GCC Orthopedic Devices Market Size, Share, Trends and Forecast by Product, End-Use, and Country, 2025-2033

GCC Orthopedic Devices Market Size and Share:

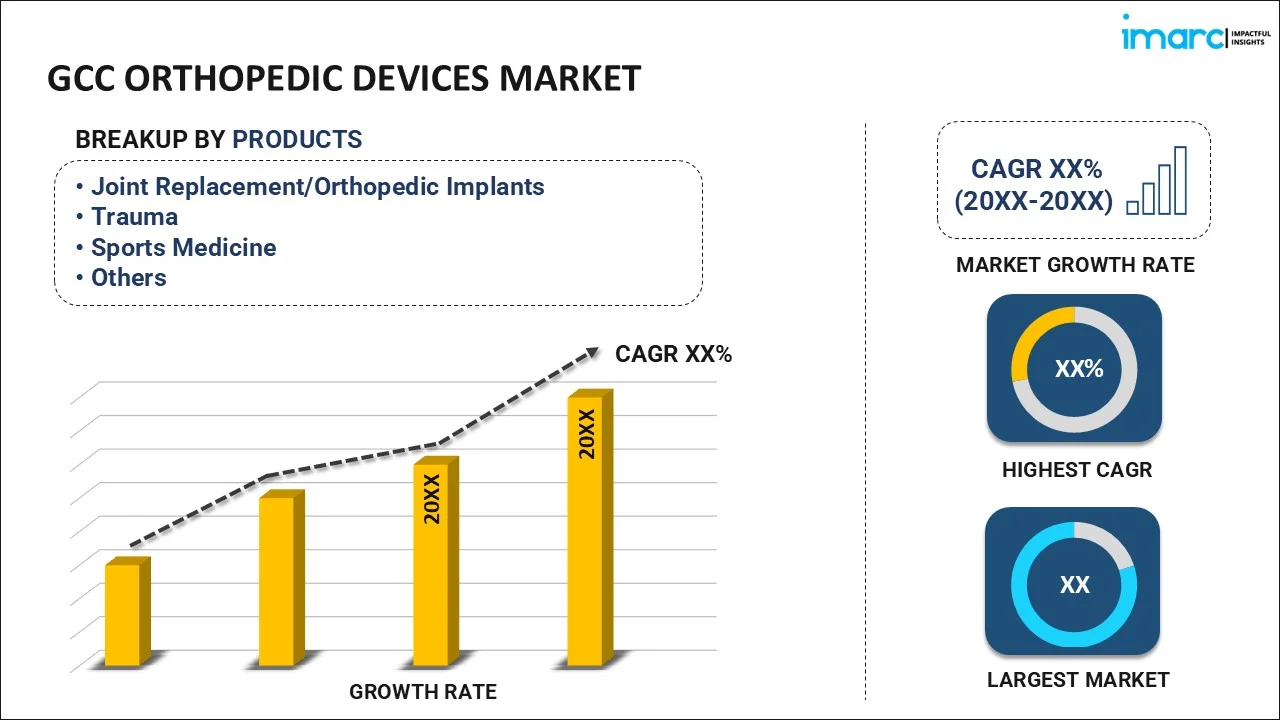

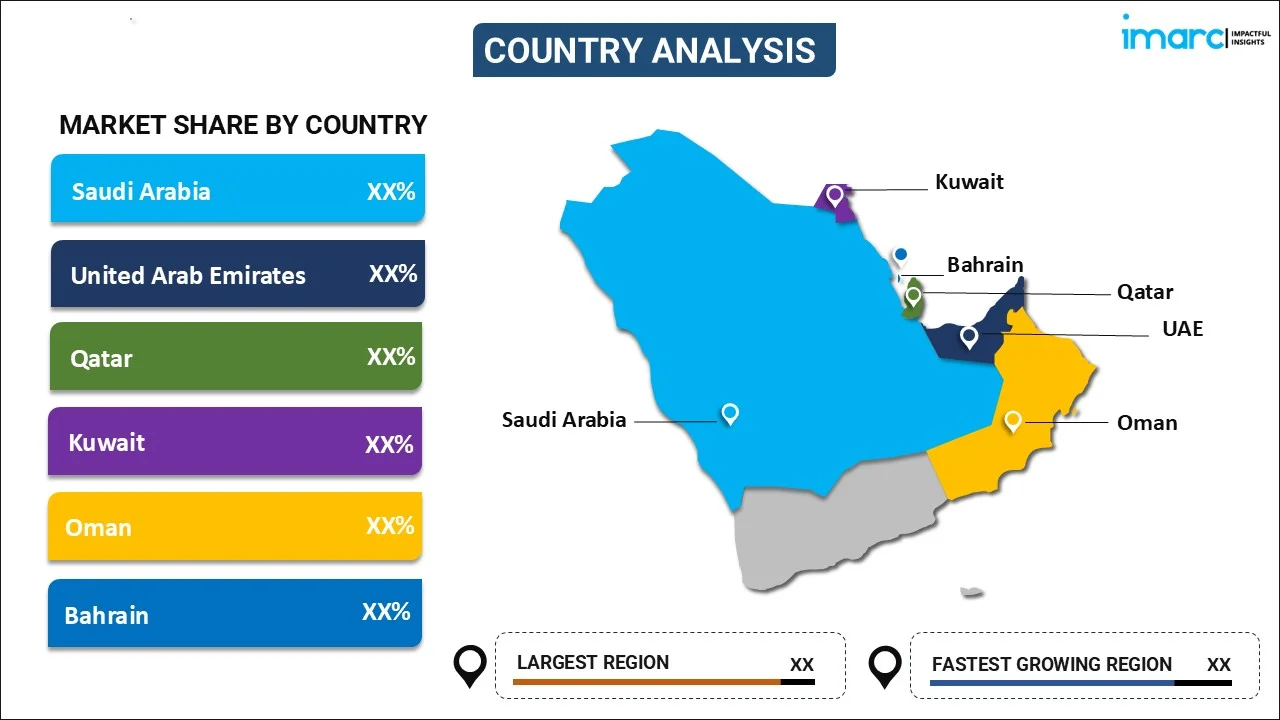

The GCC orthopedic devices market size was valued at USD 845.90 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1503.61 Million by 2033, exhibiting a CAGR of 6.10% from 2025-2033. UAE currently dominates the market, with 31.5% of the market share. The market is primarily driven by the growing demand for customizable, patient-specific solutions, the ongoing integration of artificial intelligence in orthopedics, continual advancements in precision medicine, government-led initiatives, strategic collaborations, public-private partnerships, and a heightened focus on value-based healthcare models to enhance patient outcomes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 845.90 Million |

| Market Forecast in 2033 | USD 1503.61 Million |

| Market Growth Rate (2025-2033) | 6.10% |

The market in the GCC is largely driven by the increasing number of medical cases involving musculoskeletal disorders including arthritis, osteoporosis, and fractures. This can be attributed to the growing geriatric population, increasing prevalence of sedentary lifestyle and obesity, which is resulting in a higher uptake of advanced orthopedic treatments. The GCC Statistical Centre estimated that until March 10, 2024, around 2.6 million elder people aged over 60 years have made up 4.5% of the GCC's population in the year 2023. Orthopedic services will be strongly needed by this part of the demographics. Moreover, there is a significant increase in healthcare infrastructure investment by the GCC governments. For example, Saudi Arabia has its Vision 2030, while the UAE has similar plans with an emphasis on accessibility and quality of care, thereby fostering market growth.

The increasing adoption of advanced technologies in orthopedic devices is also a significant driver of market growth in the GCC region. Similarly, ongoing innovations such as robotic-assisted surgery, 3D printing, and minimally invasive techniques are gaining traction, enhancing surgical precision, patient outcomes, and recovery experiences. Furthermore, rise in medical tourism, plays a vital role in market expansion by offering high-quality orthopedic treatments at competitive costs. A 2024 industry report highlights that the UAE has already been recognized as one of the world’s leading destinations for medical tourism. In 2022, wellness tourists spent USD 5.4 Billion in the UAE, up from USD 2.1 Billion in 2020, according to the Global Wellness Economy Monitor. Dubai Health Authority informed that 674,000 medical tourists bestowed Dh992 Million (USD 270 Million) in 2022. With healthcare expenditurein the UAE projected to reach USD 30.7 Billion by 2027, strategic collaborations between global manufacturers and local providers ensure access to advanced orthopedic solutions, supporting sustained market demand.

GCC Orthopedic Devices Market Trends:

Rising Demand for Customizable and Patient-Specific Devices

The GCC market is witnessing a marked shift towards customized, patient-specific solutions due to the growing demand for precision medicine and better healthcare outcomes. Such advanced technologies as 3D printing can create customizable implants and prosthetics based on individual anatomical requirements. As a result, such innovations improve better surgical outcomes, comfort, and recovery times for patients. The GCC healthcare players are adopting this innovation to cater to rising patient expectations regarding personalized care. Strategic partnerships between global manufacturers and regional healthcare institutions are further driving this trend. Biongevity, for instance, launched Dubai's first precision health and longevity clinic on September 15, 2024, focusing on precision medicine in the region. The clinic focuses on personalized healthcare with advanced genomics, AI, and data-driven insights to optimize healthspan and quality of life, marking a milestone in longevity and genomic science.

Integration of Artificial Intelligence (AI) in Orthopedics

The integration of AI in orthopedics is transforming the market through enhanced diagnostic accuracy, more efficient planning for surgeries, and improved patient outcomes. AI algorithms help analyze imaging data to identify early indicators of specific orthopedic conditions, leading to timely interventions and better care through AI-powered robotic-assisted surgeries that enhance the precision of surgery, reduce associated risks, and lead to improvements in recovery results. Strategic investments of the GCC in digital health infrastructure and AI-driven solutions represent an indicator of commitment toward innovation in the health sector within the region. Notably, on August 19, 2024, Saudi Arabia's Ministry of Health introduced the "Regulatory Healthcare Sandbox" program with the intention of encouraging innovation and AI-driven solutions in the realm of digital health. It was launched with Vision 2030 and the Healthcare Sector Transformation Program with the goals of modernizing healthcare, increasing access, and establishing innovative services. AI's increasing presence in orthopedics will drive the market growth and better clinical outcomes.

Growing Adoption of Value-Based Healthcare Models

The GCC orthopedic devices market is increasingly adopting value-based healthcare models that focus on the betterment of patient outcomes and cost-effectiveness. This model resonates with the government-driven reforms, such as Saudi Arabia's Vision 2030 and the UAE's National Strategy for Wellbeing 2031, which have a strong emphasis on quality healthcare and efficient resource utilization. For instance, on June 3, 2024, Keralty and Burjeel Holdings launched AL KALMA, a venture that delivers the value of healthcare and mental health in the MENA regions. Launched in Saudi, the program sets a target coverage of 30 million patients that focus on a preventive care setting and spread throughout all regions. Leading healthcare providers in the GCC are now getting the most complex orthopedic devices and modern minimally invasive treatment to enhance positive clinical outcomes that save cost effectively. Bundled payment further encourages innovative technology, hence forcing the trend in value-based care. Orthopedic treatments stand to change to become more efficient as well as a better way for patients.

GCC Orthopedic Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC orthopedic devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and end-use.

Analysis by Product:

- Joint Replacement/Orthopedic Implants

- Lower Extremity Implants

- Knee Implants

- Hip Implants

- Foot and Ankle Implants

- Spinal Implants

- Dental

- Dental Implants

- Craniomaxillofacial Implants

- Upper Extremity Implants

- Elbow Implants

- Hand and Wrist Implants

- Shoulder Implants

- Lower Extremity Implants

- Trauma

- Implants

- Accessories (Plates, Screws, Nails, Pins, Wires)

- Instruments

- Sports Medicine

- Body Reconstruction and Repair

- Accessories

- Body Monitoring and Evaluation

- Body Support and Recovery

- Orthobiologics

- Viscosupplementation

- Demineralized Bone Matrix

- Synthetic Bone Substitutes

- Bone Morphogenetic Protein (BMP)

- Stem Cell Therapy

- Allograft

- Others

Joint replacement/orthopedic implants dominate the market with a share of 42.7%, due to the region's aging population, rising incidences of joint-related disorders, and increased healthcare spending. The demand for joint replacement surgeries, including hip, knee, and shoulder replacements, is growing as a result of the region’s high prevalence of conditions like osteoarthritis and musculoskeletal disorders. Additionally, advancements in implant technologies, such as the use of minimally invasive surgical techniques and improved materials, have enhanced patient outcomes, driving adoption. The region's well-established healthcare infrastructure and high standards of medical care further support the widespread use of orthopedic implants. Furthermore, rising healthcare awareness and the region's focus on providing world-class medical services contribute to the dominance of joint replacements in the market.

Analysis by End-Use:

- Hospitals

- Outpatient Facilities

Hospitals leads the market with around 63.5% of the share in 2024, due to their central role in providing advanced medical treatments, including orthopedic surgeries and rehabilitation. With a rising incidence of musculoskeletal disorders, hospitals are the primary centers for joint replacements, fracture treatments, and complex orthopedic surgeries. The region's well-developed healthcare infrastructure, supported by government investments and private sector participation, enables hospitals to adopt state-of-the-art devices. Furthermore, hospitals offer specialized care, skilled surgeons, and access to modern medical technology, which attracts patients seeking high-quality treatment. The growing demand for orthopedic surgeries, driven by aging populations and lifestyle-related conditions, ensures that hospitals remain the key consumers of orthopedic devices in the GCC. Their capacity to deliver comprehensive care and advanced medical services solidifies their dominance in the market.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

In 2024, UAE leads the market with 31.5% of the share, given its advanced healthcare infrastructure, increasing demand for specialized treatments, and strategic investments in medical technology. The country has established itself as a regional healthcare hub, attracting both local and international patients seeking high-quality orthopedic care. With a growing aging population and rising prevalence of musculoskeletal disorders, the demand for orthopedic devices such as joint replacements and spinal implants is increasing. The UAE's strong focus on healthcare innovation, state-of-the-art medical facilities, and highly skilled professionals’ further fuels market growth. Additionally, government initiatives to promote healthcare as a key sector, along with the country's commitment to world-class healthcare services, contribute significantly to the UAE's leadership in the GCC orthopedic devices market.

Key Regional Takeaways:

Kingdom of Saudi Arabia (KSA) Orthopedic Devices Market Analysis

The orthopedic devices market in KSA is seeing rapid growth. This is as a result of the aging population, the increase in the number of musculoskeletal disorders cases, and developments in healthcare infrastructures. In a study that was conducted at Saudi Arabia's Eastern Province by NCBI, it was noted that 82% of cardiac sonographers are experiencing work-related musculoskeletal pain, with a rate higher than 65% in other healthcare professionals. The highest prevalence was noted in the shoulders (72%) and hands (56%), significantly affecting social and work activities. Interestingly, 41% of cardiac sonographers reported considering changing careers attributed to this pain. The rising number of musculoskeletal conditions such as osteoarthritis, spinal disorders, and trauma injuries is also escalating the demand for orthopedic devices in KSA. The large population base of the country and the rise in focus on orthopedic treatment are pushing the demand for joint replacement, spinal implants, and trauma fixation devices, thus helping the healthcare industry to grow.

United Arab Emirates (UAE) Orthopedic Devices Market Analysis

The United Arab Emirates (UAE) market is experiencing huge growth with an increasing population, heightened health-care spending, and the prevalence of musculoskeletal disorders. There is a significant increase in orthopedic device demand due to the increasing incidence of conditions like osteoarthritis, osteoporosis, and spinal disorders and the growing age of the population. A 2024 review of knee osteoarthritis (OA) prevalence in the UAE reported rates ranging from 1.4% to 25.8%, which mirrors the global pooled prevalence of 16%. The increased cases of sports injuries, along with the rising awareness regarding high-end treatments, are further fueling the growth of the market. Furthermore, the strong healthcare infrastructure in the UAE along with government actions intended to render better healthcare service, has created a favorable atmosphere for increasing the market. The UAE allocated USD 1.56 Billion (AED 5.74 Billion) for healthcare and community prevention services in its 2024 budget, up by 10.4%. In terms of public health spending, according to its fiscal plan 2022-2026, the UAE has foreseen growth of this category to occur at 7.7% compound annual growth rate during the period between 2022 and 2028. Moreover, in becoming the health destination within the region, it invites multinational companies for doing businesses and expands more upon technologies regarding orthopedic devices as it promotes cost-efficient yet excellent-quality demand.

Competitive Landscape:

The competitive landscape of the market is led by the global and regional players through innovation, strategic partnerships, and strong distribution networks. Companies focus on expansion of product portfolios, investments in research and development (R&D), and advanced orthopedic devices like joint replacements, spinal implants, and trauma fixation products. Regional players are gaining ground through localized solutions designed for the region's unique healthcare needs. Burjeel Holdings, for example, will showcase its cutting-edge orthopedic solutions at the Global Health Exhibition in Riyadh from October 21-23, 2024, including advancements in physiotherapy and wellness services via its PhysioTherabia network and upcoming Specialized Day Surgery Centers. With growing healthcare demand and technological progress, competition in the market is intensifying. In addition to this, the increasing focus on affordable healthcare is pushing companies to introduce cost-effective, high-quality orthopedic devices.

The report provides a comprehensive analysis of the competitive landscape in the GCC orthopedic devices market with detailed profiles of all major companies.

Latest News and Developments:

- February 1, 2024: Auxein Medical showcased advanced orthopedic implants and trauma solutions at Arab Health 2024 in Dubai, introducing innovations like AV-wiselock plates and arthroscopy tools. With operations in 70+ countries, Auxein focuses on minimally invasive surgery, R&D, and global education, aligning with US FDA and CE standards to advance orthopedic care worldwide.

- September 18, 2024: Dhofar Pharmaceutical Industries opened a factory in Oman’s Raysut Industrial City, specializing in I.V. and dialysis solutions. With Oman Vision 2040’s focus on advanced medical industries, including orthopedic devices, the facility enhances drug security, reduces imports, and aims to export to MENA.

GCC Orthopedic Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End-Uses Covered | Hospital, Outpatient Facilities |

| Countries Covered | Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC orthopedic devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC orthopedic devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC orthopedic devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC orthopedic devices market was valued at USD 845.90 Million in 2024.

The market is majorly driven by increasing musculoskeletal disorders, aging population, sedentary lifestyles, obesity, advancements in technologies like AI and 3D printing, value-based healthcare models, government-led initiatives, medical tourism, strategic collaborations, and rising healthcare infrastructure investments in the region.

IMARC estimates the India fast food market will value at USD 1503.61 Million in 2033 and exhibit a CAGR of 6.10% during 2025-2033.

Joint replacement/orthopedic implants accounted for the largest product segment of the GCC orthopedic devices market, due to the rising demand for demand for joint replacement surgeries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)