Gene Therapy Market Size, Share, Trends and Forecast by Gene Type, Vector Type, Delivery Method, Application, and Region, 2025-2033

Gene Therapy Market Size and Share:

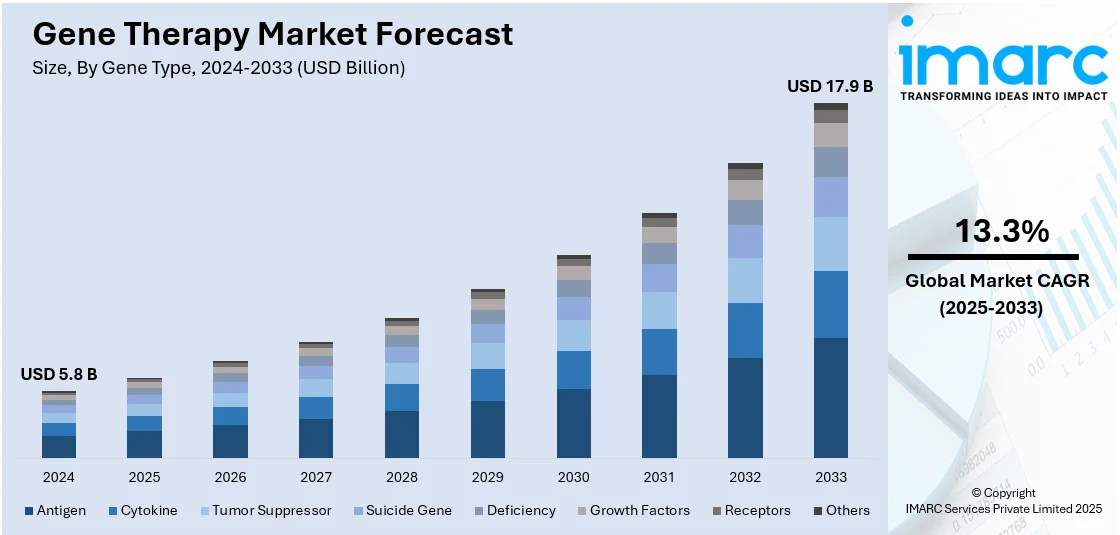

The global gene therapy market size was valued at USD 5.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.9 Billion by 2033, exhibiting a CAGR of 13.3% from 2025-2033. North America currently dominates the market, holding a market share of over 56% in 2024. The North American market is driven by robust healthcare infrastructure, rising investments in research operations, advanced regulatory frameworks, and the presence of leading biotechnology firms fostering innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 17.9 Billion |

| Market Growth Rate 2025-2033 | 13.3% |

The growing incidence of genetic disorders, such as cystic fibrosis, hemophilia, and sickle cell anemia, is driving the demand for innovative treatments like gene therapy. Additionally, chronic diseases like cancer and cardiovascular conditions, which may have underlying genetic components, are increasing interest in therapies that target the root cause at the genetic level. Besides this, rapid advancements in technologies, including clustered regularly interspaced short palindromic repeats (CRISPR) associated protein 9 (Cas9), viral and non-viral vectors, and next-generation sequencing, are enhancing the efficiency and safety of gene therapy approaches. These innovations are significantly reducing research timelines and improving the success rates of clinical trials. Moreover, many governmental bodies and regulatory agencies are backing gene therapy through simplified approval procedures and incentives. Approval of new treatments for rare illnesses and cancer is boosting market confidence and promoting further development.

To get more information on this market, Request Sample

The United States has emerged as a crucial segment in the market attributed to high incidences of genetic disorders like hemophilia and spinal muscular atrophy, coupled with chronic conditions, such as cancer and cardiovascular diseases. Apart from this, the development of genetic treatments targeting rare and complex diseases is bolstering the market growth. These therapies address the root genetic causes of conditions, offering potentially curative solutions with a single administration. In 2024, Orchard Therapeutics announced the US launch plans for Lenmeldy™ (atidarsagene autotemcel), the first FDA-approved gene therapy for early-onset metachromatic leukodystrophy (MLD). With a one-time treatment cost of $4.25 million, the therapy offers transformative potential by addressing the genetic cause of MLD. The rollout includes five specialized treatment centers and innovative value-based reimbursement models.

Gene Therapy Market Trends:

Advancements in Viral Vector Technology

Continuous progress and innovation in viral vector technology are important factors driving the market. Therapeutic genes are introduced directly into the cells of the patient through viral vectors. Gene therapy treatments have, in recent years, experienced enhanced safety and efficacy, among the many developments that include the development of more specific and targeted viral vectors such as adeno-associated viruses (AAVs) and lentiviruses, with AAVs enjoying widespread application because of their characteristic ability to carry genetic material in an immune reaction and damage-minimum approach. Moreover, according to the gene therapy market overview, researchers are working on developing viral vectors that may carry bigger genetic payloads, thus expanding the scope of curable disorders. These technical innovations not only enhance the efficiency of gene treatments but also minimize the chances of adverse effects, thus making them safer for patients. As a result, the development of viral vector technology is speeding up the acceptance and efficacy of gene therapy treatments for a wider range of medical conditions. According to the Centers for Disease Control and Prevention, in the United States, in 2021, 1,777,566 new cancer cases were reported. For example, MERCK KGaA, the VirusExpress 293 Adeno-Associated Virus (AAV) Production Platform, provides full viral vector manufacturing, including AAV and lentiviral vectors. Additionally, Catalent Inc. launched the UpTempo Virtuoso platform process for the development and manufacturing of adeno-associated viral (AAV) vectors.

Investment And Funding in Research and Development

The growing investments and funding for gene therapy research and development (R&D) efforts are supporting the market growth. According to reports, the Gene Therapy Innovation Fund (GTIF) is a USD 6.1 Million annual fund. The funding panel reviews full applications and makes funding decisions twice a year. The fund provides grants to academic researchers working to advance new gene therapies and who require viral vector material manufactured to GMP (or GMP-like) grade in order to support the program. Pharmaceutical businesses, biotechnology firms, and government agencies are putting major resources into developing gene therapy technologies and therapeutics. Gene treatments have a strong potential for addressing unmet medical needs and providing long-term benefits, which is drawing significant funding. Major pharmaceutical corporations are either purchasing gene therapy startups or building their own gene therapy sections to speed up research, which is positively impacting the gene therapy market outlook.

Rising Prevalence of Genetic Disorders and Rare Diseases

The rising prevalence of genetic abnormalities and rare illnesses is propelling the market growth. Many of these diseases have little or no effective treatment choices, making gene therapy an intriguing alternative. As our understanding of genetics advances, more people are diagnosed, and the demand for novel medicines grows. Moreover, gene therapy has the ability to treat the underlying causes of many disorders by repairing or replacing defective genes. This comprises illnesses including muscular dystrophy, cystic fibrosis, and other hereditary metabolic disorders. Pharmaceutical and biotechnology businesses are investing in gene therapy research to fulfill this expanding medical demand, resulting in market expansion and improvements in the area. According to the United States Center for Disease Control and Prevention, SMA is a genetic disorder that affects around 1 in every 10,000 people. Therefore, it is one of the most common rare diseases.

Gene Therapy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gene therapy market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on gene type, vector type, delivery method, and application.

Analysis by Gene Type:

- Antigen

- Cytokine

- Tumor Suppressor

- Suicide Gene

- Deficiency

- Growth Factors

- Receptors

- Others

Antigens are recognized as central to advancing immunotherapy, particularly in oncology, by enhancing the immune system's ability to identify and eliminate cancer cells. These molecules, often specific to tumor cells, are the foundation for innovative treatments such as cancer vaccines and chimeric antigen receptor (CAR)-T cell therapies. Cancer vaccines harness tumor-associated antigens to activate the immune system, prompting a targeted attack on malignant cells. CAR-T therapies take this further by engineering patient T cells to recognize and destroy cancer cells expressing specific antigens, achieving remarkable success in treating aggressive and resistant cancers. Research is now focused on discovering novel antigens and refining delivery systems to boost effectiveness and reduce side effects. Personalized medicine is also leveraging antigen-based therapies to match treatments with individual tumor profiles, enhancing outcomes. As antigen research progresses, it is reshaping oncology, offering transformative potential for treating complex and refractory cancers.

Analysis by Vector Type:

- Viral Vector

- Adenoviruses

- Lentiviruses

- Retroviruses

- Adeno-Associated Virus

- Herpes Simplex Virus

- Poxvirus

- Vaccinia Virus

- Others

- Non-Viral Techniques

- Naked and Plasmid Vectors

- Gene Gun

- Electroporation

- Lipofection

- Others

Viral vector holds the biggest market share, accounting for 55.5% in 2024. Viral vector (adenoviruses, lentiviruses, retroviruses, adeno-associated virus, herpes simplex virus, poxvirus, vaccinia virus, and others) dominates the gene therapy market due to its superior efficiency in delivering genetic material into host cells. Viral vectors are widely used for their ability to achieve high transduction rates and stable gene expression. Among these, AAV has gained significant traction for its safety profile and reduced immunogenicity, making it ideal for treating rare genetic disorders and chronic diseases. Lentiviruses and retroviruses are extensively used in ex vivo therapies like CAR-T cell treatments for cancer, further bolstering the segment's growth. Advances in vector engineering have addressed earlier concerns related to safety and toxicity, expanding their application scope across various therapeutic areas. Regulatory approvals for viral vector-based therapies and increased funding for research and development are further driving this segment. Additionally, collaborations between pharmaceutical companies and academic institutions are accelerating the commercialization of viral vector-based treatments, solidifying their dominance in the gene therapy market.

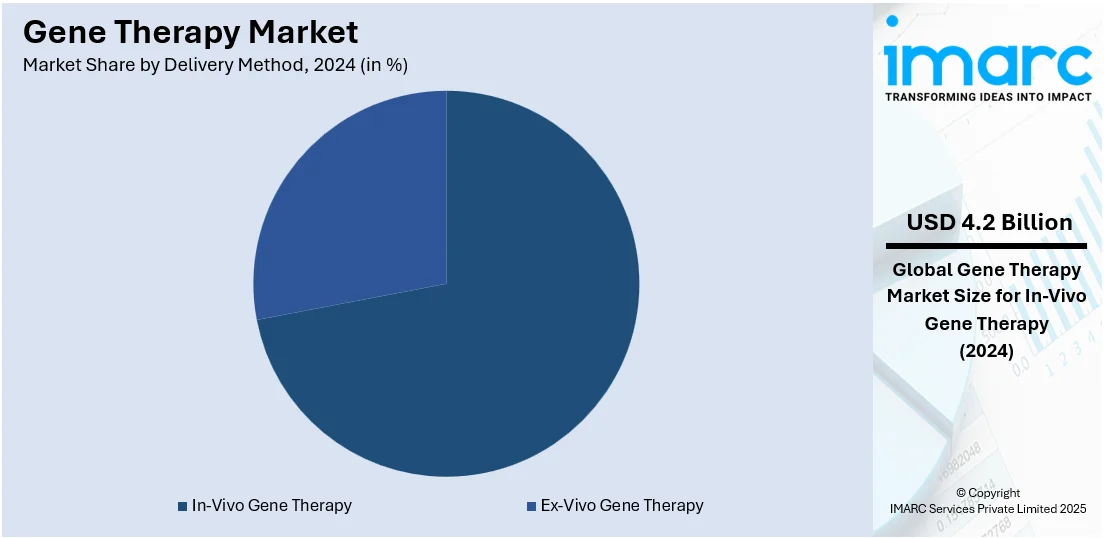

Analysis by Delivery Method:

- In-Vivo Gene Therapy

- Ex-Vivo Gene Therapy

In-vivo gene therapy market accounted for the largest share in 2024, holding 71.5% of the market. In-vivo gene therapy involves delivering genetic material directly into a patient's body using vectors such as viruses or non-viral techniques. It is most useful for treating diseases in which the affected cells are not easily accessible; hence, it is used to treat neurological disorders, liver diseases, and other genetic disorders. Advances in targeted delivery systems, building pipelines for rare and chronic diseases, and an increasing approval rate of innovative treatments also drive the market. Notable recent breakthroughs like addressing previously untreatable spinal muscular atrophy and even hemophilia have underpinned the potential of in-vivo gene therapy. The growing investment in research operations, coupled with favorable regulatory frameworks, is driving adoption, and this segment has become a core part of the gene therapy market.

Analysis by Application:

- Oncological Disorders

- Rare Diseases

- Cardiovascular Diseases

- Neurological Disorders

- Infectious Disease

- Others

Oncological disorders hold the largest market share, attributed to the increasing incidence of cancer and the need for new therapy. Gene therapies against cancers are directed at altering genes to augment immune responses, inhibit tumor growth, or enhance the effectiveness of any existing therapy. CAR-T cell therapy, oncolytic viruses, and the delivery of tumor suppressor genes have shown promising effects in the treatment of both hematological malignancies and solid tumors. Advances in gene-editing technologies, such as CRISPR, and viral vectors, including lentiviruses and AAVs, further optimize the precision and safety of these therapies. Regulatory approvals of breakthrough therapies, such as CAR-T treatments for leukemia and lymphoma, have set a suitable foundation for further innovation in this segment. Furthermore, the increasing adoption of combination therapies that integrate gene-based approaches with traditional treatments, like chemotherapy and immunotherapy, enhances therapeutic outcomes.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the market, holding 56% in 2024, due to its advanced health infrastructure, strong research and development ecosystem, and the initial adoption of cutting-edge medical technologies. The well-regulated frameworks provide streamlined pathways to expedite the development and approval of gene therapies. High prevalence rates of genetic disorders, cancers, and chronic diseases in this region are driving the demand for such innovative treatments. North America hosts some of the world's major biotech firms, top universities, and specialized treatment centers, so there's always an excellent opportunity to collaborate and advance commercialization activities. Value-based care models and well-entrenched reimbursement systems are also key contributors to this access to high-priced treatments for patients. In 2024, OmniaBio Inc. opened the largest CGT manufacturing facility in Hamilton, Ontario, Canada. This advanced site utilizes AI and automation to enhance production efficiency and serves North American and global biotherapy clients. Its first commercial customer is MEDIPOST, who will manufacture the stem cell therapy CARTISTEM for patients with osteoarthritis.t

Key Regional Takeaways:

United States Gene Therapy Market Analysis

The gene therapy market in the United States is currently expanding due to several critical factors. Researchers are increasingly focusing on developing personalized treatments for genetic disorders, with advanced CRISPR technologies enabling precise gene editing and enhancing the efficacy of therapies. The US government is actively supporting gene therapy innovation through funding initiatives and regulatory incentives, such as accelerated approval pathways from the FDA, which is encouraging biotech firms to push the boundaries of genetic medicine. Pharmaceutical companies are forging strategic collaborations with academic institutions and startups to expedite the development of gene therapies for rare and chronic diseases. According to American Diabetes Association, 38.4 million people have diabetes in the United States which is 11.6% of the US population. Additionally, ongoing clinical trials are demonstrating promising results for conditions like sickle cell anemia, muscular dystrophy, and certain cancers, increasing investor confidence in gene therapy's potential. Insurance providers are also gradually expanding coverage for gene therapy treatments, further promoting patient access. Advances in viral vector technology and delivery mechanisms are overcoming past challenges related to the safe and effective delivery of genetic material, fuelling market growth. With an aging population and rising demand for innovative treatments, gene therapy is becoming a focal point in the U.S. healthcare system, positioning it for sustained market growth in the coming years.

Europe Gene Therapy Market Analysis

The gene therapy market in Europe is experiencing significant growth as advanced technologies are increasingly enabling the development of targeted treatments for rare and complex diseases. Researchers are making rapid strides in overcoming delivery challenges, with companies currently focusing on improving viral and non-viral vector systems to enhance the efficiency and safety of gene transfer. Regulatory authorities like the European Medicines Agency (EMA) are adapting their frameworks to accelerate the approval process for gene therapies, providing a favorable environment for innovation. Pharmaceutical companies are intensifying collaborations with biotech firms and academic institutions to expand their gene therapy pipelines, particularly in areas like oncology, genetic disorders, and cardiovascular diseases. According to reports, there are more than 385,000 new cancer cases in the UK every year, that's more than 1,000 every day. Healthcare providers are becoming more receptive to gene therapies as clinical trials demonstrate substantial efficacy in treating previously untreatable conditions, creating demand for these cutting-edge solutions. Moreover, the increasing prevalence of inherited diseases, coupled with a rising patient pool, is driving investments in gene-based treatments. The growing awareness and education among healthcare professionals about the potential of gene therapies are also contributing to market expansion. At the same time, advancements in CRISPR and other gene-editing technologies are continually improving the precision and effectiveness of therapies, positioning Europe as a key hub for gene therapy innovation.

Asia Pacific Gene Therapy Market Analysis

The Asia Pacific gene therapy market is rapidly expanding as countries like China, India, and Japan are increasingly investing in gene therapy research and clinical trials. Healthcare systems are prioritizing the treatment of genetic disorders, particularly rare diseases, which are seeing rising prevalence in the region due to genetic factors and lifestyle changes. Governments and private organizations are actively funding gene therapy development, leading to a surge in innovation. The region is also witnessing an increase in the adoption of precision medicine, which is further accelerating the demand for gene therapies tailored to individual genetic profiles. Regulatory bodies in Asia Pacific are continuously updating their frameworks to support the commercialization and faster approval of gene therapies. Additionally, the region is becoming a hub for advanced manufacturing technologies, including viral vector production and CRISPR-based gene editing, which are reducing treatment costs and increasing the availability of therapies. Public awareness campaigns and collaborations between biotechnology firms and hospitals are contributing to the growing acceptance and utilization of gene therapies. The healthcare infrastructure is rapidly modernizing, enabling better access to these innovative treatments, especially in urban areas, while overcoming challenges such as affordability and distribution in rural locations. According to Press Information Bureau, the number of hospitals operating across India are 37,725.

Latin America Gene Therapy Market Analysis

The gene therapy market in Latin America is experiencing rapid growth due to several key drivers. Health systems across the region are increasingly adopting advanced biotechnology, enabling greater access to gene therapy treatments. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), of Brazil’s 7,191 hospitals, 62% are private. Governments and healthcare providers are allocating more resources towards rare diseases, with ongoing collaborations between local and global biopharmaceutical companies to make gene therapies more affordable and accessible. Research and development investments are escalating, as companies are actively exploring new treatment modalities for genetic disorders prevalent in the region, including sickle cell anemia, hemophilia, and muscular dystrophy. Moreover, local regulatory bodies are continuously working to streamline approval processes, enhancing market accessibility and reducing the time to market for gene therapies. Healthcare professionals are expanding their knowledge and expertise in genetic treatments, driving awareness and acceptance of these therapies among patients. Public-private partnerships are also playing a crucial role in facilitating the introduction of cutting-edge treatments by leveraging funding, infrastructure, and regulatory expertise. Furthermore, the increasing prevalence of chronic genetic conditions in Latin America is further fuelling demand for innovative solutions, while local patient advocacy groups are pushing for more targeted and personalized treatments.

Middle East and Africa Gene Therapy Market Analysis

The gene therapy market in the Middle East and Africa (MEA) is experiencing rapid growth as healthcare providers are increasingly focusing on addressing rare genetic disorders through advanced treatments. With numerous government-backed initiatives, countries in the region are investing heavily in research and development to improve access to gene therapies. Several pharmaceutical companies are actively expanding their presence in the MEA region, forming strategic partnerships with local healthcare institutions and academic research bodies. As the region’s healthcare infrastructure modernizes, hospitals are adopting advanced genetic testing and screening technologies, enabling earlier detection and personalized treatment approaches. According to the Ministry of Health and Prevention, in 2020, in the UAE there are 157 hospitals and 5369 health centers. Additionally, the country is divided into 53 public hospitals and 104 private hospitals. The increasing prevalence of genetic disorders, such as sickle cell anemia and hemophilia, is driving the demand for targeted therapies, especially in regions with high genetic disease burdens like the Gulf Cooperation Council (GCC) countries. Additionally, the adoption of innovative biotechnological methods in local manufacturing is reducing treatment costs, making gene therapies more accessible. Regulatory frameworks are also evolving to fast-track approvals for novel gene-based treatments, further accelerating market growth. With rising healthcare awareness and improved insurance coverage, patients are showing greater willingness to opt for gene therapies, contributing to the region's growing adoption of these cutting-edge treatments.

Competitive Landscape:

Key players in the market are focusing on advancing research operations to improve the safety, efficacy, and accessibility of gene-based treatments. They are actively investing in clinical trials, scaling production capacities, and forming strategic partnerships to accelerate innovation. Emphasis is placed on improving vector technologies and streamlining regulatory processes to bring therapies to market faster. Companies are also expanding their therapeutic pipelines to target a broader range of diseases, including rare genetic disorders and cancers. Efforts to reduce costs and enhance delivery methods are aimed at making gene therapy more accessible globally. In 2024, Precigen announced a strategic focus on commercializing its PRGN-2012 AdenoVerse® gene therapy for recurrent respiratory papillomatosis (RRP), with plans for a rolling biologics license application (BLA) submission under an accelerated approval pathway later in 2024. The company is reallocating resources, pausing non-priority programs, and preparing for a potential 2025 launch.

The report provides a comprehensive analysis of the competitive landscape in the gene therapy market with detailed profiles of all major companies, including:

- Abeona Therapeutics Inc.

- Adverum Biotechnologies, Inc.

- Amgen Inc.

- Astellas Pharma Inc.

- BioMarin Pharmaceutical Inc.

- bluebird bio, Inc.

- Gilead Sciences, Inc.

- Mustang Bio

- Novartis AG

- Orchard Therapeutics plc

- Roche Holding AG

- Sangamo Therapeutics

- uniQure NV

Latest News and Developments:

- October 2024: Roche announced its plan to apply Dyno Therapeutics’ engineered adeno-associated virus (AAV) capsid platform to develop next-generation AAV vectors for gene therapies targeting unspecified neurological diseases, through a collaboration that could generate more than USD 1 billion for Dyno.

- January 2024: Ginkgo Bioworks, which is building the leading platform for cell programming and biosecurity, announced the successful completion of the gene therapy collaboration they announced with Biogen in May 2021.

Gene Therapy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gene Types Covered | Antigen, Cytokine, Tumor Suppressor, Suicide Gene, Deficiency, Growth Factors, Receptors, Others. |

| Vector Types Covered |

|

| Delivery Methods Covered | In-Vivo Gene Therapy, Ex-Vivo Gene Therapy |

| Applications Covered | Oncological Disorders, Rare Diseases, Cardiovascular Diseases, Neurological Disorders, Infectious Disease, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abeona Therapeutics Inc., Adverum Biotechnologies, Inc., Amgen Inc., Astellas Pharma Inc., BioMarin Pharmaceutical Inc., bluebird bio, Inc., Gilead Sciences, Inc., Mustang Bio, Novartis AG, Orchard Therapeutics plc, Roche Holding AG, Sangamo Therapeutics, uniQure NV, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gene therapy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global gene therapy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gene therapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Gene therapy is a medical technique that involves modifying or manipulating genes within a person's cells to treat or prevent diseases. It typically uses viral or non-viral vectors to deliver therapeutic genes into the target cells. It aims to replace faulty genes, introduce new genes, or deactivate problematic ones, offering potential cures for genetic disorders, cancers, and certain chronic diseases.

The global gene therapy market was valued at USD 5.8 Billion in 2024.

IMARC estimates the global gene therapy market to exhibit a CAGR of 13.3% during 2025-2033.

The global gene therapy market is driven by advancements in genetic engineering, growing prevalence of rare and genetic disorders, and rising investment in biotechnology research. Increased regulatory approvals and innovation in vector technologies are enhancing treatment efficacy. Additionally, collaborations among biopharmaceutical firms and expanding patient awareness are accelerating the adoption of gene therapy solutions.

In 2024, antigen represented the largest segment by gene type, driven by its critical role in immunotherapy, personalized cancer treatments, and advancements in cancer vaccines and CAR-T cell therapies.

In 2024, viral vector represented the largest segment by vector type, driven by its high efficiency, stable gene expression, and widespread use in therapies targeting rare and chronic diseases.

In 2024, in-vivo gene therapy represented the largest segment by delivery method, driven by advancements in targeted vectors like AAVs, its effectiveness for inaccessible cells, and growing applications in rare and chronic diseases.

The oncological disorders are the leading segment by application owing to advancements in CAR-T cell therapies, targeted gene-editing technologies, and rising cancer prevalence requiring innovative and effective treatment solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global gene therapy market include Abeona Therapeutics Inc., Adverum Biotechnologies, Inc., Amgen Inc., Astellas Pharma Inc., BioMarin Pharmaceutical Inc., bluebird bio, Inc., Gilead Sciences, Inc., Mustang Bio, Novartis AG, Orchard Therapeutics plc, Roche Holding AG, Sangamo Therapeutics, uniQure NV, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)