GCC Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Country, 2026-2034

GCC Meat Market Size and Share:

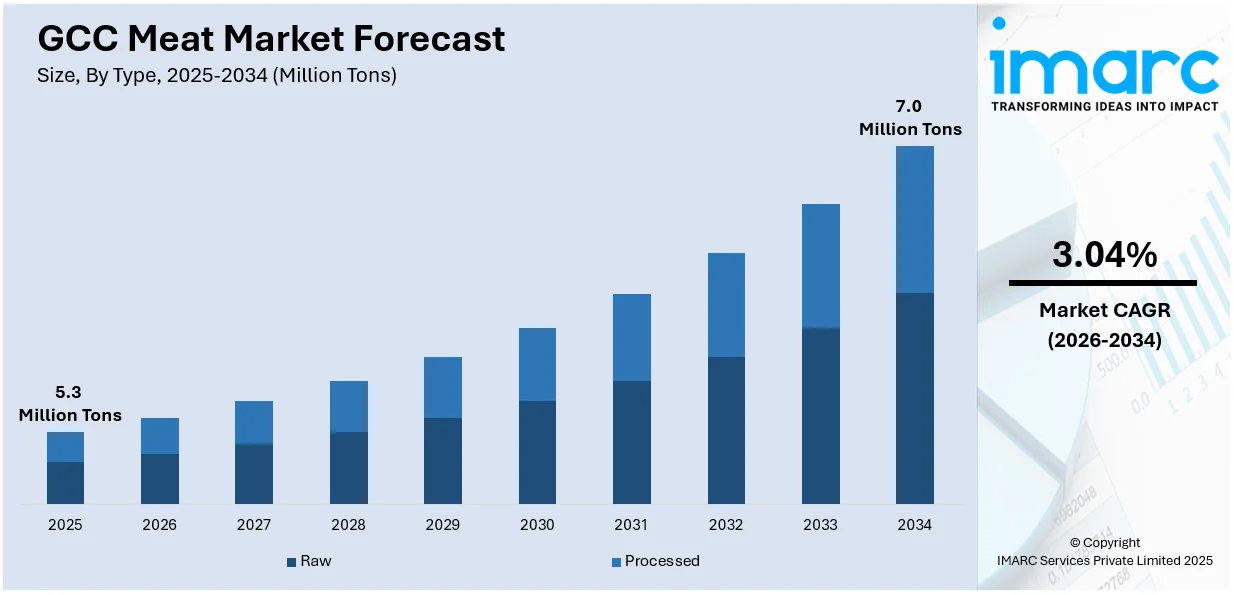

The GCC meat market size reached 5.3 Million Tons in 2025. Looking forward, IMARC Group estimates the market to reach 7.0 Million Tons by 2034, exhibiting a CAGR of 3.04% from 2026-2034. The market is growing steadily, driven by rising demand for halal-certified and premium products, increasing population, and expanding hospitality and tourism sectors. Government initiatives supporting local production and food security, coupled with evolving consumer preferences for convenience and organic options, further contribute to the market’s sustained growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 5.3 Million Tons |

| Market Forecast in 2034 | 7.0 Million Tons |

| Market Growth Rate (2026-2034) | 3.04% |

The GCC meat market share is expanding significantly du to the rising consumer demand for high-quality protein sources, fueled by increasing population and urbanization. With growing disposable incomes, consumers are seeking premium and halal-certified meat products to meet cultural, religious, and dietary preferences. For instance, in April 2024, Meats & Cuts, a premium meat boutique, launched its first Riyadh branch, offering high-quality meats, artisan cheeses, dry-aged steaks, handcrafted sausages, and exceptional catering in a luxurious and customer-friendly environment. The hospitality and tourism sectors also play a significant role, as the demand for diverse cuisines and premium dining experiences drives meat consumption. Additionally, the increasing prevalence of health-conscious lifestyles has led to greater interest in organic and grass-fed meat products, further supporting market growth across the region.

To get more information on this market Request Sample

Government initiatives to improve food security, promote local production, and halal certification are also propeling GCC meat market growth. For instance, according to industry reports, the Saudi Arabia Food and Drug Authority (SFDA) mandated halal certification and halal shipment certification for commonly consumed food from November 2023, requiring recognized certification from SFDA’s Saudi Halal Center-approved bodies like SGS Gulf Ltd. Moreover, investments in advanced livestock farming techniques and sustainable practices aim to reduce reliance on imports and improve supply chain efficiency. The growing preference for convenience foods has bolstered demand for processed and ready-to-cook meat products, catering to urban lifestyles. Furthermore, the rapid expansion of e-commerce platforms has made meat products more accessible, offering consumers convenience and a wide variety of choices.

GCC Meat Market Trends:

Expanding E-Commerce and Online Meat Retail

E-commerce is transforming the GCC meat market, with online platforms offering fresh, frozen, and processed meat directly to consumers. This trend is driven by the convenience of home delivery, detailed product information, and competitive pricing offered by online retailers. Digital platforms are increasingly catering to diverse consumer needs, including halal-certified, organic, and specialty meat products. For instance, in August 2024, Meat House Gourmet, a premium meat provider in the UAE, launched an online butcher shop offering specialty meats like Wagyu beef and beef Wellington, with free delivery over 250 AED, same-day delivery in Dubai, and personalized customer service. The rapid adoption of e-commerce, fueled by advancements in logistics and mobile applications, has made online meat retail a growing segment, particularly in urban areas with tech-savvy consumers seeking efficient shopping solutions.

Rising Demand for Halal-Certified Meat

The GCC meat market is experiencing a significant trend in the rising demand for halal-certified products, driven by the region's cultural and religious practices. Halal certification ensures compliance with Islamic dietary laws, making it a critical factor in consumer choice. Businesses are responding by expanding halal-certified product lines and ensuring robust certification processes. For instance, in July 2024, Tanmiah, a Saudi-based halal food company, through its Poultry Division, Agricultural Development Company (ADC), achieved the highest BRCGS AA+ rating. This accomplishment highlights Tanmiah’s commitment to halal standards, food safety, superior quality, and alignment with Saudi Vision 2030, reinforcing its leadership in the halal food industry. In addition, the growing preference for halal-certified meat is also influencing imports and local production, as suppliers aim to meet the strict standards required by this segment.

Increasing Demand for Organic and Premium Meat Products

The GCC meat market is witnessing a growing demand for organic and premium meat products as consumers become more health-conscious and prioritize quality over price. Organic meat, free from additives and antibiotics, is particularly appealing to high-income households and those seeking healthier alternatives. In line with this, premium cuts, grass-fed options, and specialty meat products are also gaining traction in upscale supermarkets and restaurants. For instance, in August 2024, Stanbroke, partnered with Classic Fine Foods, launched premium Australian beef to the UAE and KSA, offering exceptional quality, a diverse product range, and sustainable practices, enhancing dining experiences in restaurants, hotels, and the food service sector. This trend is further supported by the rising influence of social media, which highlights the benefits of organic and premium meat, encouraging consumers to make informed purchasing decisions.

GCC Meat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC meat market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on type, product, and distribution channel.

Analysis by Type:

- Raw

- Processed

Raw meat is a significant segment in the GCC meat market, catering to consumers seeking fresh, unprocessed options for home cooking and foodservice applications. It includes halal-certified chicken, beef, mutton, and niche products like pork, tailored to diverse preferences. Raw meat is favored for its versatility in preparing traditional and international cuisines. Rising demand for high quality and traceable meat products drives this market segment, complemented by strong imports and local production. Furthermore, raw form meets customer demands directly and hence, very much popular among consumers like households or restaurants of the area.

Processed meat is the growing segments in the GCC meat market as a result of an increase in convenience and demand for ready-to-eat foods. Products such as sausages, nuggets, cold cuts, and marinated meats form the important part of this category, and they meet the demand for a fast-paced lifestyle and wide-ranging culinary inclinations. Processed meat products find their way into markets in supermarkets, hypermarkets, and online platforms for easy reach. The rising preference for halal-certified processed items and innovations in packaging and flavor enhance their appeal. This segment is particularly favored by urban consumers and the foodservice industry, contributing to its steady growth in the GCC.

Analysis by Product:

- Chicken

- Beef

- Pork

- Mutton

- Others

Chicken is a prominent segment product in GCC meat markets, especially preferred because it is inexpensive, versatile, and accepted across all sorts of cultures and diets. Most households and foodservice industries use chicken as a common protein source in traditional and international cuisines. The increase in halal-certified chicken products, therefore, meet the needs of countries that practice these religious principles. The increasing demand for halal chicken products complies with the religion of the region. Furthermore, the growing trend in processed and ready-to-cook chicken products offers convenience to consumers, thereby propelling market dynamics in the region of the GCC.

Beef is another popular type of meat in the GCC meat market, which becomes the foundation for high-value dishes and used in high-protein diets. Primarily, beef has been popular for its rich taste and nutritional value for both fine dining and casual dining. Most beef products on the market are halal-certified for religion and culture-based purposes. With high soaring demands for health-conscious grass-fed and organic beef are also increasing, thereby propelling the market growth. Moreover, there is the hospitality and tourism sector demand further increasing the requirement for quality beef products in the GCC.

Pork represents a niche segment in the GCC meat market, primarily catering to expatriates and non-Muslim residents in the region. Available through specialty stores and specific sections of supermarkets, pork products are strictly regulated to meet the dietary preferences of a select demographic. The demand for processed pork products such as bacon, sausages, and ham are most acute, particularly within this group. Although it is limited, this segment's consistent growth is drawing in areas with diverse expatriate populations, supplemented by the travel and hospitality markets.

Mutton is a traditional favorite in the GCC meat market, deeply rooted in the region’s culinary culture. It is widely used in popular dishes like biryanis, stews, and grilled preparations, making it a preferred choice for both households and restaurants. The demand for halal-certified mutton remains strong, aligning with cultural and religious practices. In addition, mutton is very popular during festive occasions and family gatherings. It is fresh and high-quality mutton that delivers on its importance in local cuisines, thus brings in a good and consistent demand in the GCC market.

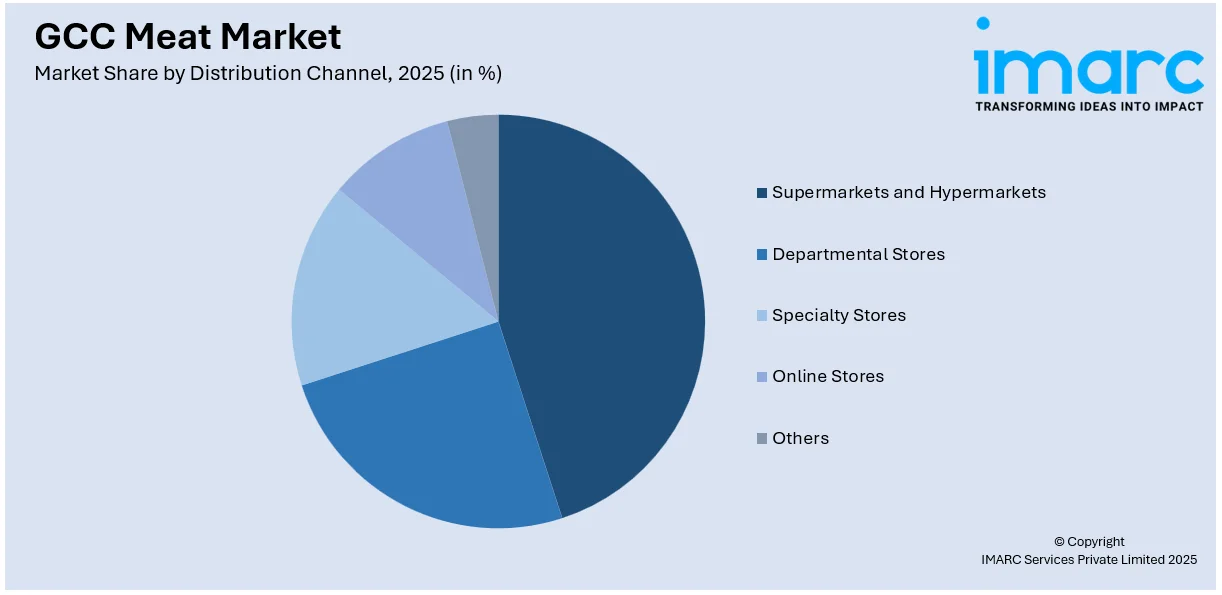

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets dominate the GCC meat market as key distribution channels due to their extensive reach, diverse product offerings, and convenience for consumers. These outlets provide a wide range of fresh, frozen, and processed meat products, catering to various dietary preferences and budgets. Their ability to maintain high standards of quality and hygiene further attracts customers. Additionally, promotional activities and loyalty programs in these stores encourage repeat purchases, making them a preferred choice for both households and bulk buyers like restaurants and catering services.

Departmental stores play a significant role in the GCC meat market, offering consumers easy access to a variety of meat products within a multi-category shopping environment. These stores typically stock packaged and processed meat products, catering to the convenience-focused segment of shoppers. Their central locations and emphasis on providing a curated selection of products make them popular among urban consumers. While not as expansive as supermarkets, departmental stores benefit from loyal customer bases and the ability to deliver a personalized shopping experience, driving consistent demand in this segment.

Specialty stores cater to niche markets within the GCC meat industry, focusing on premium, organic, or halal-certified meat products. These outlets are particularly favored by health-conscious and high-income consumers seeking superior quality and specific certifications. Specialty stores emphasize traceability, freshness, and customized options, such as cuts and seasoning, to enhance customer satisfaction. Their targeted approach and ability to provide expert recommendations create a unique shopping experience, making them a growing segment in the GCC meat market, especially in urban and affluent areas.

Online stores are rapidly gaining traction in the GCC meat market due to their convenience and accessibility. These platforms offer a diverse range of fresh, frozen, and processed meat products, often with doorstep delivery services. The growing preference for e-commerce, fueled by busy lifestyles and advancements in digital payment systems, supports this segment’s expansion. Online stores also provide detailed product information, enabling consumers to make informed decisions. The increasing adoption of mobile apps and competitive pricing, coupled with frequent discounts and offers, make online stores an essential and growing distribution channel in the GCC.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia holds a vital place in the meat market of GCC due to its large population and strong demand for high-quality protein sources. The culture and religion of the country make the consumption of halal meat an integral part of growth in this sector. Demand for premium and processed meat products is expected to grow with increasing disposable incomes and urbanization. Another factor that helps create continuity of its good trade activity is Saudi Arabia’s dependence on importation of meat products to feed its population. The government initiatives on improving food security and the domestic production capacity are significantly influencing the dynamics of the meat market.

The UAE is a significant market for meat in the Gulf Cooperative Council (GCC) because of a mixed population and a growing hospitality and tourism industry. The demand for meat in the country is highly skewed towards premium-quality, including organic and halal-certified, as it serves as a culinary hub. The UAE’s strong dependence on imports makes available a huge diversity of meat products for meeting different nationalities in the country. The increasing demand for safety and sustainable foods by the government and consumer trends for convenience and ready-to-cook meat products further fortifies the meat market in the UAE.

Qatar’s meat market is growing steadily, supported by its rising population and increasing disposable incomes. The country’s emphasis on high-quality halal meat products aligns with cultural and dietary preferences, driving demand across households and the hospitality sector. Qatar’s investments in local livestock farming to boost self-sufficiency and reduce reliance on imports are reshaping the market dynamics. The growing demand for premium and processed meat products, particularly in urban areas, further contributes to the expansion of Qatar’s meat market, positioning it as a vital segment in the GCC.

Bahrain’s meat market is fueled by its small but growing population and increasing consumer preference for premium and halal-certified meat products. The country’s reliance on meat imports ensures diverse options are available to meet local demand. Bahrain’s thriving foodservice sector, driven by tourism and an active expatriate community, also plays a significant role in market growth. Additionally, government initiatives to maintain food security and promote sustainable farming practices further support the meat market’s development, highlighting Bahrain’s importance within the GCC meat industry.

Kuwait’s meat market is expanding due to its high purchasing power and strong consumer preference for premium halal meat products. The country’s reliance on imports ensures the availability of diverse meat options to meet local demand. Kuwait’s growing hospitality sector and the increasing popularity of international cuisines are boosting demand for high-quality meat. Additionally, government efforts to enhance food security through investments in local production and supply chain efficiency are contributing to market growth, reinforcing Kuwait’s role as a key player in the GCC meat industry.

Oman’s meat market is characterized by a strong preference for halal meat and growing consumer demand for fresh and processed meat products. The country’s investments in local livestock farming and food security initiatives are aimed at reducing dependency on imports. Oman’s thriving tourism sector and urbanization are further driving the demand for high-quality meat in both households and foodservice establishments. Additionally, the increasing availability of convenient and ready-to-cook meat products aligns with changing consumer lifestyles, contributing to the steady growth of Oman’s meat market in the GCC.

Competitive Landscape:

The GCC meat market is characterized by a competitive landscape driven by both regional and international players. Key market participants focus on offering a diverse range of halal-certified, organic, and processed meat products to meet evolving consumer demands. Additionally, local producers are investing in advanced farming technologies and sustainable practices to enhance supply chain efficiency and reduce reliance on imports. The expansion of e-commerce platforms has significantly increased competition, offering consumers enhanced accessibility and a wider range of choices. Furthermore, strategic partnerships, product innovation, and government-backed initiatives are shaping the dynamics of the GCC meat market. For instance, in June 2024, AGWA and Believer Meats collaborated to develop cultivated meat capabilities in Abu Dhabi, focusing on market expansion, manufacturing, and R&D. The partnership addresses food security, promotes alternative proteins, and establishes halal certification standards for cultivated meat in the MENA region.

The report provides a comprehensive analysis of the competitive landscape in the GCC meat market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Fam Foods, in partnership with the Kobe Beef Association, introduced halal-certified Kobe beef to Saudi Arabia, aiming to advance premium dining experiences, strengthen cultural ties, and bring Japanese culinary innovation to the region through elevated gastronomic offerings and collaboration.

- In November 2024, BRF, a Brazilian meat company, partnered with the Halal Products Development Company to acquire a 26% stake in Saudi poultry producer Addoha for USD 84.2 million, strengthening its Middle East presence and supporting regional food security initiatives.

- In November 2024, Land Alpha Co., launched Kagoshima Halal Wagyu beef in Saudi Arabia, introducing premium Japanese beef with Halal certification to the GCC market, meeting local consumer demand for quality and authenticity.

- In December 2024, Halal Sanda Beef debuts in Saudi Arabia, marking the introduction of Japan's premium Halal-certified Wagyu brand to the Kingdom, catering to the growing demand for luxury, high-quality beef in the region.

- In December 2024, Al Ghurair Foods launched a new integrated poultry facility in Khalifa Economic Zones of Abu Dhabi (KEZAD), featuring a hatchery, processing plant, rendering facility, and effluent treatment, supporting the company’s role in UAE's 2051 food security strategy.

GCC Meat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC meat market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC meat market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Meat refers to the edible flesh of animals, including beef, poultry, lamb, and seafood, used as a primary protein source in diets worldwide. It is a versatile ingredient in culinary applications, supporting diverse cuisines and nutritional needs. Meat is widely utilized in households, restaurants, and food processing industries.

The GCC meat market size reached USD 5.3 Million Tons in 2025.

IMARC estimates the GCC meat market to exhibit a CAGR of 3.04% during 2026-2034.

The market is driven by rising consumer demand for high-quality protein sources, increasing population, and expanding disposable incomes. Growth in tourism and hospitality sectors boosts demand for premium meat products. Additionally, government initiatives to ensure food security and the growing preference for convenience foods further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)