GCC Mattress Market Size, Share, Trends and Forecast by Product, Distribution Channel, Size, Application, and Country, 2026-2034

GCC Mattress Market Size and Share:

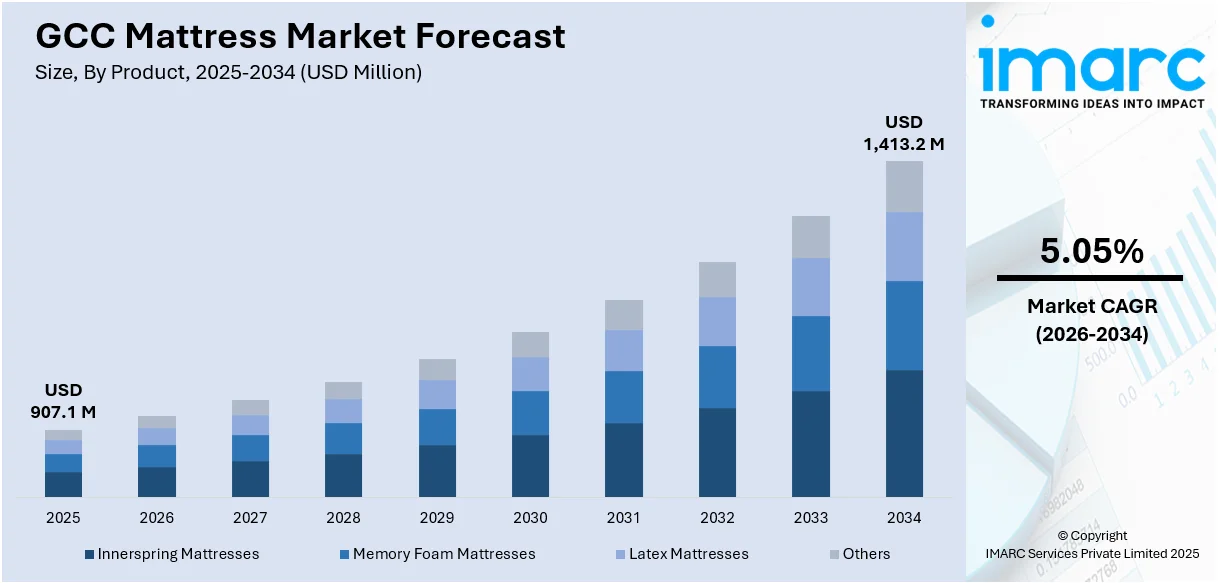

The GCC mattress market size was valued at USD 907.1 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,413.2 Million by 2034, exhibiting a CAGR of 5.05% from 2026-2034. Saudi Arabia dominates the region driven by rising urbanization, increasing disposable income, growing hospitality sector, expanding residential construction, and surging demand for premium mattresses in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 907.1 Million |

|

Market Forecast in 2034

|

USD 1,413.2 Million |

| Market Growth Rate (2026-2034) | 5.05% |

The GCC mattress market is witnessing robust growth due to rapid urbanization and the demand for better-quality sleep products. In addition to this, the increasing disposable income in the region is encouraging consumers to spend on better-quality mattresses for comfort and durability, thus aiding the market growth. Moreover, the expansion in the real estate industry, such as housing and commercial projects is boosting the market demand for single and double mattresses, especially in Saudi Arabia and the United Arab Emirates (UAE). For instance, the UAE attracts over 20 million visitors annually, which is constantly boosting demand for hospitality furnishings in the region. Furthermore, the shifting trend towards personal health and improving sleep quality is becoming more significant for customers, which is influencing the development of different mattress types and impelling the market growth.

To get more information on this market Request Sample

Concurrent with this, the hospitality sector is acting as another growth-inducing factor in the GCC mattress market. This is fueled by a booming tourism industry and increasing government initiatives to diversify economies, thus contributing to the market expansion. Besides this, hotel chains and luxury resorts are expanding their presence in the region, creating significant demand for premium mattresses to enhance guest experiences, which is providing an impetus to the market. Vision 2030 in Saudi Arabia has heightened the development of infrastructure projects, including hotels and serviced apartments, supporting the market growth. For example, Saudi Arabia aims to develop approximately 320,000 hotel rooms, as part of the Vision 2030 initiative, bolstering the market demand. Apart from this, the expanding e-commerce in the region is making it easier for consumers to access a wider range of mattress products, thereby propelling the market forward.

GCC Mattress Market Trends:

Shift towards premium and customized mattresses

The GCC mattress market is experiencing a growing demand for premium and customized products. Consumers are increasingly prioritizing quality, comfort, and durability, leading to a preference for mattresses developed with advanced materials such as latex, memory foam, and hybrid designs. Additionally, customized options that cater to individual sleep needs, including orthopaedic and temperature-regulating features, are gaining traction. For instance, orthopaedic mattresses are designed for people who are diagnosed with chronic back pain and musculoskeletal diseases, ensuring proper spinal alignment. Furthermore, owing to the increased disposable income and widespread awareness of the benefits of better sleep quality among health-conscious consumers, manufacturers are focusing on innovative designs and personalized solutions to meet diverse consumer preferences in the region, catalyzing the market growth.

Growth of e-commerce and online mattress retailing

The increasing rate of e-commerce is surging the demand for mattresses in the GCC region. In line with this, customers now have access to a wide variety of brands and models on the internet to choose from, offering convenience, cost-efficiency, and transparency. Moreover, this trend is supported by the growth in internet usage along with the shift towards using digital means for payment. Approximately 60% of GCC millennials shop online, indicating a strong inclination towards e-commerce among younger demographics. Apart from this, the integration of new strategies by several brands is providing online-sale products, gifts, free trials, and home delivery services. This change to purchase a model is enabling new entrants and small businesses to advertise their products and effectively challenge big brands, thereby impelling the market expansion.

Increased focus on sustainability and eco-friendly products

The rising emphasis on environmental friendly and biodegradable products is significantly driving the market demand for mattresses in the GCC region. Concurrently, manufacturers are adopting organic materials such as cotton, bamboo, and recycled foam, to ensure sustainability. For example, 78% of consumers are seeking sustainable options to improve their lifestyle. Besides this, this trend is supported by the shifting preference of green consumers towards eco-friendly products. Furthermore, certifications like the OEKO-TEX and Global Organic Textile Standards (GOTS), are compelling manufacturers to align their productions with the conscience customers. As a result, consumers seek green products, influencing the market strategy and product differentiation in the mattress industry, and fueling the market demand.

GCC Mattress Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC mattress market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, distribution channel, size, and application.

Analysis by Product:

- Innerspring Mattresses

- Memory Foam Mattresses

- Latex Mattresses

- Others

Innerspring mattresses dominate the GCC mattress market, driven by their affordability, durability, and widespread availability. These mattresses are favored for their robust support, which caters to a wide range of sleep preferences, making them a popular choice among consumers. Moreover, their breathable design enhances airflow, making them suitable for the hot climate of the region. Furthermore, the hospitality sector relies on innerspring mattresses due to their cost-effectiveness and ability to maintain comfort over time. Additionally, manufacturers are introducing hybrid models that combine innerspring with memory foam or latex to meet evolving consumer demands, which is strengthening the market share.

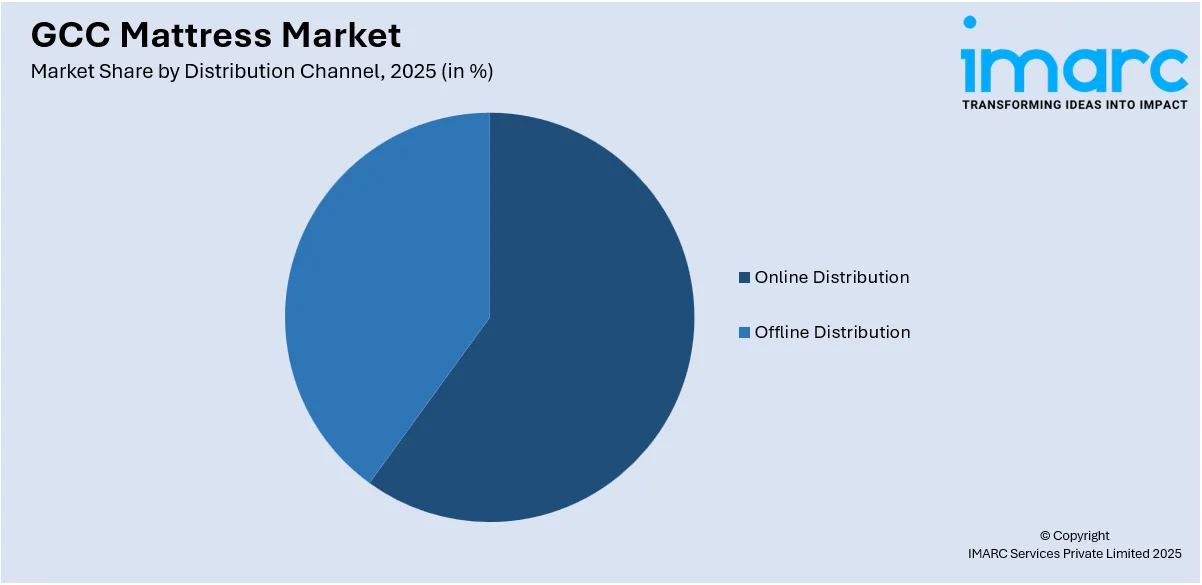

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online Distribution

- Offline Distribution

Offline distribution leads the GCC mattress market driven by a large number of consumers, as they prefer shopping for mattresses offline where they can personally feel the mattresses. Besides this, the increase in offline sales is demonstrated by the expanding network of physical shops resulting from rising urbanization in the region. Moreover, retail chain affiliation offers greater product exposure, and customer acceptance by the large manufacturing companies. Additionally, the off-line segment continues to have more value share, especially in the super-premium and luxury mattresses due to the growth in the e-business market share, thereby fueling the market demand.

Analysis by Size:

- Twin or Single Size

- Twin XL Size

- Full or Double Size

- Queen Size

- King Size Mattress

- Others

Queen-size mattresses hold the largest market share in the GCC mattress market due to their balance of space and affordability. It makes them ideal for couples and individuals seeking extra comfort. Their versatility suits the residential and hospitality sectors, which is further driving consistent demand in the region. In confluence with this, queen-size mattresses are appropriate for the contemporary bedroom as they provide comfort without taking up too much space. Concurrently, they are easily available in a wide range of varieties, on offline and online platforms. Apart from this, manufacturers are integrating features such as memory foam and hybrid designs in the queen-size mattress to meet the customers’ needs, boosting the market expansion.

Analysis by Application:

- Domestic

- Commercial

The domestic accounts for the largest segment in the GCC mattress market due to the growth in residential construction and consumers' expenditure on home furnishings. Populous cities and rapid urbanization are increasing the need for good-quality mattresses aligning with unique sleep requirements. In addition, cultural aspects that involve the provision of courtesy to people within households justify buying several mattresses for accommodating guests. Moreover, the rising middle class is seeking better quality mattresses, as this general shift is making people aware of sleep health, which is significantly contributing to the market expansion.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia holds the largest market for mattresses in the GCC, driven by its expanding population, rapid urbanization, and robust real estate sector. The government's Vision 2030 initiative has fueled large-scale housing and infrastructure projects, including luxury hotels and residential developments. As part of this initiative, the Saudi government aims to raise homeownership rates to 70% by 2030, necessitating the construction of additional housing units. Besides this, the rising disposable incomes and growing awareness of sleep health are encouraging consumers to invest in premium and customized mattresses. Additionally, the hospitality sector plays a significant role, with increased tourism driving demand for high-quality bedding. Furthermore, Saudi Arabia’s strong retail presence and growing e-commerce platforms ensure easy accessibility, propelling the market forward.

Competitive Landscape:

The competition in the GCC mattress market is fragmented with the presence of international players and regional producers along with new entrants. The leading global players engage in the adoption of higher technologies and high-end products like memory foam and orthopaedic beds. In addition, regional manufacturers provide solutions that meet local markets’ needs, with seamless integration taking and considering the regional market dynamics. However, new entrants and other innovative entrant firms are introducing competition in the form of environment-friendly and sustainable products due to an increase in environmental consciousness. Apart from this, the market has seen a high rise in green manufacturing, and companies are emphasizing certifications on the processes adopted in this field. These dynamics encourage companies to improve customers’ value proposition through offers, guarantees, and free trials to remain competitive in the market.

The report provides a comprehensive analysis of the competitive landscape in the GCC mattress market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, Dubai Furniture Manufacturing Company (DFMC) announced a partnership with a local recycling firm, La-Z-Boy, to produce eco-friendly mattresses using recycled materials, aligning with the region's sustainability goals.

GCC Mattress Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Others |

| Distribution Channels Covered | Online Distribution, Offline Distribution |

| Sizes Covered | Twin or Single Size, Twin XL Size, Full or Double Size, Queen Size, King Size Mattress, Others |

| Applications Covered | Domestic, Commercial |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC mattress market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC mattress market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC mattress industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A mattress is a rectangular pad designed to support the body while lying down, often placed on a bed frame or base. It is made from materials like foam, latex, and springs, offering comfort and support. It is widely applicable in residential use, healthcare facilities, and the hospitality sector.

The GCC mattress market was valued at USD 907.1 Million in 2025.

IMARC estimates the GCC mattress market to exhibit a CAGR of 5.05% during 2026-2034.

Key factors like rapid urbanization, increasing disposable income, growing health awareness, expansion in the hospitality and real estate sectors, rising e-commerce adoption, and sustainability-focused innovations, are fueling the market demand in the region.

In 2025, innerspring mattresses represented the largest segment by product, driven by affordability, superior durability, breathability, and widespread consumer preference.

Offline distribution leads the market by distribution channel owing to in-store product testing, personalized assistance and established retail networks.

The queen size is the leading segment by size, driven by its ideal dimensions, affordability, and suitability for modern bedrooms.

Domestic accounted for the largest market share by application, due to the growing residential developments, increased homeownership, and rising demand for comfort-focused products.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman, wherein Saudi Arabia currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)