GCC Residential Real Estate Market Size, Share, Trends and Forecast by Type, and Country, 2025-2033

GCC Residential Real Estate Market Size and Share:

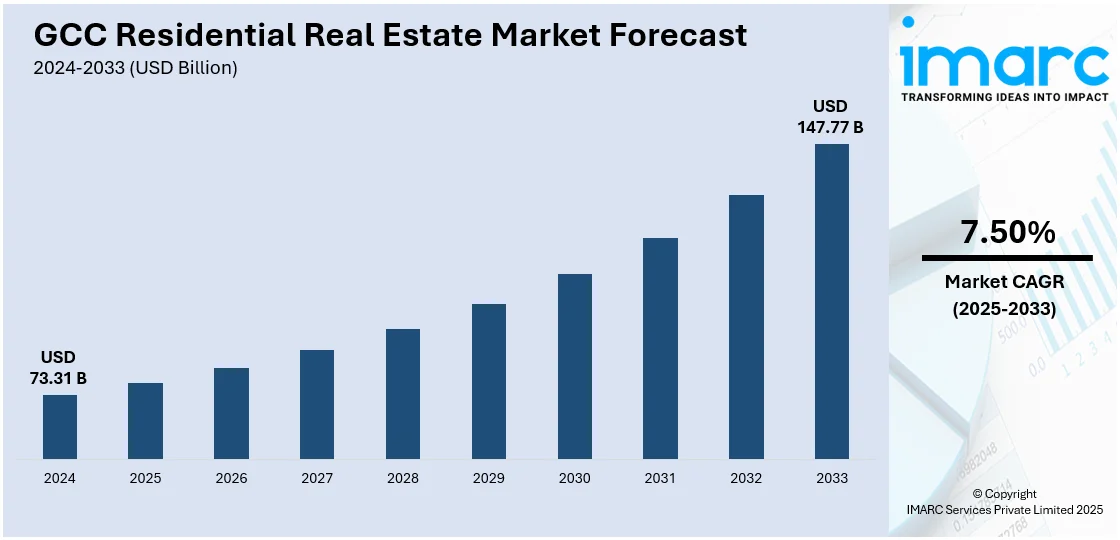

The GCC residential real estate market size was valued at USD 73.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 147.77 Billion by 2033, exhibiting a CAGR of 7.50% from 2025-2033. The market is primarily driven by the increasing demand for high-quality housing from a growing expatriate population, rapid urbanization, and significant government infrastructure investments. Additionally, favorable property laws for foreign buyers, higher disposable incomes, shifting consumer preferences for luxury and smart homes, long-term residency permits, and the rise in tourism all contribute to the market's expansion. Furthermore, sustainability trends and smart city developments are shaping the future of residential spaces in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 73.31 Billion |

| Market Forecast in 2033 | USD 147.77 Billion |

| Market Growth Rate (2025-2033) | 7.50% |

The market in GCC is primarily driven by the increasing demand for good quality housing options by the ever-growing expatriate population. This demand is further fostered by the increased rate of urbanization in all the cities of the region, which is supplemented through government initiatives promoting infrastructure developments. For instance, as per a report by S&P Global Ratings that most GCC corporate and infrastructure ratings remained resilient in 2024, despite global economic softness and elevated interest rates. The agency forecasts a 7% growth in non-oil earnings for 2024, a decline from the 15% estimated in 2023. In addition, growth in foreign investments through amenable property ownership laws also adds significantly to the development of the market. Also, high disposable incomes and changed consumer preferences towards modern amenities make way for luxury residential developments in the GCC.

The increase in smart city developments promotes a demand for technologically sophisticated residential space, depicting the shift toward sustainable dwelling. Additionally, with long-term residency permits launched in the market, participation within the market has increased for those expatriates that have been seeking permanent residing facilities. With growing affordability in housing solutions, the developer is expanding to a larger group, thereby supporting the market growth. Increased tourism and demand for secondary residences is also significantly a driving force for market expansion. As per the market analysis, government incentives combined with the sound economy is always further enhancing the prospects of GCC residential real estate. For instance, as per an article by Zawya, the Egyptian Gulf Alliance has launched the Mahawer Developments project, a USD 137 Million investment that aims to transform the country's real estate landscape in Egypt. The focus is sustainable urban development with residential, commercial, and recreational spaces and designed to meet the increasing demand for modern infrastructure. This initiative forms part of a broader effort aimed at improving the real estate landscape and stimulating economic growth within the region.

GCC Residential Real Estate Market Trends:

Digital Transformation in Real Estate Development

Developers are using the advanced technologies of AI and big data analytics to improve property management and buyer engagement. Smart home features and IoT integration have become necessary, reflecting demand for tech-driven living solutions. For instance, article by sells do states that the rising need for digital transformation in real estate, which has been further accelerated by the COVID-19 pandemic. The real estate companies are using technology to improve customer engagement, streamline processes, and adjust to changing market conditions. In addition, it identifies the growing preference for digital pathways, driven by safety concerns and the convenience of remote interactions, which has reshaped home-buying behaviors and demands in the industry. Virtual property tours and blockchain in real estate transactions are making the processes smoother, transparent, and more customer friendly. This digital shift aligns with growing consumer preferences for convenience and is contributing significantly to modernizing the GCC residential real estate market.

Diversification of Housing Options

The GCC market is increasingly diversified in residential offerings for different demographics. Developers are launching affordable housing options for middle-income buyers alongside luxury apartments targeting high-net-worth individuals. For instance, as per an article by United Health Group, UnitedHealth Group surpassed USD 1 Billion in investments for affordable housing, marking a major milestone in advancing health equity. The initiative, which was launched in 2011, has helped to develop over 25,000 homes in 31 states across urban and rural areas to support families, seniors, and military veterans. The company integrates efforts to provide health services through housing projects. For instance, the redevelopment of Aya Tower in Georgia seeks to improve both affordable living and access to community health resources. These investments improve housing security while fostering healthier communities. Mixed-use developments, combining residential, commercial, and leisure facilities, are gaining popularity to meet urban lifestyles. This diversification meets the changing needs of consumers and promotes inclusivity in the market. Efforts to attract expatriates and young professionals further contribute to a dynamic real estate environment that supports sustained market growth.

Focus On Sustainability and Eco-Friendly Practices

Sustainability is one of the major focuses in the GCC residential market, with the developers showing keen interest in energy-efficient designs and eco-friendly materials. For instance, as per an article by Zawya, experts are stressing developers to embrace green buildings that reduce the adverse impact of construction on the environment, ensuring long-term profits. As demand for ecologically sound property increases, so also do green buildings, in which value is improved. They are no longer preserved solely for environmental purposes but for value addition as well. However, among those against green buildings are those complaining about the high costs for new buildings and those saying they are not well-aware about them. Promoting green building certifications and water-saving technologies is thus aligning with global climate goals. Solar-powered communities and sustainable urban planning will address growing consumer demand for sustainable living spaces. Supportive government policies for environmental conservation and green project subsidies are fueling this trend, propelling the region towards an environmentally responsible future for its real estate.

GCC Residential Real Estate Industry Segmentation:

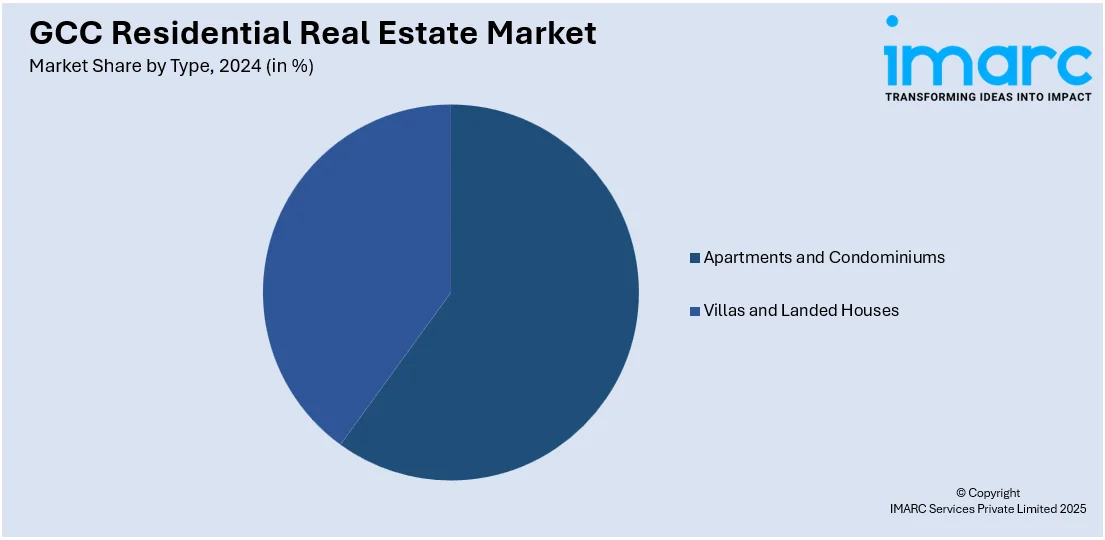

IMARC Group provides an analysis of the key trends in each segment of the GCC residential real estate market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type.

Analysis by Type:

- Apartments and Condominiums

- Villas and Landed Houses

Apartments and condominiums play an important part in the GCC residential real estate market as the growing population of expatriates as well as urban dwellers requires them to have affordable, high-quality living spaces. Developers are creating modern, luxurious apartments with amenities that appeal to local and international buyers. Due to rapid urbanization, residents in major cities prefer to stay in city centers with minimum maintenance.

Villas and landed houses play a significant role in the GCC market, especially among wealthy locals and expatriates seeking spacious, private homes. Villas offer luxury, privacy, and extensive space for families with a preference for exclusive, high-end properties. Cultural preferences for larger living areas and a growing middle class with rising disposable income fuel demand for such properties, contributing to the market's expansion. Developers are working towards delivering sustainable well-designed villas to meet the above demand.

Analysis by Country:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia is a key region for the GCC residential property market, with investment activities driven by ambitious urban ventures such as Neom and the Red Sea Project. It's all about significant investment that can spark the development of high-class home spaces in the country. Additionally, its Vision 2030 fosters demand for quality homes in pursuit of sustainable living and a high-technological community.

The UAE, particularly Dubai and Abu Dhabi, plays a very significant role in the GCC residential real estate sector. Foreign and domestic investors are attracted to this market by world-class infrastructure, iconic developments like Palm Jumeirah, and favorable property ownership laws for expatriates. With a growing population and tourism sector, the demand for high-end luxury properties is on the rise, making the UAE the leader in the region's residential real estate market.

The residential real estate market is growing in Qatar, with significant contributions from the country's fast-paced urbanization, and infrastructure projects such as Lusail City and preparations for the World Cup. Luxury housing demand is still on an upswing, fueled by high growth in the expatriate workforce as well as foreign investment. Qatar's favorable regulatory environment, such as the long-term residency permits offered for foreign investors, is also propelling further growth in the market and adds to its appeal as an investment destination for residential property.

Kuwait's residential real estate market features a blend of traditional and modern developments to accommodate the rapidly growing population and expatriates. The government investment in infrastructure projects, such as the Kuwait National Development Plan, has driven demand for residential units, especially in areas such as Kuwait City. Moreover, the country's economic diversification efforts and growing demand for high-quality living spaces are contributing to the rapid expansion of the real estate market.

Oman's residential real estate market is growing because of stability in the country's future economic outlook and investment going into developing key cities around Muscat. The government drives economic diversification, thereby adding to the demand for both expensive and affordable housing. Oman uniquely appeals to foreign investment, especially in all residential properties targeting expatriates and residents who want to benefit from modern amenities in a tranquil area.

Bahrain's residential property market is supported by its geographic advantage and increasing status as a financial hub in the GCC. The market is supplemented by government policies to encourage foreign investment, such as long-term residency schemes. Demand is being driven by the focus of Bahrain on developing mixed-use residential communities and offering a range of affordable to luxury housing options, with expatriates contributing significantly to the market's growth due to the relatively low cost of living in the country compared to its GCC counterparts.

Competitive Landscape:

The GCC residential real estate market is highly competitive, driven by both local and international developers striving to meet growing demand for residential spaces. Major players focus on offering a wide range of properties, from affordable housing to luxury developments, to cater to diverse consumer needs. With rapid urbanization, government initiatives, and increasing foreign investments, developers are continually innovating by incorporating smart technologies, sustainability, and modern amenities into their projects. Additionally, favorable regulations, including long-term residency options, further enhance market competitiveness.

The report provides a comprehensive analysis of the competitive landscape in the GCC residential real estate market with detailed profiles of all major companies.

Latest News and Developments:

- On 17 December 2024, Saudi Arabia’s National Housing Co. has been recognized as the leading real estate developer in the GCC for 2024, achieving sales of SR13 billion (USD 3.47 Billion) in the first half of the year. Arab News stated that Saudi Arabia is experiencing an increase in real estate investments due to the success of its Vision 2030 initiatives.

GCC Residential Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Apartments and Condominiums, Villas and Landed Houses |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC residential real estate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC residential real estate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC residential real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Residential real estate refers to the market for residential properties (such as, apartments, villas, and landed houses) in the Gulf Cooperation Council (GCC) countries. It includes the construction, sale, and lease of residential properties, driven by factors such as population growth, urbanization, and foreign investment.

The GCC residential real estate market was valued at USD 73.31 Billion in 2024.

IMARC estimates the GCC residential real estate market to exhibit a CAGR of 7.50% during 2025-2033.

The market is majorly driven by the the growing expatriate population, urbanization, favourable property laws for foreign investors, government infrastructure initiatives, rising disposable incomes, and demand for modern amenities. Additionally, long-term residency permits and increasing tourism also contribute to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)