GCC Pharmaceuticals Market Size, Share, Trends and Forecast by Type, Route of Administration, Distribution Channel, End User and Country, 2025-2033

GCC Pharmaceuticals Market Size and Share:

The GCC pharmaceuticals market size was valued at USD 23.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 48.98 Billion by 2033, exhibiting a CAGR of 7.60% from 2025-2033. The market is experiencing robust growth driven by rising healthcare needs, increased prevalence of chronic diseases and expanding healthcare infrastructure. Growing investments in research, innovation and biosimilars underscore the market's shift toward self-sufficiency and advanced healthcare solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 23.7 Billion |

| Market Forecast in 2033 | USD 48.98 Billion |

| Market Growth Rate (2025-2033) | 7.60% |

The key drivers in GCC pharmaceuticals market include the rising healthcare demand within the region due to growing chronic diseases and aging populations. Diabetes, hypertension, cancer, and cardiovascular diseases are rising, leading to a sustained demand for innovative drugs and therapies. For instance, a study by the International Agency for Research on Cancer reveals alarming cancer trends in the Gulf Cooperation Council (GCC) countries projecting significant increases in incidence and mortality by 2040. Government policies that encourage local production are further increasing the GCC pharmaceuticals market share. The government also provides healthcare investment through improved insurance coverage and infrastructure improvements, making it more accessible to pharmaceuticals. Public private partnerships for the expansion of health care allow the development of local manufacturing and distribution networks.

Another significant driver is the GCC's focus toward achieving pharmaceutical self-sufficiency through local production and reduced imports. Favorable regulatory frameworks and government incentives are attracting investments in research and manufacturing. For instance, in October 2024, the Saudi Minister of Health announced a licensing initiative for medical software during the Global Health Exhibition 2024 in Riyadh. This initiative aims to enhance digital health by facilitating investment in software for diagnosis and treatment promoting innovation without the need for physical manufacturing facilities. The increased adoption of biotechnology and biosimilar drugs indicates a shift in the region toward advanced healthcare solutions. One of the other key GCC pharmaceuticals market trends represent increasing technological integration such as digital health tools and AI driven research, which also accelerates drug development and delivery, fueling market expansion and innovation.

GCC Pharmaceuticals Market Trends:

Rising Local Manufacturing

The GCC region is witnessing rapid growth in local pharmaceutical manufacturing due to government focus on domestic production as an approach to reduce their import dependence and increase supply chain resilience. For instance, in August 2024, Saudi Arabia's pharmaceutical and medical device factories increased to 206 with investments totaling SR10 billion ($2.6 billion). This includes 56 licensed pharmaceutical factories accounting for SR7 billion and 150 medical device factories representing a 200% increase since 2018 totaling SR3.1 billion in investments. It is now a necessity to ensure the availability of drugs and improve self-sufficiency in health care during times of disturbances that have occurred during global crises. State of the art facility investments and incentives to local manufacturers are aiding this trend. Saudi Arabia and the UAE are encouraging local firms to enter partnerships with the world's top pharmaceutical companies to enhance knowledge transfer and technology uptake. Such an effort is enhancing regional capabilities and increasing employment while it contributes to the enhancement of economic stability.

Growth of Generic Drugs

The GCC region is witnessing a gradual shift toward the production and adoption of generic medicines as governments and consumers increasingly look for cost effective healthcare solutions. Rising healthcare prices and the requirement to make essential medicines more accessible have driven this trend. Governments are implementing supportive policies such as price regulations and incentives for local manufacturers to promote the production of generics. In order to further bolster the growth of generics and biosimilars, significant investments are being made to enhance local production capabilities in the region. For instance, in June 2024, TVM Capital Healthcare announced the investment of $35 million in Boston Oncology Arabia to enhance local production of generics and biosimilars in Saudi Arabia. Public awareness campaigns about the efficacy and affordability of generics are gaining traction. This shift not only reduces dependency on expensive branded drugs but also bolsters local manufacturing capabilities fostering sustainable GCC pharmaceutical market growth.

Advancements in Biotechnology

Advances in biotechnology in the GCC are highly influencing the pharmaceutical landscape. Increased investment in biopharmaceuticals has focused the region on personalized medicine tailored to the specific health needs of local populations. This includes developing treatments for chronic conditions prevalent in the GCC such as diabetes and cardiovascular diseases. For instance, in December 2024, Ali Abdulwahab Al Mutawa Commercial Company announced its partnership with AstraZeneca to enhance healthcare in Kuwait focusing on innovative treatments for cardiovascular disease diabetes and rare diseases. The emergence of genomics and molecular biology drives innovation which positions the region as a biotechnology leader. It enables the faster and more precise development and production of drugs. These advancements are acting as critical factors creating positive GCC pharmaceutical market outlook.

GCC Pharmaceuticals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC pharmaceuticals market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, route of administration, distribution channel, and end user.

Analysis by Type:

- Drugs

- Cardiovascular Drugs

- Dermatology Drugs

- Gastrointestinal Drugs

- Genito-Urinary Drugs

- Hematology Drugs

- Anti-Infective Drugs

- Metabolic Disorder Drugs

- Musculoskeletal Disorder Drugs

- Central Nervous System Drugs

- Oncology Drugs

- Ophthalmology Drugs

- Respiratory Diseases Drugs

- Biologics

- Monoclonal Antibodies (MAbs)

- Therapeutic Proteins

- Vaccines

Drugs dominate the GCC pharmaceuticals market by type led by the growing demand for medications used to treat chronic and lifestyle-related diseases such as diabetes, cardiovascular disorders and respiratory conditions. Governments have also been proactive in encouraging the growth of local pharmaceutical production in a bid to cut imports. With an increased focus on biosimilars and biologics this segment is gaining traction as well due to advanced treatment options. Government measures like a broadening program of health care insurance and collaboration between public-private sectors would improve access to essential drugs. A constant stream of innovation in form and delivery provides drugs with strong positions in this regional market.

Analysis by Route of Administration:

-

- Oral

- Topical

- Parenteral

- Others

Oral routes lead the GCC pharmaceuticals market since administration by such a route is most convenient, safe, and manageable by patients. Various preparations including tablets, capsules and syrups are available for different therapeutic needs from chronic disease management to acute care. Lifestyle-related diseases including diabetes and hypertension are increasingly common thereby boosting demand for oral drugs. Technological advances in drug delivery systems such as controlled-release and targeted oral formulations have enhanced therapeutic outcomes and made oral delivery the most popular route in the region's pharmaceutical market.

Analysis by Distribution Channel:

-

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Hospital pharmacies are the largest distribution channel in the GCC pharmaceuticals market as they play a crucial role in healthcare delivery. They are the first point of dispensing drugs whether administered in hospitals or clinics. With the increasing demand for specialized and emergency medicines hospital pharmacies are well-placed to cater to the complex needs of patients requiring immediate or intensive care. Hospital pharmacies are staffed with competent professionals to handle inventory so that essential drugs are available at the right time which further propels their dominance in the distribution channel segment.

Analysis by End User:

-

- Hospitals and ASCs

- Clinics

- Others

Hospitals and ASCs are the most crucial end users of the GCC pharmaceuticals market because of their role in delivering comprehensive health care. The hospitals are central service providers for all types of diseases which often require specialty and emergency drugs. ASCs are outpatient surgery centers that deal with specialty drugs used for short periods of treatment. Both institutions account for a high percentage of GCC pharmaceutical market demand since both routine and emergency medical services are required.

Clinics is another significant end user segment for the GCC Pharmaceuticals market. These clinics offer various healthcare services that range from prevention to diagnosis and minor treatments. Clinics mainly provide general as well as specialty drugs and serve as the first contact points for patients visiting a healthcare service provider. Growth in outpatient services and ease of access to health services has led to the demand for pharmaceutical products within clinics hence the importance of this market segment.

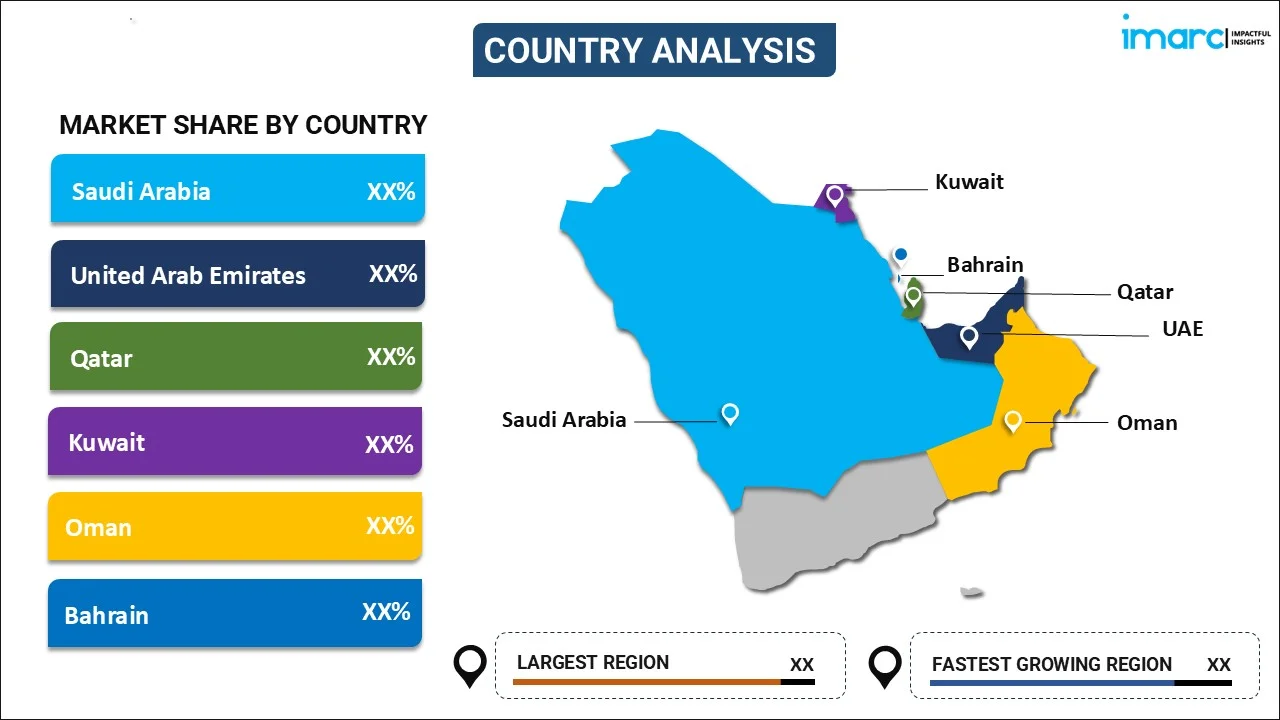

Country Analysis:

- Saudi Arabia

- UAE (United Arab Emirates)

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia leads the market accounting for 46.5% of the market share. Saudi Arabia currently leads the GCC Pharmaceuticals market with its strong health infrastructure, growing population and higher demand for good quality medical products. The development of advanced medical facilities and expanding healthcare sector plays a significant role in the pharmaceutical consumption of this country. Government initiatives on improving access to healthcare and medical technology investments boost pharmaceutical growth. With a large share of pharmaceutical spending in the region Saudi Arabia's market dominance is also fueled by its central position in the GCC attracting both regional and international pharmaceutical players.

Competitive Landscape:

The GCC pharmaceuticals market is highly competitive driven by rapid advances in healthcare infrastructure and the increasing prevalence of chronic diseases. Local and international players are investing in manufacturing facilities to meet growing regional demand and reduce reliance on imports. Companies are leveraging technological innovations to develop advanced treatments and biosimilars tailored to local health needs. Market penetration and access is maximized through strategic partnerships with providers and distributors ensuring that medicines reach patients and providers on time. Reforms that expedite the approval process of drugs as well as supporting local production strengthen the intensive competition in the market. Emphasis on research and development along with digitalization of supply chains and patient care put the market on a dynamic plane of growth and innovation.

The report provides a comprehensive analysis of the competitive landscape in the GCC pharmaceuticals market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, BOSTON ONCOLOGY ARABIA and SPIMACO announced their partnership to localize advanced oral oncology treatments in Saudi Arabia. This collaboration aims to enhance patient access to essential therapies strengthen the local pharmaceutical industry and align with Saudi Arabia’s Vision 2030 healthcare goals.

- In December 2024, Bio-Thera Solutions announced its partnership with Tabuk Pharmaceuticals to commercialize its ustekinumab biosimilar in Saudi Arabia. Tabuk will handle manufacturing, distribution and marketing while Bio-Thera will manage development and supply. This collaboration aims to enhance patient access to innovative therapies in line with Saudi Arabia's Vision 2030.

- In October 2024, Eisai launched operations at its new pharmaceutical sales subsidiary Eisai Saudi Arabia in Riyadh. The subsidiary will oversee the sales of drugs including Methycobal and Fycompa previously distributed by local partners. Eisai aims to enhance access to innovative medications in Saudi Arabia's growing pharmaceutical market.

GCC Pharmaceuticals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Route of Administration Covered | Oral, Topical, Parenteral, Others |

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Others |

| End-Users Covered | Hospitals and ASCs, Clinics, Others |

| Countries Covered | Saudi Arabia, UAE (United Arab Emirates), Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC pharmaceuticals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC pharmaceuticals market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC pharmaceuticals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pharmaceuticals market was valued at USD 23.7 Billion in 2024.

The market is driven by rising healthcare needs due to increasing chronic disease prevalence, aging populations, government investments in healthcare infrastructure, and initiatives to boost local pharmaceutical manufacturing.

IMARC estimates the pharmaceuticals market to reach USD 48.98 Billion exhibiting a CAGR of 7.60% during 2025-2033.

Drugs lead the GCC pharmaceuticals market driven by demand for treatments for chronic diseases, government healthcare initiatives, and innovations in biologics and biosimilars.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)