GCC Nuclear Energy Market Size, Share, Trends, and Forecast by Application, Reactor Type, and Country, 2025-2033

GCC Nuclear Energy Market Size and Share:

The GCC nuclear energy market size was valued at USD 543.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 703.3 Million by 2033, exhibiting a CAGR of 2.90% from 2025-2033. The market is witnessing substantial growth due to enhancing energy security and diversification and supporting industrial growth. Additionally, increasing investments in nuclear power projects, a strategic focus on sustainability, regional collaborations, and international partnerships are expanding the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 543.8 Million |

| Market Forecast in 2033 | USD 703.3 Million |

| Market Growth Rate (2025-2033) | 2.90% |

GCC countries are keen on diversifying energy sources away from fossil fuel dependence and strengthening energy security. Nuclear energy gives a stable, reliable power source, which addresses vulnerabilities in the case of volatile oil and gas markets. By incorporating nuclear energy into the national energy mix, GCC nations can achieve greater resilience against global energy market disruptions and ensure long-term energy stability. Another benefit of nuclear power is that it complements renewable energy sources with a steady base load supply that allows the region to balance its energy portfolio well. For example, in 2024, ENEC, IAEA, and the US Department of Energy held the Cyber Energy Leadership Forum in Abu Dhabi, underlining collaboration on cybersecurity to safeguard nuclear plants such as Barakah, which supply 25% of UAE electricity. This strategic move supports the economy but also ensures adequate energy infrastructure for the region to keep pace with increased demands of industrialization and urbanization across the region.

The GCC’s rapid industrialization is a significant driver for the adoption of nuclear energy, as industries require reliable, large-scale power sources to operate efficiently. Nuclear energy provides consistent and high-capacity electricity, ensuring uninterrupted power supply for energy-intensive sectors such as manufacturing, petrochemicals, and construction. Additionally, nuclear energy supports the establishment of industrial zones and enables advanced processes requiring stable energy inputs. This reliable energy infrastructure is essential for sustaining the region’s economic diversification goals, fostering industrial development, and reducing dependency on fossil fuels. For instance, according to industry reports, the UAE is investing $6.3 billion in 2024 to diversify its economy, boost industrial growth, and reduce oil dependence, supporting existing industries and emerging sectors for sustainable, balanced economic development. By powering industrial growth, nuclear energy strengthens the region’s competitiveness in the global economy.

GCC Nuclear Energy Market Trends:

Increasing Investment in Nuclear Energy Projects

The GCC region is witnessing significant investment in nuclear energy infrastructure as the governments diversify their energy sources and reduce their reliance on fossil fuels. Amongst these countries, the United Arab Emirates is one of the most prominent leaders through the successful commissioning of the Barakah Nuclear Power Plant, the first functioning nuclear site in the Arab world. For instance, ENEC and KEPCO, in 2024, would be teaming up to broaden global nuclear energy projects in pursuit of reducing emissions in combating climate change and attaining Net Zero targets. The annual production of the Barakah Plant shall amount to 40 TWh with the prevention of 22.4 million tons of emissions-the vital contribution by ENEC towards clean energy. Other nations like Saudi Arabia are also pursuing vigorous nuclear energy programs to meet a surging level of electricity demand, further augmenting industrial growth. These investments represent the commitment of the region toward energy security and sustainable development.

Strategic Focus on Sustainability

The GCC countries have emphasized nuclear energy as part of their overall approaches to achieving long-term energy sustainability and carbon reduction. Nuclear power is a low-carbon option for traditional sources of energy, as agreed upon at the global level on climate commitments. For instance, example, in September 2024, the UAE connected the fourth and final 1,400-megawatt unit of the Barakah nuclear plant to the grid, bringing total capacity up to 5,600 megawatts. The $20 billion project, supplying 25% of the country's electricity, aligns with the UAE's goal to reduce fossil fuel reliance and achieve net-zero emissions by 2050. Also, it ensures the region's sustainable energy supply needed for the pace of rapid urbanization and industrialization. Nuclear power is gaining increased support as a basic building block for national energy plans along with alternative power generation through sunlight and wind power

Regional Collaboration and International Partnerships

Collaborations within the GCC and with global nuclear energy leaders is driving technological advancements and knowledge transfer in the sector. Countries are entering into strategic partnerships with international organizations and companies specializing in nuclear technology, reactor construction, and safety protocols. For instance, in 2024, ENEC and General Atomics signed an MoU to collaborate on advanced nuclear technologies, materials, non-light water reactors, and 3D manufacturing, leveraging ENEC’s expertise in nuclear energy development. These partnerships are enhancing the region's capabilities in nuclear energy deployment while ensuring compliance with international safety and non-proliferation standards. The establishment of regional nuclear training centers and research institutions further underscores the GCC’s focus on building local expertise and fostering innovation in the nuclear energy domain. This trend reflects the region’s ambition to become a competitive player in the global nuclear energy market while addressing energy demands sustainably.

GCC Nuclear Energy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC nuclear energy market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on application and reactor type.

Analysis by Application:

- Energy

- Defense

- Others

Energy in application refers to the practical use of energy resources for generating power and supporting economic activities. It plays a significant role in the GCC nuclear energy market by ensuring efficient power generation through advanced nuclear technology. The adoption of nuclear energy in the region meets the rising demand for electricity and supports sustainability goals by reducing dependence on fossil fuels. Key players in the GCC leverage nuclear energy for large-scale applications, including industrial, residential, and commercial power supply. This will bring focus to enhancing energy efficiency and diversifying the energy mix. Thus, long-term strategies of the region for economic growth and environmental conservation are supported through nuclear energy being positioned as an integral component of the GCC's energy ecosystem.

Analysis by Reactor Type:

- Pressurized Water Reactor and Pressurized Heavy Water Reactor

- Boiling Water Reactor

- High-temperature Gas-cooled Reactor

- Liquid-metal Fast-breeder Reactor

- Others

Pressurized water reactor and pressurized heavy water reactor holds the largest share of 42.8% in 2024. They are two distinct reactor types used in nuclear power generation. A PWR utilizes light water as both a coolant and neutron moderator, maintaining high pressure to prevent the coolant from boiling. In contrast, a PHWR uses heavy water as a moderator and coolant, offering advantages such as fuel efficiency and the ability to use natural uranium as fuel. In the GCC nuclear energy market, these reactors are pivotal in driving energy diversification and ensuring stable electricity supply. Their operational efficiency and ability to generate significant power output support the region's growing energy needs, aligning with initiatives to reduce reliance on traditional fossil fuels and enhance sustainability.

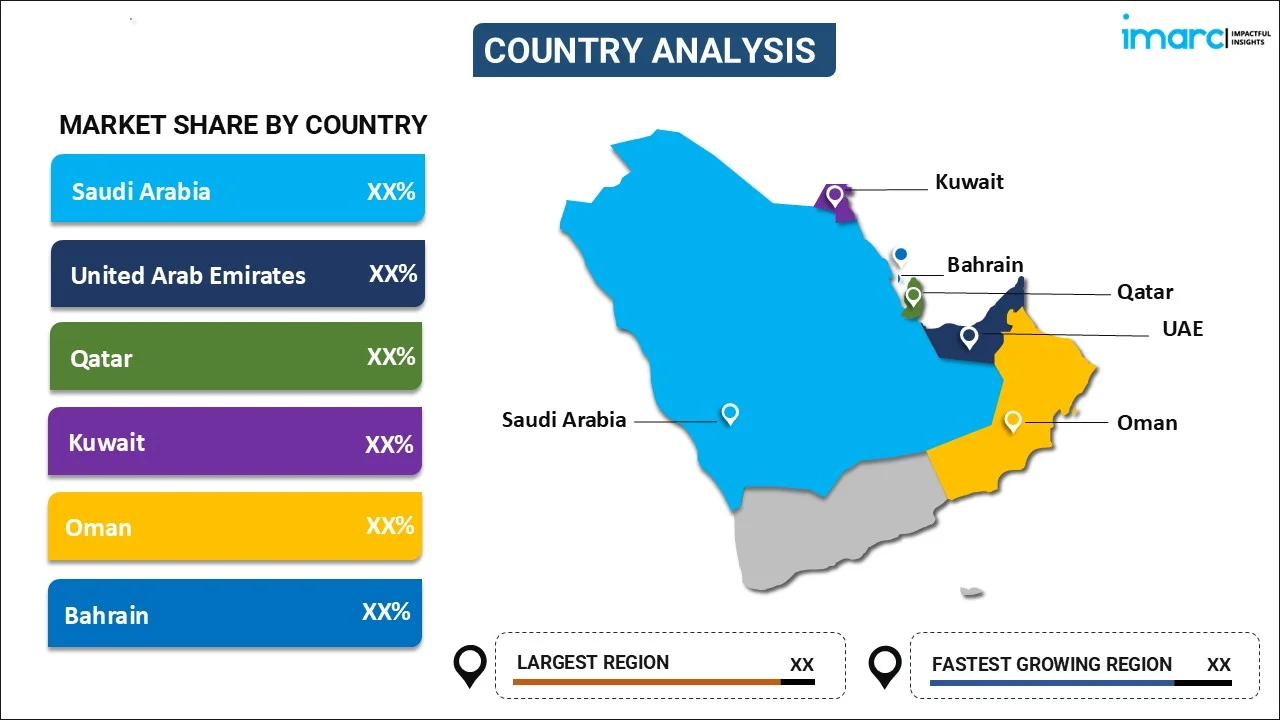

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

The UAE currently dominates the GCC nuclear energy market, holding a 45.0% share in the market due to its proactive approach in developing nuclear power infrastructure and its commitment to diversifying energy sources. The country has successfully operationalized the Barakah Nuclear Energy Plant, the first of its kind in the region, which serves as a cornerstone for meeting its growing electricity demands while reducing carbon emissions. Strategic government initiatives, regulatory support, and international partnerships have further bolstered the UAE's leadership in the sector. For instance, in 2024, the UAE plans a second nuclear plant, doubling reactors to eight by 2032, aligning with its COP28 commitment to triple global nuclear capacity by 2050. With significant investments in advanced technologies and a clear focus on energy sustainability, the UAE continues to set a benchmark for nuclear energy adoption, reinforcing its position as a key player in the GCC nuclear energy landscape.

Key Regional Takeaways:

Saudi Arabia Nuclear Energy Market Analysis

The Saudi Arabia nuclear energy market is positioned for significant growth as the nation pursues energy diversification and sustainability goals. With increasing electricity demand driven by industrial expansion and population growth, the government is investing in nuclear power to enhance energy security and reduce dependency on fossil fuels. Saudi Arabia projects renewables to provide 50% of power capacity by 2030 while expanding natural gas production for LNG exports. With intermittent renewables requiring advanced storage, reliance on gas-fired plants persists. Countering IEA’s oil demand peak forecast by 2030, OPEC predicts growth from 102.2 mb/d in 2023 to 120.1 mb/d by 2050. Additionally, collaborations with global partners and compliance with International Atomic Energy Agency (IAEA) standards highlight its commitment to safe and efficient nuclear energy deployment. These initiatives align with Vision 2030, promoting long-term economic development.

UAE Nuclear Energy Market Analysis

The UAE nuclear energy market is advancing rapidly, driven by the nation’s commitment to diversifying energy sources and achieving sustainability goals. Nuclear energy supports the UAE's energy transition, meeting rising power demand and cutting emissions. The operational success of the Barakah Nuclear Power Plant underscores the UAE’s leadership in nuclear energy within the GCC. With rising energy demand from industrial growth and population expansion, nuclear energy provides a reliable, low-carbon solution. As of March 2024, Abu Dhabi generated 40% of its electricity from nuclear and renewables, cutting natural gas use. Nuclear energy, vital for reliable power, is gaining global interest, particularly for data centers. A joint report by Microsoft, Masdar, and ADNOC, "Powering Possible," explores AI-driven solutions for boosting renewables, efficiency, and carbon-free technologies by 2030. Ongoing investments, international partnerships, and compliance with stringent safety standards ensure a robust framework for sustainable energy, aligning with the UAE’s Vision 2050 objectives.

Competitive Landscape:

The GCC nuclear energy market features a competitive landscape marked by collaboration with global technology providers and strategic partnerships. Key players include international firms specializing in nuclear reactor construction, fuel supply, and safety systems. Regional governments are also investing in indigenous capabilities, fostering local expertise through training and research initiatives. The UAE’s Barakah Nuclear Power Plant sets a benchmark for the region, while Saudi Arabia’s ambitious nuclear energy plans further intensify competition in this emerging sector. For instance, in 2024, the UAE’s Enec and China’s CNNC signed an MoU to collaborate on nuclear plant operations, fuel cycle procurement, environmental protection, and R&D. Key areas include IV generation reactors, hydrogen production, desalination, and a potential nuclear technology center.

The report provides a comprehensive analysis of the competitive landscape in the GCC nuclear energy market with detailed profiles of all major companies, including:

- Electricite de France SA (EDF)

- China National Nuclear Corporation

- Bilfinger SE

- Doosan Enerbility Co. Ltd

- Mitsubishi Heavy Industries Ltd

- Bechtel Group Inc.

Latest News and Developments:

- In October 2024, Turboden, an Italian Organic Rankine Cycle (ORC) specialist, will supply a 13MWe power plant to Riyadh Cement Company. The first ORC plant in Saudi Arabia, it will capture waste heat from cement kilns, operate autonomously to reduce OPEX, and feature water-free operation to minimize water use.

- In January 2024, Kuwait's Ministry of Electricity, Water, and Renewable Energy announced GE Vernova's upgrade of four 9F.03 gas turbines at the 2GW Sabiya Combined Cycle Power Plant. The upgrade boosts output by 6.3%, increases power production by 70MW, and enhances fuel efficiency, maintenance intervals, and carbon reduction.

GCC Nuclear Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Energy, Defense, Others |

| Reactor Types Covered | Pressurized Water Reactor and Pressurized Heavy Water Reactor, Boiling Water Reactor, High-temperature Gas-cooled Reactor, Liquid-metal Fast-breeder Reactor, OthersPressurized Water Reactor and Pressurized Heavy Water Reactor, Boiling Water Reactor, High-temperature Gas-cooled Reactor, Liquid-metal Fast-breeder Reactor, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain |

| Companies Covered | Electricite de France SA (EDF), China National Nuclear Corporation, Bilfinger SE, Doosan Enerbility Co. Ltd, Mitsubishi Heavy Industries Ltd, Bechtel Group Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC nuclear energy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC nuclear energy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC nuclear energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC nuclear energy market was valued at USD 543.8 Million in 2024.

The GCC nuclear energy market is driven by rapid industrialization, growing electricity demand, and economic diversification efforts. Governments aim to reduce reliance on fossil fuels, ensure energy security, and meet climate goals. Investments in sustainable energy, technological advancements, and international collaborations further boost nuclear energy adoption across the region.

IMARC estimates the GCC nuclear energy market to reach USD 703.308 Million by 2033, exhibiting a CAGR of 2.90% during 2025-2033.

UAE currently leads the nuclear energy market in GCC, holding a significant share of 45%. This dominance can be attributed to its early investments in advanced technology, strategic planning, and commitment to diversifying its energy sources. The country has focused on developing nuclear power as a sustainable, low-carbon energy alternative to fossil fuels. Additionally, the UAE has built a robust regulatory framework, fostering international partnerships and ensuring safety, reliability, and expertise in nuclear energy operations, positioning it as a regional leader.

Some of the major players in the GCC nuclear energy market include Electricite de France SA (EDF), China National Nuclear Corporation, Bilfinger SE, Doosan Enerbility Co. Ltd, Mitsubishi Heavy Industries Ltd, Bechtel Group Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)