Gene Synthesis Market Size, Share, Trends and Forecast by Method, Services, Application, End Use, and Region, 2025-2033

Gene Synthesis Market Size and Share:

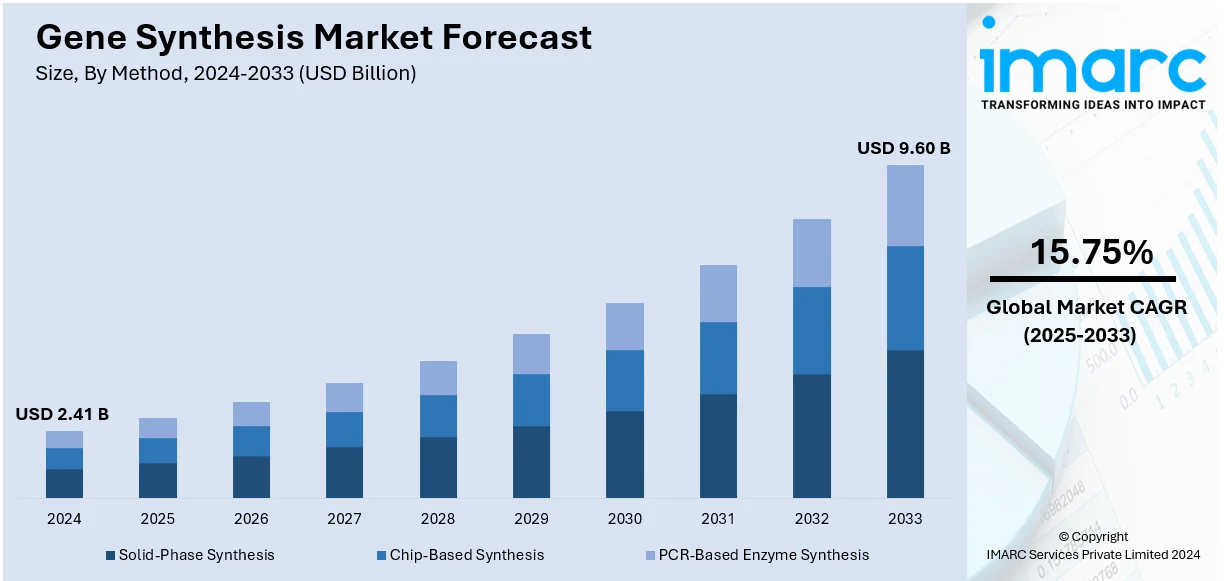

The global gene synthesis market size was valued at USD 2.41 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.60 Billion by 2033, exhibiting a CAGR of 15.75% from 2025-2033. North America currently dominates the market, holding a market share of over 39.5% in 2024. The rising prevalence of various genetic disorders, increasing preference for gene therapeutics and personalized medicine, and inflating disposable income levels represent some of the key factors boosting the gene synthesis market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.41 Billion |

|

Market Forecast in 2033

|

USD 9.60 Billion |

| Market Growth Rate 2025-2033 | 15.75% |

The rising focus on precision medicine is significantly propelling the gene synthesis market growth. Precision medicine tailors healthcare to individual characteristics, particularly genetic profiles, necessitating precise synthetic genes for diagnostics and therapeutics. In 2024, the global precision medicine market was valued at approximately USD 82.1 billion and is projected to grow at a rate of 8.63% from 2025 to 2033. This expansion underscores the increasing integration of this approach in healthcare, driving demand for gene synthesis technologies. Furthermore, in 2023, personalized medicines accounted for over one-third of new drug approvals by the U.S. Food and Drug Administration (FDA) for the fourth consecutive year, highlighting the industry's commitment to tailored therapies. The emphasis on personalized medicine is particularly evident in oncology, where treatments are customized based on individual genetic mutations. Advancements in mRNA vaccine technology have led to personalized cancer vaccines targeting specific tumor profiles, with several clinical trials underway as of 2024. The convergence of these factors collectively accelerates the gene synthesis market demand.

The gene synthesis market share in the United States is expanding rapidly, holding 80% share, fueled by a variety of important factors. Advancements in synthetic biology and genetic engineering have increased the demand for custom DNA sequences, essential for research and therapeutic applications. Government funding and support for genomic research further propel market expansion. Initiatives by agencies such as the National Institutes of Health (NIH) have significantly contributed to advancements in genomics and biotechnology. The NIH's budget for genetic research has seen consistent increases, underscoring the government's commitment to this field. Additionally, the U.S. Food and Drug Administration (FDA) has been actively approving new gene therapies, indicating a supportive regulatory environment that encourages innovation and application of gene synthesis technologies.

Gene Synthesis Market Trends:

Increasing demand for synthetic biology

Synthetic biology involves designing novel biological devices, technologies, and systems. This tool helps develop novel drugs including gene therapies and biopharmaceuticals that specifically depend on the accurate synthesis of the specific original DNA sequences. The new enthusiasm on vaccine research is centered on synthetic biology. As stated by the World Health Organization (WHO), this process is highly concentrated, with 85% of total market value belonging to just 10 manufacturers. Gene synthesis is a critical factor in the design and development of antigens and other elements used in the vaccine and thus contributes to the increasing demand for these services. Synthetic biology is a change in genetic makeup of an organism, which in turn is also opening up the scope of the gene synthesis market. It will include development of new genes for research, agriculture, and pharmaceuticals. Synthetic biology in biomanufacturing, where the microbes are engineered for the production of enzymes, biofuels, and medications in large quantity, require-large-scale gene synthesis. Businesses leverage synthetic biology to enhance efficiency and reduce costs in their manufacturing processes.

Advancements in biotechnology

According to the latest gene synthesis market forecast, innovations in DNA synthesis technology, such as microfluidics and high-throughput sequencing, improve the speed, accuracy, and cost-effectiveness of gene synthesis. These developments facilitate scientists and businesses in accessing custom-made genes tailored to their needs. NGS technologies are revolutionizing genomics by enabling fast and comprehensive gene synthesis market analysis of genetic data. The global next-generation sequencing (NGS) market size reached USD 23.3 Billion in 2024. This rise in sequencing data necessitates matching synthetic genes for research and therapeutic applications, resulting in increased demand for gene synthesis services. As researchers use these methods for genetic engineering, they rely more on synthesized genes to make precise changes, increasing the requirement for gene synthesis.

Rising investments in genomic research

As per the recent gene synthesis market trends, government agencies, private foundations, and venture capitalists are all making significant investments in genomic research. This financing supports a wide range of studies, including some that require bespoke gene synthesis, which increases demand for these services. As genomic research focuses on precision medicine, which tailors treatments to individual genetic profiles, there is an increase in the demand for synthetic genes that can be utilized to produce tailored therapeutics. According to the National Human Genome Research Institute (NHGRI), genomics research is projected to generate between 2 and 40 exabytes of data over the next decade. The demand for tailored treatments is considerably impelling the gene synthesis market growth. Investments in genomic research result in a greater understanding of the genetic basis of diseases, allowing for the creation of new diagnostic tools and therapeutic techniques. These advancements frequently necessitate the creation of synthetic genes for experimental and validation purposes.

Gene Synthesis Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gene synthesis market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on method, services, application, and end use.

Analysis by Method:

- Solid-Phase Synthesis

- Chip-Based Synthesis

- PCR-Based Enzyme Synthesis

The latest gene synthesis market outlook indicates that solid-phase synthesis represents the largest market share of over 36.5% due to its efficiency, precision, and scalability. This method allows for the step-by-step addition of nucleotides on a solid substrate, ensuring high fidelity in creating complex genetic sequences. Its application spans research and commercial production, offering a reliable foundation for synthetic biology and genomics. The ability to produce high-purity synthetic genes at reduced costs while minimizing errors has made it a preferred choice for biotechnology companies and research institutes alike. Continuous advancements in automated systems further bolster its dominance in the market.

Analysis by Services:

- Antibody DNA Synthesis

- Viral DNA Synthesis

- Others

Antibody DNA synthesis stand as the largest component in 2024, holding around 60.5% of the market. The increasing impetus of monoclonal antibodies in diagnostics and therapeutics generates demand for antibody DNA synthesis services. Synthetic DNA development is the basis for the preparation of antibodies to be used for creating aimed treatments in cancer, autoimmune diseases, and infectious diseases. Furthering the advantage of yielding high-precision DNA synthesis is the emergence of engineered antibodies, such as bispecific and antibody-drug conjugates. Companies and research institutions are working toward antibody DNA synthesis for accelerated drug discovery and enhanced therapeutic efficacy.

Analysis by Application:

- Gene and Cell Therapy Development

- Vaccine Development

- Disease Diagnosis

- Others

Gene and cell therapy development continues to be the most important market segment for gene synthesis, holding a share of over 36.6%. This is especially when breakthroughs occur in the treatment of genetic disorders and cancers. Synthetic genes are fundamental to the construction of viral vectors, CAR-T cells, and so on, hence gene synthesis becomes necessary for such innovations. The rapidly increasing number of approved gene therapies and the birth of next-generation therapeutic products further testify to the intensive reliance on custom DNA synthesis. Investments by the big pharmaceuticals and governments, like the U.S. FDA's on speeding approval for gene therapy, strengthen this area of application.

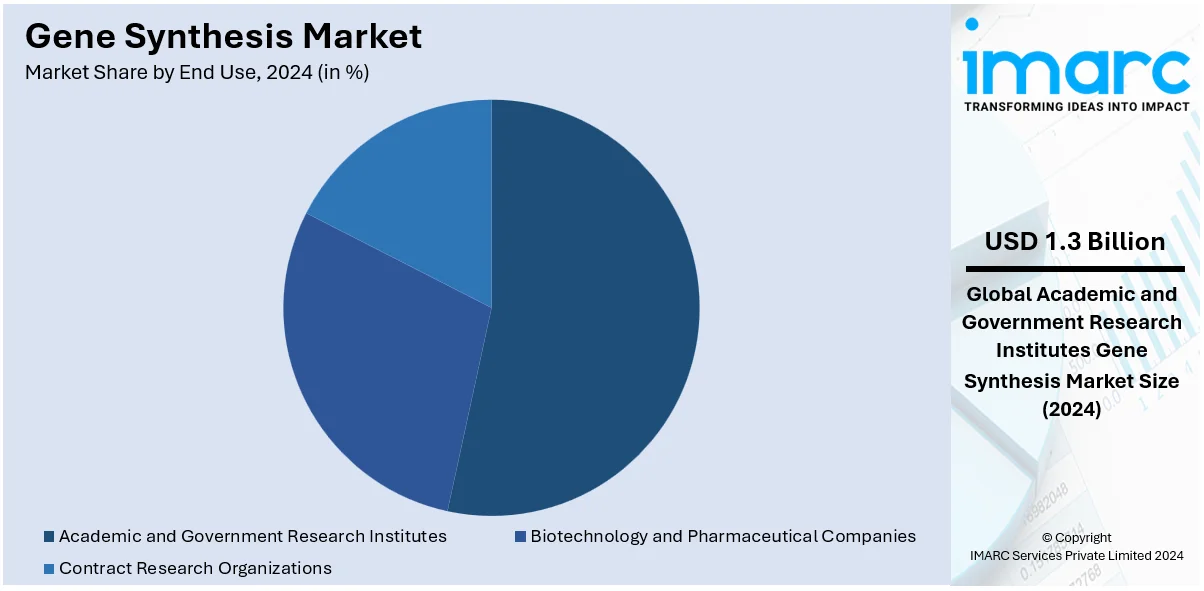

Analysis by End Use:

- Biotechnology and Pharmaceutical Companies

- Academic and Government Research Institutes

- Contract Research Organizations

Academic and government research institutes represent the largest market share of 54.0%. This growth is driven by their central role in advancing genomics and biotechnology. These institutions rely heavily on synthetic genes for research into functional genomics, genetic engineering, and molecular diagnostics. Government-backed genomic initiatives, such as the UK’s Genomics England and the NIH’s Human Genome Project, ensure a steady influx of research funding. Furthermore, partnerships between academic institutes and industry players for translational research amplify their market share.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Robust biotechnology and pharmaceutical industries, advanced healthcare infrastructure and high R&D investments have made North America the prime region having maximum market share of 39.5% for the gene synthesis Market. The involvement of major market players further strengthens this leadership. The continually growing market is also supported by the strong regulatory framework that the region creates toward innovative therapies, supplemented by government support such as that from the Advanced Research Projects Agency for Health (ARPA-H). More so, it is the gene synthesis’s wide usage across applications-from personalizing medicine to agricultural biotechnology-that makes North America a market leader.

Key Regional Takeaways:

United States Gene Synthesis Market Analysis

The US gene synthesis market has also grown significantly owing to rapid advancements in biotechnology and genomics. Another factor driving demand is the increasing interest in personalized medicine; as per a survey conducted, 69% of people in the US are interested in developing this approach. As a result, increased demand for gene therapies is witnessed from customers seeking gene-specific therapies for genetic disorders and diseases like cancer. The United States has a thriving biotechnology industry with major players and research institutions at the forefront of carrying out state-of-the-art research that relies significantly on gene synthesis services. In addition, the rising utilization of gene-editing technologies such as CRISPR also contributes to the market's growth. Funding and other support mechanisms from the government further strengthen the environment for the development of gene synthesis. In addition, the high incidence of genetic disorders and the need for new therapeutics are fueling the growth of gene synthesis in research and clinical applications. With a well-developed healthcare infrastructure and a qualified workforce, the U.S. remains at the forefront of the global market for gene synthesis, poised to be a leader in personalized medicine and genetic research.

Europe Gene Synthesis Market Analysis

The gene synthesis market in Europe is growing due to technological advancements, increasing investments in genetic research, and the ever-increasing demand for personalized therapies. The European market is bolstered by a robust presence of academic institutions and biotechnology companies driving advancements in gene synthesis technologies. The rising demand for gene therapies is fueled by the increasing prevalence of cancer in Europe. The number of new cancer cases rose by 2.3% from 2020, reaching 2.74 million in 2022. Cancer-related deaths also saw a 2.4% increase during the same period, as per estimates from the European Commission's European Cancer Information System. Such statistics make all the pressure more important to have innovative therapeutic solutions, including gene therapies and precision medicine, which depend heavily on gene synthesis. Other significant gene editing technologies, such as CRISPR, are gaining widespread adoption in both research and clinical applications. The strict regulatory environment within Europe has established clear guidelines on the development of gene-based therapies, promoting a safe and effective process. Furthermore, public-private partnerships are fueling the market, creating an impressive pipeline of gene synthesis applications. There are expectations that demand for targeted therapies and the field of regenerative medicine will provide Europe with great growth opportunities for its gene synthesis market.

Asia Pacific Gene Synthesis Market Analysis

The gene synthesis market in the Asia Pacific region is witnessing robust growth, fueled by advancements in biotechnology and the growing demand for personalized medicine. The pharmaceutical market in India reached USD 61.36 Billion in 2024, highlighting the region's expanding healthcare sector. This growth is fueling the adoption of gene synthesis technologies, as the need for tailored treatments and gene therapies intensifies. Nations like China and India are making substantial investments in research and development (R&D), which is boosting gene synthesis capabilities. The rising prevalence of genetic disorders, along with the growing demand for gene editing technologies like CRISPR, is also driving market growth. Additionally, government initiatives aimed at improving healthcare infrastructure and growing awareness of genetic research are creating favorable conditions for the gene synthesis market in APAC. This trend is expected to continue as biotechnology innovation accelerates in the region, further driving the demand for gene synthesis solutions.

Latin America Gene Synthesis Market Analysis

The gene synthesis market in Latin America is growing, fueled by the increasing demand for gene therapies and personalized medicine. According to industry reports, rare diseases, which are mainly genetic disorders, individually affect a small percentage of people but, in aggregate, impact about 350 Million people globally, including 40 to 50 Million in Latin America. This growing prevalence of rare diseases is pushing the need for advanced genetic research and therapies, creating a significant opportunity for gene synthesis technologies. Both government and private sector investments in biotechnology are steadily increasing, further propelling the gene synthesis market in the region.

Middle East and Africa Gene Synthesis Market Analysis

The gene synthesis market in the Middle East and Africa is expanding, fueled by growing investments in biotechnology and healthcare research. In the UAE, for instance, the prevalence of self-reported chronic diseases stands at 23.0%, with obesity (12.5%), diabetes (4.2%), and asthma/allergies (3.2%) being the most common, according to PubMed Central. These health challenges are driving the demand for gene therapies and personalized medicine, both of which depend on gene synthesis technologies. Additionally, increasing government support, along with collaborations with global biotech companies, is creating favorable conditions for market expansion. The region is set for substantial growth in gene synthesis applications.

Competitive Landscape:

Key players in the gene synthesis market are leading innovation and expanding their capabilities to meet the increasing demand across the biotechnology, pharmaceutical, and research sectors. Companies are making significant investments in research and development (R&D) to improve synthesis accuracy, lower costs, and accelerate turnaround times. They are integrating automation, AI, and machine learning into their platforms to optimize gene design and assembly processes. Strategic collaborations and partnerships are also a key focus, enabling players to combine expertise, access emerging markets, and broaden their service offerings. Several firms are emphasizing the development of high-throughput and cost-effective synthesis technologies to support applications like synthetic biology, gene editing, and vaccine development. Additionally, leading companies are concentrating on offering end-to-end solutions, including gene synthesis, cloning, and downstream applications such as antibody engineering and pathway analysis.

The report provides a comprehensive analysis of the competitive landscape in the gene synthesis market with detailed profiles of all major companies, including:

- ATUM

- Boster Biological Technology

- Eurofins Genomics

- Genewiz Inc. (Azenta Life Sciences)

- Genscript Biotech Corp.

- Integrated DNA Technologies Inc.

- Merck KGaA

- OriGene Technologies Inc.

- ProMab Biotechnologies Inc.

- ProteoGenix Inc

- Thermo Fisher Scientific Inc.

- Twist Bioscience

Latest News and Developments:

- October 2024: Twist Bioscience signed a USD 15 Million royalty agreement with XOMA Royalty, granting XOMA 50% of future milestone and royalty payments from existing biopharma collaborations. Twist retains all other revenues and rights to future agreements, excluding synthetic biology, NGS, and data storage. Twist’s silicon-based DNA synthesis platform advances gene production for applications in healthcare, agriculture, and research, supporting its growth in biopharma and gene synthesis innovation.

- September 2024: The Center for Health Security announced the Gene Synthesis Screening Information Hub, a new online platform dedicated to help nucleic acid synthesis providers, manufacturers, and customers to adhere to a new federal Framework aimed at preventing intentional misuse of synthetic nucleic acids and supporting safe scientific research practices in the United States.

- May 2024: Integrated DNA Technologies (IDT) has expanded its synthetic biology operations with a new 25,000-square-foot facility in Coralville, IA. The site doubles IDT's synthetic biology footprint and enhances its gene synthesis capabilities, including a planned rapid gene synthesis offering by late Q2. Located near IDT’s headquarters, the facility includes lab spaces, offices, and resources designed for lean, energy-efficient operations.

- December 2023: Evonetix Ltd. entered into a joint development and commercial supply agreement with Analog Devices, Inc. (ADI) to advance semiconductor-scale gene synthesis technology. The collaboration aimed to address limitations in DNA synthesis by developing a chip-based gene foundry capable of producing gene-length DNA in three days. This innovation was designed to accelerate the design-build-test cycle for biologics, including antibodies and vaccines, and enhance productivity in gene delivery.

- December 2022: Barcode Biosciences (BBS), a Bengaluru-based genomic company, has successfully synthesized artificial genes in-house, becoming the first biotech company in India to initiate end-to-end gene synthesis at a commercial scale.

Gene Synthesis Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Methods Covered | Solid-Phase Synthesis, Chip-Based Synthesis, PCR-Based Enzyme Synthesis |

| Services Covered | Antibody DNA Synthesis, Viral DNA Synthesis, Others |

| Applications Covered | Gene and Cell Therapy Development, Vaccine Development, Disease Diagnosis, Others |

| End Uses Covered | Biotechnology and Pharmaceutical Companies, Academic and Government Research Institutes, Contract Research Organizations |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ATUM, Boster Biological Technology, Eurofins Genomics, Genewiz Inc. (Azenta Life Sciences), Genscript Biotech Corp., Integrated DNA Technologies Inc., Merck KGaA, OriGene Technologies Inc., ProMab Biotechnologies Inc., ProteoGenix Inc, Thermo Fisher Scientific Inc., Twist Bioscience, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gene synthesis market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global gene synthesis market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gene synthesis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gene synthesis market was valued at USD 2.41 Billion in 2024.

IMARC estimates the gene synthesis market to exhibit a CAGR of 15.75% during 2025-2033.

The rising prevalence of various genetic disorders, increasing preference for gene therapeutics and personalized medicine, and inflating disposable income levels represent some of the key factors supporting the market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the gene synthesis market include ATUM, Boster Biological Technology, Eurofins Genomics, Genewiz Inc. (Azenta Life Sciences), Genscript Biotech Corp., Integrated DNA Technologies Inc., Merck KGaA, OriGene Technologies Inc., ProMab Biotechnologies Inc., ProteoGenix Inc, Thermo Fisher Scientific Inc., Twist Bioscience, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)