Geosynthetics Market Report by Product (Geotextiles, Geomembranes, Geogrids, Geonets, Geosynthetic Clay Liner (GCL), Pre-Fabricated Vertical Drains (PVD), and Others), Type (Woven, Non-Woven, Knitted, and Others), Material (Polypropylene, Polyester, Polyethylene, Polyvinyl Chloride, Synthetic Rubber, and Others), Application (Road Construction and Pavement Repair, Railroads, Drainage Systems, Soil Reinforcement and Erosion, Water and Waste Management, and Others), and Region 2025-2033

Global Geosynthetics Market:

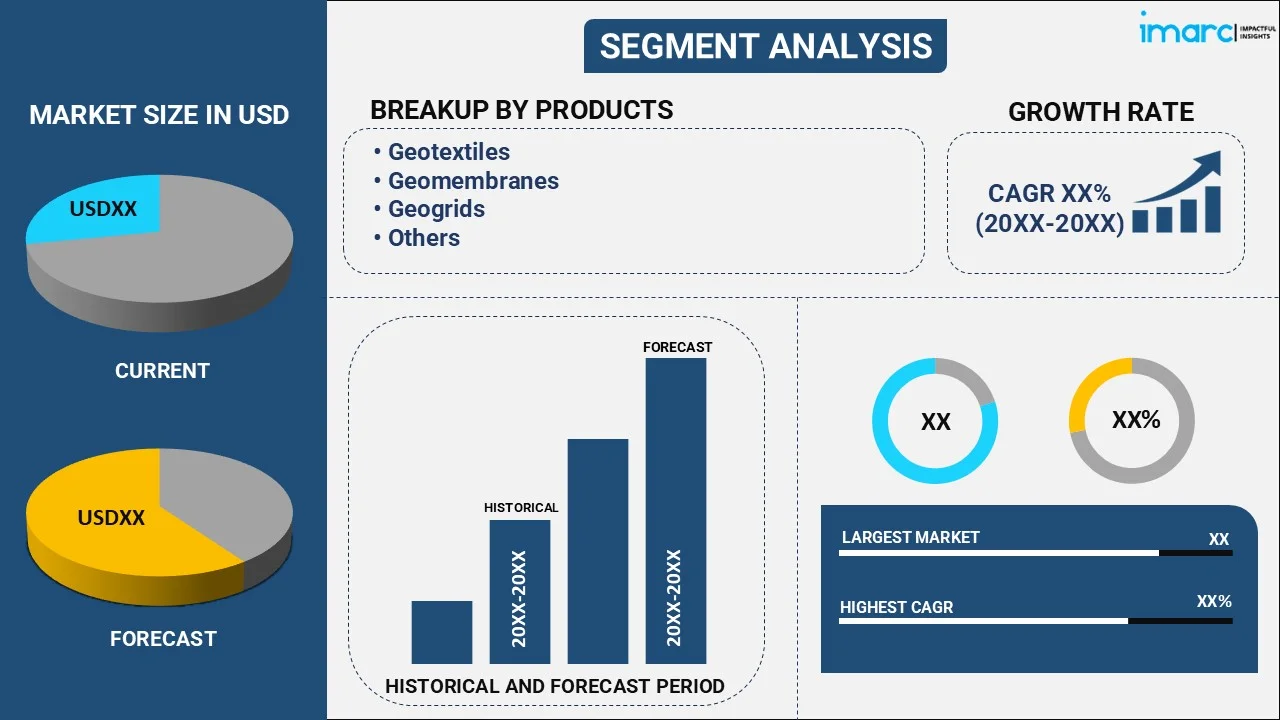

The global geosynthetics market size reached USD 13.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.85% during 2025-2033. Asia-Pacific dominates the market, driven by increasing environmental regulations and expanding product adoption across diverse industries. The growing construction activities and transport infrastructure projects and the surging emphasis on water conservation are some of the factors propelling the market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 21.1 Billion |

| Market Growth Rate 2025-2033 | 4.85% |

The market is propelled by the increasing significance of environmental protection, with geosynthetics being extensively utilized for waste containment, landfill liners, and water management to avert soil and groundwater pollution. The growing awareness about sustainability and climate resilience has enhanced their utilization in flood management, coastal defense, and erosion prevention scenarios. In farming, geomembranes and geotextiles support effective irrigation by reducing water loss, stabilizing soil, and preserving resources, which is vital in areas with limited water supply. Rapid urban growth and building projects are also creating the need for soil reinforcement, drainage systems, and slope stabilization. Technological innovations are enhancing product strength, durability, and eco-friendliness, expanding their applicability in diverse sectors. Additionally, government agencies are implementing stringent regulations on sustainable construction practices, encouraging the adoption of geosynthetics as cost-effective and long-lasting alternatives to traditional methods.

To get more information on this market, Request Sample

Geosynthetics Market Trends:

Expansion of highways, railways, and airports

The rapid expansion of highways, railways, and airports is driving significant demand for geosynthetics, as these large-scale infrastructure projects require durable, cost-effective, and sustainable solutions for soil stabilization and ground reinforcement. In August 2025, Heathrow Airport, UK, announced specifics of its strategy to enhance and upgrade the airport for £49 Billion. The UK government supported proposals for a third runway. Geotextiles, geogrids, and geomembranes are extensively used to improve load-bearing capacity, prevent soil erosion, and enhance drainage in transport infrastructure. In highways and runways, geosynthetics help extend service life by reducing maintenance costs, while in railway networks, they provide stability on weak soils and control settlement. Their role in airport construction is equally crucial, ensuring smooth and durable foundations capable of handling heavy loads. With government agencies and private players investing heavily in transport connectivity, geosynthetics have become indispensable in ensuring long-term durability, safety, and efficiency of modern transportation infrastructure.

Increasing mining activities

The growth of mining activities is a major driver for the geosynthetics market, as mining operations involve large-scale earthworks, waste containment, and tailings management. As per the US Bureau of Labor Statistics, in 2024, the mining industry represented 0.5% of employment in the non-farm business sector and contributed 1.3% to the US GDP. Geosynthetics, such as geomembranes and geotextiles, are essential in lining tailing ponds, heap leach pads, and waste storage facilities, preventing leakage of hazardous materials into soil and groundwater. Their high chemical resistance, durability, and ability to withstand harsh conditions make them a reliable choice for mining companies looking to comply with stringent environmental regulations. Additionally, geogrids are used for access roads and haul roads within mining areas to ensure stability and lower maintenance costs under heavy traffic.

Rising oil and gas exploration projects

The expansion of oil and gas exploration projects is fueling the market growth, as the sector requires advanced materials to handle complex challenges, such as soil stabilization, containment, and environmental protection. Geosynthetics are widely used in constructing drilling pads, access roads, containment ponds, and pipelines to improve ground strength and ensure safe operations in harsh terrains. Geomembranes play a crucial role in preventing leaks from storage and wastewater pits, protecting groundwater resources, while geotextiles and geogrids provide reinforcement in areas with weak soils. With rising exploration in offshore and onshore fields, geosynthetics offer durable, lightweight, and cost-efficient solutions that reduce operational risks and environmental damage. As the demand for oil and gas continues to increase, reliance on geosynthetics is expected to strengthen further. As per the IBEF, India's oil demand is set to double, achieving 11 Million Barrels per day by 2045.

Key Growth Drivers of Geosynthetics Market:

Rising environmental awareness

Increasing environmental awareness is driving the adoption of geosynthetics, as these materials offer eco-friendly and sustainable solutions for construction, waste management, and soil conservation. Government agencies and industries are focusing on reducing environmental degradation, controlling soil erosion, and protecting water resources, which has accelerated the demand for geosynthetics. Geomembranes and geotextiles are used in landfills and wastewater facilities to prevent leakage and contamination, while geogrids and erosion control mats help preserve landscapes and restore degraded ecosystems. Their utilization supports circular economy goals by extending infrastructure life and minimizing material usage compared to conventional methods. With stringent regulations and global initiatives towards sustainability, geosynthetics are becoming a preferred choice for eco-conscious projects, balancing infrastructure growth with environmental responsibility and long-term resource protection.

Technological innovations

Technological innovations are significantly propelling the market growth, as advancements in material science and manufacturing processes are enhancing product performance, durability, and application scope. New generations of geotextiles, geomembranes, and geogrids are being developed with improved tensile strength, chemical resistance, and permeability to address diverse construction and environmental challenges. Smart geosynthetics with embedded sensors are emerging, enabling real-time monitoring of soil stability, erosion, and leakage, which adds value to large-scale infrastructure and environmental projects. Moreover, the development of eco-friendly and recyclable geosynthetics aligns with global sustainability goals. Continuous innovations are also making these materials more cost-efficient and adaptable to harsh climatic conditions. As industries demand safer, longer-lasting, and sustainable solutions, technological progress is expanding the market potential and broadening the applications of geosynthetics.

Growing agriculture and irrigation infrastructure needs

Rising need for efficient agriculture and irrigation infrastructure is a key driver of the geosynthetics market, as these materials play a vital role in improving water management and soil conservation. Geomembranes are widely used for lining canals, reservoirs, and ponds to minimize water seepage and ensure efficient irrigation, while geotextiles support soil stabilization in farmlands and prevent erosion. In greenhouse and aquaculture applications, geosynthetics provide durable and cost-effective solutions for water containment and crop protection. With increasing need to boost agricultural productivity and optimize water resources, especially in arid and semi-arid regions, geosynthetics are becoming integral in modern farming practices. Their ability to minimize water loss, improve efficiency, and enhance sustainability positions them as essential materials in advancing agricultural infrastructure.

Global Geosynthetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global geosynthetics market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on product, type, material, and application.

Breakup by Product:

- Geotextiles

- Geomembranes

- Geogrids

- Geonets

- Geosynthetic Clay Liner (GCL)

- Pre-Fabricated Vertical Drains (PVD)

- Others

Geomembranes dominate the market

The report has provided a detailed breakup and analysis of the market based on the product. This includes geotextiles, geomembranes, geogrids, geonets, geosynthetic clay liner (GCL), pre-fabricated vertical drains (PVD), and others. According to the report, geomembranes represented the largest segment.

According to the geosynthetics market outlook, the growing necessity for effective water conservation and management has emerged as a significant factor propelling the demand for geomembranes. With their impermeability and durability, geomembranes play a crucial role in preserving water resources, especially in regions experiencing water scarcity. Moreover, they are frequently employed in lining water reservoirs, canals, and ponds to prevent water loss through seepage, which contributes to their increasing demand. In addition to this, the bolstering growth of the aquaculture industry, which relies heavily on geomembranes to create reliable and sustainable fish farming environments, is acting as another significant growth-inducing driver. Furthermore, the escalating demand for desalination plants, primarily in arid regions, is propelling the need for these geosynthetic materials.

Breakup by Type:

- Woven

- Non-Woven

- Knitted

- Others

Woven holds the largest share in the market

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes woven, non-woven, knitted, and others. According to the report, woven accounted for the largest market share.

According to the geosynthetics market overview, the rising demand for woven geosynthetics is significantly driven by their robust load distribution and soil reinforcement capabilities. Their high tensile strength and dimensional stability make them an optimal choice for large-scale infrastructure projects that demand reliable soil reinforcement and separation applications, creating a positive market outlook. Moreover, these geosynthetics are widely utilized in applications such as retaining walls, steepened slopes, and embankment reinforcement, which is aiding in market expansion. Furthermore, the burgeoning renewable energy sector presents lucrative growth opportunities for woven geosynthetics. For instance, according to IMARC, the global renewable energy market size reached US$ 892.7 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,733.0 Billion by 2032, exhibiting a growth rate (CAGR) of 7.65% during 2025-2033 Their usage in wind farm projects for access road construction and turbine base stabilization and in solar farms for erosion control and soil stabilization is significantly driving their demand in this green energy sector.

Breakup by Material:

- Polypropylene

- Polyester

- Polyethylene

- Polyvinyl Chloride

- Synthetic Rubber

- Others

Polypropylene dominates the market

The report has provided a detailed breakup and analysis of the market based on the material. This includes polypropylene, polyester, polyethylene, polyvinyl chloride, synthetic rubber, and others. According to the report, polypropylene represented the largest segment.

The demand for polypropylene geosynthetics is gaining momentum due to their unique properties and advantages. Polypropylene, being highly resistant to most acids, alkalis, and salts, provides excellent performance in varied environmental conditions, making it ideal for applications in harsh or chemically challenging environments. Furthermore, polypropylene geosynthetics possess superior elongation characteristics and excellent tensile strength, making them beneficial in applications requiring strain accommodation. Another factor contributing to their market growth is the increasing demand for cost-effective and durable materials for soil stabilization and reinforcement, where polypropylene geosynthetics are seeing substantial usage. In addition to this, the ongoing expansion of the packaging industry, which leverages these geosynthetics for their durability and lightweight properties, is influencing the market growth.

Breakup by Application:

- Road Construction and Pavement Repair

- Railroads

- Drainage Systems

- Soil Reinforcement and Erosion

- Water and Waste Management

- Others

Road construction and pavement repair holds the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes road construction and pavement repair, railroads, drainage systems, soil reinforcement and erosion, water and waste management, and others. According to the report, road construction and pavement repair accounted for the largest market share.

The surge in demand for geosynthetics in road construction and pavement repair can be attributed to their exceptional characteristics that enhance pavement performance and lifespan. Geosynthetics offer cost-effective solutions for reinforcing weak subgrade soils, reducing rutting, and preventing reflective cracking. Furthermore, they assist in maintaining the aggregate material's thickness, reducing overall construction costs. Besides this, the growing global emphasis on building resilient transportation infrastructure that can withstand heavy loads and harsh weather conditions is propelling the demand for geosynthetics. For instance, in 2023–2024, the Ministry of Road Transport and Highways plans to build between 12,000 and 13,000 kilometers of national highways. Furthermore, the advent of green roads and paved surfaces that minimize environmental impact is a critical factor driving the use of geosynthetics, given their sustainable and energy-efficient attributes.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Asia-Pacific exhibits a clear dominance, accounting for the largest geosynthetics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia-Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia Pacific represented the largest market.

According to the geosynthetics market statistics, the demand for geosynthetics in the Asia Pacific region is primarily driven by the rapid urbanization and infrastructure development in the region's emerging economies, including China, India, and Southeast Asian countries. These nations are witnessing a surge in construction projects, including residential, commercial, and public infrastructure developments, which require efficient and cost-effective soil reinforcement and stabilization solutions. Additionally, the region is experiencing a surge in transport infrastructure projects, including the construction of highways, roads, railways, and airports, further fueling the demand for geosynthetics. For instance, in February 2024, the Government of Uttar Pradesh planned to invest around INR 950 crores to build cutting-edge infrastructure, including building high-quality roads. The region's escalating concerns about environmental conservation, leading to stricter regulations on waste management and erosion control, also contribute significantly to the growing demand for geosynthetic materials.

Competitive Landscape:

The global geosynthetic market presents a competitive and diverse landscape, marked by the presence of numerous international and regional players. Key market participants often engage in a variety of strategies, such as product innovation, mergers and acquisitions, and expansion of production capacities to gain a competitive edge. Besides this, the rising emphasis on the development of eco-friendly or green geosynthetics has been observed among leading market players, responding to the increasing global demand for sustainable construction solutions. Furthermore, technological advancements have also heightened collaborations between companies and research institutions. Despite the fierce competition, new entrants have opportunities due to the burgeoning demand across various sectors.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Agru America, Inc.

- ACE Geosynthetics Inc.

- Asahi Kasei Advance Corporation

- Belton Industries, Inc.

- Carthage Mills

- Hanes Companies, Inc. (Leggett & Platt, Incorporated)

- Huesker Synthetic GmbH (Huesker Group)

- Naue GmbH & Co. KG

- Officine Maccaferri S.p.A.

- Strata Systems, Inc.

- Terram (Magnera Corporation)

- Thrace Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Geosynthetics Market News:

- June 2025: The Geosynthetic Institute (GSI) was set to be relocated from Folsom, Pa., to the Georgia Institute of Technology (GT) campus in Atlanta, Ga., by the end of 2025. The institute is expected to expand and maintain its multidisciplinary research, organize events, and provide educational pathways for geosynthetics.

- November 2024: The Canadian Geotechnical Society (CGS) partnered with the Canadian National Chapter of the International Association of Hydrogeologists (IAH-CNC) to conduct GeoMontréal 2024 in Montréal, Quebec, Canada. The talks featured developments in geosynthetic clay liners, a novel technique for forecasting the stress crack resistance of HDPE geomembranes, the creation of drainage geocomposites for gas gathering and extraction, and an examination of the thermos-hydro-mechanical properties of two sloped experimental cover systems using HDPE and LLDPE geomembranes.

- October 2024: White Cap finalized an agreement to acquire Triumph Geo-Synthetics Inc., a distributor of geosynthetics and erosion control products located in Anaheim, California, catering to non-residential and infrastructure markets. The firm anticipated providing enhanced value-added services and a greater variety of products for its local clientele.

Geosynthetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Geotextiles, Geomembranes, Geogrids, Geonets, Geosynthetic Clay Liner (GCL), Prefabricated Vertical Drains (PVD), Others |

| Types Covered | Woven, Non-Woven, Knitted, Others |

| Materials Covered | Polypropylene, Polyester, Polyethylene, Polyvinyl Chloride, Synthetic Rubber, Others |

| Applications Covered | Road Construction and Pavement Repair, Railroads, Drainage Systems, Soil Reinforcement and Erosion, Water and Waste Management, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Agru America, Inc., ACE Geosynthetics Inc., Asahi Kasei Advance Corporation, Belton Industries, Inc., Carthage Mills, Hanes Companies, Inc. (Leggett & Platt, Incorporated), Huesker Synthetic GmbH (Huesker Group), Naue GmbH & Co. KG, Officine Maccaferri S.p.A., Strata Systems, Inc., Terram (Magnera Corporation), Thrace Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global geosynthetics market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global geosynthetics market?

- What is the impact of each driver, restraint, and opportunity on the global geosynthetics market?

- What are the key regional markets?

- Which countries represent the most attractive geosynthetics market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the geosynthetics market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the geosynthetics market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the geosynthetics market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the geosynthetics market?

- What is the competitive structure of the global geosynthetics market?

- Who are the key players/companies in the global geosynthetics market?

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the geosynthetics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global geosynthetics market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the geosynthetics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)