GCC Rice Market Report by Product Type (Regular, Aromatic), Type (Red Rice, Arborio Rice, Black Rice, Grain Fragrance Rice, Brown Rice, Rosematta Rice, Grain Parboiled Rice, Sushi Rice, and Others), Grain Size (Long Grain, Medium Grain, Short Grain), Distribution Channel (Offline Stores, Online Stores), Application (Food, Feed, and Others), and Country 2026-2034

GCC Rice Market Size:

The GCC rice market size reached USD 108.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 143.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.20% during 2026-2034. The market is primarily influenced by the adoption of favorable government programs, population expansion and rapid urbanization, increased consumer demand for a variety of cuisines, and dietary trends that favor rice.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 108.3 Million |

|

Market Forecast in 2034

|

USD 143.2 Million |

| Market Growth Rate 2026-2034 | 3.20% |

Access the full market insights report Request Sample

GCC Rice Market Analysis:

- Major Market Drivers: The growing need for quick meal alternatives like rice is driven by the GCC nations' increasing populations and urbanization, and the rising health consciousness of consumers who opt for rice as a gluten-free and nutritious staple.

- Key Market Trends: The changing customer convenience and preferences resulting in the shift toward packaged and branded rice products and the growing desire for premium and organic rice types brought on by health and lifestyle trends.

- Competitive Landscape: The competitive landscape is dominated by local firms who have established brands and prioritize strategies related to cost and quality. Besides this, international brands are increasing their market share through marketing efforts and product innovation across the region.

- Challenges and Opportunities: The challenges include shifting import laws and transportation expenses that have an impact on supply chain effectiveness and price. Moreover, the GCC rice market overview shows that there are chances for new entrants due to the rising awareness of the health advantages of rice, expanded product portfolios, and unexplored markets like Oman and Bahrain.

GCC Rice Market Trends:

The Growing Population

The significant population growth in the Gulf Cooperation Council (GCC) is one of the main factors contributing to the increased demand for rice, a basic meal in the GCC. According to the 64th International Statistical Institute (ISI) World Statistics, the population of the GCC region increased, almost doubling from 26.2 million in 1995 to 56.4 million by 2021. Also, the arrival of foreign workers attracted to the region to help its social and economic development is contributing to the market growth. Moreover, local population growth in several GCC countries exceeded 19% between 2010 and 2021. These nations are commonly comprised of younger people, in 2021, over half of the population was under 25, and just 5% of people were 65 years of age or older. Hence, the rice market is adjusting to the growing demand, which forces major companies to reevaluate their distribution and supply chain plans to satisfy the expanding consumer demands, thus contributing to the GCC rice market growth.

Rapid Urbanization in GCC

According to the United Nations Development Programme, the Gulf Cooperation Council (GCC) region's urban population is predicted to increase from 43.3 million in 2015 to 54.6 million by 2030. Additionally, the population of the Saudi Transition Nations (STC) is expected to increase from 27.5 Million in 2015 to 45.2 Million by 2030. Furthermore, the GCC is the most urbanized subregion, with rates of urbanization estimated to be 82.2% in 2015 and 84.3% by 2030. Also, the urban diet includes more processed and convenient meals, with rice playing a significant role due to its adaptability and simplicity of preparation. Besides this, the fast-paced lifestyles of urban residents make quick-cooking rice types and pre-packaged rice dishes popular, which promotes market variety and product innovation. Therefore, as the number of people who can buy rice increases it escalates the consumption of rice through stronger distribution networks across the GCC region.

Government Food Security Initiatives

The GCC governments have made significant investments in food security measures, especially in the construction of strategic rice stockpiles, in response to the vulnerabilities shown by interruptions in the global supply chain. For instance, Saudi Arabia's Vision 2030 represents a bold attempt to restructure the Kingdom's economy with a focus on improving food security. It includes a $10 Billion plan aimed at boosting regional agricultural productivity and stabilizing the world food supply chain. It is also affecting the expansion of the rice market by emphasizing local food production and lowering dependency on imports. These measures open the potential for rice cultivation and production inside the GCC by addressing issues with food security and promoting local agriculture, which raise interest in rice as a staple crop. As a result, these nations work toward more regional food self-sufficiency, thus escalating the GCC rice demand.

GCC Rice Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product type, type, grain size, distribution channel, and application.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Regular

- Aromatic

The report has provided a detailed breakup and analysis of the market based on the product type. This includes regular and aromatic.

Regular rice is a popular option for homes due to its cost and adaptability, whereas white and brown rice are staples in daily meals and are considered to be regular forms of rice. It is widely used in traditional recipes like machboos and kabsa due to its mild flavor and capacity to absorb seasonings. Also, the regular rice market is driven by its widespread usage in home cooking and the food service industry due to easy accessibility across the GCC region.

In the GCC rice market, aromatic rice including premium types like Basmati and Jasmine, is a popular product. These kinds are well known for their unique tastes and scents that enhance the eating experience. Aromatic rice has a higher price point than plain rice since it is typically linked with extraordinary events and gourmet food. Cultural affinities and the growing consumer demand for sophisticated, tasty, high-quality food alternatives impact the desire for fragrant rice. For instance, as per Gitnux, traditional polishing methods enhance the flavor and nutritional value of Kinmemai premium rice. Furthermore, the aromatic rice market is expanding due to the growing middle-class family and an increasing number of foreign residents, who bring diverse culinary preferences.

Breakup by Type:

- Red Rice

- Arborio Rice

- Black Rice

- Grain Fragrance Rice

- Brown Rice

- Rosematta Rice

- Grain Parboiled Rice

- Sushi Rice

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes red rice, arborio rice, black rice, grain fragrance rice, brown rice, Rosematta rice, grain parboiled rice, sushi rice, and others.

Red rice is gaining popularity due to its nutty flavor and high nutritional content which includes fiber and antioxidants across the GCC region. Along with this, red rice is frequently used in traditional dishes and is preferred due to its possible health benefits, which include decreasing blood sugar levels and promoting heart health. Additionally, the unique hue and sturdy texture make it a great fit for filling meals and fit in nicely with the GCC market's health-conscious trends and dietary preferences. Moreover, red rice is also promoted as a luxury product and draws in customers searching for organic, whole-grain choices. As a result, red rice is gaining popularity and larger shelf space in supermarkets and specialty health food stores across the region.

Arborio rice, an Italian staple is prized for its creamy texture and flavor-absorbing capacity, which make it perfect for risotto recipes. It is widely popular in the GCC among Italian expats and local foodies who value foreign cuisine. Additionally, luxury eateries and homes that relish experimenting with international cuisine are increasing the demand for Arborio rice. Besides this, the market for Arborio rice is anticipated to grow as customers in the area become more familiar with international culinary trends. Furthermore, this growth will be supported by cooking demonstrations and workshops that provide fresh approaches to preparing this adaptable rice for daily meals.

Black rice, also known as forbidden rice, is prized for its dramatic color and high levels of anthocyanins, which contribute to its antioxidant properties. In the GCC, it appeals to a niche segment of health-conscious consumers and those interested in exotic and gourmet foods. Additionally, black rice is often featured in health food stores and upscale supermarkets, catering to an audience that prioritizes health and wellness. Its use in contemporary dining, along with its visual appeal in dishes, enhances its status as a luxury ingredient in the GCC culinary scene, promoting its integration into modern and traditional dishes.

Grain fragrance rice, often exemplified by varieties like Jasmine and Basmati, holds a significant market share in the GCC due to its aromatic qualities and versatility in cooking. Favored in numerous local and South Asian recipes, this rice is essential in everyday cuisine across the region. The segment benefits from both the large expatriate community from South Asia and the local population’s preference for fragrant rice in their meals. The steady demand for grain fragrance rice is supported by its widespread availability and the cultural integration of rice-centric dishes in social and family gatherings.

Brown rice is recognized in the GCC for its whole grain benefits, contributing to a healthier diet with its high fiber content and low glycemic index. This rice type is increasingly popular among health-conscious consumers looking to manage weight or improve overall health. The growing awareness of diabetes and obesity in the region has propelled the demand for brown rice. Supermarkets and health food stores prominently feature brown rice, reflecting its status as a staple in the health-oriented segments of the GCC food market. Additionally, governmental health initiatives often promote brown rice as a healthier alternative to white rice.

Rosematta rice, a robust, red-hued variety from India, is cherished in the GCC for its earthy flavor and high nutritional value. It is particularly popular among the Kerala community in the region but has also gained broader acceptance as consumers seek diverse and healthful rice options. Rosematta rice is typically used in traditional dishes like biryanis and porridges, where its unique taste and texture can be fully appreciated. Its niche market is expanding as more consumers become interested in regional varieties of rice that offer both health benefits and new culinary experiences.

Grain parboiled rice, known for its cooking stability and higher nutritional content compared to white rice, is a favored choice in the GCC market. This rice type undergoes a parboiling process, which infuses the grains with nutrients from the husk. Popular in both household cooking and in commercial establishments due to its versatility and enhanced shelf life, grain parboiled rice is commonly used in a variety of dishes from daily meals to gourmet recipes. Its ease of cooking and nutritional advantages making it a preferred option in a region that values both convenience and health.

Sushi rice is catering to the growing appetite for Japanese cuisine within the GCC. This short-grain rice is essential for creating authentic sushi and is cherished for its sticky texture and slightly sweet flavor. The influx of Japanese restaurants and the increasing popularity of sushi among locals and expatriates alike have bolstered the demand for sushi rice. Retail outlets and specialty stores have responded by stocking more of this rice, highlighting the fusion of international culinary tastes in the GCC market. Sushi rice’s segment is expected to grow as the region continues to embrace and integrate diverse food cultures.

Breakup by Grain Size:

- Long Grain

- Medium Grain

- Short Grain

The report has provided a detailed breakup and analysis of the market based on the grain size. This includes long grain, medium grain, and short grain.

Long-grain rice is highly prized in the GCC for its characteristic non-sticky texture after cooking, making it a staple in dishes like biryani and mandi. It is imported from countries like India and Pakistan, where aromatic varieties such as Basmati are grown. According to Gitnux, some high-quality rice undergoes aging to enhance its flavor, resulting in a higher price tag, like the Indian Basmati rice. It appeals to consumers looking for rice that remains fluffy and separate when cooked, making it ideal for rich, spiced recipes prevalent in the region. Moreover, the long-grain rice market is bolstered by a strong consumer preference for its elongated grains and ability to absorb flavors, which is escalating the demand in household and commercial kitchens across the GCC.

Medium-grain rice, with its slightly shorter and more rounded grains, offers a more tender and slightly sticky consistency compared to long-grain varieties. This type of rice is essential in many traditional dishes in the GCC, where a slightly clumpy texture is desired, such as in kabsa or machboos. Additionally, medium grain rice is often sourced from countries like Egypt and sometimes the United States, as it holds a significant place in the GCC market. It is favored in recipes requiring a soft texture that holds together, making it suitable for stuffing vegetables or as a base for rich sauces and stews, which are common in local cuisines.

Short-grain rice is the least common in the GCC compared to its long and medium counterparts, but it still maintains a niche market. Additionally, short-grain rice is characterized by its round, plump appearance and sticky texture upon cooking, which is ideal for dishes where a creamy consistency is desired, such as in puddings or certain types of desserts. Moreover, short-grain varieties are appreciated for special recipes and specific culinary uses. It also caters to a more selective market that values the textural qualities short grain rice brings to certain traditional and gourmet dishes.

Breakup By Distribution Channel:

- Offline Stores

- Online Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline stores and online stores.

Offline stores, including supermarkets, hypermarkets, and specialty stores, are the traditional and dominant distribution channels for rice in the GCC region. These stores offer consumers the advantage of physical inspection and immediate purchase, which are significant factors given the variety of rice available, from Basmati to Jasmine. Additionally, retail outlets provide a tactile shopping experience, enabling consumers to assess the quality, texture, and fragrance of rice, crucial for making purchasing decisions. Moreover, the presence of knowledgeable staff can assist buyers in choosing the right type of rice based on their cooking preferences and dietary needs. Furthermore, the established trust and convenience of these brick-and-mortar stores continue to make them a preferred choice among many consumers. For instance, on 1st October 2023, Lulu Group launched its newest Hypermarket in Hawally, Kuwait. This marks their 15th store in the country. The grand opening ceremony saw the presence of ambassadors, diplomats, government officials, and dignitaries from Kuwait, UAE, and other countries. The store is located in Hawally, and spans 83,000 square feet. It is a prominent commercial hub, that offers a wide range of products including groceries like rice, lentils, and wheat, non-food items, health and beauty products, and fresh foods such as chilled and dairy products, frozen goods, fruits, vegetables, meat, fish, while featuring in-house kitchen and delicatessen services.

Moreover, the online sector of the GCC rice market has been growing steadily, due to the broader digital transformation and increased internet penetration in the region. Additionally, online stores offer convenience and time savings, appealing to the busy lifestyles of modern consumers. These platforms often provide competitive pricing, detailed product descriptions, and customer reviews, which help consumers make informed choices from a wide array of rice products. Besides this, the easy availability of home delivery and easy payment options further enhance the appeal of online shopping. Moreover, during events like the COVID-19 pandemic, online sales of staple foods like rice saw a significant increase as consumers preferred contactless shopping options to adhere to social distancing guidelines across the globe.

Breakup by Application:

- Food

- Feed

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food, feed, and others.

Food represents the most substantial portion of the rice market, underpinning a staple diet component for the region’s diverse population. Rice is consumed daily, highlighting its cultural and culinary significance across GCC countries. Additionally, the preference for aromatic and long-grain varieties such as Basmati is prevalent, which aligns with local tastes and traditional cuisines. This segment's robust demand is fueled by household consumption and extensive use in the hospitality sector, including restaurants and hotels. Furthermore, the rice market is further diversified within this segment by the varying quality grades, ranging from premium to more economically priced options, catering to a wide economic spectrum of consumers. For instance, in October 2023, LuLu, the prominent global retail giant based in Abu Dhabi, announced a bold initiative to substantially increase its imports from Vietnam in the upcoming years. Additionally, the emphasis is on sourcing high-quality food products from Vietnam, particularly focusing on rice, cashew nuts, and fish.

Feed plays an essential role in the GCC rice market. It primarily utilizes broken grains and rice by-products like husks and bran, which are by-products of the rice milling process. These materials are integral components of animal feed, especially in poultry and cattle diets. Additionally, GCC, with its expanding poultry industry and rising focus on sustainable agriculture, sees this sector growing as farmers seek cost-effective, nutritious, and locally available feed options. Furthermore, the integration of rice by-products into animal feed supports local agriculture and contributes to a circular economy by reducing waste and enhancing resource efficiency.

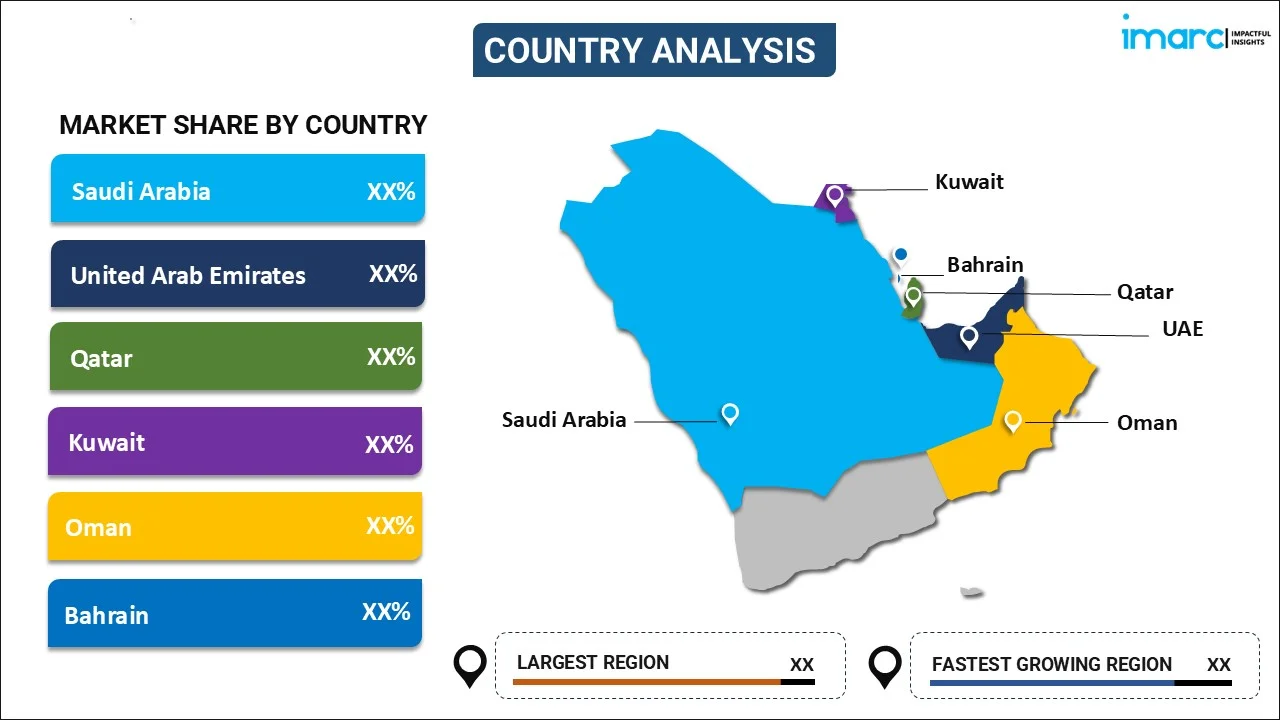

Breakup by Country:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The report has also provided a comprehensive analysis of all the major markets in the region, which include Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman.

Saudi Arabia represents the largest market for rice within the GCC, given its substantial population and strong purchasing power. The preference here leans towards long-grain aromatic rice, such as Basmati, which is extensively used in traditional dishes like Kabsa and Mandi. The country largely relies on imports from India and Pakistan due to its arid climate not being suitable for rice cultivation. Recent years have seen a surge in health-conscious consumption, driving demand for organic and brown rice varieties. Additionally, the government's economic diversification efforts might influence import dynamics and possibly stimulate investments in food processing and storage technologies to ensure food security.

United Arab Emirates rice market is characterized by its cosmopolitan population, featuring a high expatriate community from South Asia, where rice is a staple. This demographic factor drives a strong demand for a wide variety of rice, including Basmati, Jasmine, and other specialty types. Dubai and Abu Dhabi, as bustling trade hubs, facilitate extensive rice import and re-export activities across the Middle East and Africa. The luxury hospitality sector also influences rice consumption patterns, with a demand for premium rice varieties to cater to international tourists and residents. The UAE government's focus on sustainable food sources is also promoting interest in more sustainable rice farming practices and alternative grains. For instance, LuLu Group International (LuLu Group) is a diversified conglomerate led by Yusuff Ali M.A., renowned for its global presence and strategic business ventures. With headquarters in UAE and Abu Dhabi, the group plays a significant role in enhancing the Gulf region's economic landscape, boasting an annual turnover exceeding US$ 8 Billion. Its extensive international portfolio encompasses hypermarket chains, shopping mall development, manufacturing, trading, hospitality assets, and real estate ventures. Operating predominantly across 23 countries spanning the Middle East, Asia, the US, and Europe, LuLu Group continues to expand its global footprint and influence.

Qatar's rice market is notably impacted by its economic affluence and high standard of living, which translate into a preference for premium rice varieties. Additionally, basmati rice remains the most popular, and there is growing interest in diversifying to include other varieties such as Thai Jasmine and Italian Arborio, particularly among the expatriate community and in the luxury dining sectors. Furthermore, the country now actively seeks to establish secure and sustainable food supply chains, which include investments in food storage and processing facilities.

Bahrain, with its smaller population, has a relatively compact rice market that closely follows the consumption patterns of its GCC neighbors, predominantly focusing on Basmati rice. However, the country's growing health awareness and the increasing prevalence of lifestyle diseases like diabetes have encouraged a shift towards healthier rice alternatives such as brown and wild rice. Bahrain's government supports this trend through educational campaigns promoting healthy eating habits. Additionally, the country's strategic geographic location as a gateway to the Gulf makes it a critical point for the transit and re-exportation of rice to other GCC countries.

In Kuwait, rice is an essential component of the national diet, deeply embedded in the culinary traditions of the local and expatriate communities. Additionally, the market is dominated by high-quality Basmati rice, which is preferred for its aroma and taste, essential in dishes such as Biryani and Machboos. Moreover, Kuwait's market also shows a significant inclination toward health-oriented products, including fortified and organic rice varieties, driven by rising health consciousness among its population. Furthermore, the involvement of the government in regulating rice imports ensures a steady supply while keeping prices stable, which is crucial given the country's complete reliance on food imports.

Oman's rice market is distinctive with its strong preference for traditional varieties and eating habits. Basmati rice dominates due to its flavor and texture that suits Omani dishes such as Shuwa and Harees. Additionally, the country’s growing tourism sector influences rice consumption patterns, with an increasing demand for various international rice varieties to cater to tourists' tastes. Moreover, Oman is also focusing on enhancing food security by investing in food storage and distribution infrastructures, which impacts rice market dynamics. Furthermore, there is a noticeable trend toward sustainable and self-sufficient food production, which may eventually lead to initiatives aimed at increasing local rice cultivation despite the challenging climatic conditions.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the GCC rice industry are influencing the market growth.

- At present, key players in the market are implementing various strategies to expand their GCC rice market share. They are broadening their import sources beyond traditional markets like India and Pakistan to include countries like Thailand and Vietnam, which helps mitigate supply chain risks. These players are also forming partnerships with local distributors to enhance their market reach and consumer access. Additionally, investment in advanced storage and processing technologies is a priority to maintain rice quality and extend shelf life, aligning with the region's increasing focus on food security. For instance, in February 2023, Al Rabie Saudi Foods Company Ltd took part in the Gulf Food Exhibition Gulfood 2023, the foremost yearly trade event in the food, beverage, and hospitality services industry. Al Rabie showcased a range of notable products and engaged in panel discussions at the exhibition. Additionally, the company actively joined in various activities and strategic seminars addressing critical topics aimed at advancing the food and beverage sector, emphasizing consumer health and safety.

GCC Rice Market News:

- In February 2024, according to the Agricultural and Processed Food Products Export Development Authority (APEDA) of the Indian government, the UAE emerged as one of the leading markets for Indian basmati rice during the initial nine months of the ongoing fiscal year.

GCC Rice Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Regular, Aromatic |

| Types Covered | Red Rice, Arborio Rice, Black Rice, Grain Fragrance Rice, Brown Rice, Rosematta Rice, Grain Parboiled Rice, Sushi Rice, Others |

| Grain Sizes Covered | Long Grain, Medium Grain, Short Grain |

| Distribution Channels Covered | Offline Stores, Online Stores |

| Applications Covered | Food, Feed, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC rice market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC rice market?

- What is the breakup of the GCC rice market on the basis of product type?

- What is the breakup of the GCC rice market on the basis of type?

- What is the breakup of the GCC rice market on the basis of grain size?

- What is the breakup of the GCC rice market on the basis of distribution channels?

- What is the breakup of the GCC rice market on the basis of application?

- What are the various stages in the value chain of the GCC rice market?

- What are the key driving factors and challenges in the GCC rice market?

- What is the structure of the GCC rice market, and who are the key players?

- What is the degree of competition in the GCC rice market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC rice market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC rice market.

The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region. - Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC rice industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)