GCC Perfume Market Size, Share, Trends and Forecast by Price, Gender, Product, and Region, 2025-2033

GCC Perfume Market Size and Share:

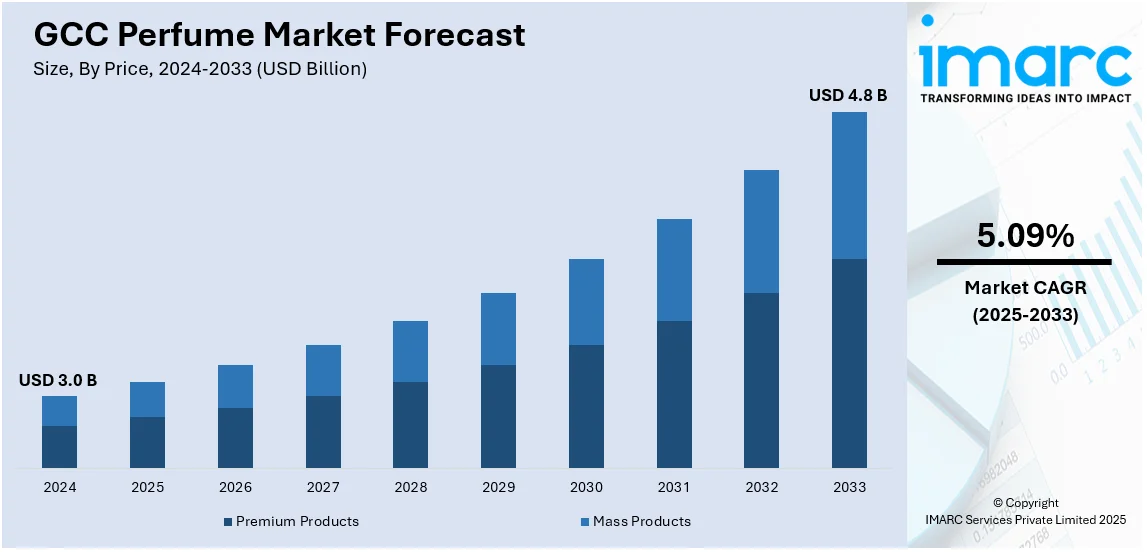

The GCC perfume market size was valued at USD 3.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.8 Billion by 2033, exhibiting a CAGR of 5.09% during 2025-2033. Saudi Arabia currently dominates the market, holding a significant market share. The growing focus on personal grooming and maintaining hygiene and freshness, rising preference for online retailing channels due to their easy access facilities, and the thriving tourism industry are among the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Market Growth Rate 2025-2033 | 5.09% |

The perfume market in GCC is driven by a combination of cultural, economic, and demographic factors unique to the region. Cultural affinity for fragrances plays a central role, as perfumes are deeply embedded in the daily lives and religious traditions of the Gulf population. The widespread use of attars, oud, and bakhoor fuels consistent demand, especially for both traditional and modern scent blends. High disposable incomes and a luxury-oriented lifestyle in countries like the UAE and Saudi Arabia support robust spending on premium and niche fragrance brands. For instance, in October 2024, Ajmal Perfumes, an international farm-to-fragrance label with seventy years of expertise in the delicate craft of perfumery, revealed the exclusive introduction of three new fragrances, Golden Hawk, Blue Hawk, and Feather Blossom, in the UAE. Every scent is carefully designed to represent elegance, sophistication, and the area's appreciation for luxurious fragrances. The market also benefits from strong tourism and duty-free retail, which boosts perfume sales in major cities such as Dubai, Doha, and Riyadh.

The youthful demographic in the region, with a preference for international trends and personalized scents, is reshaping product offerings. Global brands are responding by launching GCC-exclusive lines and adapting packaging to local preferences. For instance, in November 2024, Luxury fragrance label Nisara teamed up with Beauty Brands Global DMCC to serve as its sole distributor in the UAE, the brand revealed in a press statement on Monday. Through this collaboration, the company intends to enhance its brand visibility in the UAE market. Serving as the sole distributor, Beauty Brands Global will provide market knowledge and assist in establishing trade networks for the brand. The e-commerce boom, accelerated by tech-savvy consumers, has also transformed access to perfumes, offering convenience and variety. Government support for non-oil sectors, including retail and manufacturing, has attracted investments in regional fragrance production, further strengthening the market’s growth trajectory across the Gulf Cooperation Council.

GCC Perfume Market Trends:

Increasing focus on personal grooming

Perfumes are considered as an integral part of the daily life of individuals in the region, as they are used in traditional rituals and personal grooming purposes. According to an industry report, individuals in GCC countries typically apply perfumes two to four times a day. The appeal of fragrances makes it an essential element of cultural identity and self-expression. As a result, perfume manufacturers often incorporate traditional ingredients and blends to cater to this cultural connection for individuals in the region. In line with this, the rising focus on personal grooming among individuals is bolstering the growth of the market. People are increasingly becoming aware of maintaining personal hygiene. In addition, perfumes aid in keeping body odor away and boost confidence among individuals. It has become an integral component of daily attire utilized by individuals to maintain professionalism. Apart from this, the rising demand for a diverse range of scents, from light and refreshing options for daytime use to sophisticated and alluring choices for evening occasions, is propelling the GCC perfume demand.

Thriving tourism industry

The rising demand for perfumes due to the thriving tourism industry in the GCC region is contributing to the growth of the market. The GCC Secretary General reported that international tourist arrivals in GCC countries reached 68.1 million in 2023, generating USD 110.4 Billion in tourism revenue. In addition, there is an increase in the demand for perfumes among individuals seeking to experience the unique blend of luxury, tradition, and modernity of the region. Apart from this, tourists often view perfumes as tangible gifts that encapsulate the essence of their travel experience. Major players are offering a variety of fragrances that capture the cultural and luxurious products of the region. They are also offering personalized fragrance options to tourists by engaging in marketing strategies and enhancing packaging designs to enhance the overall experience of visitors.

GCC Perfume Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC perfume market, along with forecasts at the country level from 2025-2033. The market has been categorized based on price, gender, and product.

Analysis by Price:

- Premium Products

- Mass Products

Premium products dominate the market. Premium products represent a segment of fragrances that are positioned at a higher price point, characterized by their exquisite quality, unique compositions, and superior packaging. These perfumes are crafted using a blend of rare and high-quality ingredients. The emphasis is on creating an exclusive and luxurious olfactory experience that resonates with consumers seeking sophistication and elegance. These products are associated with luxury brands or perfumers renowned for their craftsmanship. The packaging and presentation of premium products attract a wide consumer base. This category caters to consumers who value exceptional scent profiles, artistic expression, and the embodiment of luxury.

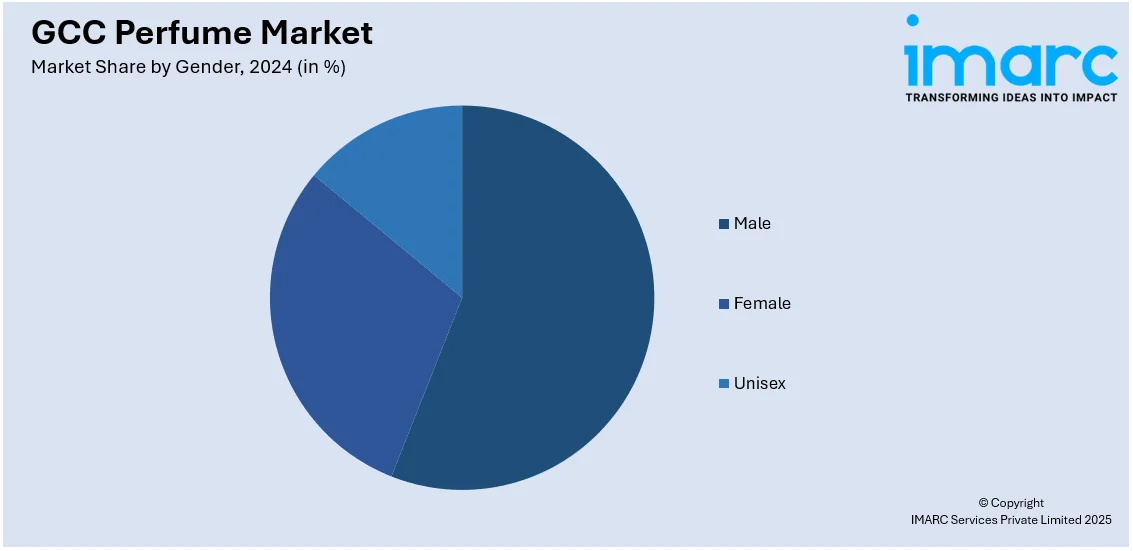

Analysis by Gender:

- Male

- Female

- Unisex

Unisex electronics leads the market. Unisex fragrances offer scents that are designed to appeal to individuals of any gender identity. These fragrances are widely utilized by males and females, presenting a harmonious blend that caters to a diverse range of preferences. They often feature versatile and neutral scent profiles and are incorporated with fresh citrus, woody undertones, or floral accords that appeal universally. This category caters to the changing societal attitudes toward personal expression and individuality, offering a more inclusive approach to fragrance consumption. In addition, the rising demand for these products due to changing consumer lifestyles and improved living standards is bolstering the growth of the market.

Analysis by Product:

- Arabic

- French

- Others

Arabic leads the market in 2024. Arabica perfumes, also known as Oud, are rooted in the rich cultural heritage of the Arabian Peninsula and are crafted using the highly valued oud, a resinous wood that emits a captivating and enduring aroma when distilled. Arabic perfumes often showcase traditional scents, blending oud with floral, woody, or spicy notes to create opulent and complex fragrances that resonate with the history and aesthetics of the region. In addition, they serve as a cultural emblem and embody the essence of Arabian traditions while also catering to an audience captivated by the allure of oriental fragrances.

Regional Analysis:

- Saudi Arabia

- UAE

- Kuwait

- Others

In 2024, Saudi Arabia accounted for the largest GCC perfume market share. Saudi Arabia held the biggest market share due to the burgeoning tourism sector. In line with this, the rising introduction of new fragrance experiences among individuals is bolstering the growth of the market in the country. Besides this, the growing demand for perfumes from online platforms is offering a positive market outlook. In line with this, the increasing preference for traditional production practices is supporting the growth of the market in Saudi Arabia.

Competitive Landscape:

Key players are rapidly investing in research and development (R&D) activities to create innovative fragrance blends that cater to evolving consumer preferences. In addition, they are experimenting with diverse ingredients and notes to produce distinctive scents that stand out in the market. Apart from this, many companies are blending modernity with tradition by infusing their fragrances with elements of local culture and history. This approach attracts consumers who are seeking a connection to their heritage while embracing contemporary trends. Moreover, major manufacturers are releasing limited-edition collections to create excitement and exclusivity among consumers. Furthermore, they are increasingly focusing on sustainability by using eco-friendly packaging, responsibly sourcing ingredients, and reducing their environmental footprint, which is offering a positive GCC perfume market outlook.

The report provides a comprehensive analysis of the competitive landscape in the GCC perfume market with detailed profiles of all major companies, including:

- Ajmal

- TFK

- Rasasi

- Arabian Oud

- Abdul samad Al qurashi

Latest News and Developments:

- February 2025: Dubai-based Huda Beauty sold its fragrance brand KAYALI to co-founder Mona Kattan and General Atlantic. The move allows Huda Beauty’s owners to regain a stake from TSG Consumer Partners. KAYALI will operate independently with Mona Kattan remaining as CEO.

- September 2024: Emirates partnered with luxury organic brand VOYA to create exclusive Eau de Toilette fragrances for First and Business Class. Inspired by Ireland’s landscapes and Middle Eastern scents, the fragrances complement Emirates' existing VOYA spa products, offering passengers a luxurious and sustainable in-flight experience.

- September 2024: Dubai princess Sheikha Mahra Al Maktoum launched a new perfume named "Divorce" under her brand Mahra M1. The launch followed her public split from Sheikh Mana bin Mohammed, which she announced through a dramatic Instagram post in July 2024.

- April 2024: UK-based Quintessence Fragrances opened a new office in Sharjah, UAE to strengthen its presence in the Middle Eastern market. The office will collaborate with the company's creative centers in the UK and India to drive regional expansion.

- February 2024: Faridah F Ajmal launched FARIDAH, a home-grown fragrance brand in Dubai. As the first Asian woman perfumer-entrepreneur in the region, she introduced unique oriental and French perfume collections.

GCC Perfume Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Prices Covered | Premium Products, Mass Products |

| Genders Covered | Male, Female, Unisex |

| Products Covered | Arabic, French, Others |

| Regions Covered | Saudi Arabia, UAE, Kuwait, Others |

| Companies Covered | Ajmal, TFK, Rasasi, Arabian Oud, Abdul samad Al qurashi, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC perfume market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC perfume market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC perfume industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC perfume market was valued at USD 3.0 Billion in 2024.

The GCC perfume market is projected to exhibit a CAGR of 5.09% during 2025-2033, reaching a value of USD 4.8 Billion by 2033.

Key factors driving the GCC perfume market include strong cultural and religious affinity for fragrances, high disposable incomes fueling demand for luxury scents, a youthful population seeking modern and personalized perfumes, rising tourism and retail expansion, and increased e-commerce activity enhancing accessibility and variety across the region.

Saudi Arabia currently dominates the GCC perfume market due to a high fragrance consumption culture, rising disposable income, youth-driven demand, luxury preferences, and retail expansion.

Some of the major players in the GCC perfume market include Ajmal, TFK, Rasasi, Arabian Oud, Abdul samad Al qurashi, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)