GCC Water and Waste Water Treatment Chemicals Market Report by Product Type (Coagulants and Flocculants, Biocides, Corrosion and Scale Inhibitor, Defoamer, PH Adjuster, and Others), Application (Cooling Water, Boiler Water, Membrane Water, Municipal, and Others), End User (Oil and Gas, Power, Mining, Pulp and Paper, Chemical and Fertilizer, Pharmaceutical, Municipal, Textile, Food and Beverages, and Others), and Country 2025-2033

Market Overview:

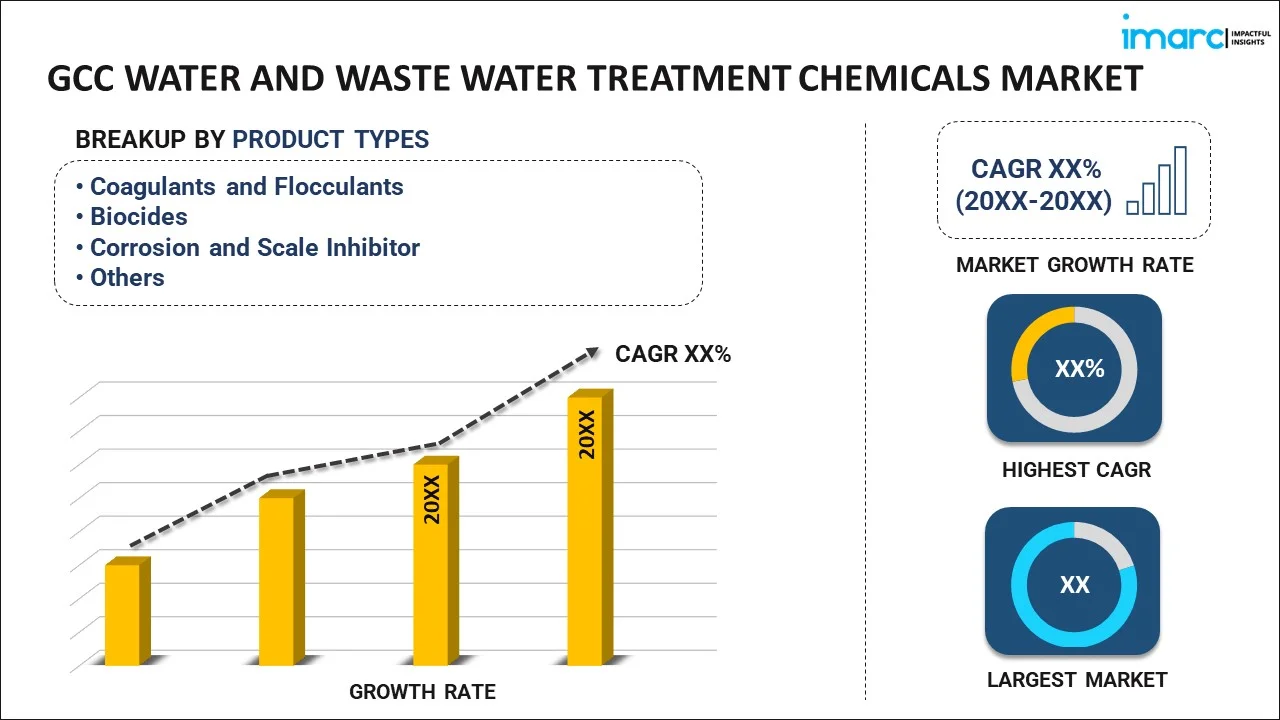

The GCC water and waste water treatment chemicals market size reached USD 742.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,661.8 Million by 2033, exhibiting a growth rate (CAGR) of 10.6% during 2025-2033. The growing focus on the proper treatment of drinking water to suppress the spread of waterborne diseases, increasing utilization of treated water in industries for various processes, and rising popularity of smart water management techniques represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 742.1 Million |

| Market Forecast in 2033 | USD 1,661.8 Million |

| Market Growth Rate (2025-2033) | 10.6% |

Water and wastewater treatment chemicals encompass a wide range of chemical substances designed to improve the quality of water by removing contaminants, pathogens, and undesirable elements. They comprise coagulants, such as alum, ferric chloride, and polymeric coagulants, which are high-molecular-weight compounds and aid in flocculation, helping particles agglomerate and settle. They also consist of disinfectants, like chlorine gas, sodium hypochlorite, chloramines, and chlorine dioxide, which are employed to disinfect pathogens in water. They include pH adjusters and numerous oxidizing agents, including hydrogen peroxide, ozone, and potassium permanganate, which are used for oxidation and reduction reactions to remove iron, manganese, and organic compounds. They remove negatively charged ions, such as nitrates and sulfates, and organic compounds, color, and odor from water through adsorption. They help to increase pH in acidic waters and aid in the purification of both drinking water and wastewater before they are released back into the environment. They are used to control foam in wastewater treatment processes that can hinder efficient operations. They are also employed to exchange positively charged ions in water, such as calcium and magnesium ions, with sodium ions. Furthermore, as they enhance particle aggregation and settling, their demand is increasing in the GCC region.

GCC Water and Waste Water Treatment Chemicals Market Trends:

At present, the increasing focus on the proper treatment of drinking water to suppress the spread of waterborne diseases and safeguarding public health represents one of the major factors influencing the market positively in the GCC region. Moreover, the rising utilization of water and waste water treatment chemicals to minimize the impact of harmful elements present in wastewater on aquatic ecosystems, preserving biodiversity and water quality, is strengthening the growth of the market. Apart from this, the growing utilization of treated water in industries for various processes is offering a positive market outlook in the GCC region. Additionally, the rising adoption of membrane technology and nanotechnology for water treatment applications is offering lucrative growth opportunities to industry investors in the region. In line with this, the increasing popularity of smart water management techniques along with data-driven solutions, such as real-time monitoring and predictive analytics, into chemical treatment processes, optimizing overall operational efficiency, is impelling the market growth in the GCC region. Besides this, the rising employment of water and waste water treatment chemicals in the pharmaceutical industry to treat water mixed with various harmful and toxic chemicals before discarding it in water bodies is propelling the growth of the market in the GCC region. In addition, governing agencies in the region are undertaking initiatives and implementing strict regulations to conduct proper wastewater treatment to prevent water pollution and degradation of marine life in the GCC region.

GCC Water and Waste Water Treatment Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC water and waste water treatment chemicals market report, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product type, application, and end user.

Product Type Insights:

- Coagulants and Flocculants

- Biocides

- Corrosion and Scale Inhibitor

- Defoamer

- PH Adjuster

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes coagulants and flocculants, biocides, corrosion and scale inhibitor, defoamer, pH adjuster, and others.

Application Insights:

- Cooling Water

- Boiler Water

- Membrane Water

- Municipal

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes cooling water, boiler water, membrane water, municipal, and others.

End User Insights:

- Oil and Gas

- Power

- Mining

- Pulp and Paper

- Chemical and Fertilizer

- Pharmaceutical

- Municipal

- Textile

- Food and Beverages

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes oil and gas, power, mining, pulp and paper, chemical and fertilizer, pharmaceutical, municipal, textile, food and beverages, and others.

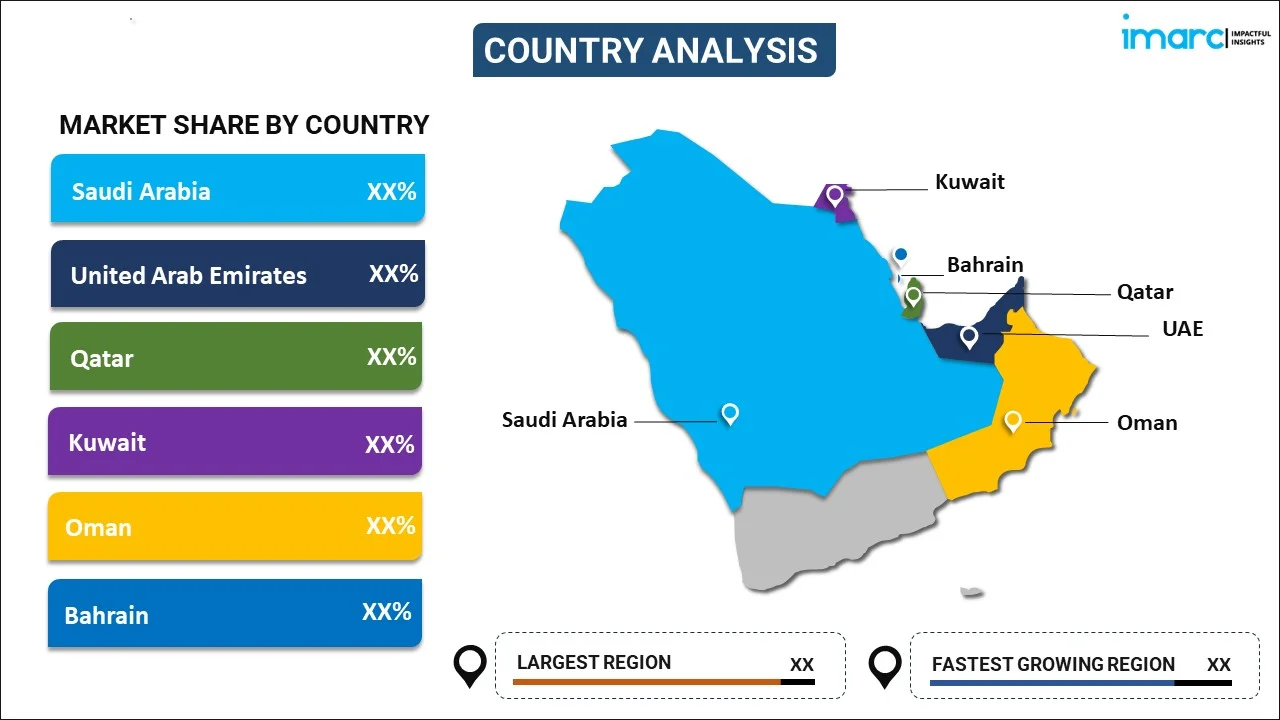

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Water and Waste Water Treatment Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Coagulants and Flocculants, Biocides, Corrosion and Scale Inhibitor, Defoamer, PH Adjuster, Others |

| Applications Covered | Cooling Water, Boiler Water, Membrane Water, Municipal, Others |

| End Users Covered | Oil and Gas, Power, Mining, Pulp and Paper, Chemical and Fertilizer, Pharmaceutical, Municipal, Textile, Food and Beverages, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC water and waste water treatment chemicals market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC water and waste water treatment chemicals market?

- What is the breakup of the GCC water and waste water treatment chemicals market on the basis of product type?

- What is the breakup of the GCC water and waste water treatment chemicals market on the basis of application?

- What is the breakup of the GCC water and waste water treatment chemicals market on the basis of end user?

- What are the various stages in the value chain of the GCC water and waste water treatment chemicals market?

- What are the key driving factors and challenges in the GCC water and waste water treatment chemicals market?

- What is the structure of the GCC water and waste water treatment chemicals market and who are the key players?

- What is the degree of competition in the GCC water and waste water treatment chemicals market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC water and waste water treatment chemicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC water and waste water treatment chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC water and waste water treatment chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)