GCC Organic Food Market Report by Product Type (Organic Fruits and Vegetables, Organic Meat, Poultry, and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Beverages, Organic Cereal and Food Grains, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, and Others), Application (Bakery and Confectionary, Ready-to-eat Food Products, Breakfast Cereals, and Others), and Country 2026-2034

Market Overview:

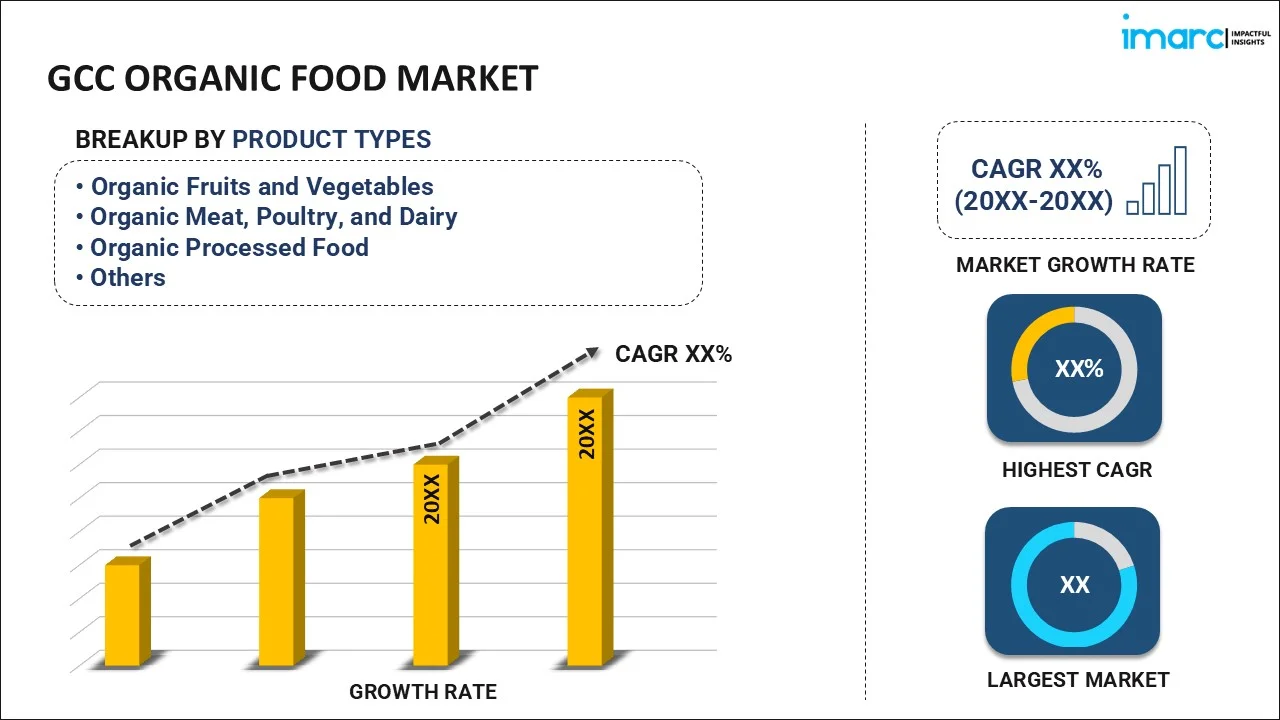

The GCC organic food market size reached USD 4.9 Billion in 2025. The market is projected to reach USD 12.4 Billion by 2034, exhibiting a growth rate (CAGR) of 10.44% during 2026-2034. The rising health consciousness, inflating disposable income levels, favorable government initiatives, increasing awareness about the benefits of organic food, rapidly expanding tourism and hospitality industry, and growing environmental concerns represent some of the key factors driving the demand for organic food market in the GCC region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.9 Billion |

| Market Forecast in 2034 | USD 12.4 Billion |

| Market Growth Rate (2026-2034) | 10.44% |

Access the full market insights report Request Sample

Organic food refers to agricultural products that are produced and processed using environmentally friendly practices and without the use of synthetic chemicals, genetically modified organisms (GMOs), antibiotics, hormones, or irradiation. The core principles behind organic farming include promoting ecological balance, conserving biodiversity, and enhancing soil fertility. The aim is to create a sustainable and harmonious relationship between humans, animals, plants, and the environment. Consuming organic food offers several potential benefits. Firstly, organic farming practices reduce the exposure to synthetic pesticides and fertilizers, which can have negative effects on human health and the environment. Organic food is often perceived to have higher nutritional value and better taste, although scientific evidence supporting these claims is still limited. Moreover, organic farming promotes sustainable agriculture by preserving soil quality, reducing water pollution, and conserving biodiversity.

GCC Organic Food Market Trends:

Expansion of Digital Grocery Platforms

The increasing number of e-commerce channels in the GCC is allowing consumers to access a wider range of certified organic products, including imports that may not be found in nearby grocery stores. The appeal of digital shopping to urban and younger consumers who value clean eating is enhanced by convenience, comprehensive product information, and delivery to their doorsteps. Retailers and organic brands are putting significant resources into easy-to-use apps and focused digital marketing strategies to connect directly with health-minded individuals. According to the International Trade Administration (ITA), it is projected that the number of internet users participating in e-commerce in Saudi Arabia will hit 33.6 million by 2024, highlighting the increasing trend of online retail. The rise in digital grocery usage not only boosts sales volume but also enables brands to monitor preferences, address feedback, and cultivate direct connections with their buyers.

Trade Events Enhancing Market Accessibility and Visibility

Large-scale industry events are playing a significant role in advancing the growth of the organic food market in the GCC by facilitating direct engagement between suppliers, distributors, and buyers. These platforms allow producers to showcase their offerings, understand regional preferences, and form valuable commercial partnerships. The visibility gained through such events contributes to faster brand recognition and trust, especially for new entrants seeking market entry. The Middle East Organic & Natural Products Expo Dubai 2025, scheduled from November 17 to 19 at the Dubai World Trade Centre, exemplifies this impact. Attracting over 15,000 trade visitors and 550 exhibitors annually, including 350 international participants, the event acts as a major networking and sourcing hub. Organized by GL Exhibitions, it focuses on food, health, beauty, and sustainable living products, offering a structured environment to explore emerging trends. This growing event infrastructure supports long-term market growth by strengthening supply chains and increasing regional product availability.

Focus on Environmental Sustainability

Environmental considerations are becoming increasingly prominent in national policy discussions across the GCC, particularly in relation to long-term objectives concerning sustainability, water conservation, and soil preservation. Organic agriculture is being promoted as a viable alternative to conventional, chemical-reliant farming, as it aligns closely with these environmental priorities. In response to the rising climate challenges and growing water scarcity, methods such as composting, crop rotation, and non-chemical pest control are receiving greater institutional backing. At the consumer level, there is a higher awareness about how food choices impact the environment, including reductions in pesticide contamination, carbon emissions, and land degradation. Several organic brands are responding by highlighting these environmental benefits on packaging, resonating with a younger, more environmentally conscious audience. The perception of organic food is evolving to encompass both personal and ecological well-being.

GCC Organic Food Market Growth Drivers:

Rising Health Concerns and Lifestyle Diseases

Diet-related health concerns are prompting significant changes in consumer behavior across the GCC, with increasing attention to the nutritional quality and safety of food. Individuals are becoming more cautious about ingredient composition, reducing their intake of processed products, and opting for certified organic alternatives perceived to be safer and more beneficial to long-term health. These adjustments are often influenced by personal health experiences, medical advice, or greater exposure to health-focused content across digital platforms. The urgency surrounding these changes is supported by findings from the 2024 National Health Survey conducted by the General Authority for Statistics (GASTAT), which revealed that 23.1% of adults and 14.6% of children in Saudi Arabia are affected by obesity. Such data highlight the growing need for healthier dietary practices. Regionally, there is a broader shift toward viewing organic food as a preventive health measure rather than a luxury item, with parents playing a leading role in guiding household food choices.

Policy Shifts and Domestic Farming Initiatives

Governing bodies across the GCC region are actively promoting organic agriculture through targeted policy measures, financial support, and food security initiatives. These efforts include the establishment of certification bodies, quality control frameworks, and incentives to encourage farmers to shift from conventional to organic practices. For example, in 2025, Sharjah launched the Organic Farm Support Programme to help local farmers transition to organic farming by offering certified materials, seeds, and training. The initiative supports sustainable agriculture, food security, and environmental health. Certified farmers will receive guidance and organic resources starting this planting season. Apart from this, new research centers and agricultural startups are working on soil regeneration, pest control, and organic fertilizers tailored for arid conditions. With government entities promoting these efforts through public campaigns and school programs, the visibility of organic farming is no longer limited to trade expos or niche publications.

Educational Campaigns and School Nutrition Programs

Public knowledge about food choices is growing throughout the region, with formal education systems actively contributing to the development of healthier habits. Numerous governing bodies are establishing school nutrition initiatives that emphasize the advantages of whole, natural, and organic foods compared to processed options. These efforts are influencing parents to align household meals with what children are taught in educational settings. Outside of schools, multiple stakeholders, including health ministries, non-governmental organizations (NGOs), and fitness experts are producing digital and in-person content, such as videos, articles, and workshops, aimed at promoting better food literacy. Organic food is often portrayed in these campaigns as a standard for safe and healthy consumption. Retailers further enhance this educational effort by hosting in-store events, cooking demos, and seminars highlighting the benefits of organic eating.

GCC Organic Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC organic food market report, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product type, distribution channel, and application.

Product Type Insights:

To get more information on this market, Request Sample

- Organic Fruits and Vegetables

- Organic Meat, Poultry, and Dairy

- Organic Processed Food

- Organic Bread and Bakery

- Organic Beverages

- Organic Cereal and Food Grains

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic fruits and vegetables, organic meat, poultry, and dairy, organic processed food, organic bread and bakery, organic beverages, organic cereal, and food grains and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online stores, and others.

Application Insights:

- Bakery and Confectionary

- Ready-to-eat Food Products

- Breakfast Cereals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes bakery and confectionary, ready-to-eat food products, breakfast cereals, and others.

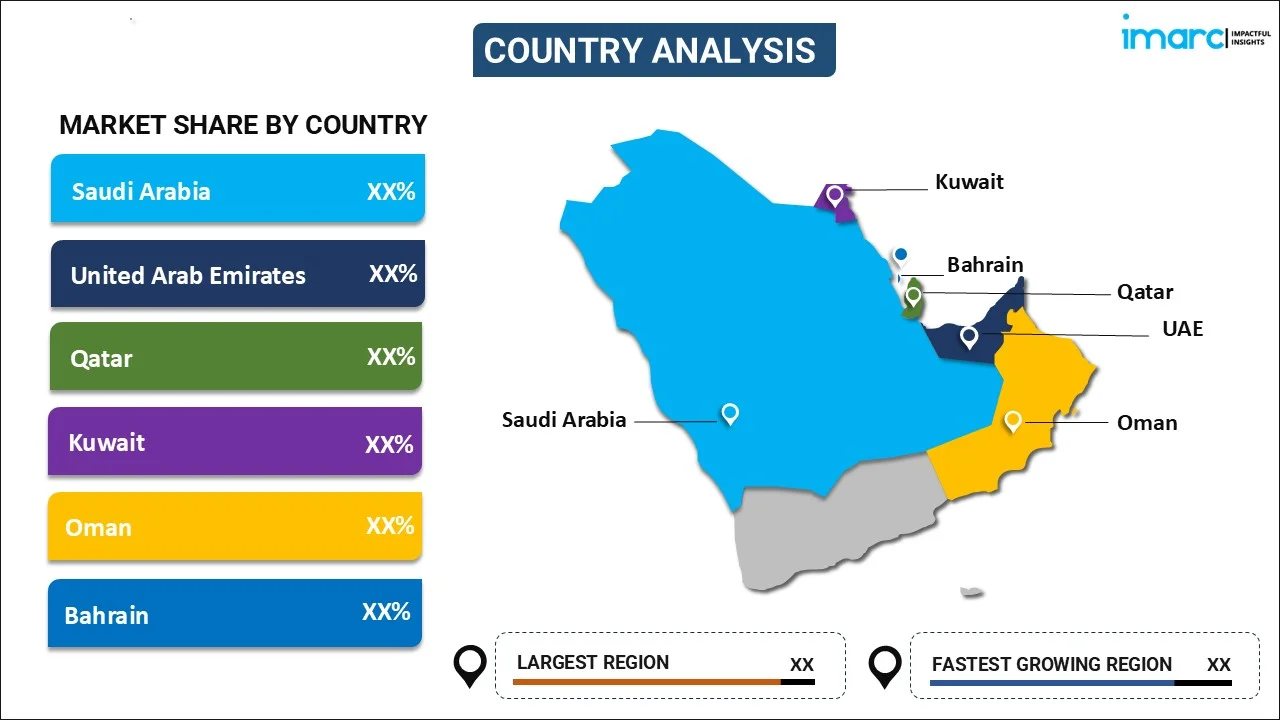

Country Insights:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, the UAE, and Others (Qatar, Oman, Kuwait, and Bahrain).

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the GCC organic food market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Organic Food Market News:

- In February 2025, Sharjah launched a new line of local organic fruits and vegetables grown in four greenhouses in Al Dhaid, expected to produce around 250 tons annually. The project uses heirloom seeds with high genetic diversity and is the region’s first to cultivate organic blueberries, supporting local organic agriculture and food innovation. Expansion plans include more greenhouses, nurseries, and advanced irrigation systems.

- In January 2025, Sharjah Agriculture and Livestock launched Meliha Laban, expanding its popular organic dairy line ahead of Ramadan, with new products aimed at children set to release by the end of January. This initiative supports the UAE’s push for healthier nutritional lifestyles and organic food security.

- In December 2024, Podar Pearl School in Mashaf celebrated the success of its rooftop vegetable garden, an eco-friendly project led by the school’s Horticulture Club using recycled water and organic fertilizers. The initiative promoted sustainable agriculture, environmental awareness, and healthy eating habits. The Harvest Festival showcased the garden’s produce and educated the community on sustainability.

- In November 2024, Saudi Arabia’s Asir Province launched a public awareness campaign to promote organic food culture, led by the Ministry of Environment, Water and Agriculture. The initiative aimed to educate consumers on the health benefits of organic products and support innovation in organic food quality. This campaign was part of a broader strategy to develop the organic food sector across Saudi society.

- In September 2024, Oman’s Ibri date farm became the largest certified organic palm farm in the country, earning the international Ecocert certification. Expansion plans aimed to increase cultivation to 50,000 trees, enhancing Oman’s organic agriculture sector.

- In August 2024, Happa Foods exported organic fruit and vegetable purees to six countries, including the UAE, Kuwait, and Oman. The company offers premium, preservative-free baby meals, aiming to provide nutritious options globally. This expansion highlights India’s growing role in producing high-quality finished goods for international markets.

GCC Organic Food Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Organic Fruits and Vegetables, Organic Meat, Poultry, and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Beverages, Organic Cereal and Food Grains, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Applicationss Covered | Bakery and Confectionary, Ready-to-eat Food Products, Breakfast Cereals, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC organic food market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC organic food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC organic food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic food market in GCC was valued at USD 4.9 Billion in 2025.

The GCC organic food market is projected to exhibit a CAGR of 10.44% during 2026-2034, reaching a value of USD 12.4 Billion by 2034.

The growing health awareness, rising disposable incomes, government initiatives supporting sustainable agriculture, and a shift in consumer preference toward natural products are driving the GCC organic food market. Expanding retail channels, including supermarkets and online platforms, along with increased product availability and certifications, further contribute to the market demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)