GCC Wearable Medical Devices Market Size, Share, Trends and Forecast by Product, Site, Application, Grade Type, Distribution Channel and Country, 2025-2033

GCC Wearable Medical Devices Market Size and Share:

The GCC wearable medical devices market size was valued at USD 856.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2070.42 Million by 2033, exhibiting a CAGR of 9.40% from 2025-2033. The GCC wearable medical devices market share is experiencing rapid growth, driven by technological advancements, increased focus on preventive healthcare, and strong government support for digital health initiatives, leading to widespread adoption of wearable devices for monitoring chronic conditions and enhancing overall health management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 856.8 Million |

| Market Forecast in 2033 | USD 2070.42 Million |

| Market Growth Rate (2025-2033) | 9.40% |

The global GCC wearable medical devices market growth is driven primarily due to accelerating needs for remote health care solutions coupled with growing uses of digital technologies in health services. Shifting trends towards at-home care-the increased desire by many people today to opt for home and personal health-and its drive from a comfort-loving culture is fueling demand for home use of continuously monitored vital-sign wearables. With the advancement in wireless technology and the availability of internet-enabled devices, consumers and healthcare providers can monitor health metrics including blood pressure, heart rate, and glucose levels. For instance, In November 2024, companies like Gulf Drug launched the EOFlow wearable insulin pump in the UAE, contributing to advancements in diabetes management in the GCC region. Moreover, the intensifying rates of chronic diseases, such as diabetes, hypertension, and cardiovascular conditions increase the demand for more effective monitoring tools that would detect early complications, thus lowering hospital visits and improving patient outcomes.

Another major driving force is increasing health awareness in the population. People are getting more proactive in maintaining their health and fitness. Preventive healthcare among the younger generation, who are tech-savvy, is also on the rise, bolstering the demand for wearable devices that provide real-time data and insights. The healthcare systems in the GCCs are now enhancing their focus on the care of quality access and optimizing healthcare delivery, which hampers the gradual acceptance of wearable technologies. Innovative product offerings, wristbands, smartwatches, and health-monitoring sensors have led to escalating mainstreaming of these devices with support from regulatory clauses for health technology. This is therefore contributing to the growth of the market as consumers and healthcare providers realize the advantage of integrating wearable devices into the management of healthcare.

GCC Wearable Medical Devices Market Trends:

Technological Advancements in Wearable Medical Devices

Technological innovation will be a dominant trend propelling the GCC wearable medical devices market outlook. Advanced sensors and artificial intelligence (AI) in combination with machine learning (ML) algorithms can change the future of health care monitoring using wearables. The potential in such wearable medical devices now can be achieved for better data delivery, the onset of symptoms indicating a potential condition, or a predictive insight on health risk possibilities. For instance, wearable devices with integrated ECG sensors or the functions of blood glucose monitoring enable users to monitor their health in real-time and respond accordingly. Furthermore, advances in battery technologies and wireless communication protocols, such as BLE, have made these devices more usable and expand the possibilities of the product by making it more efficient, long-lasting, and providing constant health insights without the need for frequent recharging or information loss.

Rising Focus on Preventive Healthcare

The need for preventive health is on the rise in the GCC region, and wearable medical devices are regarded as crucial in proactive health management. There is heightening awareness among the public on early detection and intervention, thus investing in wearable devices that can report on regular monitoring of their health metrics. These devices track key parameters, like heart rate and activity, to monitor sleep and other activities of daily life that can potentially allow for the earlier detection of certain health conditions that may turn critical if not diagnosed promptly. Wearable medical devices play a very positive role in prevention of chronic diseases in the GCC region, given the increasing rates of lifestyle diseases, such as obesity and diabetes. As people take care of their health, the requirement for devices providing accurate health information and insights accelerates the market's growth.

Government Support and Healthcare Infrastructure Expansion

The GCC region is witnessing significant investment in healthcare infrastructure, and the government is also showing intensifying support for uptake in health technologies. As part of the goals of the Vision 2030, the regions are focusing on improving the quality of healthcare services and access to medical care through digital health solutions. For instance, in January 2025, government initiatives like Abu Dhabi’s home care model and the UAE’s updated smart patient platform have significantly boosted digital healthcare adoption, improving access to remote patient care. Moreover, this encompasses public health systems through the integration of wearable medical devices to enhance the monitoring of remote patients, reducing hospital visits and enhancing efficiency in healthcare delivery. The government support initiatives and their regulatory frameworks supporting innovation in medical technology are making for a favorable ecosystem for wearable device manufacturers. Further, healthcare insurance schemes that offset the costs of wearable devices accelerate the growth rate of the market as individuals and healthcare providers will easily be able to incorporate such devices into everyday healthcare practices.

GCC Wearable Medical Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC wearable medical devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, site, application, grade type, and distribution channel.

Analysis by Product:

- Diagnostic Devices

- Vital Sign Monitoring Devices

- Heart Rate Monitors

- Activity Monitors

- Electrocardiographs

- Pulse Oximeters

- Spirometers

- Blood Pressure Monitors

- Others

- Sleep Monitoring Devices

- Sleep Trackers

- Wrist Actigraphs

- Polysomnographs

- Others

- Electrocardiographs Fetal and Obstetric Devices

- Neuromonitoring Devices

- Electroencephalographs

- Electromyographs

- Others

- Vital Sign Monitoring Devices

- Therapeutic Devices

- Pain Management Devices

- Neurostimulation Devices

- Others

- Insulin/Glucose Monitoring Devices

- Insulin Pumps

- Others

- Rehabilitation Devices

- Accelometers

- Sensing Devices

- Ultrasound Platform

- Others

- Respiratory Therapy Devices

- Ventilators

- Positive Airway Pressure (PAP) Devices

- Portable Oxygen Concentrators

- Others

- Pain Management Devices

Diagnostic devices dominate the GCC wearable medical devices market forecast, accounting for an impressive 63.5% market share. These devices have gained popularity with the choice of monitoring and controlling essential health parameters, like heart rate and blood pressure, by dynamically regulating oxygen saturation. This is especially due to boosting trend of chronic diseases, such as cardiovascular disorders and diabetes, which forms the need for proper diagnosis in clinical and personal stages as well. Advanced technologies, including artificial intelligence (AI) and Internet of Things (IoT), further enhance their functionality by providing real-time insights and remote monitoring capabilities. Devices like vital sign monitors, sleep trackers, and electrocardiographs are particularly popular among healthcare providers and consumers seeking preventative care solutions. Moreover, government initiatives aimed at digital healthcare transformation and increasing health awareness among the population contribute to their widespread adoption. This strong demand thus positions diagnostic devices at the core of the wearable medical devices market in the GCC region.

Analysis by Site:

- Handheld

- Headband

- Strap/Clip/Bracelet

- Shoe Sensors

- Others

These portable wearable healthcare devices are of the size with ease in accessibility to monitor patients' health by including glucometers, blood pressure checkup, or pulse oxymeters. That enables tracking vital signs at the pocket, which easily boost the popularities of people within both domestic and professional lives of healthcare and its facilities.

Headband-wearable medical devices are mainly intended for monitoring the activity of the brain and the analysis of sleep. Equipped with advanced sensors, they are used to measure parameters such as EEG signals and sleep quality. They are also highly used to manage stress and for neurofeedback therapies and for improving sleep hygiene in a more comfortable and effective manner.

Combination of style and functionality are part of straps, clips, and bracelets, which are some of the most popular wearable devices for medical purposes. These devices track essential health metrics, including vital signs, physical activity, and sleep patterns. They are light, of ergonomic shape, and quite useful for everyday use by fitness enthusiasts and individuals suffering from chronic health issues.

Shoe sensors are the innovative wearable technologies designed to track movement and posture. They are often used by athletes and people undergoing physiotherapy, where parameters like gait, balance, and activity levels are recorded. These sensors are valuable for monitoring mobility and optimizing performance or recovery processes effectively.

This category encompasses diverse wearable medical devices, including smart rings, chest patches, and smart clothing. These devices cater to niche requirements such as continuous ECG monitoring, hydration tracking, and temperature regulation. Their specialized features and applications make them essential tools in advanced and personalized healthcare.

Analysis by Application:

- Sports And Fitness

- Remote Patient Monitoring

- Home Healthcare

Remote patient monitoring is the leading application segment in the GCC wearable medical devices market, accounting for 46.5% of the total share. Growth in the Japan agriculture equipment market is taking place due to an increased patient-centric approach in care and an urgent need to manage chronic diseases effectively. Wearable devices designed for remote monitoring provide real-time data on vital health parameters, enabling healthcare providers to make timely decisions. These devices are particularly beneficial for patients managing conditions such as hypertension, diabetes, and cardiovascular diseases. The convenience of tracking health metrics from home has enhanced patient compliance and reduced the need for frequent hospital visits. Furthermore, advancements in telemedicine and digital health integration have strengthened the use of wearable medical devices for remote monitoring. With a growing emphasis on preventive healthcare and personalized medicine, this segment is poised to expand further, reshaping how healthcare services are delivered in the region.

Analysis by Grade Type

- Consumer-Grade Wearable Medical Devices

- Clinical Wearable Medical Devices

Consumer-grade wearable medical devices dominate the GCC market with a commanding share of 66.5%, driven by the high adoption of health and fitness gadgets. These devices, including smartwatches, fitness trackers, and health bands, appeal to a wide audience ranging from fitness enthusiasts to individuals seeking to monitor chronic conditions. Their user-friendly interfaces, affordability, and ability to integrate with smartphones and apps have made them a preferred choice among consumers. The continuous evolution of features, such as heart rate monitoring, step counting, and sleep tracking, has further boosted their demand. As consumers become more health-conscious, the emphasis on preventive care has increased, solidifying the market for consumer-grade devices. The segment's popularity is also supported by the availability of a variety of options across different price ranges, making wearable medical technology more accessible to a broader audience.

Analysis by Distribution Channel:

- Pharmacies

- Online Channel

- Hypermarkets

Pharmacies lead the distribution channel for wearable medical devices in the GCC market, holding a substantial share of 42.5%. Pharmacies are trusted sources of medical products. Consumers can easily get a variety of wearable devices through pharmacies. They can give advice on how to select and use wearable medical devices, which is one of the attractions. Pharmacies also serve as a convenient point for consumers to purchase devices alongside other health-related products, enhancing their market dominance. The growing trend of equipping pharmacies with advanced diagnostic devices for demonstration purposes has further heightened consumer awareness and adoption rates. In addition, partnerships between pharmacies and wearable device manufacturers have streamlined the availability of the latest models. As wearable medical devices become integral to personal healthcare, pharmacies are expected to continue as a leading distribution channel, capitalizing on their reputation and accessibility.

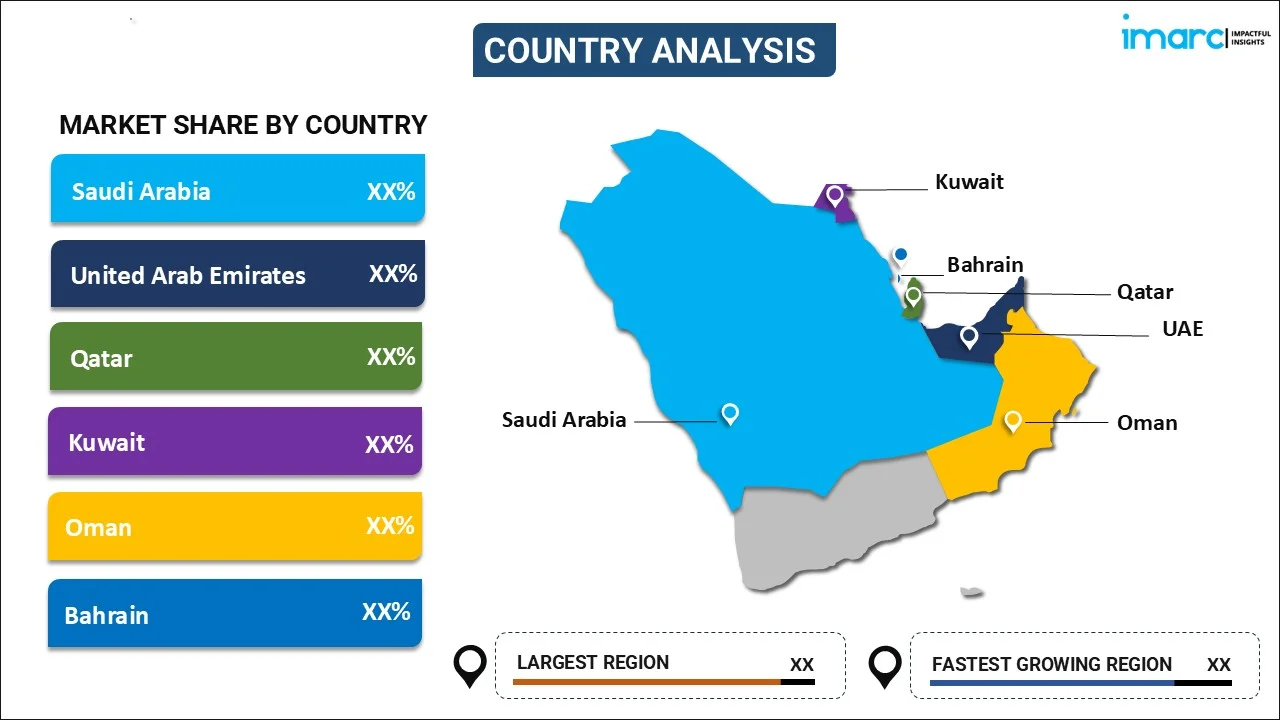

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia leads the GCC wearable medical devices market, contributing 32.5% of the total share. The country's leadership is driven by its robust healthcare infrastructure, a growing population with increasing health awareness, and strong government initiatives promoting digital health adoption. Saudi Arabia’s Vision 2030 emphasizes the modernization of healthcare services, including the integration of innovative technologies like wearable medical devices. The high prevalence of lifestyle-related diseases such as diabetes and cardiovascular disorders has further spurred demand for these devices, as they offer effective solutions for monitoring and managing health. Additionally, the availability of advanced devices and the presence of major manufacturers in the region have strengthened the market. With continued investments in healthcare technology and a rising focus on preventive care, Saudi Arabia is well-positioned to maintain its dominance in the GCC wearable medical devices market.

Competitive Landscape:

The competitive landscape of the wearable medical devices market is characterized by intense competition, driven by rapid technological advancements and innovation. Key players focus on developing multifunctional devices that combine diagnostic and therapeutic capabilities while ensuring user-friendly interfaces and portability. Companies are also heavily investing in research and development (R&D) to integrate artificial intelligence (AI) and machine learning (ML) for enhanced data accuracy and real-time monitoring. Common strategies to expand market presence and diversify product portfolios include partnerships and collaborations with healthcare providers and tech firms. Additionally, manufacturers are leveraging distribution channels like e-commerce platforms and retail outlets to reach a broader audience. The market's ever-changing nature drives constant evolution, as both established players and new entrants compete for consumer favor.

The report provides a comprehensive analysis of the competitive landscape in the GCC wearable medical devices market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, OMRON Healthcare will launch its FDA-approved blood pressure monitors featuring AI-powered atrial fibrillation (AFib) detection with IntelliSense™ technology. This innovation aims to enhance AFib screening accessibility, aligning with OMRON's mission to eliminate heart attacks and strokes through advanced healthcare solutions.

- In November 2024, Samsung Gulf Electronics introduced enhanced health features for Galaxy Watch users across the GCC, including Bahrain, Qatar, Kuwait, and Oman. The update offers advanced tools like ECG monitoring, heart rate alerts, and FDA-approved sleep apnea detection, empowering users with professional-grade health tracking on their wrists.

- In August 2024, Medtronic received FDA approval for its Simplera™ CGM, a compact and disposable glucose monitoring device. The company also announced a global partnership with Abbott to integrate Abbott's CGM technology with Medtronic's insulin delivery systems. This collaboration aims to enhance innovation and accessibility in diabetes care on a global scale.

GCC Wearable Medical Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sites Covered | Handheld, Headband, Strap/Clip/Bracelet, Shoe Sensors, Others |

| Applications Covered | Sports And Fitness, Remote Patient Monitoring, Home Healthcare |

| Grade Types Covered | Consumer-Grade Wearable Medical Devices, Clinical Wearable Medical Devices |

| Distribution Channels Covered | Pharmacies, Online Channel, Hypermarkets |

| Countries Covered | Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC wearable medical devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC wearable medical devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC wearable medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC wearable medical devices market was valued at USD 856.8 Million in 2024.

The prevalence of chronic diseases, improved health awareness, new technologies, and government healthcare policies and remote monitoring of patients contribute to the increasing growth of wearable medical devices in the GCC. Moreover, the aging population, coupled with improved healthcare infrastructure and digital health adoption, helps the market expand. The adoption of AI, IoT, and wearable devices for real-time health monitoring plays a key role in driving this growth.

IMARC Group estimates the market to reach USD 2070.42 Million by 2033, exhibiting a CAGR of 9.40% from 2025-2033.

Pharmacies lead the distribution channel for wearable medical devices in the GCC market, as it is a trusted source for medical products, offering consumers easy access to a wide range of wearable devices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)