GCC Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Country, 2026-2034

GCC Real Estate Market Size and Share:

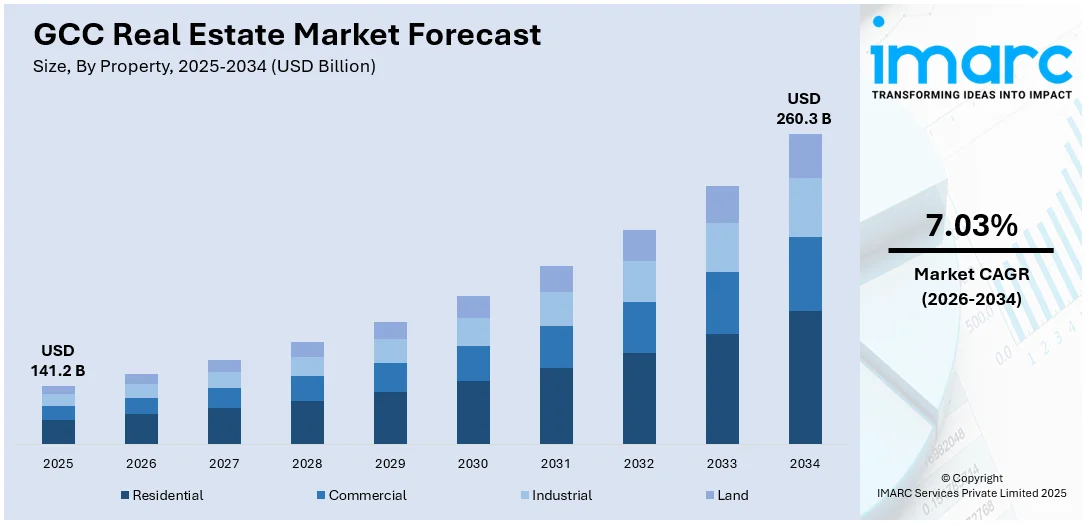

The GCC real estate market size was valued at USD 141.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 260.3 Billion by 2034, exhibiting a CAGR of 7.03% during 2026-2034. UAE currently dominates the market, holding a significant market share of over 61.1% in 2025. The market is experiencing steady growth driven by the accelerating government initiatives focused on economic diversification, infrastructure development, and increasing smart cities. Additionally, the rising tourism and hospitality sector across the GCC and the development of smart cities are further expanding the GCC real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 141.2 Billion |

| Market Forecast in 2034 | USD 260.3 Billion |

| Market Growth Rate (2026-2034) | 7.03% |

The GCC real estate market is primarily driven by economic diversification efforts, with governments investing heavily in infrastructure and mega-projects to reduce reliance on oil revenues. Visionary initiatives have influenced demand for residential, commercial, and hospitality properties. Dubai residential property prices soared 19.46% compared to 10.16% for Abu Dhabi year-on-year in November 2024. In 2023, the total figure for real estate deals in the UAE stood at a record AED 893 Billion (USD 243.1 Billion), including both residential and commercial transactions. Dubai led the way with 180,987 transactions worth AED 522.5 Billion (approximately USD 142.2 Billion), while Abu Dhabi accounted for AED 47.92 Billion (approximately 13.04 Billion). The ongoing strong demand, economic stability, and confidence from foreign investors are key factors propelling significant growth in the real estate market across the GCC. Population growth, urbanization, and a rising expatriate workforce further fuel housing needs. Additionally, favorable regulatory reforms, such as long-term visas and foreign ownership laws, attract international investors. Stable economic recovery post-pandemic and increased foreign direct investment (FDI) also contribute to a sustained GCC real estate market demand.

To get more information on this market Request Sample

In addition, the growing demand for affordable and luxury housing, driven by a young, expanding population and high disposable incomes is favoring the market. Tourism and business hubs such as Dubai and Riyadh enhance demand for short-term rentals and hospitality assets. Government incentives, including tax exemptions and relaxed mortgage rules, encourage homeownership. Technological advancements, such as proptech and smart city developments, enhance market efficiency and appeal. Saudi Arabia is witnessing growth in its real estate sector, especially in smart city and smart home projects, growing at a rate of 7% annually. This growth is driving a 25% annual growth rate in smart home tech adoption expected through 2030. 73% of the residential property under development is mixed-use, 69% sustainable in design, and 54% aligned to the aspirations of Vision 2030. Riyadh and Jeddah are leading the way in this demand; with the exception of KSA residential investments return 5%-8%, thus supporting the Kingdom's ranking as a tech-powered real estate hub in the GCC. Additionally, geopolitical stability and safe-haven status attract global capital, while sustainability trends push green building initiatives. With rising interest in mixed-use developments and REITs, investor confidence remains strong, ensuring long-term growth in the GCC real estate sector.

GCC Real Estate Market Trends:

Government initiatives and economic diversification

The escalating governmental initiatives throughout the GCC to diversify their economies away from being over-reliant on oil are driving the market. Along with this, huge infrastructure projects are being undertaken to create new cities, transport networks, and entertainment places to attract local and foreign investments. According to reports, the UAE is developing the USD 19 Billion Masdar City in Abu Dhabi, a flagship green urban project while Kuwait has invested USD 4 Billion in Saad Al-Abdullah, its first smart city. Such programs are part of a broader national vision that also involves Saudi Arabia's Vision 2030 and the UAE Vision 2021, in which a diversified economic fabric is sought through the help of non-oil industries. The UAE was ranked fourth in the world for the quality of its infrastructure in the Global Competitive Report 2023 which was released by the World Economic Forum. A total of 258 projects were undertaken by the Ministry of Energy and Infrastructure over the last decade at an investment of AED 13 billion. The GCC real estate market report indicates that free zones and business-friendly regulations further increase the growth of commercial real estate, inviting more multinational corporations to set up GCC headquarters. According to the GCC real estate market forecast, such encouraging government policies set up a favorable environment for real estate development and, hence, market growth as demand for residential, commercial, and mixed-use properties will increase.

Population growth and urbanization

The growing population growth and urbanization are key drivers that are positively influencing the GCC real estate market size. High fertility rates and a large number of expatriates constantly immigrating in search of employment are increasing the demand for houses in the GCC. Cities are growing with this new influx, as new residential areas are being set up and old urban facilities are being renovated. According to the real estate market forecast in GCC, modern, high-quality living spaces and amenities are in demand by the high population of young and high-income individuals. Saudi Arabia’s population is projected to grow by 32% by 2050, with 90.4% of the population expected to reside in urban areas further fueling the need for urban infrastructure and quality housing. Such urban expansion also flows into the development of retail areas, educational and health facilities, and entertainment zones. The salient features of unbridled urban sprawl and increasing living standards, therefore, provide the real estate sector with reasons for high growth. The ongoing expansion of urban areas is prompting the construction of diverse property types, from luxury apartments to functional commercial spaces, further broadening the scope of the real estate market. As a result, these factors are creating a positive GCC real estate market outlook.

Tourism and hospitality sector growth

The growing tourism and hospitality are impacting the GCC real estate market. Additionally, the escalating investments into the infrastructure in countries such as the UAE and Saudi Arabia host a global audience in terms of hotels, resorts, and other leisure facilities is significantly increasing real estate demand in GCC. Along with this, the accelerating number of high-profile events in Dubai and the ongoing buzz around Saudi Arabian tourism projects which are attracting global attention and investment is also favoring the market. The hospitality growth is providing supportive real estate in the form of retail, food and beverage, and leisure facilities. Dubai's Department of Economy and Tourism (DET) has launched the 'Dubai Sustainable Tourism Stamp' certification in a move that will assist and empower the tourism sector in supporting the country's sustainability goals, among which is the UAE's NetZero 2050 initiative. The aim is to position Dubai as one of the most prominent global destinations for sustainable tourism, ideally, the best city to visit, live, and work in. According to Ministry News, Saudi Arabia ranked third globally in the growth rate of international tourist arrivals, with over 61% growth from January to August and September 2024, underscoring its emergence as a world-class tourist destination. An increasing number of short-term accommodations, in turn, bring interest to make long-term residential investments, especially in tourist-driven areas. Thus, the growth in tourism helps the overall GCC real estate market growth and diversification of the market.

GCC Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC real estate market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on property, business, and mode.

Analysis by Property:

- Residential

- Commercial

- Industrial

- Land

Residential stands as the largest component in 2025, holding around 64.7% of the market, driven by population growth, urbanization, and government initiatives promoting homeownership. Demand ranges from affordable housing for middle-income families to luxury villas and high-end apartments catering to affluent buyers and expatriates. Developers are increasingly focusing on integrated communities with amenities such as schools, retail, and healthcare to enhance livability. Off-plan sales remain popular, supported by flexible payment plans and investor-friendly regulations. Additionally, rising demand for short-term rentals in tourist hubs is shaping the market. Sustainability is becoming a key trend, with eco-friendly designs and smart home technologies gaining traction. Despite economic fluctuations, the residential sector remains resilient due to strong underlying demand and supportive policies.

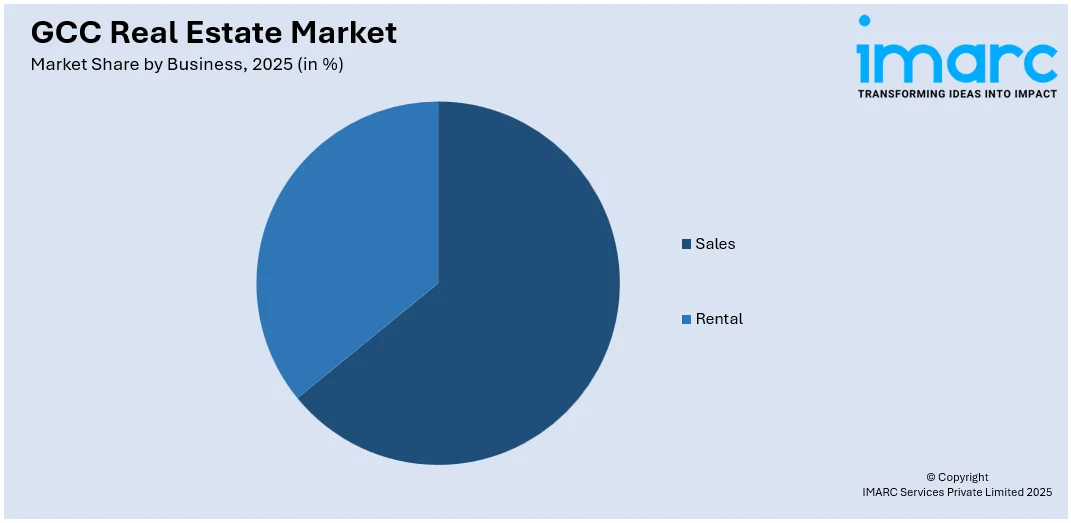

Analysis by Business:

Access the comprehensive market breakdown Request Sample

- Sales

- Rental

Sales lead the market with around 64.3% of market share in 2025, fueled by investor demand, government incentives, and economic growth. Residential property sales dominate, with off-plan projects attracting buyers through flexible payment plans and high potential returns. Luxury properties in prime locations remain popular among high-net-worth individuals, while affordable housing initiatives cater to middle-income buyers. Commercial property sales, including office spaces and retail units, are rising in business hubs, driven by foreign investment and economic diversification. Land sales also contribute significantly, particularly in emerging development zones. Developers are leveraging digital platforms and virtual tours to streamline transactions, while regulatory reforms, such as relaxed ownership laws, continue to enhance buyer confidence and market liquidity.

Analysis by Mode:

- Online

- Offline

Offline leads the market with around 79.2% of market share in 2025, anchored by personal relationships and traditional business practices. Face-to-face interactions with brokers and developers continue to instill trust, especially for high-value transactions involving luxury properties or commercial assets. Physical showrooms, sales centers, and open-house viewings provide tangible experiences that digital platforms cannot fully replicate. Institutional investors and local buyers often prefer offline channels for complex negotiations and legal processes. While slower than online methods, offline transactions benefit from established regulatory oversight and localized expertise. The segment adapts by integrating hybrid models combining digital tools with in-person consultations—to cater to diverse client needs while maintaining its relevance in the region’s real estate ecosystem.

Regional Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

In 2025, UAE accounted for the largest market share with a share of over 61.1%. The UAE remains the most dynamic real estate market in the GCC, with Dubai and Abu Dhabi leading in innovation and investment. The residential sector sees strong demand for luxury properties and expat-friendly communities, while commercial real estate benefits from the UAE's status as a global business hub. Tourism-driven segments, including short-term rentals and hospitality assets, are thriving post-pandemic. The industrial and logistics sector is expanding due to e-commerce growth and strategic trade positioning. Proptech adoption and sustainability initiatives, such as green building standards, further enhance the market's appeal. Despite periodic fluctuations, the UAE's stable regulatory environment and investor-friendly policies ensure long-term growth across all real estate segments.

Competitive Landscape:

The competitive landscape in the GCC real estate market is characterized by intense rivalry among major developers, with key players focusing on large-scale mixed-use projects, smart city developments, and sustainable construction to gain a competitive edge. Many are expanding their portfolios with luxury residential towers, integrated communities, and commercial hubs to cater to rising demand. Strategic partnerships with international firms and government entities are common, enabling access to prime land and funding. Some developers are leveraging technology, such as AI and virtual reality, to enhance customer experience and streamline sales. Others are adopting flexible payment plans and rent-to-own schemes to attract buyers. Additionally, a few are diversifying into hospitality and retail to capitalize on tourism growth, while also investing in REITs to provide alternative investment opportunities. The focus remains on innovation, affordability, and premium offerings to maintain market dominance.

The report provides a comprehensive analysis of the competitive landscape in the GCC real estate market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Christie’s International Real Estate launched in Saudi Arabia in partnership with tech firm Wasalt, aiming to serve the Kingdom’s growing luxury property market. Backed by Vision 2030, the move capitalized on rising high-end real estate demand, with international exposure and developments from Dar Global and Dar Al Arkan.

- September 2024: Mountain View launched its new venture, “Mountain View Saudi Arabia,” marking its entry into the Kingdom’s real estate sector. In partnership with Maya and Al Saedan Real Estate, the company acquired land in Riyadh to develop urban communities aligned with Vision 2030, emphasizing quality of life and regional expansion.

- February 2025: AI-powered real estate platform GetProp launched in the UAE, aiming to transform property transactions with features including AI-driven search, virtual tours, and PropTok video showcases. Headquartered in Dubai, it offered verified listings, and free postings for agents, and targeted a database of 5,000 properties by month-end to streamline the market experience.

- February 2025: BAMX Properties officially launched in the UAE, bringing 30 years of global real estate expertise to Dubai. The firm introduced its five specialized subsidiaries, emphasizing sustainability, luxury, and innovation. At a Dubai event, Chairman Mehdi Kavoosi highlighted plans to shape the city’s skyline and seize growth opportunities in the market.

- January 2025: Kuwait Real Estate Company and IFA Hotels launched the AED 3.5 Billion Al Tay Hills project in Sharjah, featuring 1,100 villas and townhouses across 6 million sq. ft. Set for 2028 completion, the development included scenic green spaces, modern amenities, and a 2.5 km Green River, promoting sustainable living.

GCC Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC real estate market from 2020-2034.

- The GCC real estate market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate market was valued at USD 141.2 Billion in 2025.

The GCC real estate market is driven by government-backed economic diversification, infrastructure development, rising tourism, increasing urbanization, favorable regulatory reforms, technological advancements such as smart city initiatives, and growing demand for residential and commercial properties from a young and affluent population.

The real estate market is projected to exhibit a CAGR of 7.03% during 2026-2034, reaching a value of USD 260.3 Billion by 2034.

The residential segment accounted for the largest share of the GCC real estate market in 2025, holding approximately 64.7% of the total market share. This dominance is primarily attributed to population growth and urbanization, government initiatives encouraging homeownership, strong demand for both affordable and luxury housing, and rising interest in short-term rentals in tourist hubs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)