GCC Stout Market Report by Distribution Channel (On-Trade, Off-Trade), and Country 2025-2033

Market Overview:

The GCC stout market size reached USD 188 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 287 Million by 2033, exhibiting a growth rate (CAGR) of 4.8% during 2025-2033. The changing demographics and lifestyle preferences, the growing popularity of food and beer pairing experiences in the region, and the expanding middle class and rising disposable incomes represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 188 Million |

| Market Forecast in 2033 | USD 287 Million |

| Market Growth Rate (2025-2033) | 4.8% |

Stout is a type of beer known for its dark, rich, and robust characteristics. It belongs to the broader category of ales and is widely recognized for its deep color and bold flavors. Typically brewed using roasted barley, which imparts its dark hue, stout offers a wide range of taste profiles, including notes of coffee, chocolate, caramel, and sometimes even hints of dried fruits. The presence of roasted malts gives stout its distinctive bitterness and a satisfying full-bodied mouthfeel. It comprises certain essential nutrients, including B vitamins, antioxidants, and minerals such as iron. These nutrients can contribute to improved energy levels, immune system support, and overall well-being. Additionally, stout's moderate alcohol content may have cardiovascular benefits when enjoyed responsibly.

GCC Stout Market Trends:

The changing demographics and lifestyle preferences are driving the market in GCC. As the GCC countries experience a growing expatriate population and an increase in international tourism, there has been a rise in demand for diverse food and beverage options. This shift has led to a greater appreciation for western alcoholic beverages, such as stout, among both locals and expatriates. Furthermore, the expanding middle class and rising disposable incomes in the GCC region have contributed to increased consumer spending on premium and specialty products, including craft beers. Stout, with its distinct flavors and artisanal qualities, has become an appealing choice for consumers seeking unique and indulgent beverages. The emergence of a vibrant craft beer culture across the GCC has also played a significant role in driving the stout market. Local and international breweries have capitalized on this trend, introducing a variety of craft stouts with innovative ingredients and brewing techniques. Craft beer festivals and events have further popularized stouts, providing consumers with an opportunity to explore different styles and brands. Moreover, marketing and promotional activities by beer companies have impelled consumer awareness and interest in stouts. Through strategic partnerships, sponsorships, and social media campaigns, breweries have successfully positioned Stout as a trendy and sophisticated choice, resonating with the preferences of the young and urban population. Additionally, the growing popularity of food and beer pairing experiences in the region has led to an increase in demand for stouts that complement the local cuisine. This trend has encouraged restaurants, bars, and hotels. Furthermore, the presence of antioxidants in stout can help combat free radicals in the body, potentially reducing oxidative stress and promoting cell health. However, it's essential to remember that any potential health benefits are closely linked to moderation, as excessive alcohol consumption can have adverse effects on health.

GCC Stout Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC stout market report, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on distribution channel.

Distribution Channel Insights:

- On-trade

- Off-trade

The report has provided a detailed breakup and analysis of the GCC stout market based on the distribution channel. This includes on-trade and off-trade.

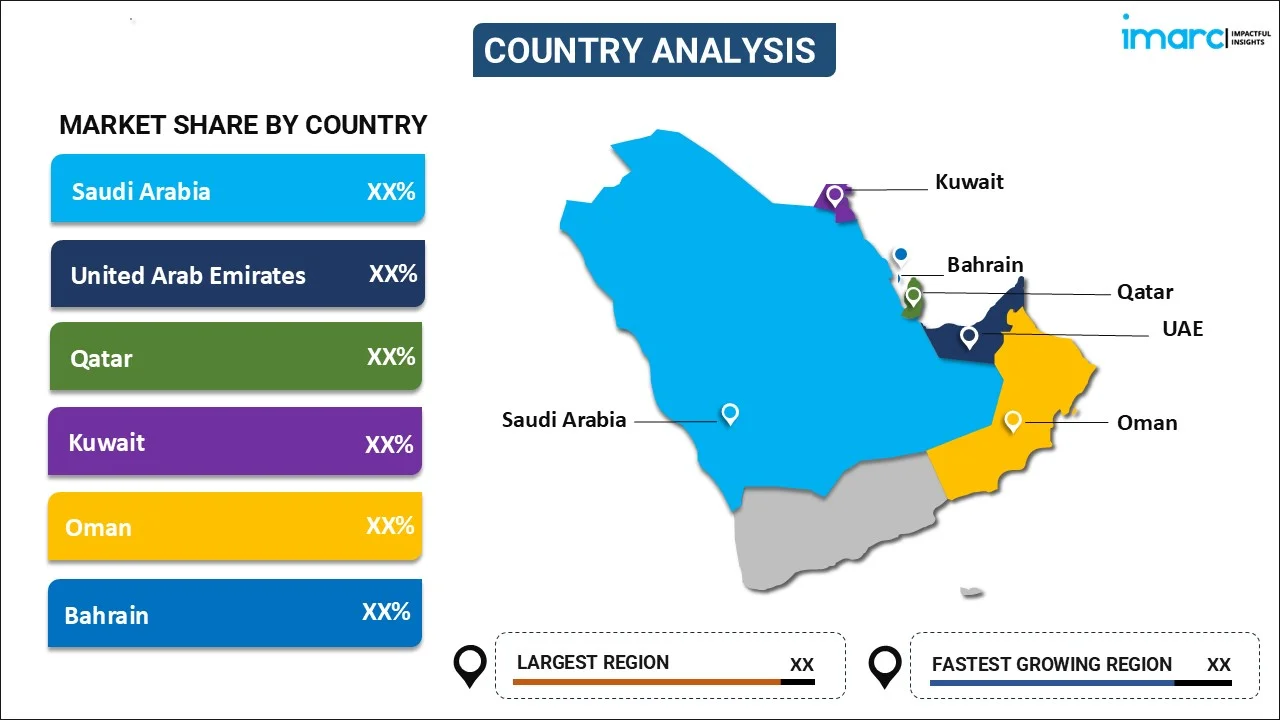

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The report has also provided a comprehensive analysis of all the major country markets, which include Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Stout Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Distribution Channels Covered | On-Trade, Off-Trade |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC stout market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC stout market?

- What is the breakup of the GCC stout market on the basis of distribution channel?

- What are the various stages in the value chain of the GCC stout market?

- What are the key driving factors and challenges in the GCC stout market?

- What is the structure of the GCC stout market and who are the key players?

- What is the degree of competition in the GCC stout market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC stout market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC stout market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC stout industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)