GCC Smart Mining Market Size, Share, Trends and Forecast by Component and Mining Type, and Country, 2025-2033

GCC Smart Mining Market Size and Share:

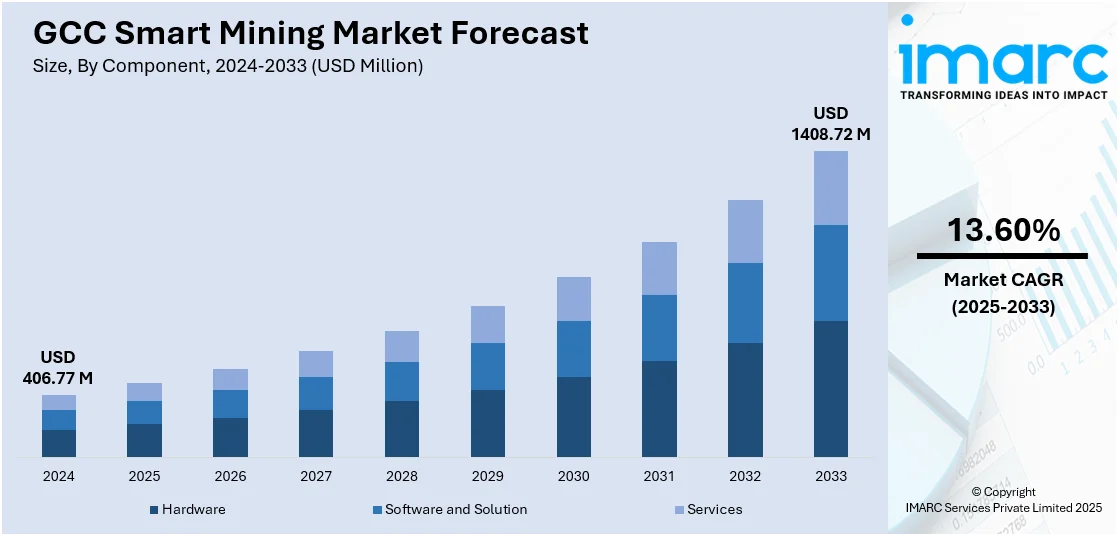

The GCC smart mining market size was valued at USD 406.77 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1408.72 Million by 2033, exhibiting a CAGR of 13.60% from 2025-2033. The GCC smart mining market is driven by advancements in automation, Internet of Things (IoT) integration, real-time data analytics, growing demand for sustainable mining practices and resource optimization supports adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 406.77 Million |

| Market Forecast in 2033 | USD 1408.72 Million |

| Market Growth Rate (2025-2033) | 13.60% |

Advanced technologies, including IoT, artificial intelligence (AI), and real-time data analytics, have highly favored the GCC smart mining market. These technologies make the process of mining much easier and more streamlined. Predictive maintenance, higher equipment efficiency, and minimal downtime have become possible. The risks involved in operations like drilling, hauling, and monitoring are minimized while ensuring better safety for workers. This facilitates better resource management and reduces the negative environmental impacts due to energy optimization. The upgrades provided by these technologies answer to the focus on modernizing industries with a perspective toward increased productivity and cost-effectiveness that promotes the adoption of smart mining solutions across key GCC countries.

Sustainability initiatives are a key driver of smart mining adoption in the GCC, as governments and companies prioritize reducing the environmental impact of mining activities. For instance, GCC is committed to sustainability, aiming to reduce CO2 emissions through its climate change strategy. By 2024, all cement operations will switch to 100% Portland limestone cement (PLC), supporting customer sustainability goals. Additionally, GCC is expanding carbon capture research and linking senior management’s compensation to meeting these environmental targets. Smart technologies promote resource efficiency, reduce carbon emissions, and waste management, thus contributing to sustainability goals in the global perspective. The digital monitoring system ensures environmental compliance through its accurate data of emissions and resources. In the diversification of the economy of the GCC, sustainable practices in mining promote long-term growth in the industry while maintaining natural ecosystems. This focus on sustainable mining practice leads to the adoption of intelligent and environmentally responsive mining solutions in the region.

GCC Smart Mining Market Trends:

Integration of AI and IoT

The integration of IoT and AI technologies is a prominent trend in the GCC smart mining market, enabling real-time monitoring, predictive maintenance, and data-driven decision-making. IoT sensors provide actionable insights by tracking equipment performance and environmental conditions, while AI algorithms optimize resource extraction and reduce operational costs. These technologies enhance safety by identifying potential risks and automating hazardous tasks. Their implementation reflects a shift toward fully digitized mining ecosystems, improving efficiency and productivity. As GCC countries emphasize technological innovation, mining companies increasingly invest in these tools to modernize operations and stay ahead in a rapidly evolving market.

Growing adoption of renewable energy in mining

Renewable energy deployment in the GCC is largely concentrated in the UAE, which holds over 60% of the region's total capacity and nearly 70% of investments. However, other GCC countries are expected to accelerate their renewable energy initiatives. The shift toward renewable energy in mining operations is a growing trend in the GCC, driven by sustainability goals and high energy consumption in traditional mining practices. Companies are incorporating solar and wind energy solutions to power mining equipment, reducing reliance on fossil fuels and lowering carbon footprints. This trend aligns with GCC governments' focus on green energy transitions and supports cost-effective operations. Hybrid energy systems combining renewable sources with smart grids further improve energy efficiency and reliability in remote mining locations. This focus on sustainable energy integration is reshaping the region’s mining landscape toward eco-friendly practices.

Increased use of autonomous equipment

The use of autonomous equipment is transforming mining operations across the GCC, emphasizing efficiency, safety, and cost reduction. In line with this, the electrification of mining equipment has grown due to technological advancements, with the industry expected to reach $23 Million by 2044. Mining contributes 2-3% of global CO2 emissions, largely from diesel-powered equipment. Self-driving trucks, robotic drills, and automated loaders reduce human involvement in hazardous environments, minimizing accidents and ensuring consistent performance. Advanced global positioning system (GPS) and sensor technologies enable precise navigation and operation of these machines, optimizing resource extraction and transport. This trend aligns with the GCC’s push for innovation and digital transformation in heavy industries. The scalability of autonomous solutions makes them a preferred choice for large-scale mining projects, paving the way for a future where automation becomes a standard in the industry.

GCC Smart Mining Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC smart mining market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component and mining type.

Analysis by Component:

- Hardware

- RFID Tags

- Sensors

- Intelligent System

- Others

- Software and Solution

- Logistics Software

- Data and Operation Management Software

- Data and Security Systems

- Connectivity Solutions

- Services

The hardware segment for the GCC smart mining market includes sensors, drones, autonomous vehicles, and other advanced machinery used in mining. Such devices increase the efficiency of operations, monitor performance, and allow automation. The increasing demand for high-tech, durable hardware for efficient resource extraction and safety is driving market growth.

In line with this, the software and solution segment involve advanced applications like AI-driven analytics, IoT platforms, and predictive maintenance tools. These software solutions streamline operations by enabling real-time data analysis, improving decision-making, and optimizing resource management. Growing reliance on digital technologies to enhance efficiency and reduce costs fuels the demand for software solutions in the sector.

Moreover, the services segment includes consulting, integration, and maintenance services essential for implementing smart mining technologies. These services help companies integrate IoT, AI, and automation systems into existing operations, ensuring seamless functionality and maximum productivity. As smart mining adoption grows, demand for specialized services to support these technologies continues to rise.

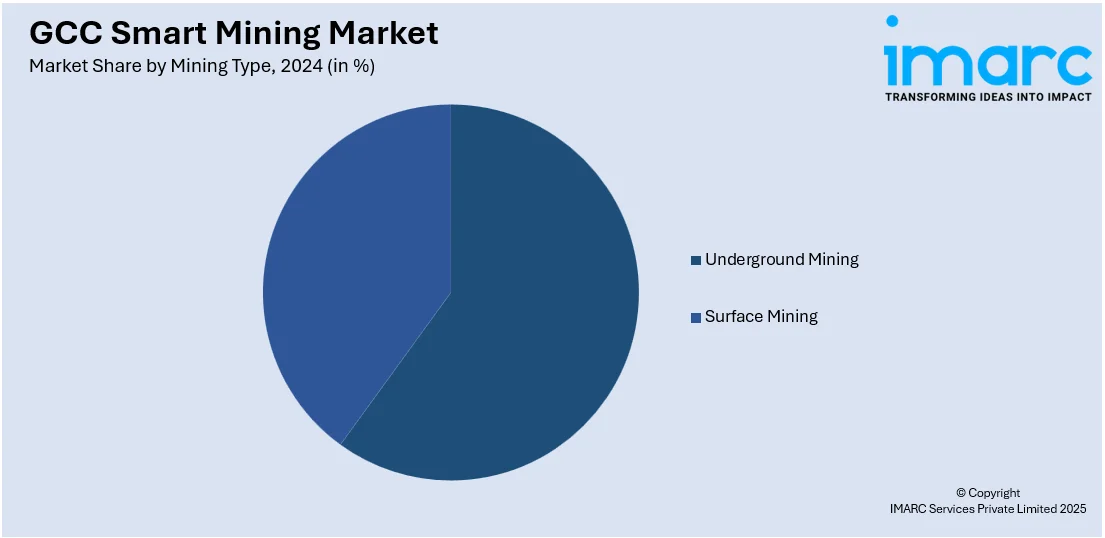

Analysis by Mining Type:

- Underground Mining

- Surface Mining

Underground mining in the GCC smart mining market involves extracting minerals below the earth's surface. Advanced technologies like automation, robotics, and real-time data analytics are increasingly used to enhance safety, optimize resource extraction, and improve efficiency in harsh environments. This segment is expanding due to rising demand for deeper resources.

Besides this, the surface mining involves the extraction of minerals from open pits, quarries, or surface deposits. The adoption of smart technologies such as autonomous vehicles, drones, and IoT sensors is transforming this process by increasing productivity, reducing environmental impact, and improving operational efficiency. The growing focus on sustainability boosts surface mining innovation.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia leads the GCC smart mining market, focusing on modernization through automation, IoT, and AI technologies. The government's Vision 2030 initiative promotes mining sector diversification, encouraging investments in sustainable practices and smart technologies. The country is expanding its mineral extraction capacity, driven by technological advancements and regulatory support.

Additionally, the UAE's smart mining sector is growing due to the country's focus on innovation and technological integration. Investments in automation, AI, and data analytics are improving mining efficiency and reducing environmental impact. The UAE's strategic initiatives, including sustainability goals and infrastructure development, drive the adoption of smart mining solutions.

Moreover, Qatar is embracing smart mining technologies to improve operational efficiency and sustainability in its mineral extraction processes. The government’s investments in digital transformation and automation are contributing to better resource management and safety. Qatar’s vision for economic diversification fuels the adoption of advanced mining solutions for long-term growth.

Also, Bahrain's mining sector is adopting smart technologies to modernize operations, increase efficiency, and align with environmental sustainability goals. The country’s focus on diversifying its economy and reducing carbon emissions encourages the integration of automation and AI-driven solutions. Smart mining adoption is a crucial part of Bahrain's industrial transformation.

Furthermore, the Kuwait is gradually introducing smart mining solutions to improve resource extraction processes. Government-backed initiatives to modernize industries, coupled with investments in automation and AI technologies, drive this shift. Smart mining solutions are helping Kuwait enhance efficiency, reduce operational costs, and meet sustainability objectives in the sector’s growth strategy.

Apart from this, Oman is actively investing in smart mining technologies to enhance productivity and resource management. The country’s commitment to diversifying its economy and promoting sustainable mining practices supports the adoption of IoT, automation, and AI tools. Oman's focus on innovation is expected to drive growth in the smart mining sector.

Competitive Landscape:

The GCC smart mining market is extremely competitive with a focus on technology innovations and strategic partnerships from key players to gain the upper hand in the market. Advanced automation solutions and IoT-enabled systems characterize market leaders in the region. Regional firms also expand their presence by taking cutting-edge technologies suited to regional mining problems. Market growth is being driven through mergers and acquisitions as well as through collaborations with technology providers. Also, government support for modernization of the mining sector as well as diversification of the economy is encouraging more competitive rivalry. The focus on sustainability and smart energy solutions is further influencing market forces by encouraging companies to invest in 'greener' and more effective extraction methodologies.

The report provides a comprehensive analysis of the competitive landscape in the GCC smart mining market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, GCC countries, leveraging abundant energy resources and forward-thinking leadership, are positioning themselves as crypto mining hubs. UAE, with initiatives like regulatory frameworks and partnerships, is fostering crypto adoption. Bitcoin mining aligns with economic diversification, offering opportunities to reduce oil dependency, attract foreign investment, and support digital and knowledge-based economies.

GCC Smart Mining Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Mining Types Covered | Underground Mining, Surface Mining |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC smart mining market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC smart mining market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC smart mining industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

GCC smart mining refers to the integration of advanced technologies like IoT, AI, automation, and data analytics into the mining sector in Gulf Cooperation Council (GCC) countries. This transformation enhances operational efficiency, safety, sustainability, and resource management, aligning with the region's goals for economic diversification and technological advancement in mining.

The GCC smart mining market was valued at USD 406.77 Million in 2024.

IMARC estimates the GCC smart mining market to exhibit a CAGR of 13.60% during 2025-2033.

Key factors driving the GCC smart mining market include technological advancements in automation, IoT, and AI, improving operational efficiency and safety. Government initiatives promoting economic diversification and sustainability, along with rising demand for resource optimization and eco-friendly practices, further bolstering the adoption of smart mining solutions in the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)