GCC Medical Tourism Market Size, Share, Trends and Forecast by Treatment Type, Gender, Service Provider, and Country, 2026-2034

GCC Medical Tourism Market Size and Share:

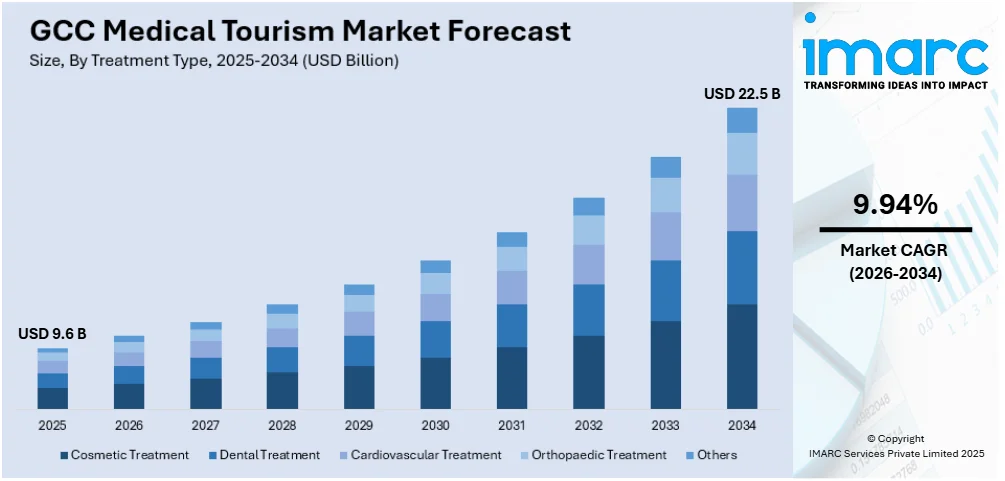

The GCC medical tourism market size reached USD 9.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 22.5 Billion by 2034, exhibiting a CAGR of 9.94% from 2026-2034. The industry is experiencing notable expansion driven by the presence of an advanced healthcare infrastructure, along with quality of services and government initiatives and support. Additionally, the integration of digital health technologies, the rise of wellness tourism, and an enhancing focus on specialized treatments are expanding the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.6 Billion |

| Market Forecast in 2034 | USD 22.5 Billion |

| Market Growth Rate (2026-2034) | 9.94% |

The GCC region has made substantial investments in healthcare infrastructure to position itself as a premier destination for medical tourism. Countries like the UAE and Saudi Arabia are home to state-of-the-art hospitals equipped with the latest technologies, offering world-class healthcare services that are globally accredited. For instance, in 2024, American Hospital Dubai opened three medical tourism offices in Nigeria, contributing to the UAE’s plan to establish 30 offices across Africa and Eastern Europe. This expansion underscores the region's commitment to offering specialized services like cosmetic surgery, fertility treatments, and cardiac care, delivered by highly skilled professionals, many trained or certified in Western countries. The region’s high standards of care, coupled with shorter waiting times compared to Western nations, enhance its appeal, attracting patients from neighboring regions and beyond seeking advanced and reliable medical solutions.

To get more information on this market Request Sample

Governments in GCC are actively promoting medical tourism as a vital economic sector through a series of strategic initiatives and supportive policies. Countries such as the United Arab Emirates, particularly Dubai, have introduced specialized medical tourism portals that offer comprehensive packages, including medical treatments, travel, and accommodation. Furthermore, the implementation of streamlined visa processes and collaborations with global healthcare organizations highlight the region’s commitment to fostering growth and development in this sector. For instance, in 2024, Thumbay Medical Tourism collaborated with Ethiopian Airlines to ensure patient care, further cementing its position as the first choice for affordable healthcare destination for more than 175 nationalities. Moreover, marketing efforts are made to reach affluent populations in Europe, Asia, and Africa. By aligning healthcare development with tourism objectives, GCC nations are effectively enhancing their competitiveness on the global medical tourism stage, driving growth, and establishing the region as a preferred destination for quality healthcare services.

GCC Medical Tourism Market Trends:

Integration of Digital Health Technologies

Digital health adoption is transforming the GCC medical tourism market with advanced technologies in the form of telemedicine, electronic health records, and artificial intelligence-based diagnostics, increasingly adopted by healthcare systems to optimize both patient experience and operational efficiency. For instance, in 2024, Dubai Health demonstrated AI-based innovations in healthcare, including VR technology at the Thalassemia Center, with a 20-minute experience to make comfortable procedures for patient care in collaboration with Dubai Digital. Telemedicine enables international patients to consult with specialists in their home countries before traveling, thereby enhancing their preparation and minimizing unforeseen circumstances. AI-based systems facilitate more accurate diagnostics and treatment, while Electronic Health Records (EHRs) ensure efficient communication among healthcare providers. These technological advancements not only enhance the quality of medical services but also position the GCC as a technologically advanced destination for medical tourism.

Rise of Wellness Tourism

Wellness and medical tourism are gradually gaining traction in the GCC region. International visitors increasingly seek treatments that integrate medical procedures with wellness therapies, such as detox programs, physiotherapy, and spa treatments. The region's luxury hospitality sector supports this trend by offering comprehensive wellness packages tailored to health-conscious travelers. Facilities in the UAE and Qatar provide holistic experiences that blend ancient therapies with modern medical practices, thereby attracting a diverse clientele and driving the growth of this industry. For instance ,in 2024, Forbes Middle East Medical Tourism and Wellness Summit, hosted by American Hospital Dubai, demonstrated the growth of Dubai as a global wellness destination, bringing together authorities to discuss trends, challenges, and opportunities, in which 3000 delegates registered for participation.

Focus on Specialized Treatments

The GCC medical tourism market is witnessing a shift towards specialized healthcare services, including cosmetic surgery, fertility treatments, and orthopedics. For instance, in 2024, Al Zahra Hospital Dubai announced that it has successfully completed over 400 robotic surgeries, marking a significant milestone in its commitment to innovative healthcare. This achievement reflects the hospital’s dedication to providing precise, minimally invasive procedures across various specialties, including urology, gynecology, and oncology. As a pioneer in robotic surgery in the GCC, the hospital continues to invest in advanced technologies to ensure high-quality, patient-centric care. Advanced centers dedicated to these areas are attracting patients from Europe, Africa, and Asia. Cosmetic surgery, in particular, benefits from the region’s reputation for high standards and confidentiality, while fertility centers leverage cutting-edge reproductive technologies. Orthopedic procedures are also in demand due to shorter recovery times facilitated by advanced post-operative care. This focus on niche markets allows the GCC to cater to specific patient needs, enhancing its appeal and competitiveness globally.

GCC Medical Tourism Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC medical tourism market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on treatment type, gender, and service provider.

Analysis by Treatment Type:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Others

Cosmetic treatment, in the treatment type category, means treatments that are improves physical appearance, like surgery rhinoplasty and liposuction, and other non-invasive options of Botox and laser treatments. In the GCC medical tourism market, this attracts international patients to avail the advanced facilities and cost-effective services by expert doctors, which enhance the health appeal of the region.

Dental treatment, within the treatment type segment, includes procedures like dental implants, orthodontics, cosmetic dentistry, and routine oral care. In the GCC medical tourism market, this treatment plays a pivotal role by offering cutting-edge technology, expert practitioners, and competitive pricing, attracting international patients seeking high-quality dental care in a globally connected region.Cardiovascular treatment falls under the treatment type segment, which covers treatments for heart and blood vessel conditions, including angioplasty, bypass surgery, and valve repair. The GCC medical tourism market, attracts international patients through state-of-the-art cardiac care, renowned specialists, advanced technologies, and cost-effective solutions that enhance the region's healthcare prominence globally.

Orthopedic treatment, under the treatment type segment, encompasses musculoskeletal conditions, such as joint replacement, spine surgery, and sports injury care. In the GCC medical tourism market, it attracts patients through advanced surgical techniques, experienced specialists, and comprehensive rehabilitation programs, reinforcing the region's reputation for delivering high-quality, cost-effective orthopedic healthcare services.

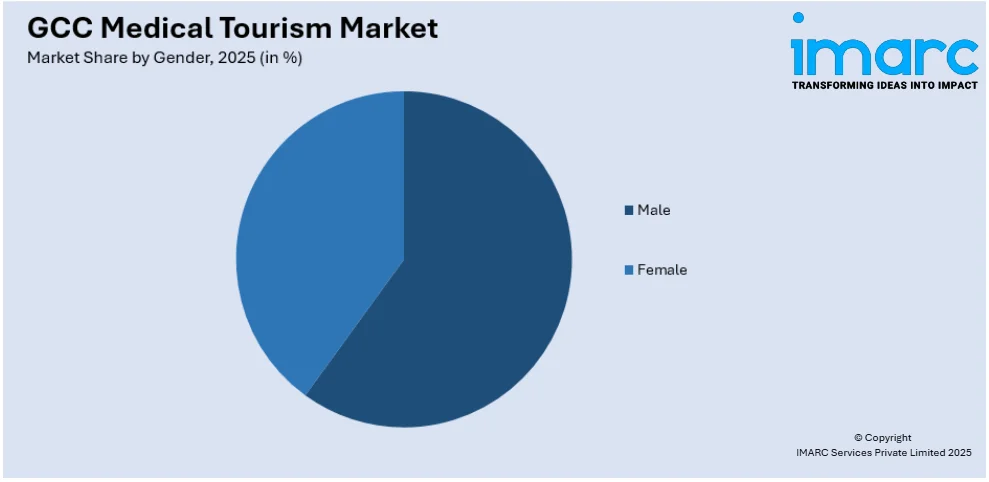

Analysis by Gender:

Access the Comprehensive Market Breakdown Request Sample

- Male

- Female

Male patients are a significant contributor to the GCC medical tourism market, as they opt for specialized treatments, such as urology, orthopedic care, cardiovascular procedures, and wellness programs. The advanced medical facilities, skilled professionals, and tailored healthcare services of the region attract male medical tourists, thereby increasing the growth of the market and raising its global reputation.

Female patients in the GCC medical tourism market are driven by the services like gynecology, fertility treatments, cosmetic procedures, and wellness therapies. Advanced healthcare infrastructure in the region, the reputation of specialists, and the focus on personalized care draw female medical tourists' interest, contributing to the market's growth and global appeal.

Analysis by Service Provider:

- Private

- Public

Under service providers, private connotes non-governmental institutions - basically private hospitals, clinics, and specialized centers. These medical tourism service providers cater to the GCC market by providing first-class services, state-of-the-art technology, and attention to patients. Their responsiveness, shorter waiting times, and international accreditations keep attracting global patients, which is driving the growth of healthcare in the region.

The public under the service provider segment would be healthcare facilities owned by the government, comprising hospitals and clinics providing services either subsidized or state-funded. Public providers will be serving the GCC medical tourism market by delivering quality care at affordable rates, using sophisticated infrastructure, and supporting the medical tourism initiatives that increase the global reputation of this region as a healthcare destination.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia is bolstering the GCC medical tourism market through its advanced healthcare infrastructure, world-class hospitals, and specialized services, including oncology, cardiovascular, and orthopedic treatments. Government initiatives, such as Vision 2030, promote medical tourism by enhancing service quality, attracting global patients, and positioning the Kingdom as a premier healthcare destination.

The UAE is a key player in the GCC medical tourism market, offering advanced healthcare facilities, renowned specialists, and innovative treatments across fields like cosmetic surgery, cardiology, and orthopedics. Government-backed initiatives, seamless visa processes, and wellness programs attract international patients, positioning the UAE as a leading global medical tourism hub.

Qatar is enhancing the GCC medical tourism market through its state-of-the-art healthcare facilities, expert medical professionals, and specialized services in areas like orthopedics, cardiology, and oncology. Government investments, international partnerships, and patient-centric care attract global medical tourists, solidifying Qatar’s position as a premier destination for advanced and reliable healthcare solutions.

Bahrain supports the GCC medical tourism market by offering high-quality healthcare services, advanced facilities, and specialized treatments in areas like fertility, dermatology, and wellness. Strategic government initiatives, skilled professionals, and its focus on patient-centric care attract regional and international medical tourists, strengthening Bahrain’s reputation as a trusted healthcare destination.

Kuwait contributes to the GCC medical tourism market by providing advanced healthcare facilities, skilled medical professionals, and specialized treatments in fields like oncology, cardiology, and dentistry. Kuwait is becoming a rising hub for both regional and global medical tourism, primarily due to government funding in healthcare infrastructure and a strong emphasis on delivering high-quality patient care.

Oman is strengthening the GCC medical tourism market by offering high-quality healthcare services, advanced facilities, and expertise in areas such as orthopedics, cardiology, and wellness therapies. Government initiatives to enhance medical infrastructure and promote affordable care attract international patients, positioning Oman as a growing hub for medical tourism in the region.

Competitive Landscape:

The GCC medical tourism market features intense competition driven by advancements in healthcare infrastructure, government initiatives, and the integration of digital technologies. Key players include internationally accredited hospitals and specialized clinics in the UAE, Saudi Arabia, and Qatar, competing to attract patients through high-quality care, cutting-edge treatments, and tailored medical tourism packages. Collaboration with global healthcare providers and luxury hospitality sectors further enhances competitiveness within the region. For instance, in 2024, UAE’s Zulekha Hospital partnered with Israel’s Health Plus to boost medical tourism, fostering healthcare collaboration and expertise exchange, and strengthening the healthcare systems of both nations through this strategic agreement.

The report provides a comprehensive analysis of the competitive landscape in the GCC medical tourism market with detailed profiles of all major companies.

Latest News and Developments:

- In 2024, the Dubai Health Authority and Dubai Department of Economy and Tourism signed an MoU to strengthen medical tourism, attract healthcare investments, showcase advanced services, and support business development under the Dubai Economic Agenda, D33.

GCC Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Others |

| Genders Covered | Male, Female |

| Service Providers Covered | Private, Public |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC medical tourism market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Medical tourism refers to traveling to another country for medical treatment, often to access specialized care, advanced technology, or cost-effective procedures. It includes treatments like surgeries, dental care, fertility services, and wellness therapies, attracting patients seeking high-quality healthcare combined with the opportunity to explore a new destination.

The GCC medical tourism market was valued at USD 9.6 Billion in 2025.

IMARC estimates the GCC medical tourism market to exhibit a CAGR of 9.94% during 2026-2034.

The GCC medical tourism market is driven by advanced healthcare infrastructure, government initiatives promoting the region as a medical hub, cost-effective treatments, highly skilled medical professionals, and integration of innovative technologies like telemedicine. Additionally, the region's strategic location, wellness offerings, and visa facilitation policies attract international patients seeking quality care.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)