GCC Property Management Market Report by Component (Solution, Services), Deployment (Cloud, On-Premises), Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), End User (Housing Associations, Real Estate Agents, Property Investors, and Others), Application (Residential, Commercial, Industrial, Recreational Facilities), and Country 2025-2033

GCC Property Management Market Overview:

The GCC property management market size reached USD 75.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 140.7 Million by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The market is significantly expanding, driven by rapid urbanization, increased real estate investments, and growing demand for professional management services to enhance asset value and operational efficiency. Additionally, technological adoption and government-backed infrastructure projects further bolster market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 75.25 Million |

| Market Forecast in 2033 | USD 140.7 Million |

| Market Growth Rate 2025-2033 | 6.80% |

GCC Property Management Market Trends:

Technological Integration in Property Management

The GCC property management market is witnessing a significant trend of technological integration, as companies adopt advanced solutions to streamline operations and enhance client service. Firms are leveraging property management software, IoT-enabled devices, and artificial intelligence for key functions, such as predictive maintenance, automated leasing, and tenant engagement, which is helping expand the market presence. For instance, according to industry reports, in 2024, Ejari, Saudi Arabia’s real estate technology company, secured $14.65 million in funding to expand its Rent Now, Pay Later (RNPL) services, exemplifying the region's commitment to innovation. This shift enhances operational efficiency and enables data-driven decision-making, offering real-time insights for superior asset management. The emphasis on smart building technologies and sustainable solutions aligns with the GCC’s push for infrastructure modernization, positioning property management firms to deliver competitive and future-ready services in an evolving market.

Sustainability and Green Building Practices

Sustainability is becoming a central focus in the GCC property management market, driven by regulatory mandates and the region’s commitment to environmental sustainability. Property management companies are increasingly adopting green building practices and energy-efficient systems to align with government initiatives and sustainability goals, which, in turn, is favoring the market growth. For instance, according to industry reports, in 2024, Saudi Arabia’s Public Investment Fund (PIF) significantly expanded its green investment portfolio, allocating over $19.4 billion to 91 eligible projects spanning renewable energy, green buildings, clean transportation, and sustainable water management. These practices include the integration of solar panels, energy-efficient HVAC systems, and smart water management solutions. The move toward sustainable property management not only reduces operational costs but also enhances property value and tenant satisfaction. Moreover, this trend reflects a broader shift in the real estate market towards eco-friendly solutions and responsible resource management, reinforcing the sector’s alignment with global sustainability standards.

Increased Demand for Comprehensive Property Services

The GCC property management market is experiencing increased demand for comprehensive property services, driven by a surge in real estate development and a focus on value-added offerings. For instance, according to industry reports, Dubai's real estate sector is witnessing significant growth in 2024, with 90,000 new homes expected over the next two years. Presently, 1,034 projects are in progress, totaling 288,020 units under construction, showcasing the market’s strong ability to meet demand. Property owners and investors seek end-to-end management solutions that cover leasing, maintenance, financial management, and tenant relations. This trend reflects a shift from traditional property oversight to integrated services that maximize asset performance and tenant satisfaction. Companies are expanding their service portfolios to include facilities management and consulting services, catering to both residential and commercial properties. The competitive landscape is pushing property management firms to differentiate themselves by offering tailored solutions that cater to the evolving needs of clients in a dynamic market environment.

GCC Property Management Market News:

- In August 2024, Sakan acquired Hapondo, signaling a major expansion into the Qatari market. This strategic acquisition enhances Sakan’s regional footprint, boosts property listings, and integrates data-driven insights to improve transparency and user experience, positioning the company as a key innovator in the GCC real estate and PropTech sectors.

GCC Property Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on component, deployment, organization size, end user, and application.

Component Insights:

- Solution

- Facility Management

- Lease Accounting and Real Estate Management

- Asset Maintenance Management

- Workspace and Relocation Management

- Reservation Management

- Project Management

- Security and Surveillance Management

- CRM Software

- Others

- Facility Management

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution [facility management (lease accounting and real estate management, asset maintenance management, workspace and relocation management, and reservation management), project management, security and surveillance management, CRM software, and others)] and services [professional services and managed services].

Deployment Insights:

- Cloud

- On-Premises

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes cloud and on-premises.

Organization Size Insights:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises (SMEs) and large enterprises.

End User Insights:

- Housing Associations

- Real Estate Agents

- Property Investors

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes housing associations, real estate agents, property investors, and others.

Application Insights:

- Residential

- Commercial

- Industrial

- Recreational Facilities

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, industrial, and recreational facilities.

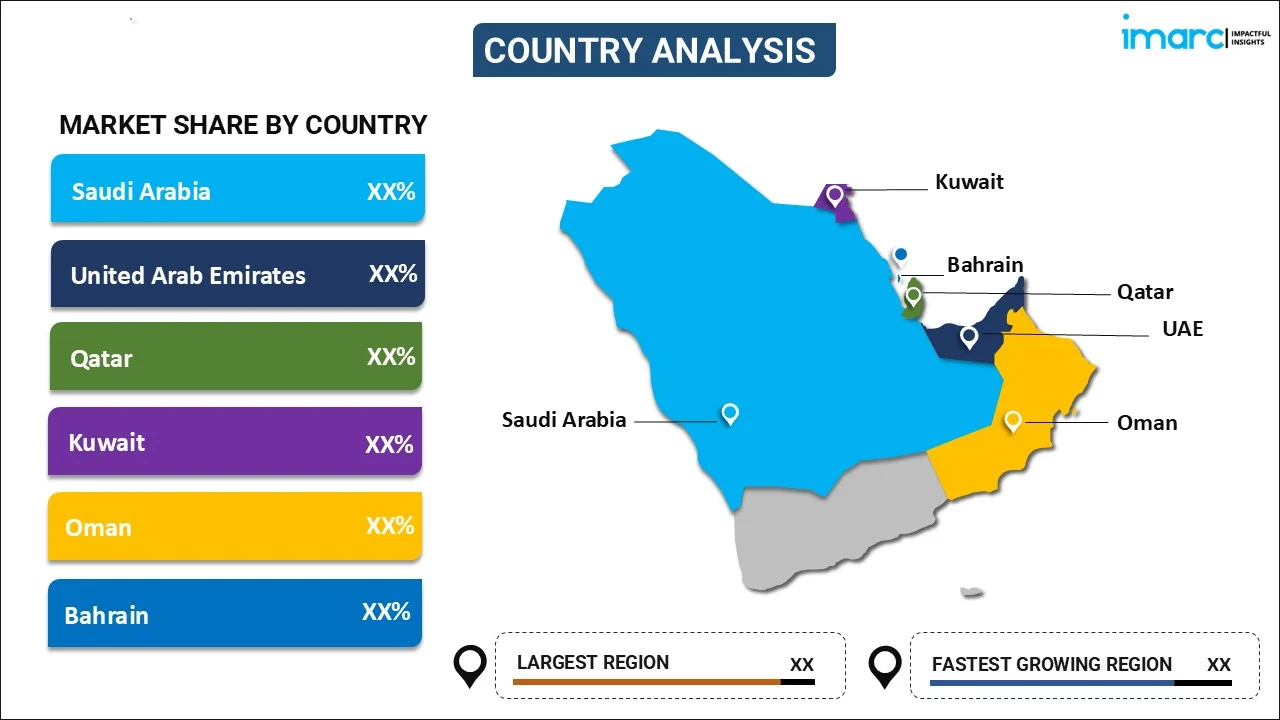

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Property Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployments Covered | Cloud, On-Premises |

| Organization Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| End Users Covered | Housing Associations, Real Estate Agents, Property Investors, Others |

| Applications Covered | Residential, Commercial, Industrial, Recreational Facilities |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC property management market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC property management market?

- What is the breakup of the GCC property management market on the basis of component?

- What is the breakup of the GCC property management market on the basis of deployment?

- What is the breakup of the GCC property management market on the basis of organization size?

- What is the breakup of the GCC property management market on the basis of end user?

- What is the breakup of the GCC property management market on the basis of application?

- What are the various stages in the value chain of the GCC property management market?

- What are the key driving factors and challenges in the GCC property management?

- What is the structure of the GCC property management market and who are the key players?

- What is the degree of competition in the GCC property management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC property management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC property management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC property management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)