Gene Panel Market Size, Share, Trends and Forecast by Products and Services, Technique, Design, Application, End User, and Region, 2025-2033

Gene Panel Market Size and Share:

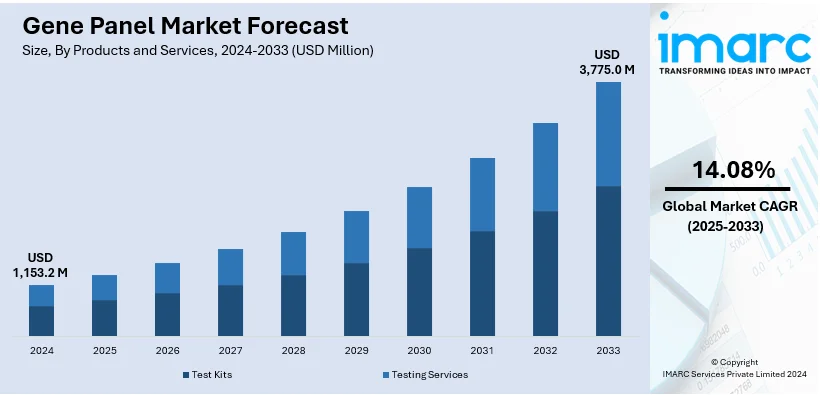

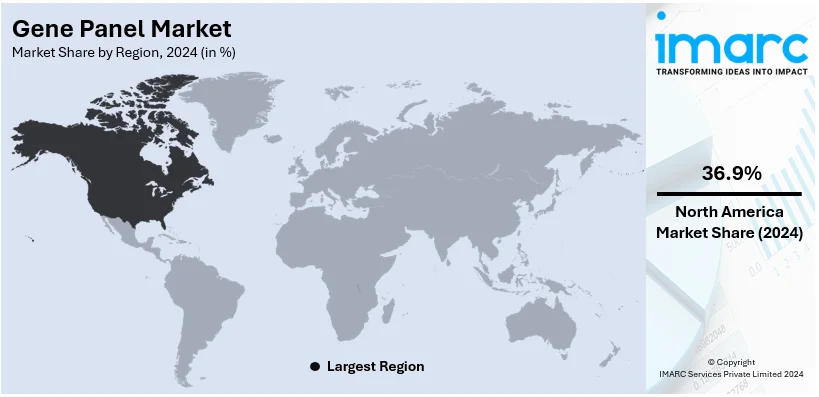

The global gene panel market size was valued at USD 1,153.2 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,775.0 Million by 2033, exhibiting a CAGR of 14.08% from 2025-2033. North America currently dominates the market, holding a market share of over 36.9% in 2024. This is chiefly propelled by its robust healthcare infrastructure, increase in genomic research efforts, and extensive utilization of next-generation sequencing technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,153.2 Million |

| Market Forecast in 2033 | USD 3,775.0 Million |

| Market Growth Rate (2025-2033) | 14.08% |

The global gene panel market is driven by advancements in precision medicine, rising prevalence of genetic disorders, and the increasing adoption of next-generation sequencing (NGS) technologies. Growing demand for personalized cancer therapies and the need for early detection of hereditary diseases further propel market growth. Moreover, declining costs of genetic testing and expanding applications in oncology, pharmacogenomics, and rare disease research support the market’s expansion. Additionally, favorable regulatory frameworks, robust research funding, and technological innovations in genomic tools enhance the accessibility and efficiency of gene panels, solidifying their role in clinical diagnostics and research applications.

The United States is a dominant force in the global gene panel market, driven by advanced healthcare infrastructure, significant investments in genomic research, and widespread adoption of precision medicine. The high prevalence of genetic disorders and cancer fosters demand for gene panels in diagnostics and treatment planning. For instance, according to the National Cancer Institute, 2,001,140 new cancer cases are expected to be diagnosed in the U.S. during 2024, with 611,720 estimated deaths. In addition to this, government initiatives, such as funding for genomic projects and regulatory support, further propel market growth. Besides, the presence of leading biotechnology firms and research institutions accelerates innovation and adoption of gene panel technologies. Furthermore, the country's focus on personalized healthcare ensures its continued leadership in this market.

Gene Panel Market Trends:

The rising incidences of hereditary disorders and cancer across the globe represent the primary factor driving the market growth. According to WHO, genetic disorders and congenital abnormalities impact 2%-5% of live births, contributing significantly to pediatric hospitalizations and childhood mortality, highlighting the importance of gene panels for precise diagnosis and effective intervention strategies in the Eastern Mediterranean Region. Besides this, there is a significant increase in demand for efficient diagnostic methods among clinicians to understand the genetic predisposition of any cancer or other known genetic disorders to determine better disease prognostics and therapeutics. Consequently, the escalating need for genetic screening to take presumptive actions for reducing the mortality rate due to genetic disorders has augmented the product demand. In addition, the surging popularity of predesigned and customizable gene panels, along with direct-to-consumer genetic testing kits that do not require extensive laboratory setup or personnel, has propelled the market growth. Furthermore, numerous biopharmaceutical and biotechnology companies are heavily investing in research and development (R&D) activities to develop targeted therapies for cancer treatment. For instance, targeted cancer therapies, leveraging monoclonal antibodies, small molecule inhibitors, and immunotherapy, enhance survival for select cancers, though only 8% of advanced cancer patients qualify. Gene panels optimize these therapies by identifying actionable genetic biomarkers, advancing personalized, tumor-agnostic treatments. In line with this, the increasing usage of gene panel techniques to discover new cancer therapies has catalyzed market growth. Moreover, the emerging applications of gene panels for pre-gestational, prenatal, and neonatal screening procedures are contributing to market growth. Other factors, including the launch of nationwide screening programs by governments of various countries, the minimally invasive nature of gene panels, the rising prevalence of congenital diseases, and continual technological advancements in diagnostics services and methods, are also anticipated to provide a positive thrust to the market growth.

Gene Panel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gene panel market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on products and services, technique, design, application, and end user.

Analysis by Products and Services:

- Test Kits

- Testing Services

Test kits stand as the largest component in 2024, holding around 60.5% of the market. This segment is principally driven by their ease of use, accuracy, and growing adoption in clinical diagnostics. These kits offer pre-validated and standardized solutions, streamlining workflows for healthcare providers and researchers. Moreover, the increasing focus on early detection of genetic disorders and personalized medicine fuels demand for test kits across diagnostic laboratories and hospitals. Advancements in technology, including next-generation sequencing (NGS), enhance the reliability and speed of these kits, further expanding their utility. In addition, regulatory approvals for novel test kits and growing consumer awareness of genetic testing contribute to the segment's growth. As healthcare providers increasingly integrate gene panels into routine diagnostics, test kits remain a cornerstone for expanding the market.

Analysis by Technique:

- Amplicon-based Approach

- Hybridization-based Approach

Amplicon-based approach leads the market with around 79.2% of market share in 2024. This is attributed to its high efficiency, cost-effectiveness, and suitability for targeted sequencing. This method simplifies sample preparation while ensuring high accuracy in detecting genetic mutations. Furthermore, its applicability across oncology, inherited diseases, and pharmacogenomics research strengthens its market position. Moreover, the reduced sequencing turnaround time and lower sample input requirements make this technique attractive for clinical laboratories and research institutions. Continuous advancements in sequencing technologies and software tools further optimize the amplicon-based approach, enhancing its precision and reliability. Additionally, the growing focus on tailored cancer therapies and expanding use of targeted sequencing solidify its dominance within this segment.

Analysis by Design:

- Predesigned Gene Panel

- Customized Gene Panel

Predesigned gene panel leads the market with around 66.5% of market share in 2024. This leadership is owned to its efficiency and cost-effectiveness in identifying specific genetic mutations. These panels are extensively used in diagnostics and research, offering a ready-to-use solution for common genetic testing needs. Their standardized design ensures reliable results, making them a preferred choice among laboratories and healthcare providers. Moreover, predesigned panels reduce the need for custom development, enabling faster implementation in clinical workflows. Increasing adoption in oncology and rare disease research further drives demand for these panels. Moreover, the availability of a wide array of predesigned panels targeting specific genes or pathways supports their leadership in the global gene panel market.

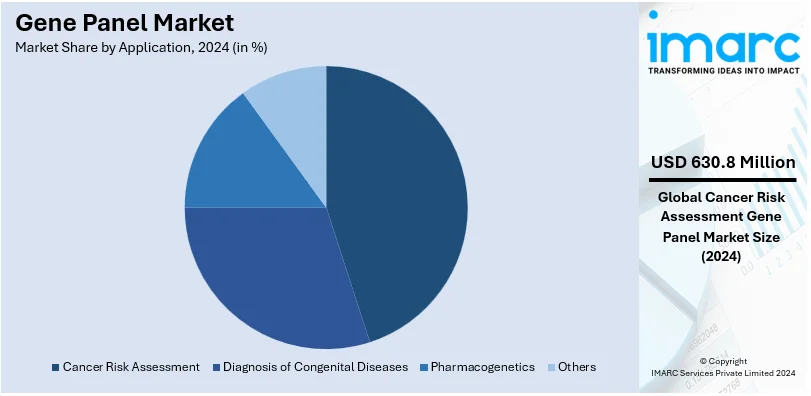

Analysis by Application:

- Cancer Risk Assessment

- Diagnosis of Congenital Diseases

- Pharmacogenetics

- Others

Cancer risk assessment stand as the largest component in 2024, holding around 54.7% of the market. This segment is propelled by rising cancer prevalence and the need for early detection strategies. Gene panels enable comprehensive analysis of hereditary cancer syndromes, aiding personalized treatment planning and preventive care. Furthermore, increased awareness of genetic predisposition and advancements in precision medicine encourage widespread adoption of gene panels in oncology. In addition to this, regulatory endorsements and insurance coverage for genetic testing bolster this application area. Moreover, the integration of gene panel testing into routine cancer care protocols highlights its essential contribution to advancing treatment results and optimizing patient care.

Analysis by End User:

- Academic and Research Institutes

- Hospital and Diagnostic Laboratories

- Pharmaceutical and Biotechnology Companies

Academic and research institutes lead the market with around 42.8% of market share in 2024. The segment is chiefly driven by their extensive focus on genetic research and innovation. These institutes utilize gene panels for studying disease mechanisms, identifying novel biomarkers, and developing advanced therapies. Furthermore, significant funding from government agencies and private organizations supports large-scale genomic projects, contributing to the dominance of this segment. The demand for gene panels in academic settings is further amplified by collaborations with biopharmaceutical companies for drug development and clinical trials. With advancements in genomics and bioinformatics, research institutes remain key players in driving the evolution of the global gene panel market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.9%. North America dominates the global gene panel market mainly because of extensive utilization of next-generation sequencing technologies, its leading-edge healthcare infrastructure, and elevated investments in genomic research. The region's robust emphasis on customized healthcare solutions and precision medicine bolsters the need for gene panels in managing as well as detecting cancers or genetic disorders. Magnifying incidences of chronic disorders, majorly including cardiovascular conditions and cancer, further fosters market expansion. For instance, 247,100 individuals in Canada are anticipated to be diagnosed with cancer in the year 2024, with 88,100 estimated deaths. In addition, the resilient presence of major market players and strong research funding boosts advancements in gene panel technologies, whereas beneficial regulatory policies incentivize their clinical deployment. The United States, in particular, plays a critical role in this regional market, owing to its well-established biotechnology segment and amplifying emphasis on personalized medicine ventures. Canada also contributes through heavy government funding and research efforts in genomics, fortifying North America's domination in the gene panel market.

Key Regional Takeaways:

United States Gene Panel Market Analysis

In 2024, United States accounted for 75.90% of the market share in North America. The increasing occurrence of genetic diseases and cancer is promoting the use of gene panels throughout the United States. Progress in precision medicine, along with strong research financing, is driving the need for targeted diagnostics. The incorporation of genomic data into clinical workflows within the healthcare system is boosting the use of gene panels. Encouraging regulatory frameworks and reimbursement policies promote innovations in panel design and access. Collaborations and partnerships between academic institutions and biotech firms are accelerating advancements in next generation sequencing technologies, improving diagnostic efficiency. Moreover, the demand for personalized treatment approaches is driving healthcare providers to utilize multigene panels for comprehensive genetic assessment. For instance, in December 2020, The number of personalized medicines in the U.S. market more than doubled from 132 to 286 between 2016 and 2020, highlighting a record 4-year growth rate. This surge underscores the potential of gene panels in tailoring treatments to individual biological profiles, offering significant advancements in precision medicine. Increasing consumer knowledge regarding genetic testing for inherited disorders is also crucial. The significant uptake of sophisticated diagnostic instruments in oncology and cardiology fosters market growth

Europe Gene Panel Market Analysis

Europe's gene panel market is expanding due to the increasing focus on rare disease diagnosis and cancer research across the region. The adoption of cutting-edge genetic testing tools in clinical settings is gaining traction as hospitals and diagnostic centres recognize the value of multi-gene panels for delivering accurate and time-efficient results. The Europe’s robust pharmaceutical sector is also utilizing gene panels in drug development and companion diagnostic applications, driving demand for highly customizable and targeted solutions. Additionally, advancements in sequencing platforms and bioinformatics technologies are making it easier to analyse complex genomic data, which is critical for the growing field of genetic research. Academic collaborations and multinational research industries are playing a pivotal role in developing innovative gene panel designs tailored to specific medical needs. According to EU, In 2023, Europe allocated approximately USD 408 Billion to research and development, maintaining an R&D-to-GDP ratio of 2.25%, with the business sector leading at 1.50%. This substantial investment supports advancements in the medical sector, enhancing the development of gene panels to improve diagnostic precision and therapeutic outcomes. The emphasis on precision diagnostics in oncology and other specialized fields is further fuelling market growth. Moreover, the strong presence of manufacturers focusing on continuous innovation and affordable solutions is boosting market penetration. A greater emphasis on integrating genetic testing into primary care is enhancing the adoption of gene panels for non-oncological applications, such as cardiology and metabolic disorders, further diversifying the market's potential across Europe.

Asia Pacific Gene Panel Market Analysis

The gene panel market in the Asia-Pacific region is experiencing substantial growth, fueled by rising awareness of genetic testing within the urban community. The quickly advancing healthcare infrastructure in nations such as China and India facilitate the implementation of gene panels in diagnostic environments. According to ITA, the Indian healthcare sector, valued at USD 370 Billion in 2022 and projected to exceed USD 610 Billion by 2026, is undergoing transformative growth driven by rising incomes, health insurance penetration, and government investments. this expanding infrastructure supports advancements in diagnostic technologies, including gene panels, by facilitating accessibility to high-quality medical equipment. enhanced healthcare facilities are poised to improve early detection and treatment outcomes across diverse populations. Government programs supporting genomics research are enabling the advancement of regional diagnostic technologies. The growing incidence of lifestyle-related diseases and genetic conditions is driving the adoption of specific genetic panels. Competitive pricing from local players makes these diagnostics available to more extensive populations.

Latin America Gene Panel Market Analysis

The gene panel sector in Latin America is experiencing growth due to heightened awareness of genetic issues and a rising occurrence of complicated diseases, including hereditary cancers and uncommon disorders. According to reports, the COVID-19 pandemic led to a 5-12% reduction in expected cancer mortality rates in Brazil from 2020-2022, with stomach cancer showing the most significant decline. Gene panels benefit by identifying high-risk populations, optimizing treatment prioritization, and addressing gaps revealed by lower-than-anticipated mortality trends. The area is experiencing an increasing demand for precise and effective diagnostic tools as healthcare professionals aim to enhance patient results. The engagement of global diagnostic firms in the area is bringing sophisticated gene panel technologies that address regional clinical requirements. Moreover, partnerships between universities and biotechnology companies in different regions are improving research abilities, promoting the creation of cost-effective and accessible gene panels. The growing dependence on contemporary sequencing technologies and analytical instruments is further promoting the use of gene panels in Latin America.

Middle East and Africa Gene Panel Market Analysis

In the Middle East and Africa, the gene panel market is driven by the rising burden of inherited disorders and non-communicable diseases, necessitating advanced diagnostic solutions. The adoption of innovative testing tools, including gene panels, is expanding as healthcare institutions strive to address complex cases with precise and efficient methods. For instance, Saudi Arabia's healthcare system, serving over 34 Million people, has achieved notable progress with approximately USD 39.2 Billion in spending, 460+ hospitals, and improved quality metrics like life expectancy (74 years) and reduced infant mortality (5.3 per 1,000). These advancements provide a strong foundation for leveraging gene panels, enhancing personalized medicine and diagnostic accuracy across the healthcare infrastructure. The market benefits from the growing entry of international diagnostic providers introducing tailored solutions for genetic analysis. Additionally, collaborations between local research institutions and global firms are fostering the development of region-specific panels that account for unique genetic variations. The availability of advanced genomic platforms and data analysis systems is further supporting the adoption of gene panels in both clinical and research contexts across the region.

Competitive Landscape:

The market is represented by intense competition, mainly influenced by the establishment of leading companies and growing innovators. Key players are actively emphasizing tactical acquisitions, partnerships, and product innovation to fortify their market position. For instance, in October 2024, Pillar Biosciences Inc. announced the expansion of its strategic collaboration with Illumina. As per partnership agreement, a wider range of Pillar’s oncoReveal NGS panels will be accessible directly through Illumina. Numerous oncology panels from Pillar will feature as part of the certified libraries available on the MiSeq i100 Series sequencing platform. Furthermore, industry leaders are heavily investing in research and development projects to improve next-generation sequencing technologies and proliferate their product offerings. Collaborations with both healthcare providers and academic institutions further foster innovations in diagnostic applications. Moreover, regulatory certifications and geographic extension remain critical strategies for competitive augmentation. In addition to this, emerging firms are utilizing cost-efficient solutions and niche applications to attain significant market share.

The report provides a comprehensive analysis of the competitive landscape in the gene panel market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- BGI Genomics Co. Ltd. (BGI Group)

- Eurofins Scientific SE

- F. Hoffmann-La Roche AG

- Genewiz LLC (Azenta Inc.)

- Illumina Inc.

- Integrated DNA Technologies Inc. (Danaher Corporation)

- Novogene Co. Ltd.

- Qiagen N.V.

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- February 2024: Roche Diagnostics unveiled an enhanced hereditary cancer gene panel featuring over 100 genes associated with diverse cancer syndromes. The updated panel incorporates recently identified cancer-related genes, improving diagnostic precision. Enhanced variant interpretation capabilities provide deeper insights into genetic predispositions. This advancement supports more personalized and effective cancer risk assessments.

- April 2024: Twist Bioscience launched a new service enabling researchers to design and order customized gene panels efficiently. Leveraging proprietary DNA synthesis technology, the service delivers bespoke panels tailored to specific research goals. Orders are completed in weeks, streamlining the process for genetic studies. This innovation empowers faster exploration of genetic phenomena in various research domains.

- December 2023: Qiagen introduced a gene panel focused on neurological conditions, including Alzheimer’s, Parkinson’s, and ALS. The panel aims to advance research on genetic contributors to these diseases and their progression. It also supports the development of targeted treatments by identifying precise genetic markers. This tool represents a significant step toward addressing complex neurological disorders.

- April 2023: Agilent Technologies introduced a next-generation sequencing (NGS) assay tailored for somatic variant profiling in diverse solid tumors. The assay supports precision oncology by enabling comprehensive genomic profiling (CGP). This development enhances the detection of genetic alterations linked to cancer progression and treatment responses. It underscores Agilent's commitment to advancing personalized cancer care and diagnostic innovation.

- May 2023: Unipath Specialty Laboratory in India launched the HRD Gene Panel powered by SOPHiA GENETICS technology. This innovation aids in identifying homologous recombination deficiencies (HRD), crucial in cancer treatment planning. The panel represents a significant step toward improving cancer genomics and fostering advanced diagnostic capabilities. It aligns with efforts to integrate global technologies into local healthcare systems.

Gene Panel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products and Services Covered | Test Kits, Testing Services |

| Techniques Covered | Amplicon-based Approach, Hybridization-based Approach |

| Designs Covered | Predesigned Gene Panel, Customized Gene Panel |

| Applications Covered | Cancer Risk Assessment, Diagnosis of Congenital Diseases, Pharmacogenetics, Others |

| End Users Covered | Academic and Research Institutes, Hospital and Diagnostic Laboratories, Pharmaceutical and Biotechnology Companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., BGI Genomics Co. Ltd. (BGI Group), Eurofins Scientific SE, F. Hoffmann-La Roche AG, Genewiz LLC (Azenta Inc.), Illumina Inc., Integrated DNA Technologies Inc. (Danaher Corporation), Novogene Co. Ltd., Qiagen N.V., Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gene panel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global gene panel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gene panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A gene panel is a diagnostic tool that analyzes a specific set of genes associated with particular diseases or conditions. It allows for targeted genetic testing, enabling accurate identification of mutations. Gene panels are widely used in healthcare for personalized medicine, cancer research, and inherited disorder diagnosis.

The gene panel market was valued at USD 1,153.2 Million in 2024.

IMARC estimates the global gene panel market to exhibit a CAGR of 14.08% during 2025-2033.

The market is driven by advancements in precision medicine, increasing prevalence of genetic disorders, and growing demand for personalized cancer therapies. Rising adoption of next-generation sequencing (NGS) and declining costs of genetic testing further propel market growth, alongside supportive regulatory frameworks and technological innovations.

In 2024, test kits represented the largest segment by product and service, driven by widespread use in diagnostics and ease of accessibility.

Amplicon-based approach leads the market by technique, driven by its simplicity and cost-effectiveness.

The predesigned gene panel is the leading segment by design, driven by convenience and standardized protocols.

In 2024, cancer risk assessment represented the largest segment by application, driven by rising cancer prevalence and the need for early detection.

Academic and research institutes lead the market by end user, driven by increasing research activities and genomic advancements.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global gene panel market include Agilent Technologies Inc., BGI Genomics Co. Ltd. (BGI Group), Eurofins Scientific SE, F. Hoffmann-La Roche AG, Genewiz LLC (Azenta Inc.), Illumina Inc., Integrated DNA Technologies Inc. (Danaher Corporation), Novogene Co. Ltd., Qiagen N.V., Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)