GCC Textile Market Size, Share, Trends and Forecast by Raw Material, Product, Application, and Country, 2026-2034

GCC Textile Market Size and Share:

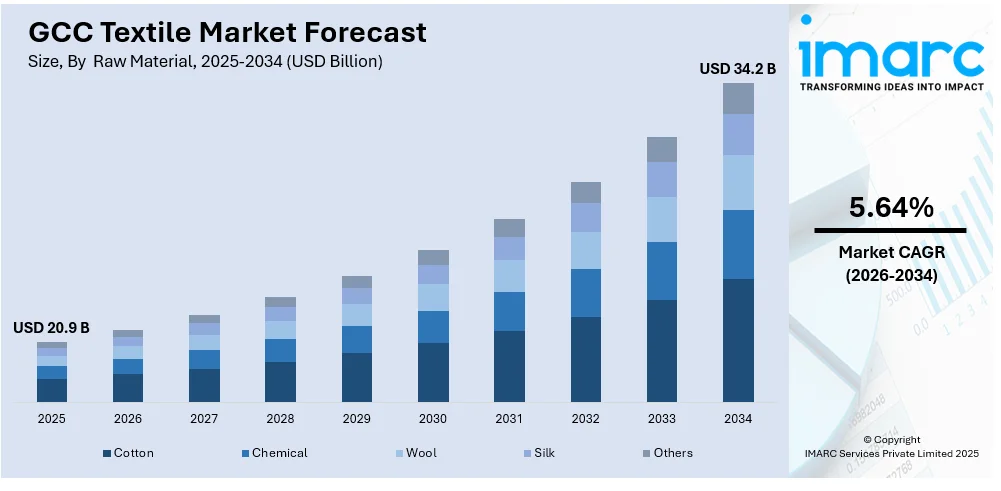

The GCC textile market size was valued at USD 20.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 34.2 Billion by 2034, exhibiting a CAGR of 5.64% from 2026-2034. The market is influenced by growing demand for luxury, technical, and sustainable textiles, fueled by rapid urbanization, high disposable incomes, and infrastructure development. Furthermore, with increasing local production, government support, and a focus on innovation, the region is emerging as a key player, blending traditional craftsmanship with modern manufacturing advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 20.9 Billion |

| Market Forecast in 2034 | USD 34.2 Billion |

| Market Growth Rate (2026-2034) | 5.64% |

The GCC textile market is propelled by rapid urbanization and large-scale infrastructure projects, creating a consistent demand for technical and industrial textiles. Additionally, the booming tourism industry drives demand for luxury and fashion textiles, particularly in retail hubs like the UAE and Saudi Arabia. For instance, Saudi Arabia’s strategic location and major projects, including the Red Sea project, Amaala, and Diriyah Gate, aim to attract 150 million tourists by 2030, driving growth in retail and boosting the economy. Besides this, the growing middle class, combined with high disposable incomes, supports the appetite for premium fabrics and tailored garments, ensuring sustained market growth.

To get more information on this market Request Sample

Another key driver is the region's commitment to diversifying its economy and reducing reliance on imports. Government-backed initiatives, such as Vision 2030 in Saudi Arabia, promote domestic manufacturing and innovation in textile production, further accelerating the textile market share. For instance, in 2024, Riyadh Fashion Week hosts 30 designers over five days, supporting Vision 2030 goals. With fashion sales projected to reach USD 32 billion by 2025, it promotes Saudi luxury globally, emphasizes sustainability, and aims to attract 2 million Chinese tourists annually by 2030. Moreover, sustainability is a significant focus, with manufacturers adopting eco-friendly processes and materials to align with global environmental standards. This shift not only meets evolving consumer expectations but also enhances the region’s competitiveness in the global market.

GCC Textile Market Trends:

Shift Towards Sustainable Practices

Sustainability is becoming a cornerstone of the GCC textile market. Consumers and manufacturers are increasingly prioritizing eco-friendly materials and production processes. Companies are expanding their businesses by adopting organic cotton, recycled fibers, and water-saving technologies to address environmental concerns. For instance, in December 2024, Fabrica Kraft, a sustainable fashion company, entered the GCC market, launching collections in the UAE, Saudi Arabia, Bahrain, Qatar, and Kuwait. This expansion is supported by a strategic partnership with Falcon E-Commerce Solutions to enhance sustainable fashion and accessibility in the region. These efforts are not only reshaping production strategies but also influencing consumer choices, with demand for sustainable fashion and home textiles rising steadily across the region.

Expansion of Luxury and High-Value Textiles

The GCC’s affinity for luxury goods is driving growth in premium textile segments. With a strong base of high-net-worth individuals, demand for high-quality fabrics, embroidery, and custom-made designs remains robust. Additionally, markets are experiencing increased investments in premium textile manufacturing to cater to regional and global requirements. For instance, according to the State of Fashion Sector in Saudi Arabia report, in 2024, GCC fashion and luxury market is valued at USD 80 billion, with Saudi Arabia holding approximately 40% of the total market share, showcasing its significant influence in the region.

Booming E-Commerce and Digital Retailing

E-commerce is revolutionizing the way textiles are marketed and sold in the GCC. With high internet penetration and a tech-savvy population, digital retail platforms are becoming crucial for textile sales. Additionally, fashion and home textile brands are leveraging online channels to reach a broader audience, often offering tailored products and personalized services. For instance, in August 2024, Saudi Arabia’s monthly revenue for e-commerce fashion reached USD 201 million, highlighting consistent consumer interest and growth in the Kingdom’s online fashion retail sector. This trend is further supported by regional logistics advancements, such as same-day delivery, making online textile shopping highly convenient for consumers.

GCC Textile Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC textile market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on raw material, product, and application

Analysis by Raw Material:

- Cotton

- Chemical

- Wool

- Silk

- Others

Cotton is a cornerstone raw material in the GCC textile market, valued for its natural softness, durability, and breathability. Sourced primarily from global markets, cotton serves as the base for a variety of products, including clothing, home textiles, and industrial applications. Its compatibility with modern textile manufacturing processes and consumer demand for sustainable fabrics drive its continued prominence. Moreover, the GCC's strategic trade positioning facilitates the import and export of high-quality cotton, supporting the region's growing textile industry and aligning with global trends toward eco-friendly materials.

Chemical fibers, including polyester, nylon, and acrylic, play a pivotal role in the GCC textile market. These synthetic materials offer durability, flexibility, and cost-effectiveness, catering to a wide range of applications from clothing to technical textiles. The region's strong petrochemical industry provides a robust supply chain for producing synthetic fibers locally, reducing dependency on imports. Additionally, with advancements in recycling technologies and growing interest in sustainable textiles, chemical fibers are adapting to align with environmental concerns, further strengthening their market position.

Wool is a premium raw material in the GCC textile market, recognized for its natural warmth, elasticity, and moisture-wicking properties. Sourced from key international producers, it is commonly used in high-end apparel, such as suits, sweaters, and outerwear, as well as luxury home textiles. The material’s versatility and sustainable appeal align well with the increasing consumer preference for eco-friendly products. While wool consumption in the GCC is niche compared to other fibers, its value in the luxury and winterwear segments remains significant.

Silk is synonymous with luxury in the GCC textile market, known for its unmatched softness, luster, and lightweight properties. Typically imported from Asia, silk is highly sought after for premium garments, traditional attire, and upscale home furnishings. The region's affluent consumer base and demand for high-quality textiles contribute to silk's steady market share. Although production within the GCC is minimal, the market benefits from a well-established global supply chain and evolving innovations in silk blends to enhance durability and reduce production costs.

Analysis by Product:

- Natural Fibers

- Polyesters

- Nylon

- Others

Natural fibers, including cotton, wool, and silk, form a vital segment of the GCC textile market, driven by growing consumer preference for sustainable and eco-friendly materials. These fibers are widely used in household textiles, fashion, and traditional garments such as abayas and kanduras. The demand for premium-quality natural fibers aligns with the region's focus on luxury textiles and cultural preservation. Efforts to promote organic cotton and responsibly sourced fibers are further enhancing the segment's appeal, meeting the needs of environmentally conscious consumers and aligning with global textile industry trends.

Polyester is a key product segment in the GCC textile market due to its versatility, durability, and cost-effectiveness. It is widely used across applications such as apparel, home furnishings, and technical textiles. The fiber's resistance to shrinking and stretching makes it ideal for high-demand products. GCC manufacturers are increasingly adopting recycled polyester to meet sustainability goals and align with global environmental standards. Furthermore, the fiber's adaptability to diverse applications ensures its continued relevance and growth within the market, especially in fast-growing segments like activewear and industrial textiles.

Nylon holds a significant position in the GCC textile market due to its high strength, elasticity, and resistance to abrasion, making it ideal for technical textiles and fashion applications. It is commonly used in activewear, outdoor gear, and industrial fabrics. Nylon's lightweight and durable properties cater to the region's demand for high-performance materials. With advancements in production technologies, recycled nylon is gaining traction, aligning with sustainability trends. Additionally, its adaptability across diverse sectors, including automotive and construction, ensures nylon remains an essential product in the GCC textile market.

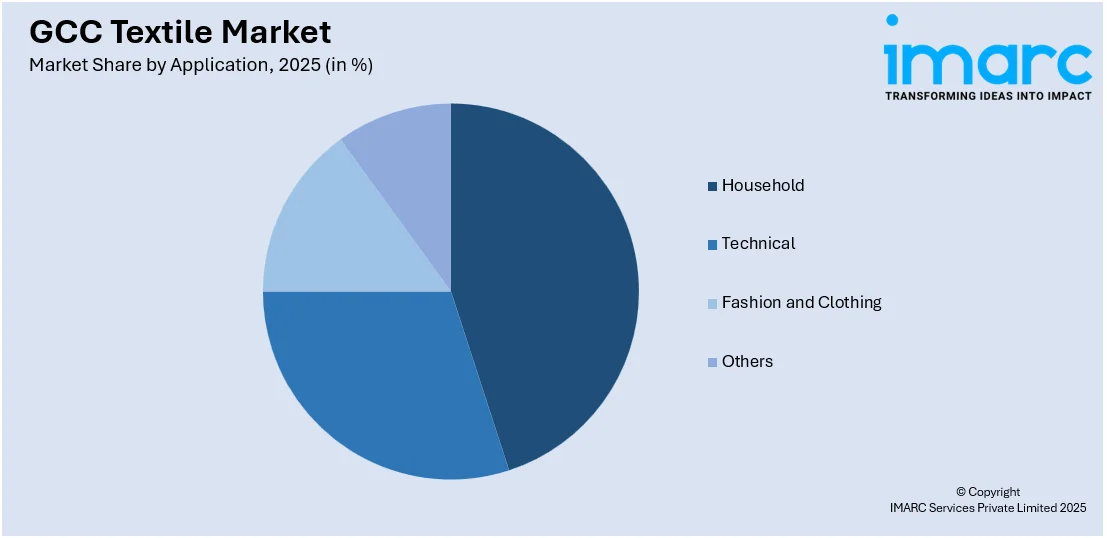

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Household

- Technical

- Fashion and Clothing

- Others

The household textile segment in the GCC market is driven by increasing urbanization, rising disposable incomes, and a growing demand for premium home furnishings. This category includes bed linens, curtains, carpets, and upholstery, with a focus on durability, comfort, and aesthetics. Sustainable and eco-friendly textiles are gaining popularity in the region, particularly among environmentally conscious consumers. The hospitality sector, including luxury hotels and resorts, further propels demand for high-quality household textiles. Moreover, GCC nations, particularly the UAE and Saudi Arabia, are significant markets for imported and locally produced household textiles.

The technical textile segment in the GCC market is expanding due to its wide range of applications across industries like construction, healthcare, automotive, and agriculture. Products such as geotextiles, medical textiles, and industrial fabrics are in high demand, supported by the region’s robust infrastructure projects and industrial growth. Technical textiles are valued for their functionality, including properties like strength, durability, and resistance to environmental factors. Furthermore, investments in advanced manufacturing technologies and a growing emphasis on sustainability are driving innovation in this segment, positioning the GCC as a key player in the global technical textile market.

The fashion and clothing segment is a prominent segment to the GCC textile market, fueled by the region’s preference for luxury and high-end apparel. The uplift in demand for fashionable clothing has risen due to the growing youthful population and rising disposable income levels and the complemented cultural events that act as a stage for showcasing both traditional and modern designs. Moreover, sustainable fashion act a key contributor, among consumers leaning towards environmentally conscious materials and production processes. GCC countries, particularly Saudi Arabia and the UAE, are becoming major attraction points for international brands about the retail market developing alongside relative investments toward local design talents.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia drives the GCC textile market with significant investments in manufacturing, supported by Vision 2030 initiatives to diversify the economy. The Kingdom’s textile industry spans luxury, technical, and traditional segments, catering to both domestic and international markets. Moreover, Saudi Arabia’s robust retail sector and increasing demand for sustainable textiles have led to the adoption of advanced manufacturing processes. With a strong focus on infrastructure development and industrialization, the Kingdom also encourages collaborations with global brands. Furthermore, major cities like Riyadh and Jeddah serve as key hubs for textile production and retail expansion, solidifying Saudi Arabia’s leadership in the region.

The UAE is a key contributor in the GCC textile market, principally due its emphasis on luxury textiles, sustainability, and innovation. The country’s strategic location and advanced infrastructure make it a hub for textile imports and re-exports. The UAE’s emphasis on eco-friendly textiles and sustainable manufacturing corresponds with global trends, compelling to environmentally conscious consumers. In addition, Dubai and Abu Dhabi have active fashion and retail sectors, international brand presence, and a stream of events that would encourage the growth of demand for textiles. Besides that, the UAE complimented fabric culture with a contemporary design that further strengthens the UAE's competitive position in the regional textile industry.

Qatar’s textile market is attributed to high-quality imports catering to its premium consumer base. The luxury and bespoke textiles represent the wealthy population which is developing a growing demand for more exclusive offerings in fashion. In addition, the infrastructural investment in retail and hospitality projects in Qatar has created a new area of opportunities for textiles. Events such as the FIFA World Cup have epitomized Qatar's ability to generate demand for textiles in various sectors like uniforms, interiors, and sportswear. Furthermore, the modernizing trend in the country aligns the local textile sector with international standards, emphasizes modern quality, and strengthens its sustainability measures in catering for both domestic and international markets.

Bahrain contributes to the GCC textile market through its focus on niche segments and innovative production methods. The country’s textile sector leverages its historical significance in craftsmanship, blending traditional techniques with modern applications. Bahrain’s strategic location facilitates efficient trade and distribution, supporting its growing textile exports. Investments in sustainable practices and technical textiles align with the global shift toward eco-friendly products. Moreover, the country’s free trade agreements and business-friendly environment attract international collaborations, making Bahrain an emerging player in the regional textile market. Its diversification strategy ensures a balanced growth trajectory for its textile industry.

Kuwait’s textile market is growing steadily, supported by its expanding retail infrastructure and increasing consumer demand for premium textiles. The country emphasizes imports of high-quality fabrics to cater to its fashion-forward population and affluent consumer base. Furthermore, Kuwait is exploring opportunities in technical and sustainable textiles, aligning with global trends. Its focus on traditional textiles, combined with modern retail expansion, enhances its position within the GCC market. Moreover, the textile sector benefits from Kuwait’s economic stability and government initiatives to encourage private sector participation, ensuring a competitive edge in the region’s textile landscape.

The textile market in Oman is characterized by traditional craftsmanship and modern production techniques. Oman has very high traditional and quality textiles, like those in the abaya and dishdasha, reflecting the rich cultural heritage. Oman's government is investing in the modernization of the textile industry to satisfy needs within the region and internationally. Development of free zones and industrial clusters is benefiting to the textile sector. Furthermore, Oman is integrating sustained practices and technical textiles, thus aligning with trends elsewhere in the world while tightly connecting trade opportunities ever enhanced within the GCC and beyond.

Competitive Landscape:

The GCC textile market is characterized by intense competition among local manufacturers, regional players, and global brands. Local firms focus on traditional and cultural textiles, leveraging their understanding of regional preferences, while international brands dominate the luxury and fast-fashion segments. Moreover, government initiatives promoting domestic production and sustainability have encouraged investment in advanced manufacturing facilities, increasing competition within the region. Innovation in smart textiles and sustainable practices is a major distinguishing element for companies aiming to capture niche markets. Additionally, the rising influence of e-commerce has intensified rivalry, as businesses compete to enhance their online presence and meet the evolving expectations of tech-savvy consumers across the GCC. For instance, in November 2024, Beyoung, an Indian Fashion Brand partnered with the e-commerce platform, Noon.com to enter the Middle Eastern market. The brand emphasized meeting the UAE's demand for affordable, premium fashion while connecting with its untapped consumer base.

The report provides a comprehensive analysis of the competitive landscape in the GCC textile market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2024, Al Obaidani, a leading Dishdasha brand in Oman, launched a new collection of high-quality fabrics for Eid, offering a variety of choices, including new and improved fabric lines. The brand continues expanding its retail presence, emphasizing quality, comfort, and innovation.

- In December 2024, Landmark Group launched Landmark Circulife, the UAE's first textile recycling facility, at Dubai World Central. The facility, with an initial capacity to process 2,000 metric tons annually, supports the UAE's circular economy and sustainability goals while reducing environmental impact.

GCC Textile Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Cotton, Chemical, Wool, Silk, Others |

| Products Covered | Natural Fibers, Polyesters, Nylon, Others |

| Applications Covered | Household, Technical, Fashion and Clothing, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC textile market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC textile market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC textile industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC textile market was valued at USD 20.9 Billion in 2025.

IMARC estimates the GCC textile market to exhibit a CAGR of 5.64% during 2026-2034.

The market is driven by factors such as rising consumer demand for high-quality, sustainable products, expanding retail and e-commerce platforms, and increased investments in local manufacturing. Additionally, economic diversification and growing tourism contribute to the region's textile sector’s expansion and global market presence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)