GCC Telecommunication Market Size, Share, Trends and Forecast by Components, Industry, and Country, 2025-2033

GCC Telecommunication Market Size and Share:

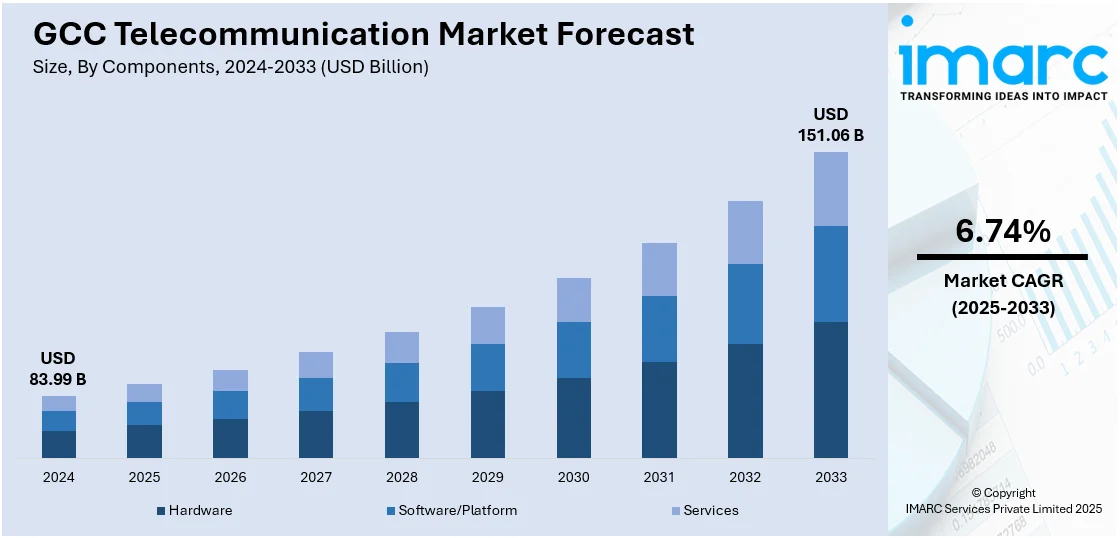

The GCC telecommunication market size was valued at USD 83.99 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 151.06 Billion by 2033, exhibiting a CAGR of 6.74% from 2025-2033. Saudi Arabia is dominating the market primarily due to the robust 5G expansion, increasing digital transformation across industries, rising demand for data services, strong infrastructure development, and surging investments in smart city projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 83.99 Billion |

| Market Forecast in 2033 | USD 151.06 Billion |

| Market Growth Rate (2025-2033) | 6.74% |

The GCC telecommunication market is significantly expanding due to rapid 5G deployment and the increasing digital transformation in the region. In addition to this, government initiatives, such as Saudi Arabia's Vision 2030 and the United Arab Emirates (UAE's) Smart City projects, are boosting strong investments to enhance the telecom infrastructure, thus aiding the market growth. Moreover, the rising adoption of the Internet of Things (IoT), cloud computing (CC), and artificial intelligence (AI) technologies across industries is driving demand for high-speed and reliable connectivity, which is providing an impetus to the market. Furthermore, the rising consumer demand for mobile data, streaming services, and e-commerce platforms is encouraging telecom operators to improve network coverage, ensuring seamless connectivity to meet evolving user requirements, thereby impelling the market growth.

Concurrent with this, rising investments by the public and private sectors in the GCC telecom sector are driving the development of telecom infrastructure and fiber-optic networks, fostering the market growth. Besides this, operators are developing access to the urban and rural markets due to an increased demand for the internet driven by surging sales of smartphones and an increasing population of tech literates, contributing to the market expansion. According to the statistics, the GCC countries will have a 5G subscription penetration of 47% in 2024. Additionally, new government policies are encouraging foreign investment and innovation to enhance the telecom future in the region, which is strengthening the market share. Apart from this, the shifting trend towards economic diversification is supporting the region to emerge as a world-class telecom technology and service destination, thus propelling the market forward.

GCC Telecommunication Market Trends:

5G network expansion:

The rapid rollout of 5G in the region is primarily driving the GCC telecommunication market demand. In line with this, global telecom authorities along with the government are actively aiming at increasing connectivity, and speed, meeting the requirements of big data in the region. For example, 5G’s potential to deliver data speeds as high as 100 times 4G closely matches this high-speed data and connectivity need. This expansion is leading to the development of smart cities, the adoption of IoT and other applications in various industries, and autonomous systems. Moreover, Saudi Arabia and the UAE provide the highest level of 5G development, making the region among the leaders in integrating next-generation networks. Meanwhile, the use of 5G is significantly promoting entertainment, remote working, and industrial applications, aligning with the economic development and digitization of the region, thus catalyzing the market growth.

Rising digital transformation:

The GCC telecom services are experiencing robust growth due to the surging digitization in the region. Authorities are focusing on such programs as Saudi Arabian Vision 2030 and the UAE National Innovation Strategy to promote the use of technologies in the sphere of healthcare, education, and finance sectors. In addition, businesses apply solutions based on CC, big data, and AI that require high-quality telecom support. Moreover, smart solutions and automation along with a concentration on e-governance are redesigning the communication networks. For instance, two technology solutions also solve IoT security, post-quantum cryptography (PQC) and zero trust security. Apart from this, telecom providers are widely inheriting digital transformation and providing unique technologies, guaranteeing a reliable infrastructure for supporting new developments in business and consumer needs, thereby providing an impetus to the market.

Growth in IoT and smart cities:

The implementation of the Internet of Things (IoT) and smart city projects is acting as another growth-inducing factor in the GCC telecommunication industry. Smart infrastructure is being deployed by governments in energy, transportation, and public service. In confluence with this, major cities like Riyadh, Dubai, and Doha are actively adopting IoT solutions for efficient real-time data control leading to improved operations. For example, in 2024 the number of connected IoT devices is projected to grow by 13%, driving the market demand further. Furthermore, they are creating new IoT operator platforms for the connected devices and sensors. Concurrently, this trend is demanding high-quality and low-latency networks which are fueling the demand for 5G and fiber-optic solutions. Also, the implementation of smart solutions is contributing to the escalation of telecom advancements throughout the region and impelling the market forward.

GCC Telecommunication Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC telecommunication market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on components and industry.

Analysis by Components:

- Hardware

- Broadcast Communication Equipment

- Telecoms Infrastructure Equipment

- Consumer Premise Equipment

- Software/Platform

- On-premises

- Cloud-based

- Services

- Fixed Networking Services

- Mobile Networking Services

The services segment dominates the GCC telecommunication market due to the increasing demand for fixed and mobile networking solutions. The rising usage of smartphones, enhanced internet services, and the growth of mobile data are supporting the mobile networking services. Besides this, the telecom providers are increasing their concentration on the improvements in connectivity and services offered for broadband services and the rollout of 5G networks. Moreover, traditional services are necessary for businesses and households in their implementation of cloud services and IoT and streaming systems. Furthermore, these segments align with the rising demand of consumers and enterprise requirements, thus contributing to the market expansion.

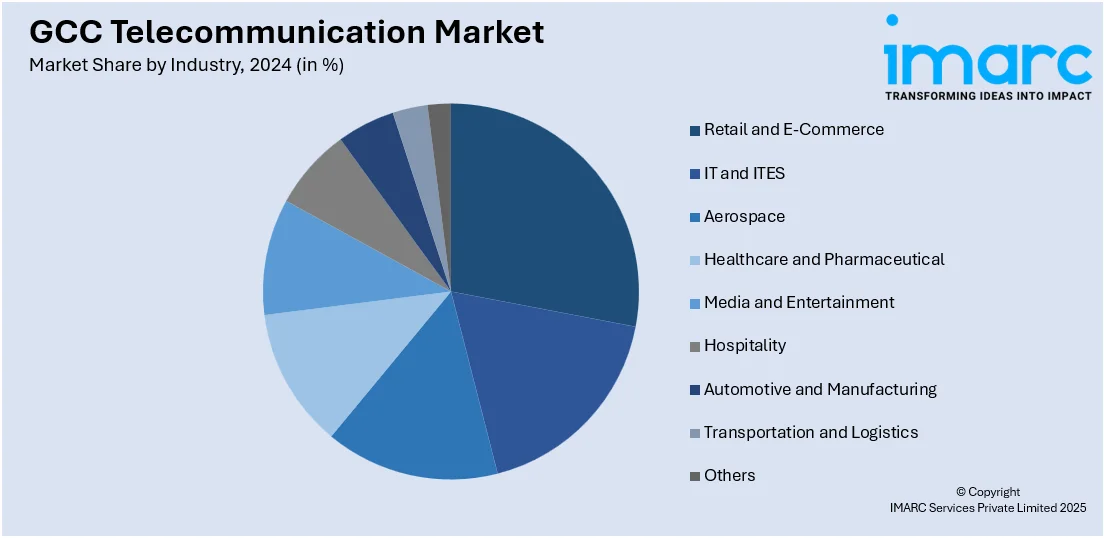

Analysis by Industry:

- Retail and E-Commerce

- IT and ITES

- Aerospace

- Healthcare and Pharmaceutical

- Media and Entertainment

- Hospitality

- Automotive and Manufacturing

- Transportation and Logistics

- Others

The retail and e-commerce segment leads the GCC telecommunication market driven by the increasing digitalization and shift in consumer behaviors. In addition to this, as the demand for online shopping and mobile retail sites is surging, the need for reliable connectivity and data services in the region is growing. Furthermore, telecommunication ensures smooth e-business interactions, cloud-based operations, and improved customer satisfaction. In conjunction with this, large retailers are integrating AI, IoT, and real-time analytics, as strong telecommunication networks are critical for business. Besides this, the availability of digital payment solutions and mobile applications in the e-commerce business is promoting the demand for advanced telecom services, thus aiding the market growth.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia leads the GCC telecommunication market, driven by comprehensive digitalization strategies and large capital expenditure on 5G services. The Vision 2030 program primarily emphasizes digital infrastructure, smart cities, and technology, which is supporting the development of a powerful telecom market in the region. For instance, in November 2024, Saudi Aramco’s unit held discussions to invest $ 1 billion in US software maker Mavenir, aiming to advance digital technology ventures. Moreover, the surging consumption of data services, IoT, and cloud solutions across health care, retail shops, and manufacturing sectors is leading to a significant expansion of the telecom market. Apart from this, the region has a strong technology-oriented customer base and continuous improvements in the infrastructure are contributing to the market expansion.

Competitive Landscape:

The competitive landscape of the GCC telecommunication market is defined by a mix of established global players, regional providers, and emerging entrants. Leading international companies are investing in advanced technologies and strategic collaborations to strengthen their presence and address the growing demand for high-speed connectivity and digital services. Regional providers focus on cost-effective solutions tailored to local markets, leveraging their understanding of regional needs to gain a competitive edge. Meanwhile, smaller innovators are introducing specialized services and sustainable practices, increasing competition across the sector. Additionally, the market is rapidly shifting toward 5G, IoT, and cloud-based solutions, driven by digital transformation initiatives and rising consumer expectations. This dynamic environment is pushing companies to prioritize research and development (R&D), enhancing network reliability, capacity, and efficiency to keep pace with evolving industry requirements and technological advancements.

The report provides a comprehensive analysis of the competitive landscape in the GCC telecommunication market with detailed profiles of all major companies.

Latest News and Developments:

In March 2024, Saudi Arabia's TAWAL signed a Memorandum of Understanding (MoU) with Dell Technologies to explore opportunities in edge computing and develop Open RAN technology, aiming to advance the telecommunications infrastructure in the region.

GCC Telecommunication Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Industries Covered | Retail and E-Commerce, IT and ITES, Aerospace, Healthcare and Pharmaceutical, Media and Entertainment, Hospitality, Automotive and Manufacturing, Transportation and Logistics, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC telecommunication market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC telecommunication market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC telecommunication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Telecommunication refers to the transmission of information over distances using electronic systems like phones, radio, television, and the internet. These devices are widely used for applications such as voice calls, video conferencing, data transfer, broadcasting, and networking, enabling global communication for businesses, personal use, healthcare, education, and entertainment.

The GCC telecommunication market was valued at USD 83.99 Billion in 2024.

IMARC estimates the GCC telecommunication market to exhibit a CAGR of 6.74% during 2025-2033.

The GCC telecommunication market is driven by increasing smartphone usage, 5G network deployment, rising internet usage, government initiatives for digital transformation, growing demand for IoT solutions, and advancements in cloud-based services, supporting smart city projects and enhanced connectivity across sectors.

In 2024, services represented the largest segment by component, driven by the rising demand for 5G networks, IoT solutions, digital connectivity, and cloud-based applications in the region.

Retail and e-commerce lead the market by industry owing to the growing digital transactions, online shopping platforms, and advanced communication technologies, enhancing strong customer engagement.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman, wherein Saudi Arabia currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)