Geogrid Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Geogrid Market Size and Share:

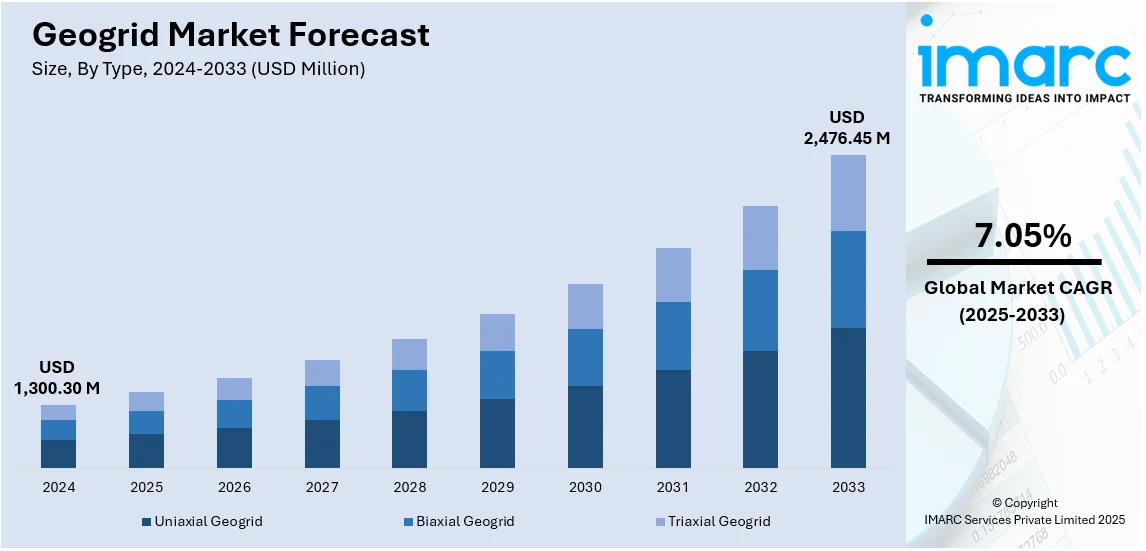

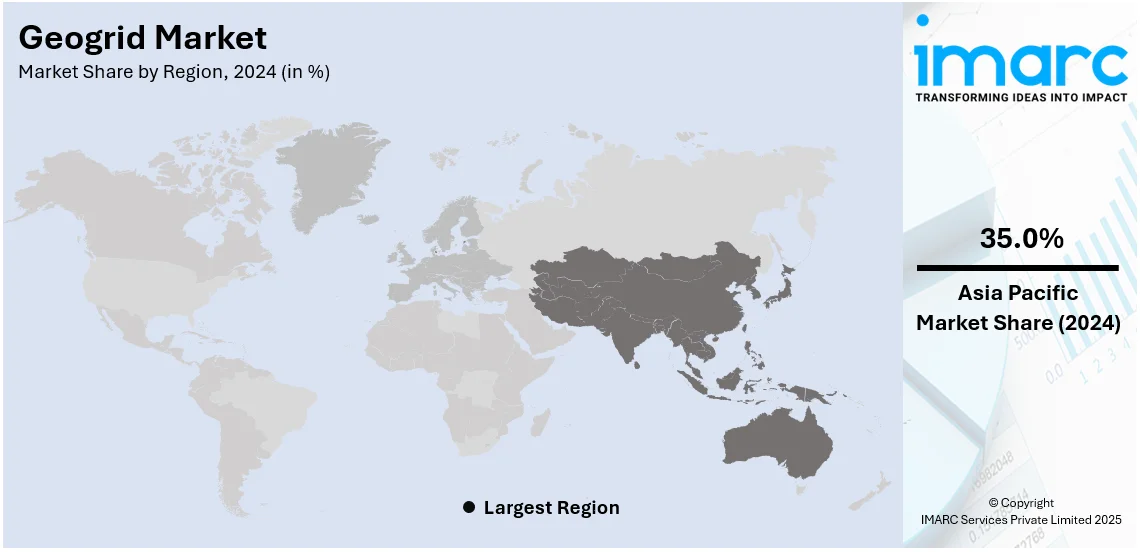

The global geogrid market size was valued at USD 1,300.30 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,476.45 Million by 2033, exhibiting a CAGR of 7.05% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 35.0% in 2024. The geogrid market share is expanding, driven by the rising usage of heavy equipment in construction activities, creating the need for geogrids to enhance load distribution and prevent pavement damage, along with the increasing implementation of environmental regulations that promote erosion control measures.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,300.30 Million |

|

Market Forecast in 2033

|

USD 2,476.45 Million |

| Market Growth Rate (2025-2033) | 7.05% |

The rapid urbanization activities and the rising need for soil stabilization in construction are impelling the market growth. Government agencies and private sectors are investing in roads, railways, and airports, driving the demand for geogrids to enhance ground strength and durability. Geogrids help to distribute loads, reduce pavement failure, and minimize long-term maintenance expenses, rendering them an economical option. Besides this, the rising environmental concerns among people are encouraging adoption, as geogrids support erosion control and sustainable construction. Industrial expansion and construction in weak soil regions further fuel the market growth. Moreover, technological advancements, such as high-performance polymer-based geogrids, improve efficiency and durability, increasing their applications.

The United States has emerged as a major region in the geogrid market owing to many factors. The increasing infrastructure development in the region is impelling the geogrid market growth. Large-scale road, highway, and railway projects drive the demand for geogrids to improve soil stabilization and extend pavement life. Government initiatives, such as infrastructure funding programs, further propel the market growth by prioritizing long-lasting and cost-effective construction solutions. According to the information provided on the official website of the US Census Bureau, in January 2025, construction expenditure in the US was projected at a seasonally adjusted annual rate of USD 2,192.5 Billion, with a variation of 0.2%. The January number was 3.3% higher than the January 2024 estimate of USD 2,122.2 Billion. Additionally, rising concerns among the masses about soil erosion and environmental sustainability encourage the use of geogrids in drainage and erosion control applications. The expansion of industrial and commercial construction also creates the need for geotechnical reinforcement.

Geogrid Market Trends:

Growing need for construction equipment

The rising demand for construction equipment is bolstering the market growth. As large-scale projects for roads, bridges, and railways increase, the need for soil stabilization and reinforcement solutions grows, boosting geogrid adoption. Advanced construction machinery allows the precise installation of geogrids, making them more effective in strengthening weak soil and reducing structural failures. Additionally, heavy equipment used in construction exerts significant pressure on the ground, creating the need for geogrids to enhance load distribution and prevent pavement damage. As industrial bases expand and urbanization activities accelerate, contractors rely on geogrids to improve construction efficiency and durability. The integration of modern machinery with geosynthetic solutions ensures faster project completion, cost savings, and long-lasting infrastructure, further driving geogrid demand in the construction sector. According to the IMARC Group, the global construction equipment market size was valued at USD 249.99 Billion in 2024. Looking forward, the market is set to attain USD 349.91 Billion by 2033, showing a CAGR of 3.42% from 2025-2033.

Increasing awareness about soil stabilization and erosion management

The rising awareness among people about soil stabilization and erosion management is impelling the market growth. Geogrids help to reinforce weak soil, preventing erosion and improving ground stability in roads, railways, and embankments. As climate change increases the risk of soil degradation and landslides, construction projects prioritize geogrids to enhance safety and longevity. Infrastructure developers recognize that geogrids reduce maintenance costs by preventing soil displacement and strengthening foundations. Additionally, environmental regulations promote erosion control measures, encouraging the use of geosynthetics in construction. Industries, such as mining, agriculture, and landfills, also rely on geogrids to stabilize terrain and manage environmental impact. As consciousness grows, more projects integrate geogrids to ensure stronger and more resilient structures, driving continuous market expansion. Moreover, due to rising environmental concerns, governing agencies of several countries, in collaboration with non-governmental organizations (NGOs), are introducing awareness campaigns to prevent soil erosion. India had a total of 1.87 lakh registered non-governmental organizations (NGOs) in 2023, according to NGO DARPAN, an initiative by NITI Aayog. This is positively influencing the sales of geogrids to improve performance, structural integrity, and the foundation of railroad beds.

Rising sustainability trends

The growing sustainability trends are offering a favorable geogrid market outlook. With the rising population, the demand for long-lasting infrastructure is high, making sustainability-oriented solutions like geogrids essential for supporting urban expansion and large-scale development projects. According to the National Bureau of Statistics of China, by the conclusion of 2024, the overall national population amounted to 1,408.28 Million. Out of this total, there were 943.50 Million urban permanent residents. In 2024, there were 9.54 Million births, translating to a crude birth rate of 6.77 per thousand. Geogrids reduce the need for excessive raw materials like concrete and gravel, lowering carbon emissions and promoting resource efficiency. They enhance soil stabilization, minimizing land degradation, which aligns with environmental conservation efforts. Additionally, the lightweight nature of geogrids decreases transportation-related emissions, making them a greener alternative to traditional reinforcement methods. With stricter environmental regulations and a worldwide shift towards sustainable development, construction projects increasingly adopt geogrids to meet green building standards.

Geogrid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global geogrid market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Uniaxial Geogrid

- Biaxial Geogrid

- Triaxial Geogrid

Biaxial geogrid accounted for 53.6% of the market share in 2024. It provides high tensile strength in both longitudinal and transverse directions, making it highly effective for soil stabilization and load distribution. It is widely used in road construction, railways, and embankments to prevent soil movement and improve the durability of structures. The material’s ability to reduce pavement deformation and increase bearing capacity makes it a cost-effective choice for infrastructure projects. Additionally, biaxial geogrid helps to lower construction and maintenance costs by minimizing the need for excavation and additional materials. Compared to a uniaxial geogrid, which provides reinforcement in only one direction, a biaxial geogrid offers more versatility and is suitable for various applications, including foundations and retaining walls. As worldwide infrastructure development activities expand, the demand for strong, durable, and reliable ground reinforcement solutions continues to rise.

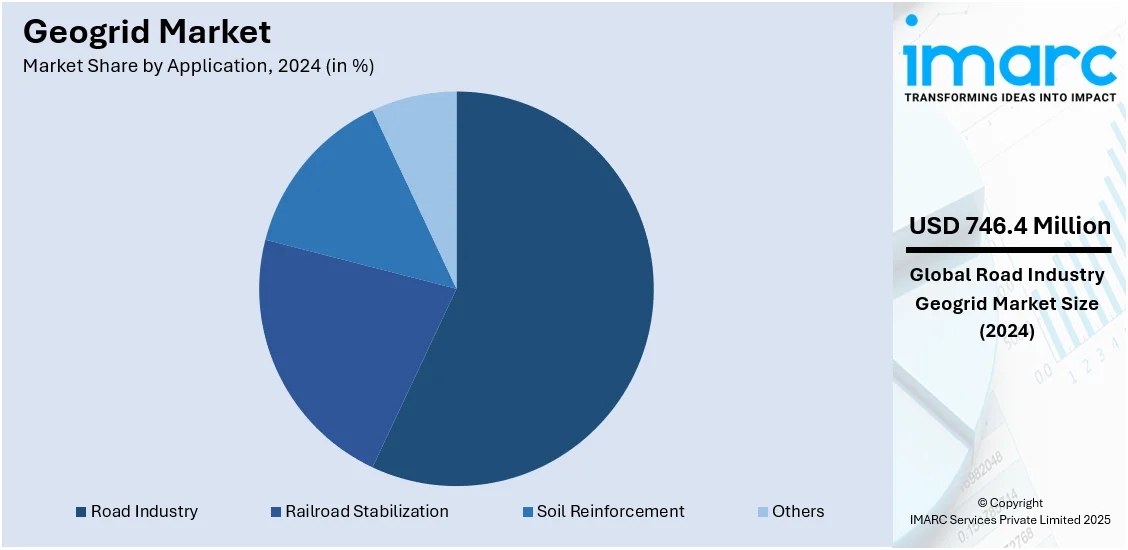

Analysis by Application:

- Road Industry

- Railroad Stabilization

- Soil Reinforcement

- Others

Road industry holds 57.4% of the market share. Geogrids enhance road durability, stability, and load-bearing capacity. With high traffic volumes and heavy vehicle movement, roads require strong reinforcement to prevent cracking, rutting, and soil erosion. Geogrids improve pavement performance by distributing loads more evenly and reducing maintenance costs over time. They also aid in stabilizing weak subgrades, allowing the construction of longer-lasting roads with reduced material usage. As government agencies and private sectors invest in infrastructure projects, the demand for geogrids in road construction is increasing. Additionally, geogrids support sustainable construction by minimizing the need for excessive aggregates and reducing environmental impact. Compared to traditional reinforcement methods, geogrids provide an economical and reliable solution, making them the suitable choice for highways, urban roads, and rural pathways. With the ongoing urbanization and infrastructure development on the rise, the road industry remains the dominant force driving the market forward.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for 35.0%, enjoys the leading position in the market. The region is noted for large-scale infrastructure projects and increasing government investments in transportation and construction. Nations like China, India, and Japan are heavily wagering on road networks, railways, and airports, driving the demand for geogrids in soil stabilization and reinforcement. For example, in August 2024, the Indian government sanctioned eight national high-speed road corridor initiatives measuring 936 km, requiring an investment of Rs 50,655 crore to enhance logistics efficiency and connectivity nationwide. The area’s growing population and expanding cities require durable and cost-effective construction solutions, making geogrids essential for improving ground strength and reducing maintenance costs. Additionally, rising industrialization activities and the need for better drainage and erosion control in construction projects further promote geogrid adoption. The Asia-Pacific region also benefits from lower production costs and a strong manufacturing base, making geogrid solutions more affordable and widely available.

Key Regional Takeaways:

United States Geogrid Market Analysis

The United States holds 83.70% of the market share in North America. The US market is experiencing significant growth due to increasing infrastructure development across the nation, particularly in road construction, highways, and soil stabilization. The demand for durable and cost-effective materials is rising, supported by government investments aimed at modernizing infrastructure. The US construction equipment market, valued at USD 43.53 Billion in 2023, is set to attain USD 68.11 Billion by 2032, growing at a CAGR of 4.60% during 2024-2032. With a rise in construction projects, the demand for materials that improve soil strength is high. Environmental regulations favoring sustainable construction solutions also contribute to the adoption of geogrids, which offer long-lasting and eco-friendly reinforcement. Moreover, the rising focus on reducing infrastructure maintenance costs has led to an increased use of geogrids for road stabilization and soil erosion control. The expansion of renewable energy projects, particularly wind and solar farms, is creating additional opportunities for geogrids, as these materials are vital for stabilizing foundations in installations. Technological advancements in geogrid materials are enhancing performance and broadening their applications in civil engineering, transportation, and agriculture sectors, thereby bolstering the market growth.

Europe Geogrid Market Analysis

The market in Europe is driven by the increasing demand for durable and cost-effective materials in civil engineering, particularly for road construction, soil stabilization, and geotechnical applications. The region's focus on enhancing transportation infrastructure while maintaining sustainability and minimizing long-term maintenance costs significantly contributes to the market growth. The European construction market, valued at USD 3.38 Billion in 2023, is set to grow to USD 5.42 Billion by 2032, with a CAGR of 5.10% from 2024-2032. This expansion reflects the rising investments in road networks, highways, and public-private partnerships aimed at improving transportation infrastructure. Additionally, the EU’s environmental regulations promote the use of eco-friendly solutions, encouraging the adoption of geogrids for infrastructure projects. The increasing focus on infrastructure resilience due to climate change challenges further accelerates the demand for geogrids in road stabilization and erosion control. As public and private sector investments in infrastructure projects continue to rise, the market will gain from greater utilization in both new developments and maintenance of existing roads and structures.

Asia-Pacific Geogrid Market Analysis

The market in the Asia-Pacific region is witnessing strong growth owing to rapid urbanization activities and large-scale infrastructure projects. Countries like India and China are investing heavily in transportation networks, including roads, highways, and railways, which is driving the demand for geogrid materials used in road construction and soil stabilization. For instance, in India, the Ministry of Road Transport and Highways set a proposed expenditure of INR 2,78,000 Crore (USD 32 Billion) for the 2024-25 fiscal year, focusing on the building and upkeep of National Highways through agencies like the National Highways Authority of India (NHAI) and the National Highway and Infrastructure Development Corporation Limited (NHIDCL). This increased focus on infrastructure development, along with environmental regulations supporting sustainable practices, encourages the adoption of geogrids in the region. Additionally, the demand for geogrids is growing due to the need for improved soil stability in agriculture, mining, and construction projects. The presence of key manufacturers in nations, such as China and India further support the regional market, as the innovations in geogrid products lead to broader applications across multiple sectors.

Latin America Geogrid Market Analysis

The geogrid market in Latin America is expanding due to increased infrastructure investments, particularly in road construction and soil stabilization. Countries like Brazil and Mexico are enhancing their transportation networks to support growing urbanization activities. According to industry reports, urbanization in Latin America was 80% in 2022, surpassing most other regions worldwide. This rapid urban expansion drives the demand for durable and sustainable solutions, including geogrids, to improve soil stability and prevent erosion. The focus on cost-effective materials further supports the adoption of geogrids across the region, positioning them as essential for infrastructure development.

Middle East and Africa Geogrid Market Analysis

The market in the Middle East and Africa (MEA) is witnessing expansion on account of large-scale infrastructure projects in countries like the UAE, South Africa, and Saudi Arabia. These regions are focusing on modernizing and broadening transportation networks to accommodate urban population growth. According to the World Bank, the Middle East and North Africa (MENA) region was already 64% urbanized in 2021, thereby driving the demand for geogrid solutions. As urbanization activities are increasing, geogrids are becoming essential for soil stabilization, road reinforcement, and infrastructure durability in both new and existing developments across the MEA region.

Competitive Landscape:

Key players work on developing modern high-performance materials to meet the high geogrid market demand. They focus on improving geogrid durability, tensile strength, and environmental sustainability. Through strategic partnerships and acquisitions, these companies expand their worldwide reach and enhance their product offerings. They also collaborate with government agencies and infrastructure developers to integrate geogrids into large-scale projects, such as highways, railways, and embankments. Additionally, key players are wagering on manufacturing advancements to reduce costs and increase production efficiency, making geogrids more accessible. Their role in promoting geosynthetic solutions for erosion control, soil stabilization, and load-bearing applications further fuels the market growth. By continuously improving technology and addressing infrastructure challenges, key players ensure that the market remains competitive and essential for modern construction. For instance, in July 2024, Wrekin Products unveiled Geoworks, an independent division focused on its geosynthetics lineup, which featured geotextiles, geogrids, geomembranes, and additional items. It upheld the same standards and service as Wrekin, providing an extensive range of geosynthetic solutions. This rebranding came after considerable investment in resources and staff, highlighting Wrekin's ongoing growth in the geosynthetics sector.

The report provides a comprehensive analysis of the competitive landscape in the geogrid market with detailed profiles of all major companies, including:

- ACE Geosynthetics Enterprise Co. Ltd.

- Carthage Mills Inc.

- HUESKER Synthetic GmbH

- Koninklijke Ten Cate B.V.

- NAUE GmbH & Co. KG

- Propex Operating Company LLC

- S i A Pietrucha Sp. z o.o.

- Taian Modern Plastics Co. Ltd

- Tensar International Corporation

- Thrace Group

- Wrekin Products Ltd

Latest News and Developments:

- January 2025: Project GeoGrid in the UK obtained EUR 480,000 (USD 590,717) from Ofgem’s SIF to investigate geothermal long-duration energy storage for optimizing the energy system. Directed by LCP Delta and its partners, the trial at the University of Leeds Geothermal Campus intended to improve grid resilience, lower expenses, and aid in decarbonization through the integration of geothermal storage into district heating and management of renewable energy.

- July 2024: Geoquest Australia launched ArmaLynk, a robust geogrid designed for ground stabilization in infrastructure developments in Australia. Constructed from high-tenacity polyester and PVA fibers, it aimed to improve road, bridge, railway, and pavement development. ArmaLynk was utilized worldwide for embankments, load distribution platforms, and strengthened slopes, providing efficiency and cost advantages compared to traditional techniques. It also demonstrated effectiveness in Europe and Asia.

- In July 2024, Geofabrics Australasia broadened its collaboration with Tensar to release the next-generation Tensar® InterAx® geogrid across Australia and New Zealand. This innovative geogrid aimed to enhance soil engagement and stability, positively impacting roads, railways, and work surfaces. Backed by the Tensar®+™ software, the solution minimized construction duration, expenses, and carbon footprint.

Geogrid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Uniaxial Geogrid, Biaxial Geogrid, Triaxial Geogrid |

| Applications Covered | Road Industry, Railroad Stabilization, Soil Reinforcement, Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | ACE Geosynthetics Enterprise Co. Ltd., Carthage Mills Inc., HUESKER Synthetic GmbH, Koninklijke Ten Cate B.V., NAUE GmbH & Co. KG, Propex Operating Company LLC, S i A Pietrucha Sp. z o.o., Taian Modern Plastics Co. Ltd, Tensar International Corporation, Thrace Group, Wrekin Products Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the geogrid market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global geogrid market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the geogrid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The geogrid market was valued at USD 1,300.30 Million in 2024.

The geogrid market is projected to exhibit a CAGR of 7.05% during 2025-2033, reaching a value of USD 2,476.45 Million by 2033.

As government agencies and private sectors are investing in roads, railways, and airport expansions, the demand for geogrids is rising to enhance ground strength and durability. Additionally, the growing environmental concerns among the masses are promoting the use of sustainable and erosion-control materials, thereby encouraging geogrid adoption. Moreover, technological advancements in geosynthetics, including high-performance polymer-based geogrids, enhance efficiency and durability, increasing their applications.

Asia-Pacific currently dominates the geogrid market, accounting for a share of 35.0% in 2024, driven by rapid urbanization activities, large infrastructure projects, and government investments in transportation. Growing industrialization, population expansion, and the need for cost-effective and durable construction solutions further drive the demand, making geogrids essential for soil stabilization and reinforcement in the region.

Some of the major players in the geogrid market include ACE Geosynthetics Enterprise Co. Ltd., Carthage Mills Inc., HUESKER Synthetic GmbH, Koninklijke Ten Cate B.V., NAUE GmbH & Co. KG, Propex Operating Company LLC, S i A Pietrucha Sp. z o.o., Taian Modern Plastics Co. Ltd, Tensar International Corporation, Thrace Group, Wrekin Products Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)