GCC New, Pre-Owned, and Rental Construction Equipment Market Report by Sales Type (New, Pre-Owned, Rental), Application (Heavy, Compact), and Country 2026-2034

Market Overview:

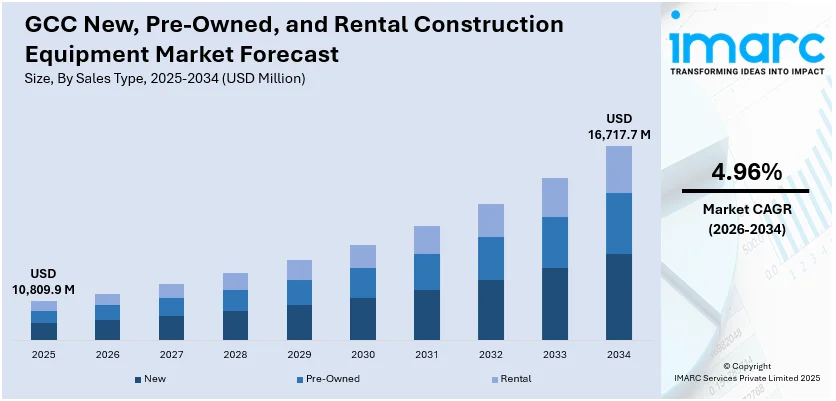

GCC new, pre-owned, and rental construction equipment market size reached USD 10,809.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 16,717.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.96% during 2026-2034. The introduction of flexible rental agreements, along with the widespread adoption of efficient, safe, and eco-friendly machinery, is primarily augmenting the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10,809.9 Million |

| Market Forecast in 2034 | USD 16,717.7 Million |

| Market Growth Rate (2026-2034) | 4.96% |

New, pre-owned, and rental construction equipment represent the diverse options available to contractors and construction firms for meeting their machinery needs. Brand-new machinery offers the latest technological features and optimal performance. While pre-owned equipment, on the other hand, involve used machinery that has undergone previous ownership. They are usually well-maintained and provide a more cost-effective option as compared to purchasing new ones. Additionally, rental construction equipment offers a flexible solution, allowing businesses to access a wide range of machinery for specific projects without the long-term commitment or ownership costs. This option is particularly advantageous for short-term or intermittent needs, providing financial flexibility and ensuring access to the latest equipment without the burden of maintenance and storage. The choice between new, pre-owned, or rental construction equipment depends on several factors, such as project requirements, budget considerations, the frequency of equipment usage, etc.

To get more information on this market Request Sample

GCC New, Pre-Owned, and Rental Construction Equipment Market Trends:

The GCC construction equipment market is undergoing significant shifts driven by diverse trends and drivers that are reshaping the landscape of new, pre-owned, and rental machinery. Additionally, with the region witnessing a surge in infrastructure projects, the demand for new construction equipment is escalating. Apart from this, the inflating need for numerous cutting-edge technologies and advanced features is acting as another significant growth-inducing factor. Moreover, the growing focus among businesses to seek cost-effective alternatives without compromising performance is further bolstering the market growth across the region. Besides this, construction firms are increasingly recognizing the value of acquiring used machinery that has been well-maintained, offering an economical solution in a competitive market. Furthermore, the inflating popularity of telematics, IoT devices, and advanced sensors to enhance the efficiency of new, pre-owned, and rental equipment is also augmenting the regional market. This trend not only improves operational capabilities but also contributes to preventive maintenance, ensuring machinery operates at optimal levels, which is anticipated to fuel the market growth across the GCC over the forecasted period.

GCC New, Pre-Owned, And Rental Construction Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on sales type and application.

Sales Type Insights:

- New

- Pre-Owned

- Seller Type

- Dealers

- Rental Companies

- Auction and Listing Sites

- Direct Sell

- Seller Type

- Rental

The report has provided a detailed breakup and analysis of the market based on the sales type. This includes new, pre-owned (seller type (dealers, rental companies, auction and listing sites, and direct sell)), and rental.

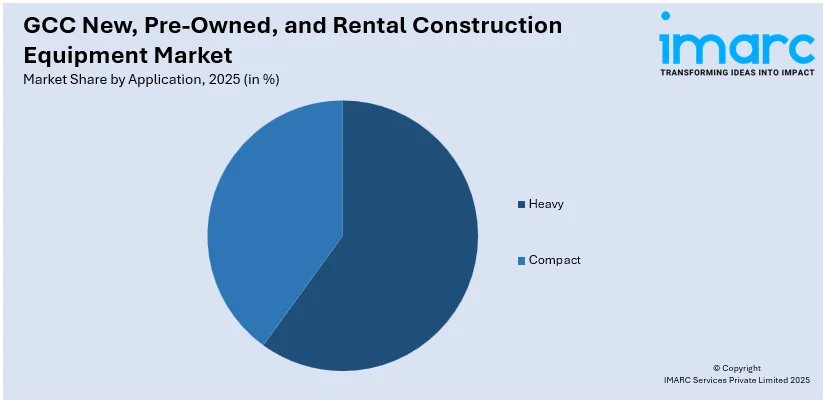

Application Insights:

Access the comprehensive market breakdown Request Sample

- Heavy

- Compact

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes heavy and compact.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC New, Pre-Owned, And Rental Construction Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sales Type Covered |

|

| Applications Covered | Heavy, Compact |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC new, pre-owned, and rental construction equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the GCC new, pre-owned, and rental construction equipment market on the basis of sales type?

- What is the breakup of the GCC new, pre-owned, and rental construction equipment market on the basis of application?

- What are the various stages in the value chain of the GCC new, pre-owned, and rental construction equipment market?

- What are the key driving factors and challenges in the GCC new, pre-owned, and rental construction equipment?

- What is the structure of the GCC new, pre-owned, and rental construction equipment market and who are the key players?

- What is the degree of competition in the GCC new, pre-owned, and rental construction equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC new, pre-owned, and rental construction equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC new, pre-owned, and rental construction equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC new, pre-owned, and rental construction equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)