Geographic Atrophy Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

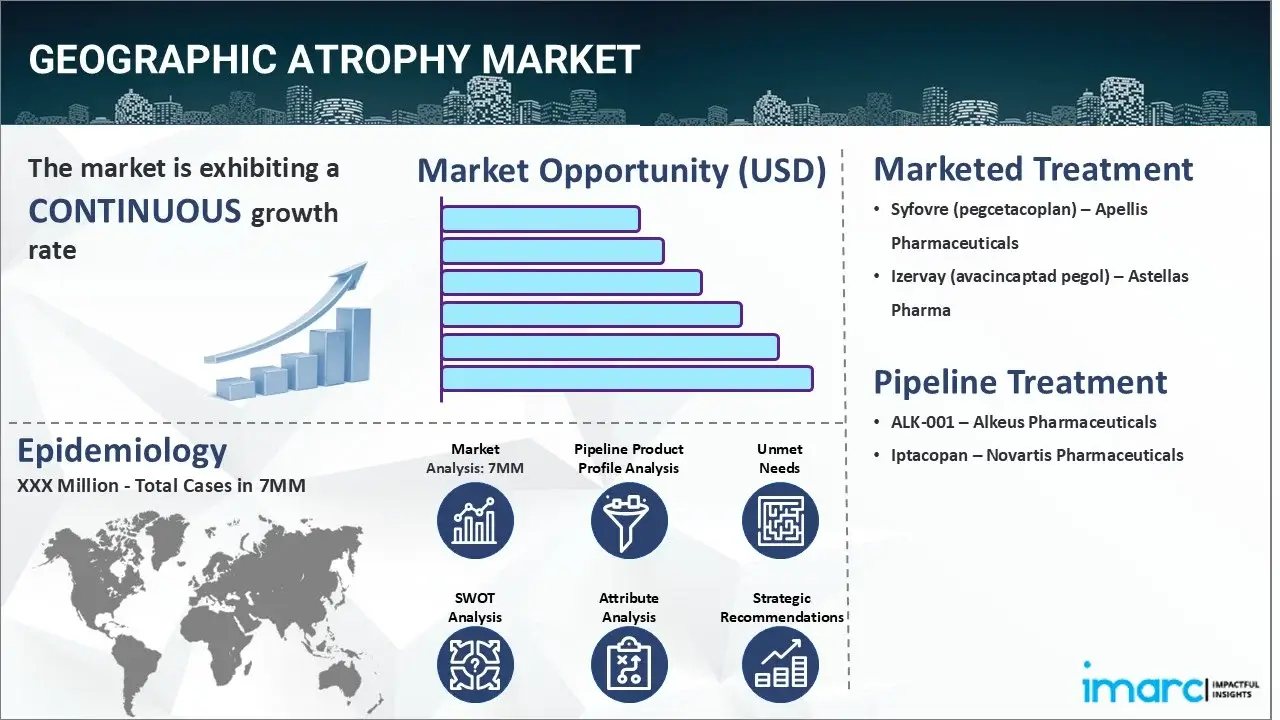

The geographic atrophy market reached a value of USD 25.6 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 47.1 Billion by 2035, exhibiting a growth rate (CAGR) of 5.47% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 25.6 Billion |

|

Market Forecast in 2035

|

USD 47.1 Billion |

| Market Growth Rate 2025-2035 | 5.47% |

The geographic atrophy market has been comprehensively analyzed in IMARC’s new report titled “Geographic Atrophy Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035”. Geographic atrophy is an advanced form of dry age-related macular degeneration that affects the retina, a part of the eye that sends information to the brain to enable sight. In this stage, the damage is so severe that it causes blind spots in the patient’s central vision. A patient can have both wet and dry age-related macular degeneration simultaneously and develop geographic atrophy independently of having wet age-related macular degeneration. This disease leads to sharply demarcated atrophy of the outer retinal tissue, retinal pigment epithelium, and choriocapillaris. The common symptoms experienced by patients are central vision loss, difficulty in low-light conditions, and trouble seeing colors. Initially, the sign is identified while reading when one or several letters are missing from a word or when looking at faces, a small region of the face is not clearly visible. Over several years, geographic atrophy causes the central vision to diminish, and the visual acuity comes down to 20/200. However, it does not usually affect peripheral vision. Geographic atrophy can be identified by an ophthalmologist using retinal imaging and a dilated examination. In a dilated exam, geographic atrophy appears as a patch of the retina without dark melanin pigment. Imaging techniques can also be used to detect geographic atrophy, including optical coherence tomography (OCT), retinal color photographs, autofluorescence imaging, etc.

To get more information on this market, Request Sample

The increasing prevalence of retinal disorders along with the expanding geriatric population is primarily driving the geographic atrophy market. Additionally, the rising incidences of obesity and cardiovascular diseases (CVDs) on account of changing dietary patterns, sedentary lifestyles, and unhealthy habits like smoking are further creating a positive outlook for the market. In line with this, the escalating usage of smartphones, laptops, televisions, etc., which is leading to prolonged and excessive screen time, is also propelling the market growth. Moreover, the introduction of retinal gene therapies, which involve injecting adeno-associated virus (AAV) into the body to prevent the development of abnormal blood vessels, is further acting as a significant growth-inducing factor. Besides this, the widespread adoption of autofluorescence imaging technology to visualize the retinal pigment epithelium (RPE) in order to assess the progression rate of the disease is also bolstering the global market. Additionally, several key players are making substantial investments in developing imaging technologies that will contribute to the understanding of the genesis and pathophysiological mechanisms of geographic atrophy. This, in turn, is positively influencing the market growth. Numerous other factors, such as extensive R&D activities for launching innovative and effective drugs and the increasing expenditure on healthcare to facilitate access to affordable treatment options, are expected to drive the geographic atrophy market in the coming years.

IMARC Group’s new report provides an exhaustive analysis of the geographic atrophy market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report the United States has the largest patient pool for geographic atrophy and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario and unmet medical needs, etc. have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the geographic atrophy market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the geographic atrophy market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the geographic atrophy market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current geographic atrophy marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Syfovre (pegcetacoplan) | Apellis Pharmaceuticals |

| Izervay (avacincaptad pegol) | Astellas Pharma |

| ALK-001 | Alkeus Pharmaceuticals |

| Iptacopan | Novartis Pharmaceuticals |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the geographic atrophy market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the geographic atrophy across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the geographic atrophy across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of geographic atrophy across the seven major markets?

- What is the number of prevalent cases (2019-2035) of geographic atrophy by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of geographic atrophy by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of geographic atrophy by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with geographic atrophy across the seven major markets?

- What is the size of the geographic atrophy patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend geographic atrophy of?

- What will be the growth rate of patients across the seven major markets?

Geographic Atrophy: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for geographic atrophy drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the geographic atrophy market?

- What are the key regulatory events related to the geographic atrophy market?

- What is the structure of clinical trial landscape by status related to the geographic atrophy market?

- What is the structure of clinical trial landscape by phase related to the geographic atrophy market?

- What is the structure of clinical trial landscape by route of administration related to the geographic atrophy market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)