national average. Although they like to stick with what they know, there is increasing interest in trying new and international options. They will pay extra for quality, and almost three out of four (72%) prefer pilsner when eating out. Microbreweries and small distilleries are thriving, backed by a passionate customer base that appreciates the authenticity and history of the locally sourced products and processes. Also, regionally produced specialty wines from local vineyards are becoming more prominent, balancing connoisseur appeal with the desires of casual consumers seeking something more than generic options. This premiumization trend not only addresses a niche audience but also promotes diversity and innovation in the industry, as manufacturers attempt to produce outstanding products that differentiate themselves within a competitive marketplace.

Germany Alcoholic Drinks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Germany alcoholic drinks market, along with forecast at the regional, and country levels from 2026-2034. The market has been categorized based on category, alcoholic content, flavor, packaging type, packaging type, and distribution channel.

Analysis by Category:

- Beer

- Wine

- Still Light Wine

- Sparkling Wine

- Spirits

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

- Others

Beer is the most widely consumed alcoholic drink in Germany, with a long tradition of brewing and regional differentiation. Mainstream lagers hold sway, but sales of craft and non-alcoholic beers are increasing. Consumers look for innovation, authenticity, and local provenance, leading to growth in specialty, organic, and low-strength beer categories.

Also, the wine market in Germany is influenced by rich domestic production, particularly of Pinot and Riesling types. Organic and biodynamic wines are increasingly attracting consumers. The trend towards premiumization and sustainability is strong, with growing demand for regional names, green initiatives, and reduced-alcohol-and-sugar wines.

Additionally, Germany's spirits market is changing with increasing demand for craft, premium, and low-strength varieties. Gin, rum, and whiskey are highly sought after, with consumers opting for small-batch and locally produced varieties. Innovation, heritage recipes, and sustainability are the drivers of consumer choice within this increasingly diversified category.

Apart from this, the other category consists of ready-to-drink (RTD) cocktails, cider, hard seltzers, and mixed drinks. These offerings cater to younger generations looking for convenience, variety in flavor, and reduced alcohol levels. RTDs, specifically, are witnessing Germany alcoholic drinks market growth because they are portable and keep pace with health trends, positioning them as a dynamic niche within the market.

Analysis by Alcoholic Content:

- High

- Medium

- Low

High wines and spirits continue to enjoy popularity for their intense taste and high-end appeal. Customers tend to purchase these for occasions or use in making cocktails. As demand continues, there's a growing trend toward moderation, leading some companies to launch lower-proof or craft-distilled versions to cater to health-driven consumers.

Alongside this, the medium-strength beverages, such as traditional wines and regular beers, constitute the majority of Germany's alcoholic drink consumption. These are well-balanced drinks that cater to a wide audience. As much as low-alcohol drinks have gained interest, medium-alcohol products still dominate because of their versatility, tradition, and high visibility in social and meal events.

Furthermore, the low-alcohol drinks, such as light beers, wine spritzers, and diluted spirits, are becoming increasingly popular with increasing health consciousness. They appeal to those who want moderation without compromising taste or social experience. Innovation and better taste have turned this segment into a significant Germany alcoholic drinks market trend, particularly among youth and wellness-conscious consumers.

Analysis by Flavour:

- Unflavoured

- Flavoured

Unflavored alcoholic drinks, like traditional beer, wine, and classic spirits (whiskey, vodka), continue to form the core of the German market. Praised for their tradition, purity, and authenticity, they find favor among purists and connoisseurs. This segment is quality-led, craftsmanship-driven, and preference-driven for natural, unchanged taste sensations.

Besides this, the flavoured alcoholic beverages such as fruit-infused beers, wines, spirits, and RTDs are growing in popularity, particularly among younger consumers. They provide variety, novelty, and seasonal appeal. This category thrives on innovation, meeting shifting tastes and trends with bold, sweet, or exotic profiles, and responds to demand for accessible, easy-drinking alcohol.

Analysis by Packaging Type:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

Glass containers lead the alcoholic beverages industry in Germany, particularly for spirits, wine, and beer, because of their high-end image, conservation quality, and recyclability. They are consistent with sustainability objectives and consumer desire for vintage, environmentally friendly packaging. Returnable glass schemes also contribute to their popularity by means of high reuse and recycling rates.

Currently, the cans or tins are becoming increasingly popular due to their convenience, portability, and light weight, especially in the beer and ready-to-drink segments. They are preferred for outdoor activities and informal occasions. Contemporary packaging designs and enhanced recyclability render them appealing to young consumers looking for functional, sustainable, and fashionable packaging options.

Also, the plastic containers are not as prevalent in Germany's alcohol drink market outlook because of environmental issues and a need for more sustainable packaging. Yet, they are utilized in economy-priced, high-volume products where cost-effectiveness and durability are sought after. More ecological awareness is driving a trend away from plastic and more toward sustainable solutions.

Besides this, bag-in-box, tetra packs, and paper bottles are the other packaging forms that are popularly utilized in wines and new-age beverages. These types are suitable for sustainability, budget-friendliness, and storage space efficiency. Though still a niche product, they are increasingly noticed as green alternatives, particularly among younger and green shoppers in search of new-generation, low-impact packaging solutions.

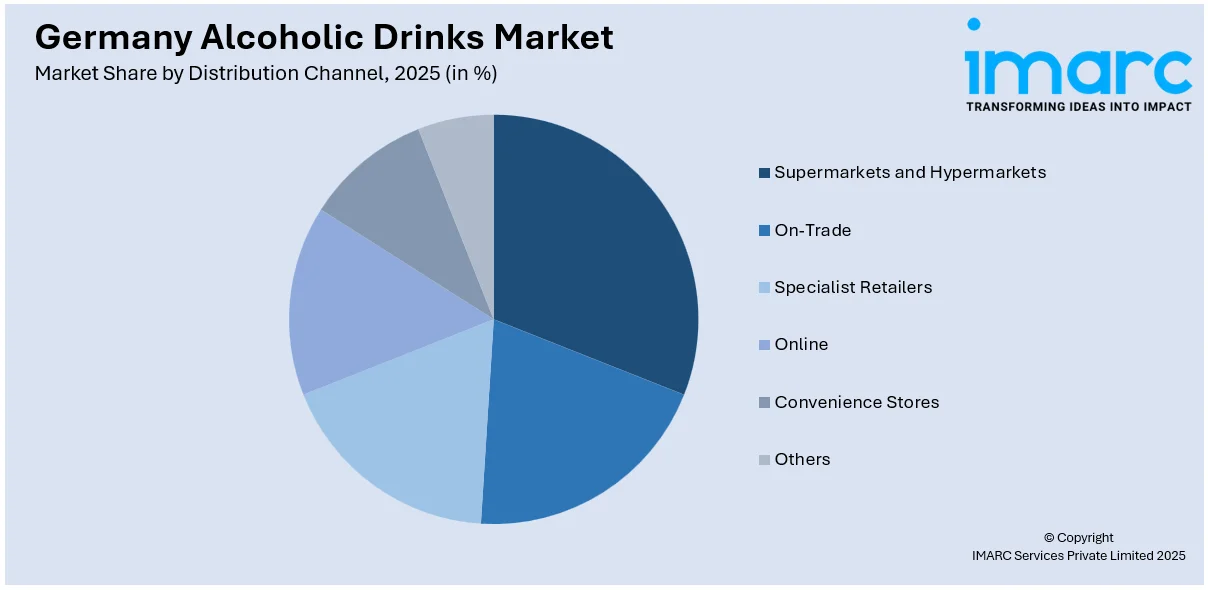

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

Supermarkets and hypermarkets account for the majority of distribution channels in Germany, providing extensive product ranges at competitive prices. One-stop shopping convenience and frequent promotions are appreciated by customers. Private labels and local brands are available at these outlets as well, making them a necessity for daily purchases and high-volume consumer coverage across demographics.

Besides this, on-trade channels of bars, pubs, restaurants, and clubs have an important part in premium and experiential drinking of alcoholic beverages. They affect trends and brand awareness, particularly for premium and craft products. Although affected by health and economic trends, on-trade continues to be essential for social occasions and new or niche product launch.

In addition, the specialist retailers provide carefully selected ranges of premium, craft, and imported alcoholic drinks. They welcome informed and discerning customers looking for quality, authenticity, and expert advice. These retailers are important for discovering distinctive products, such as rare wine and small-batch spirits, and take advantage of increasing interest in artisan and sustainable products.

Also, the internet alcoholic beverage sales are expanding in Germany quickly, supported by convenience, wider assortment, and online promotions. E-commerce is particularly appealing to young, tech-aware consumers. The platform also facilitates direct-to-consumer (D2C) business models and subscription offerings. There are regulatory intricacies involved, but increased digital adoption keeps driving its growth across all alcohol categories.

But the convenience stores are geared to impulse and on-the-move buying, selling a limited but high-turning range of alcoholic beverages, particularly beer and ready-to-drinks (RTD). They are an important outlet in urban locales and around transport hubs. They are price sensitive and convenient to access, popular with younger buyers and late-night shoppers.

Moreover, the other channels are duty-free stores, discounters, and direct-from-maker sales (i.e., vineyards or breweries). These cover niche or value-sensitive markets and enable brand exploration. Although in lower volume, they offer alternative opportunities for regional makers and are part of tourism, rural retailing, and alternative shopping experiences.

Analysis by Region:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

Western Germany, home to cities like Cologne and Düsseldorf, is a major beer-consuming region, known for local varieties like Kölsch and Altbier. It has a mature market with strong retail infrastructure and a growing interest in craft beers and premium spirits. Urbanization supports diverse offerings and evolving consumer preferences.

Concurrently, the Southern Germany, especially Bavaria and Baden-Württemberg, is steeped in brewing tradition and dominates beer production and consumption. It’s renowned for lagers, wheat beers, and beer festivals like Oktoberfest. Regional pride supports local sourcing and traditional brands, while premiumization and non-alcoholic beers are gaining ground among health-conscious consumers.

Apart from this, the Eastern Germany has a growing alcoholic drinks market driven by economic development and increasing disposable incomes. The region shows strong loyalty to local brands and traditional spirits. While price sensitivity remains, there's rising interest in affordable premium options, craft products, and regional wines from areas like Saxony and Saale-Unstrut.

Furthermore, the Northern Germany, with cities like Hamburg and Bremen, is diverse in alcohol preferences, featuring both beer and spirits consumption. The port influence brings exposure to international products. While mainstream beers remain popular, the region is also experiencing growth in premium imports, gin, and sustainable offerings driven by urban, eco-aware consumers.

Competitive Landscape:

The German alcoholic beverage market has a competitive market structure with a combination of mainstream players and upstart niche brands, leading to high competition by category. Old favorites such as beer and wine are the biggest sellers, but changing consumer demand for health, sustainability, and premium quality are transforming market trends. Innovation is a major discriminator, with brands launching low-alcohol, alcohol-free, and craft options to meet changing tastes. Supermarkets and discount chains continue to play important distribution roles, but e-commerce and D2C are increasingly viable alternatives. Marketing turns on authenticity, local sourcing, and lifestyle branding. With increasingly fragmented consumer loyalty, firms have to quickly evolve to stay attuned to shifting trends and invest in product innovation, brand building, and digital interaction to stay relevant in the Germany alcoholic drinks market forecast.

The report provides a comprehensive analysis of the competitive landscape in the Germany alcoholic drinks market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Ukraine’s Nemiroff partnered with Germany’s Hardenberg-Wilthen to distribute its De Luxe vodka range across major German retailers. Previously sold only in ethnic stores, this marks a key move in Nemiroff’s premium growth strategy, expanding its presence in Germany’s off-premises and national retail channels.

- March 2025: Radico Khaitan launched Ankahi Zaffran Spiced Liqueur at ProWein in Germany, marking its global expansion in premium spirits. Crafted with Kashmiri saffron and 21 herbs, the liqueur will ship globally from April 2025, targeting duty-free and retail markets across the USA, Europe, Asia Pacific, and the Middle East.

- February 2025: MG Destilerías partnered with MBG International to launch Coppa Cocktails in Germany. Featuring 13 classic pre-mixed cocktails in 700ml bottles, the brand targets both on- and off-trade channels. With strong retail support, Coppa aims to sell 30,000–40,000 cases in its first year.

- December 2024: Kendall Jenner’s 818 Tequila launched in Germany through an exclusive partnership with Jaguar Mezcal Boutique (JMB). Featuring four premium agave expressions, 818 enters the competitive German market after global success in 34 countries, highlighting its sustainability, craftsmanship, and nearly 50 international tasting awards.

- May 2024: Poland-based Stock Spirits launched its Amundsen vodka brand in Germany, marking its second vodka entry in the country. Already available in markets like Poland, the Czech Republic, France, Spain, Croatia, and the US, Amundsen expands Stock Spirits' international presence in the premium vodka segment.

Germany Alcoholic Drinks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Alcoholic Contents Covered | High, Medium, Low |

| Flavours Covered | Unflavored, Flavored |

| Packaging Types Covered | Glass Bottles, Tins, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany alcoholic drinks market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Germany alcoholic drinks market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany alcoholic drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Germany alcoholic drinks market was valued at USD 75.2 Billion in 2025.

The Germany alcoholic drinks market is projected to exhibit a CAGR of 3.52% during 2026-2034 reaching a value of USD 102.6 Billion by 2034.

Key factors driving the German alcoholic drinks market include shifting consumer preferences toward health-conscious options like low- and no-alcohol beverages, the rise of premium and craft products, and increasing demand for sustainability. Consumers are also prioritizing locally sourced ingredients, eco-friendly packaging, and brands with strong ethical and environmental commitments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)