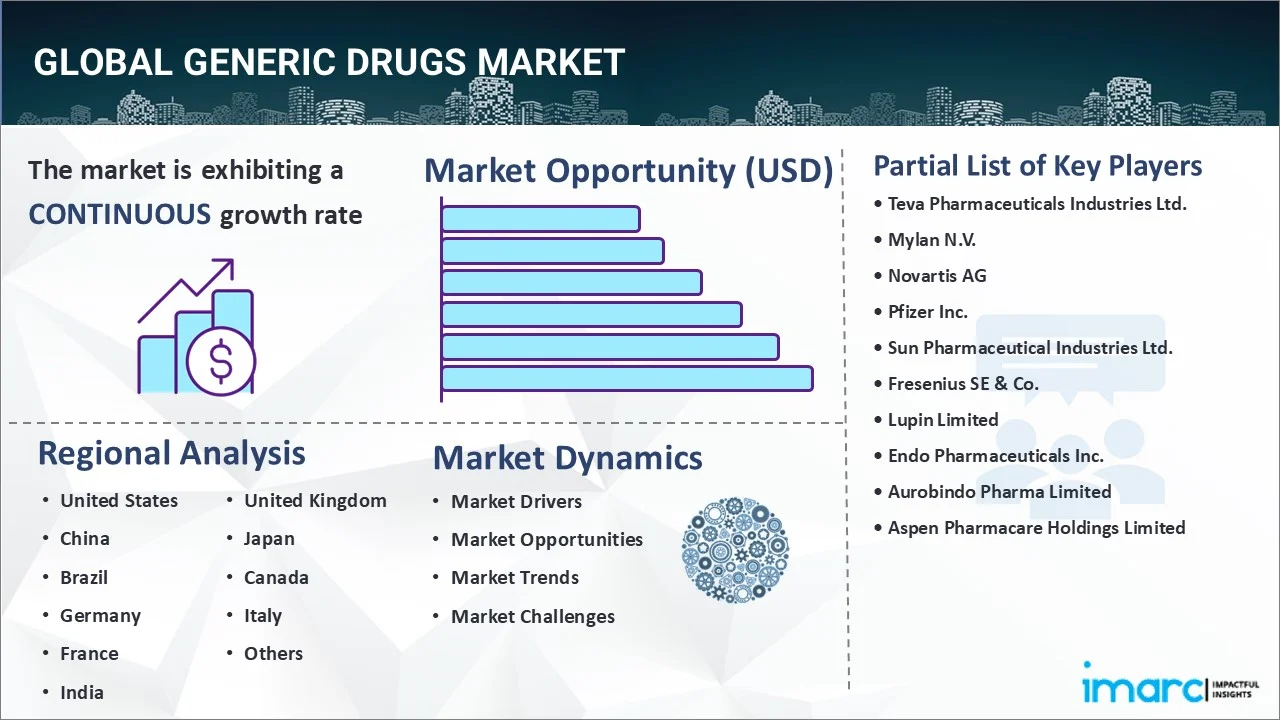

Generic Drugs Market Report by Therapy Area (Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, and Others), Drug Delivery (Oral, Injectables, Dermal/Topical, Inhalers), Distribution Channel (Retail Pharmacies, Hospital Pharmacies), and Country 2025-2033

Generic Drugs Market Size:

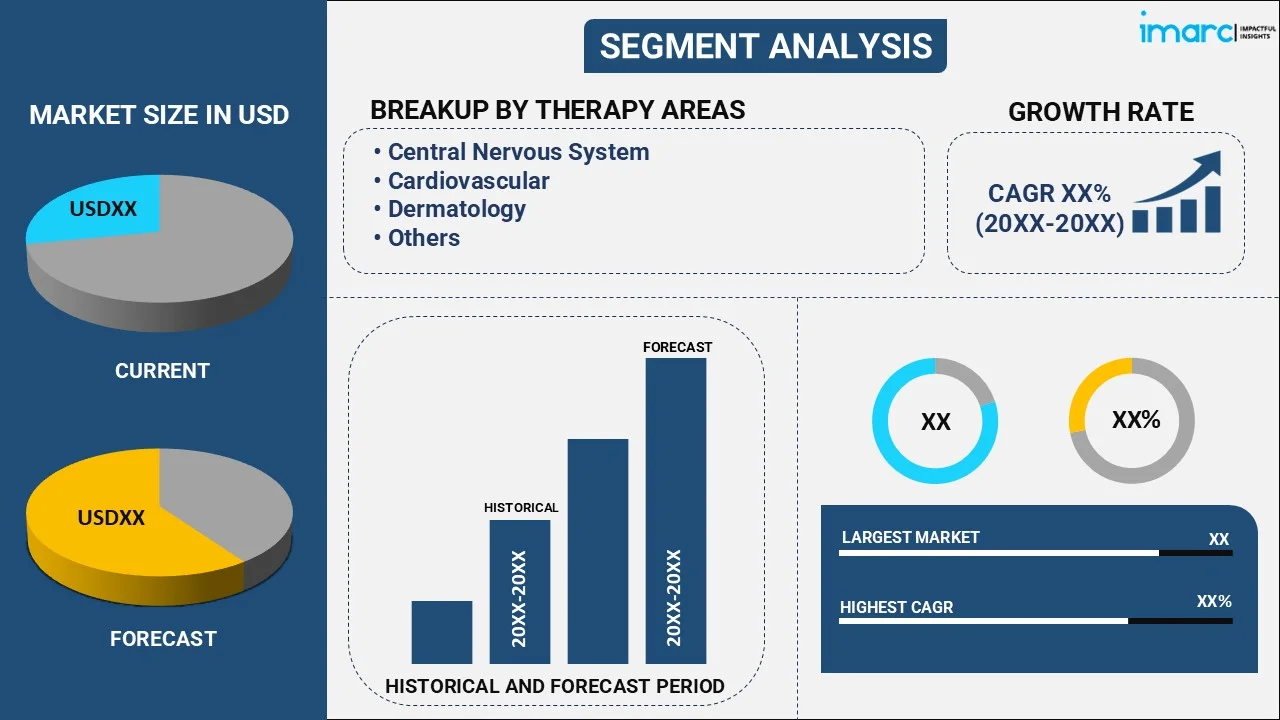

The global generic drugs market size reached USD 389.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 674.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.66% during 2025-2033. United States dominates the market in 2024, driven by the strong presence of major pharmaceutical firms and innovations in formulations. The market is driven by the increasing incidence of chronic diseases, and expiring drug patents. Supportive government policies aimed at reducing healthcare spending are fueling the generic drugs market share.

Market Size & Forecasts:

- Generic drugs market was valued at USD 389.0 Billion in 2024.

- The market is projected to reach USD 674.9 Billion by 2033, at a CAGR of 5.66% from 2025-2033.

Dominant Segments:

- Therapy Area: Central nervous system leads the generic drugs market because central nervous system disorders, such as depression, epilepsy, Parkinson’s, and anxiety, are chronic and widespread, requiring long-term medication. Generic drugs offer cost-effective treatment options, increasing accessibility and adherence for patients dealing with these lifelong neurological conditions.

- Drug Delivery: Oral dominates the market since it is the most convenient, non-invasive, and patient-preferred route. Tablets and capsules are easy to produce, store, and transport, making them ideal for mass distribution of generics.

- Distribution Channel: Retail pharmacies represent the largest market share as they are the most accessible point of purchase for people. With widespread presence and direct interaction with patients, retail pharmacies aid in driving higher volume sales of generics, especially for recurring prescriptions.

- Country: United States leads the market due to a well-developed pharmaceutical manufacturing base, high prescription volumes, and early adoption of generic substitution by pharmacies. Competitive pricing and the presence of numerous generic-focused companies are further contributing to the country’s leadership in the global generic drugs landscape.

Key Players:

- The leading companies in generic drugs market include Teva Pharmaceuticals Industries Ltd., Mylan N.V., Novartis AG, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Fresenius SE & Co., Lupin Limited, Endo Pharmaceuticals Inc., Aurobindo Pharma Limited, Aspen Pharmacare Holdings Limited, etc.

Key Drivers of Market Growth:

- Rising Aging Population: The elderly population is facing chronic illnesses requiring long-term medication. Generic drugs offer affordable options, making them essential for elderly patients on fixed incomes. As the senior population is growing, the demand for cost-effective treatments is rising, encouraging healthcare systems to employ generic drugs for better economic sustainability.

- Broadening of E-pharmacies: E-pharmacies improve access to generic drugs by offering home delivery, digital prescriptions, and easy price comparisons. They help people find cost-effective alternatives conveniently, especially in remote areas. As online platforms are expanding, they are driving greater awareness, availability, and sales of generic drugs across diverse patient populations.

- Increased Bioequivalence Approvals: Rising bioequivalence approvals ensure that generics meet regulatory standards for safety and efficacy. This aids in building trust among healthcare providers and patients, encouraging broader adoption of generic drugs.

- Innovations in Formulations: Innovative formulations like extended-release tablets and taste-masked syrups enhance patient compliance and convenience. These improvements make generic drugs more appealing to diverse age groups and medical needs.

- Expansion of Public and Private Health Insurance Coverage: Broader health insurance coverage increases access to medications while controlling costs. Insurers often favor generic drugs for their affordability, encouraging widespread use through reimbursement policies.

Future Outlook:

- Strong Growth Outlook: The generic drugs market is anticipated to see sustained expansion, driven by patent expirations, rising demand for affordable medications, and increasing healthcare access globally. With continued focus on cost containment and expanding therapeutic needs, the market is set to grow steadily, supported by innovations in drug manufacturing.

- Market Evolution: The sector is anticipated to shift from a niche segment to a mainstream component of global healthcare systems. The market is advancing through regulatory support, improved manufacturing practices, and greater acceptance. It is playing a key role in increasing access to essential medicines worldwide.

The market is driven by the growing focus on cost containment in healthcare systems, which is encouraging the use of generic drugs over branded medicines to reduce expenditure. Patent expirations of blockbuster drugs also open opportunities for generic manufacturers to introduce affordable alternatives. Additionally, government initiatives aimed at promoting the utilization of generic drugs through awareness programs and mandatory substitution policies are catalyzing the demand. Moreover, expanding healthcare infrastructure is facilitating the penetration of generic medications. Regulatory reforms and streamlined approval processes in many regions have made it easier and faster for companies to bring generic drugs to the market. Increasing partnerships between local and international pharmaceutical firms are further enhancing production capacity and distribution networks. Price sensitivity among users, especially in low- and middle-income regions, is also driving the demand for affordable drug options.

To get more information on this market, Request Sample

Generic Drugs Market Trends:

Rising aging population

The growing aging population is positively influencing the market, as older adults generally experience a higher prevalence of chronic and age-related conditions, such as arthritis, diabetes, hearing loss, cardiovascular diseases, and neurological disorders. As per the World Health Organization (WHO), by 2030, one in every six people worldwide will be aged 60 or above. With increasing age, individuals typically require long-term medication, and generic drugs offer a cost-effective solution for sustained treatment. Moreover, pensioners and retirees often rely on limited fixed incomes, making economical drug options essential. As government agencies are seeking to manage public healthcare spending, generic drugs are becoming a preferred choice in national health plans targeting senior citizens.

Expansion of e-pharmacies

The expansion of e-pharmacies is enhancing the accessibility and affordability of generic drugs. As per the IMARC Group, the global e-pharmacy market size was valued at USD 107.70 Billion in 2024. Online platforms make it easier for patients to compare prices, discover lower-cost generic alternatives, and access medications without visiting a physical pharmacy. This is especially beneficial for individuals in remote areas or with limited mobility. E-pharmacies often run targeted promotions and discounts on generic drugs, making them more attractive to cost-conscious buyers. Additionally, the digital model supports prescription verification, subscription refills, and home delivery, streamlining the process of managing long-term therapies using generic medications. By offering a wider range of options and greater transparency in drug pricing, e-pharmacies are enabling higher adoption of generic drugs. As online healthcare platforms continue to expand, their contribution to generic drug sales is expected to grow steadily.

Growth of therapeutic areas

The growth of therapeutic areas, such as oncology, is impelling the market growth. As patents for branded oncology drugs expire, generic versions become available at much lower costs, enabling broader access for patients and easing the financial burden on healthcare systems. With rising cancer prevalence, the demand for affordable therapies continues to surge, leading manufacturers to develop and launch more oncology generics. As per the NIH, in 2024, it was anticipated that there would be 2,001,140 new cancer cases in the United States. Additionally, the increased use of combination therapies in oncology is creating the need for multiple generic drugs. Hospitals and treatment centers prefer generic drugs to manage expenditure without compromising patient outcomes. This trend is further supported by healthcare providers advocating cost-efficient alternatives, reinforcing the role of generic drugs in therapeutic areas.

Key Growth Drivers of Generic Drugs Market:

Increased bioequivalence approvals

Increased bioequivalence approvals are facilitating faster market entry of cost-effective alternatives to branded medicines. Bioequivalence ensures that a generic drug has the same active ingredients, dosage form, and therapeutic effects as its branded counterpart, meeting regulatory standards for safety and efficacy. As more generics receive these approvals from authorities, such as the US Food and Drug Administration (FDA), manufacturers can produce and distribute them with confidence, leading to greater competition and price reductions. This also enhances public trust in generic drugs and encourages wider adoption by healthcare providers. Additionally, streamlined approval processes reduce development timelines and costs for generic manufacturers. Overall, increased bioequivalence approvals are contributing to broadening the availability of generic drugs and improving affordability for patients and healthcare systems alike.

Innovations in formulations

Innovations in formulations are refining drug stability, patient compliance, and therapeutic outcomes. Enhanced drug delivery methods, such as extended-release tablets, orally disintegrating forms, and taste-masked syrups, make generics more user-friendly and adaptable across different patient groups. These advancements allow generic manufacturers to differentiate their products while offering them at affordable prices. Additionally, innovation in fixed-dose combinations increases convenience, especially for patients managing multiple chronic conditions. Novel formulations also support drug adherence, reducing treatment failures and hospital re-admissions, which is crucial in value-based healthcare systems. Innovations help expand generics beyond simple copycat models, attracting more interest from prescribers and consumers. As the competition is growing, companies are investing in developing superior generic versions, enhancing their appeal and performance while maintaining cost-effectiveness.

Broadening of public and private health insurance coverage

The expansion of public and private health insurance coverage is a key driver of the market as insurers often prioritize cost containment without compromising patient care. Generic drugs offer a financially viable solution for large-scale drug reimbursements, making them a preferred choice in insurance formularies. With broader coverage, more individuals are gaining access to essential medications, and insurers are able to negotiate better pricing on generics through volume-based contracts. In addition, health insurance programs frequently include incentives or mandates to dispense generic versions when available, promoting their widespread use. As insurance penetration is growing in both developed and developing regions, the demand for affordable generic drugs is rising. This trend is supporting consistent growth in manufacturing and distribution of generics, aiding healthcare systems in managing budgets while ensuring patients receive necessary medications through covered plans.

Generic Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and country levels for 2025-2033. Our report has categorized the market based on therapy area, drug delivery, and distribution channel.

Breakup by Therapy Area:

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

Central Nervous System accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the therapy area. This includes central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others. According to the report, central nervous system represented the largest segment.

The central nervous system (CNS) segment holds a significant portion of the generic drugs market, reflecting the high burden of neurological disorders globally. Generic drugs play a crucial role in managing conditions like epilepsy, depression, and anxiety, which require long-term medication. As patents for branded CNS drugs expire, generic versions become increasingly available, offering more affordable options for patients and healthcare systems. This accessibility is essential for ongoing patient care, particularly in lower-income regions where cost can be a significant barrier to treatment. Additionally, the growth in the CNS generics market is further supported by continued research and development efforts, enhancing drug efficacy and patient compliance.

Breakup by Drug Delivery:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

Oral holds the largest share of the industry

A detailed breakup and analysis of the market based on the based on the drug delivery have also been provided in the report. This includes oral, injectables, dermal/topical, and inhalers. According to the generic drugs market research report, oral accounted for the largest market share.

The oral segment dominates the generic drugs industry due to its widespread preference for drug administration. Oral medications are favored for their convenience, safety, and ease of use, which significantly enhances patient compliance, especially in chronic conditions that require prolonged therapy. This segment's predominance is bolstered by continuous innovations and generic launches that make treatments more accessible and cost-effective. The ability to self-administer oral generics also reduces the need for hospital visits, which is particularly advantageous in reducing healthcare costs and improving the quality of life for patients with ongoing medical needs. As healthcare systems globally push for more cost-effective treatment options, the demand for oral generic drugs continues to grow, maintaining their significant share in the generic drugs market revenue.

Breakup by Distribution Channel:

- Retail Pharmacies

- Hospital Pharmacies

Retail Pharmacies represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail pharmacies and hospital pharmacies. According to the generic drugs industry report, retail pharmacies accounted for the largest market share.

Retail pharmacies constitute the largest distribution channel in the generic drugs market, driven by their accessibility and convenience for patients. These pharmacies are pivotal in delivering cost-effective generic medications directly to consumers, facilitating immediate access to essential drugs. The widespread presence of retail pharmacies ensures that generic drugs are readily available across various regions, enhancing patient adherence to prescribed therapies. Additionally, retail pharmacies often benefit from strong customer relationships and trust, encouraging the use of generics. With the increasing emphasis on reducing healthcare costs, retail pharmacies continue to play a critical role in the distribution and adoption of generic drugs, reinforcing their leading position in the market.

Breakup by Country:

- United States

- China

- Brazil

- Germany

- France

- India

- United Kingdom

- Japan

- Canada

- Italy

- Others

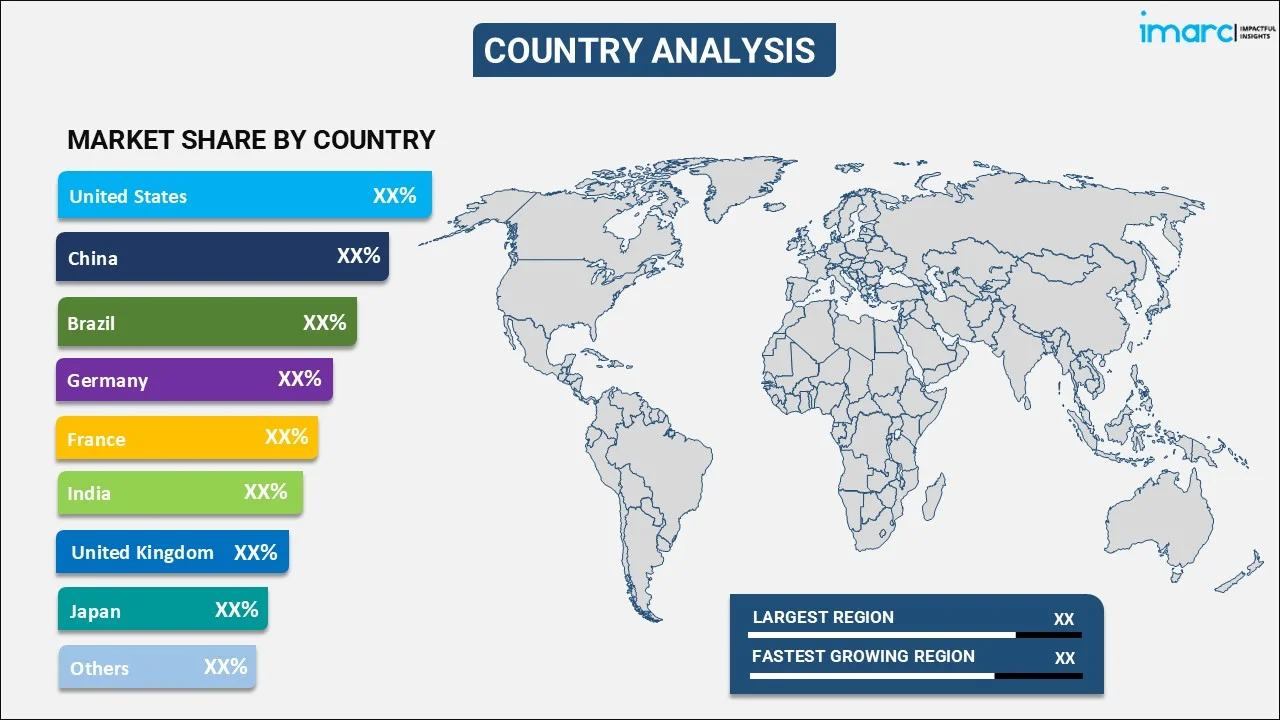

United States leads the market, accounting for the largest generic drugs market share

The report has also provided a comprehensive analysis of all the major regional markets, which include which include the United States, China, Brazil, Germany, France, India, the United Kingdom, Japan, Canada, Italy, and others. According to the report, United States represents the largest regional market, accounting for the majority of generic drugs market value.

The United States holds a dominant position in the global generic drugs market, accounting for the largest market share. This leadership is driven by a robust pharmaceutical infrastructure, high healthcare spending, and a strong emphasis on cost-effective treatment options. The U.S. market is supported by favorable government policies, such as the Generic Drug User Fee Amendments (GDUFA), which aim to speed up the approval process for generic drugs. According to the Association for Accessible Medicines (AAM), the U.S. health care system saved a record $338 billion in 2020 thanks to the use of FDA-approved generic and biosimilar drugs. Generic drugs accounted for 90% of prescriptions but only 18% of prescription drug spending. Biosimilar drugs, while occupying less than 30% of the market, saved $7.9 billion in 2020, indicating their growing impact on cost savings. Additionally, the vast network of retail pharmacies across the country ensures widespread availability and accessibility of generic medications to the American population. The U.S.'s significant role in pharmaceutical innovation and a mature healthcare system further consolidate its leading status in the generic drugs market.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the generic drugs industry include Teva Pharmaceuticals Industries Ltd., Mylan N.V., Novartis AG, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Fresenius SE & Co., Lupin Limited, Endo Pharmaceuticals Inc., Aurobindo Pharma Limited and Aspen Pharmacare Holdings Limited, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The generic drugs market is highly competitive, characterized by numerous players and a focus on cost efficiency and market penetration. Leading companies like Teva, Mylan, and Sandoz dominate due to their extensive product portfolios and global reach. These companies leverage robust manufacturing capabilities and strategic partnerships to maintain their market positions. The competition is further intensified by new entrants and local manufacturers, especially in high-growth regions like Asia-Pacific. Price wars are common, as companies aim to undercut competitors, often leading to significant price reductions. Regulatory support for generics and patent expiries of blockbuster drugs also fuel the competitive dynamics, pushing companies to innovate and expand their generic drug offerings.

Generic Drugs Market News:

- June 2025: Hikma Pharmaceuticals USA revealed it would allocate USD 1 Billion by 2030 to enhance its manufacturing and research and development (R&D) capabilities in the US. This latest investment phase ‘America Relies on Hikma: Quality Pharmaceuticals Made in the USA’ would enhance Hikma's established domestic abilities to create, manufacture, and supply a wide variety of generic drugs required by the US healthcare system to care for patients across the country.

- April 2025: Alembic Pharmaceuticals obtained approval from the United States FDA. The authorization permitted the firm to sell Carbamazepine tablets in the US. This drug was a generic form of Tegretol Tablets. Carbamazepine pills functioned as anticonvulsants and addressed pain resulting from trigeminal neuralgia.

- March 2025: Delhi High Court cleared the path for generic versions of the spinal muscle atrophy medication. Following this decision, the yearly expense for spinal muscular atrophy (SMA) treatment in India was anticipated to decrease to only INR 3,000 each year from the existing INR 22 Lakh-72 Lakh.

- December 2024: The FDA granted approval to Hikma Pharmaceuticals’ generic version of Novo Nordisk’s diabetes medication Victoza. It initially obtained tentative approval in June. The FDA emphasized that generic medications offered extra treatment choices that were more cost-effective for patients.

- December 2024: Penn Medicine collaborated with billionaire investor Mark Cuban to enhance access to generic prescription drugs across its pharmacy network. The marketplace was integral to Cuban’s broader goal to alleviate drug shortages and curb escalating healthcare expenses for patients, hospitals, and health systems by eliminating industry middlemen and restricting price increases on medications.

- October 2024: Zydus Lifesciences obtained final approval from the US health authority to produce its generic version of Paliperidone extended-release tablets, employed for treating schizophrenia. The USFDA granted approval for Paliperidone extended-release tablets in strengths of 1.5 mg, 3 mg, 6 mg, and 9 mg. The group was set to develop these tablets at their manufacturing facility located in SEZ, Ahmedabad, India.

Generic Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Areas Covered | Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, Others |

| Drug Deliveries Covered | Oral, Injectables, Dermal/Topical, Inhalers |

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies |

| Countries Covered | United States, China, Brazil, Germany, France, India, United Kingdom, Japan, Canada, Italy, Others |

| Companies Covered | Teva Pharmaceuticals Industries Ltd., Mylan N.V., Novartis AG, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Fresenius SE & Co., Lupin Limited, Endo Pharmaceuticals Inc., Aurobindo Pharma Limited, Aspen Pharmacare Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market dynamics, and generic drugs market forecast till 2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global generic drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the generic drugs industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global generic drugs market was valued at USD 389.0 Billion in 2024.

We expect the global generic drugs market to exhibit a CAGR of 5.66% during 2025-2033.

The high prevalence of numerous chronic diseases, such as diabetes, dyslipidemia, hypertension, etc., owing to the sedentary lifestyles, hectic work schedules, and changing dietary patterns of the consumers is primarily driving the global generic drugs market.

The sudden outbreak of the COVID-19 pandemic has led to a significant rise in the R&D activities pertaining to launch of generic drugs to combat the spread of the coronavirus infection.

Based on the therapy area, the global generic drugs market can be segregated into central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others. Currently, central nervous system exhibits a clear dominance in the market.

Based on the drug delivery, the global generic drugs market has been bifurcated into oral, injectables, dermal/topical, and inhalers. Among these, oral medicines hold the largest market share.

Based on the distribution channel, the global generic drugs market can be categorized into retail pharmacies and hospital pharmacies. Currently, retail pharmacies account for the majority of the total market share.

On a regional level, the market has been classified into United States, China, Brazil, Germany, France, India, United Kingdom, Japan, Canada, Italy, and others, where the United States currently dominates the global market.

Some of the major players in the global generic drugs market include Teva Pharmaceuticals Industries Ltd., Mylan N.V., Novartis AG, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Fresenius SE & Co., Lupin Limited, Endo Pharmaceuticals Inc., Aurobindo Pharma Limited, and Aspen Pharmacare Holdings Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)