GCC OTT Services Market Size, Share, Trends and Forecast by Application, Business Model, End-Use, and Country, 2025-2033

GCC OTT Services Market Size and Share:

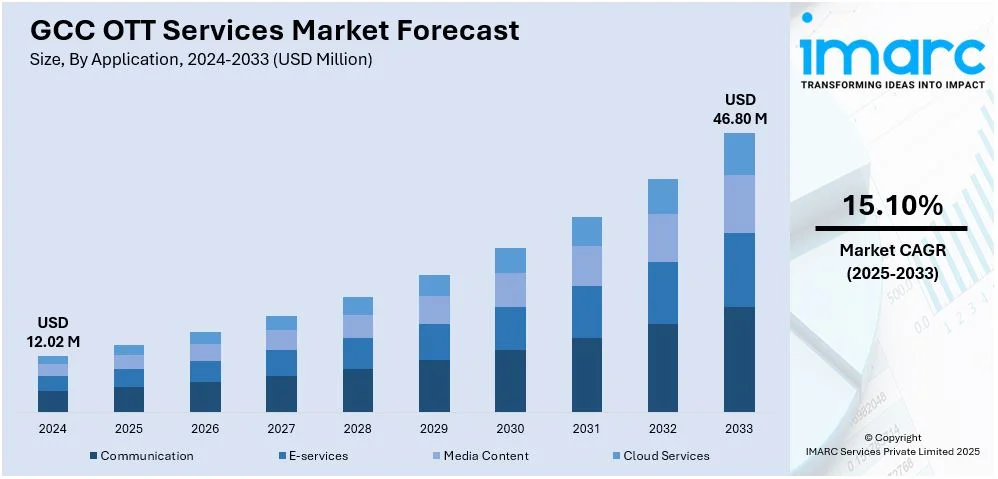

The GCC OTT services market size was valued at USD 12.02 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.80 Million by 2033, exhibiting a CAGR of 15.10% from 2025-2033. The market is driven by the increasing investments in digital infrastructure development and 5G network expansion, which is beneficial for fast content streaming, along with the rising adoption of AI-driven algorithms that offer personalized content suggestions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.02 Million |

|

Market Forecast in 2033

|

USD 46.80 Million |

| Market Growth Rate (2025-2033) | 15.10% |

The rising usage of subscription-based business models in the GCC region is impelling the market growth. As people seek personalized and on-demand content, subscription-based models provide a flexible and affordable solution. With over-the-top (OTT) platforms offering a wide range of content like movies, TV shows, and sports, users are willing to pay a fixed monthly or annual fee for unlimited access. This allows viewers to avail content whenever and wherever they want, without the need for traditional cable subscriptions. Subscription-based models also enable OTT service providers to generate steady and predictable revenue streams, which they can reinvest in acquiring and producing more content. Popular OTT platforms are capitalizing on this model by offering tiered pricing options that cater to different user preferences and income levels. Moreover, subscription-based OTT services offer exclusivity through premium content and ad-free viewing experiences, which makes them a go-to choice.

The growing availability of original content is positively influencing the market across the GCC region. As people prefer unique and engaging content, OTT platforms are responding by investing in and producing original shows, movies, documentaries, and local content that cater to the diverse choice of regional audiences. They are increasing their production of exclusive and high-quality content to attract subscribers. Original content plays a key role in differentiating OTT services from traditional TV and other streaming platforms. Regional productions with culturally relevant storylines resonate deeply with local audiences. Apart from this, in the GCC region, Arabic-language content, including dramas and reality shows, is becoming popular, which encourages OTT service providers to stream them in more numbers. This rising focus on original content enhances the user experience and assists in building loyalty, as subscribers are more likely to stay with platforms offering exclusive content they can’t find elsewhere. Furthermore, original content is chosen due to word-of-mouth recommendations, which increases subscriber acquisition and retention.

GCC OTT Services Market Trends:

Rising digital transformation

The increasing digital transformation is influencing how users reach and engage with digital content, thereby supporting the market growth. With the region’s rapid adoption of digital technologies, people are shifting towards internet-based streaming platforms. OTT services are accessible via smartphones, tablets, and other connected digital devices to provide users with convenience. Moreover, the GCC region invests in digital infrastructure development and 5G network expansion, which is beneficial for OTT platforms to enable faster internet speeds and reduce latency while streaming high-quality content. Apart from this, cloud-based OTT platforms allow users to store data efficiently and access content from multiple devices without the need for physical media or storage devices. Cloud technology also enables OTT providers to scale their services quickly and, hence, meet the increasing demand for valuable content. According to the IMARC Group’s report, the GCC digital transformation market is projected to exhibit a growth rate (CAGR) of 24.8% during 2024-2032.

Integration of artificial intelligence

The rising integration of artificial intelligence (AI) is enhancing user experience and operational efficiency, which is fueling the market growth. AI-driven recommendation algorithms offer personalized content suggestions based on viewers’ preferences and behavior to improve user engagement and retention rates. By analyzing viewing patterns, AI helps OTT platforms to curate libraries tailored as per regional and individual requirements. It also enables advanced search functionality by making content more discoverable. In the backend, it optimizes video streaming quality through adaptive bitrate streaming to reduce buffering. It provides platforms with valuable insights into user trends, allowing for informed decisions on content creation and acquisition. The data published on the website of the IMARC Group shows that the GCC AI market is expected to reach USD 23.7 Billion by 2032.

Increasing adoption of streaming analytics

The growing adoption of streaming analytics is enabling platforms to improve content delivery and enhance user engagement. Streaming analytics allows OTT providers to analyze vast amounts of real-time data generated by users during streaming sessions. By processing this data instantly, platforms can identify patterns and optimize content delivery based on viewer preferences, geographic location, and device type. This capability helps to enhance personalized recommendations and smoothen the viewing experience. Besides this, platforms can monitor video performance, detect issues, and adjust quality in real-time. It also aids in better-targeted advertising to offer more relevant ads based on user behavior and preferences, leading to high revenue generation. IMARC Group predicts that the Saudi Arabia streaming analytics market will exhibit a growth rate (CAGR) of 22.1% during 2025-2033.

GCC OTT Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC OTT services market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application, business model, and end-use.

Analysis by Application:

- Communication

- E-services

- Media Content

- Cloud Services

OTT services for communication like messaging and voice or video calling apps, are popular in the GCC region since they offer free and efficient options. They are widely used for personal and professional purposes, especially in expatriate-heavy regions, as they help to connect with families abroad. With fast internet speeds and mobile penetration, communication apps are replacing traditional telecom services owing to their convenience and cost-effectiveness.

OTT platforms are used for e-services to cover online banking, education, and healthcare. The young people in the region prefer watching content enabled by e-services. Moreover, e-learning platforms, telemedicine apps, and digital payment solutions are especially popular here. They cater to a population that values efficiency and accessibility, making life more convenient.

Media content OTT platforms comprise a significant portion of the market share, as users turn to them for entertainment. They offer a mix of Arabic and international content to cater to diverse choices. Apart from this, people opt for exclusive shows, live sports, and flexible subscription models.

Cloud-based OTT services are employed by enterprises for data storage, virtual collaboration, and software hosting. Besides this, individuals leverage cloud services for seamless streaming and content access. Cloud services are highly scalable and secure features, which promote their use to ensure efficient performance and reliability in different OTT applications.

Analysis by Business Model:

- Premium and Subscription

- Adware

- E-commerce

The premium and subscription model is widely channelized by OTT platforms to offer ad-free and high-quality content in return for a monthly fee. With a mix of regional and international shows, this model appeals to users who are willing to pay for exclusive access and seamless streaming. Moreover, it is especially popular among viewers seeking convenience, personalized recommendations, and fresh entertainment.

Adware-based OTT services like free versions of streaming platforms are highly popular in the region. They cater to audiences who prefer free access to content in exchange for watching ads. This model is ideal for a region with a high mobile usage rate to provide quick content. Advertisers utilize these platforms to target the GCC audience with localized and relevant ads.

OTT services are integrated with e-commerce platforms to attract users who value multi-functionality. This model is valuable in this region, as it is convenient and gives instant gratification. These services provide enhanced shopping experiences, exclusive deals, and content bundled together.

Analysis by End-Use:

.webp)

- Personal

- Commercial

The personal segment caters to individuals who turn to OTT platforms for entertainment. With tailored recommendations, multilingual content, and mobile-friendly access, OTT platforms fit well into everyday lives. People enjoy watching their favorite shows and on-demand blockbuster movies. Moreover, content can be easily availed on smartphones, smart TVs, and tablets for personal use.

Commercial settings like businesses, hotels, and airlines use OTT platforms to improve customer experiences. Luxury hotels provide access to premium OTT platforms for guests, while airlines stream content in-flight. Other than this, educational institutions and corporate sectors also employ these platforms for training and e-learning purposes.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia is noted for its high internet penetration, which benefits OTT service providers. With a young demographic eager for streaming content, platforms offer Arabic and international shows to gain popularity. Moreover, companies in the region spend on streaming localized and live content, such as live sports streaming and exclusive series as well as enabling fast premium services.

The United Arab Emirates (UAE) has a diverse population that prefers OTT services for entertainment across various languages. With advanced telecom infrastructure and a high smartphone penetration rate, the UAE region is a hub for international and regional platforms. Here, OTT platforms also offer flexible subscriptions and ad-supported models.

In Qatar, OTT services are particularly employed by a wealthier population with a strong preference for premium content. The region has well-setup internet connectivity and high smart TV adoption, which enables uninterrupted streaming of shows. Moreover, people opt to watch exclusive live sports offerings, as Qatar is well-known for its passion for football and association with worldwide sporting events.

Bahrain inculcates a tech-literate population, which prefers using OTT services. In the country, people are adopting smartphones and affordable data plans to encourage on-the-go streaming. Bahrainis appreciate platforms that offer localized Arabic content alongside international shows and movies.

In Kuwait, there is a high preference for digital consumption to contribute to the market growth. People opt for premium subscriptions to access buffer-free and fresh content. International platforms spend on providing seamless services to the users. Besides this, Kuwait focuses on the development of smart cities, which promoted the use of OTT to cater to its residents' entertainment habits.

Oman has well-established internet connectivity with a high number of mobile users. The younger generation in Oman is particularly drawn to affordable streaming options that offer Arabic series, movies, and international content. Apart from this, people turn to digital entertainment, as they are influenced by social media trends and changing lifestyles.

Competitive Landscape:

Key players are offering innovative content, advanced technology, and tailored experiences. They are providing diverse and localized content that resonates with GCC audiences. They leverage improved streaming technology for seamless user experiences and invest in partnerships with telecom providers to expand accessibility. Besides this, they are enabling flexible pricing models, such as ad-supported tiers, to attract a broader user base. They emphasize personalization through AI-driven recommendations and exclusive content libraries. Moreover, they are making efforts to establish OTT platforms as a preferred medium for entertainment, education, and communication across the GCC region. For instance, in March 2024, Yango, a leading tech company that provides multiple services, released its AI-powered entertainment app, ‘Yango Play’ for the audiences of Middle East and North Africa (MENA) countries. It consists of an AI-based Arabic voice assistant, Yasmin that offers different streaming options from Arabic shows to films.

The report provides a comprehensive analysis of the competitive landscape in the GCC OTT services market with detailed profiles of all major companies.

Latest News and Developments:

- March 2024: Ooredoo Group, a prominent multinational communications company based in Doha, Qatar, made an announcement about its partnership with Microsoft Azure, a cloud computing platform by Microsoft, and MediaKind, a well-known video technology company, to release its first OTT streaming platform 'Go Play Market' in six countries, namely Oman, Kuwait, Iraq, Tunisia, Algeria, and the Maldives. They aim to establish a sought-after entertainment hub and cater to the diverse preferences of users.

- January 2024: The UAE-based media and entertainment streaming service, EVision, collaborated with Disney Star, a leading premium streaming platform, to expand its services to the MENA region. This agreement provides viewers with access to popular on-demand content.

GCC OTT Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Communication, E-services, Media Content, Cloud Services |

| Business Models Covered | Premium and Subscription, Adware, E-commerce |

| End Uses Covered | Personal, Commercial |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC OTT services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC OTT services market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC OTT services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

OTT services deliver content directly to users via the internet, bypassing traditional distribution methods like cable or satellite. They include video streaming platforms, music streaming, communication apps, and cloud-based services. They are highly flexible, accessible, and cost-effective and are preferred for streaming content from user’s comfort zone.

The GCC OTT services market was valued at USD 12.02 Million in 2024.

IMARC estimates the GCC OTT services market to exhibit a CAGR of 15.10% during 2025-2033.

Young people in the region prefer streaming content on OTT platforms over traditional platforms, which is impelling the market growth. Besides this, the rising need for on-demand, ad-free, and quality content is increasing subscription rates, thereby fueling the market growth. Moreover, key players are investing heavily in expanding their content libraries and services to support the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)