GCC Luxury Market Size, Share, Trends and Forecast by Type, Gender, Distribution Channel, and Region, 2025-2033

GCC Luxury Market Size and Share:

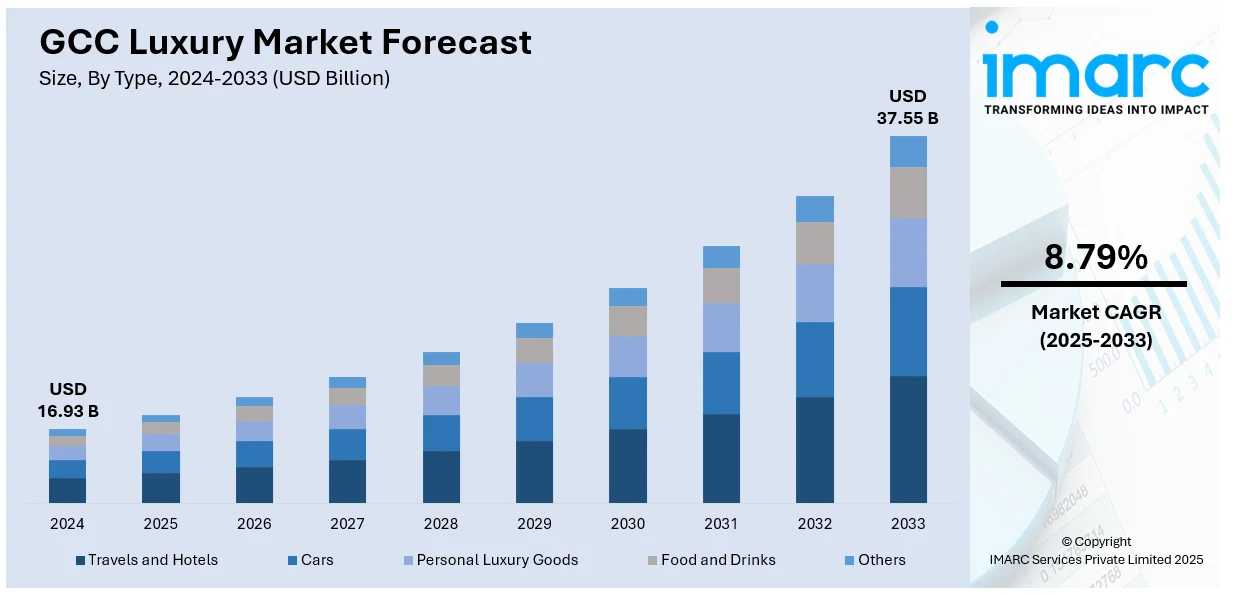

The GCC luxury market size was valued at USD 16.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.55 Billion by 2033, exhibiting a CAGR of 8.79% during 2025-2033. The United Arab Emirates dominated the market, holding a significant market share of over 48.6% in 2024. This is due to high consumer spending, a strong tourism sector, and a concentration of global luxury brands. Its world-class retail infrastructure, tax-free environment, and frequent high-profile events attract affluent shoppers and boost demand across fashion, beauty, jewelry, and premium automotive segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.93 Billion |

| Market Forecast in 2033 | USD 37.55 Billion |

| Market Growth Rate 2025-2033 | 8.79% |

The luxury market in the GCC is driven by rising disposable incomes, a strong preference for premium brands, and a culturally embedded emphasis on status and exclusivity. Rapid urbanization and the development of upscale retail destinations, including luxury malls and boutiques, have made high-end goods more accessible. Tourism plays a major role, with visitors contributing significantly to luxury spending, especially in cities like Dubai and Riyadh. The younger population is also shaping demand, influenced by global fashion trends and social media engagement. Growing digital adoption has expanded e-commerce for luxury items, supported by mobile-first shopping habits. Additionally, government initiatives promoting tourism, lifestyle, and entertainment are reinforcing the region’s image as a hub for global luxury experiences across fashion, beauty, hospitality, and automobiles.

Luxury hospitality in the GCC is embracing immersive design, personalized digital experiences, and sustainability. New developments highlight a shift toward culturally rooted stays enhanced by technology. This evolving approach is setting the stage for the region to lead in redefining upscale travel through innovation and meaningful guest engagement. For instance, in April 2025, Campbell Gray Hotels outlined its plans for the GCC luxury hospitality sector, focusing on tech-driven, personalized guest experiences and sustainable design. The group’s chairman noted a regional shift toward immersive, culturally rich stays. With upcoming projects in the UAE and Saudi Arabia, the brand aims to position the Gulf as a global benchmark for innovation-led luxury travel experiences.

GCC Luxury Market Trends:

Upsurge in Premium Lifestyle Preferences

Consumer interest in high-end lifestyle products is strengthening across the GCC, driven by a mix of cultural affinity for prestige goods, expanding retail sophistication, and increasing global brand visibility. Luxury purchases are becoming more prominent among younger demographics, who are influenced by social media and digital platforms that highlight exclusivity and personal expression. The retail landscape is also evolving, with new flagship stores, designer pop-ups, and upscale mall developments enhancing accessibility and experiential value. International fashion and accessory labels are deepening their presence through curated collections and tailored offerings that cater to regional tastes. Additionally, a surge in tourism and events across key cities continues to fuel aspirational buying, reinforcing the role of personal luxury in lifestyle expression. This shift is not just confined to traditional categories but is extending into niche areas such as artisan craftsmanship, high-end streetwear, and bespoke services that resonate with evolving consumer aspirations. For example, the GCC personal luxury goods market size reached USD 10.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.82% during 2025-2033.

Digital Influence Reshaping Luxury Buying Behavior

Luxury consumption in the GCC is being shaped by digital behavior, especially among tech-savvy consumers in markets like Saudi Arabia. Mobile-based shopping has become a common mode of access, with a large portion of purchases happening through smartphones. Social media platforms are playing a central role in shaping preferences and purchase decisions, acting as both discovery and engagement tools. The lines between physical and digital retail are becoming less defined, with online channels now complementing traditional outlets rather than competing with them. Younger buyers, in particular, are more responsive to curated content, influencer endorsements, and direct brand interactions online. This shift is prompting luxury brands to rethink how they connect, creating digital experiences that mirror the exclusivity and personal touch of in-store interactions. According to a survey, 90% of surveyed people in Saudi Arabia shop online using their smartphones. The online market continues to drive the sales of luxury products as boundaries blur with the more traditional distribution channels. Social media platforms such as YouTube, Facebook, Instagram, WhatsApp, etc. are also influencing consumers, particularly the younger generation.

New Energy Vehicles Gaining Traction

The region’s demand for premium electric vehicles is expanding, with high-performance models entering the market and capturing attention through a mix of innovation, design, and sustainability. The arrival of new entrants into the luxury automotive space reflects a growing interest in alternatives to conventional fuel-based vehicles, especially those offering cutting-edge technology and environmentally conscious engineering. Buyers in the GCC are increasingly drawn to vehicles that combine power with advanced features like extended range, intelligent systems, and efficient charging or battery-swapping capabilities. This shift also aligns with broader regional goals to promote clean energy and reduce carbon emissions. As interest continues to rise, luxury EVs are expected to carve out a distinct space alongside traditional luxury automobiles, supported by expanding infrastructure and government-backed sustainability initiatives. For instance, in October 2024, NIO introduced its flagship electric SUV, the EL8, to the UAE market, signaling its entry into the GCC's luxury automotive sector. Priced from AED 359,900, the six-seater EL8 features dual motors delivering 644 hp, a 510 km range, and innovative battery-swapping technology. This launch aligns with NIO's strategy to expand in the MENA region.

GCC Luxury Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC luxury market, along with forecasts at the regional level from 2025-2033. The market has been categorized based on type, gender, and distribution channel.

Analysis by Type:

- Travels and Hotels

- Cars

- Personal Luxury Goods

- Food and Drinks

- Others

Cars stood as the largest component of the market in 2024 due to several demand-side and lifestyle factors. High disposable incomes, a strong preference for prestige and exclusivity, and a culture that places value on personal status symbols have made luxury cars a dominant segment. Luxury cars from brands like Rolls-Royce, Bentley, Mercedes-Benz, and BMW are not just modes of transport but statements of wealth and identity. The market is further driven by limited public transport in many parts of the region, rising urbanization, and tourism-led spending, particularly in cities like Dubai, Riyadh, and Doha. Additionally, favorable import regulations and dealership support, along with an appetite for high-performance and technologically advanced vehicles, continue to bolster luxury car sales across the GCC.

Analysis by Gender:

- Male

- Female

Male led the market in 2024, driven by cultural, economic, and lifestyle factors. High male workforce participation and income levels across the region have led to stronger purchasing power among men, making them primary buyers of luxury goods, including automobiles, watches, apparel, and fragrances. In many GCC countries, luxury consumption is often associated with status and social standing, which men actively maintain through high-end purchases. Moreover, traditional gender roles and spending dynamics in the region typically allocate financial decisions and large-scale purchases to men. The popularity of male-centric luxury categories, such as high-performance cars, men’s fashion, and premium accessories, further strengthens this trend, making men the dominant contributors to luxury market growth across the GCC.

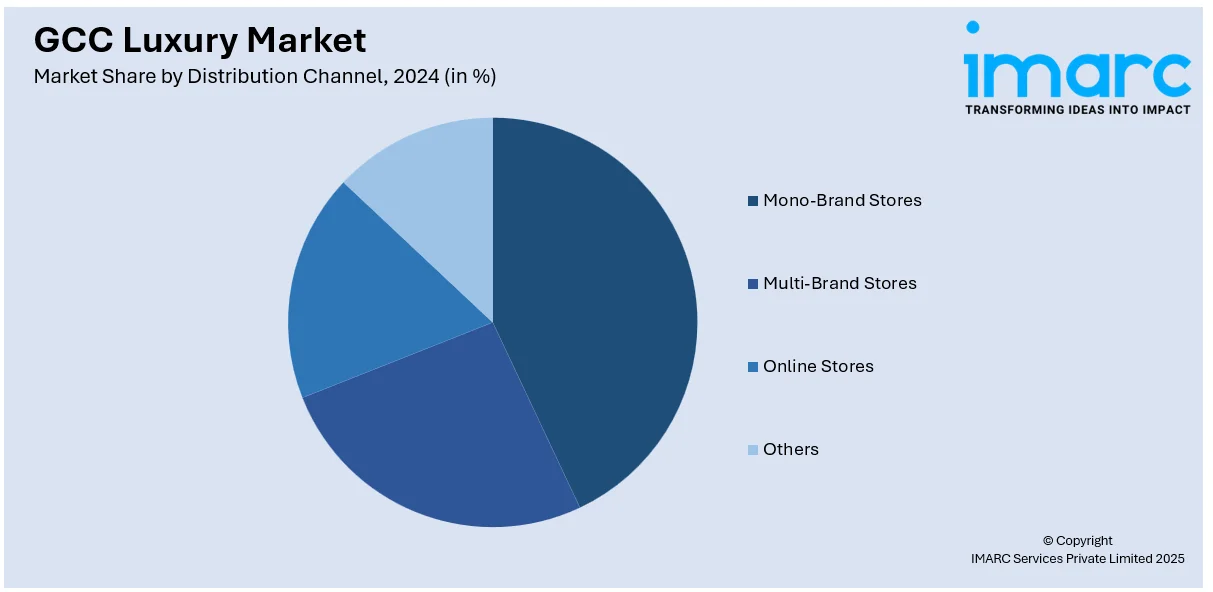

Analysis by Distribution Channel:

- Mono-Brand Stores

- Multi-Brand Stores

- Online Stores

- Others

Mono-brand stores led the market with around 45.6% of market share in 2024, owing to rising brand consciousness and demand for exclusive, immersive shopping experiences. Consumers in the region prefer direct engagement with luxury labels through flagship outlets that reflect the brand’s identity, heritage, and personalized service. These stores offer authenticity, curated collections, and premium customer service, which resonate strongly with GCC shoppers seeking prestige and trust. Leading cities like Dubai, Riyadh, and Doha have become hubs for mono-brand boutiques from names like Louis Vuitton, Chanel, and Rolex, supported by luxury malls and high-end retail zones. The controlled brand environment, tailored product offerings, and enhanced post-purchase services make mono-brand stores the preferred choice, fueling their dominance in the region's luxury retail landscape.

Regional Analysis:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

In 2024, the United Arab Emirates accounted for the largest market share of over 48.6% because of its position as a regional hub for tourism, retail, and high-net-worth individuals. Cities like Dubai and Abu Dhabi offer a dense concentration of luxury malls, flagship mono-brand stores, and exclusive shopping districts that attract affluent residents and international visitors. The country's business-friendly policies, strong expatriate population, and high levels of disposable income support consistent demand for premium goods. Events like Dubai Shopping Festival and the presence of global fashion and luxury expos also boost market visibility. With luxury retail deeply integrated into lifestyle and tourism experiences, the UAE continues to lead the region’s luxury market through its infrastructure, consumer base, and global connectivity.

Competitive Landscape:

The market is witnessing increased product launches and brand collaborations, especially in fashion, automobiles, and hospitality. Major global brands are expanding their footprints via partnerships with regional distributors and retail groups. Saudi Arabia’s Vision 2030 and Dubai’s luxury-focused retail zones are attracting fresh investments and hosting high-end launches. Events like the Riyadh Season and Dubai Fashion Week are encouraging international brand participation. Collaborations and retail partnerships remain the most common practice, enabling faster market access and localization. Additionally, growing investment in customer experience and digital innovation is visible, although large-scale funding and R&D remain limited compared to Western markets. The report provides a comprehensive analysis of the competitive landscape in the GCC luxury market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Dubai's Roads and Transport Authority (RTA) launched a luxury limousine and chauffeur rental service under the new Takamul Permit system. This initiative integrates the luxury vehicle and car rental sectors, allowing residents, tourists, and visitors to hire chauffeured luxury cars for up to one month.

- November 2024: Rolls-Royce opened a new luxury showroom in Abu Dhabi. The showroom caters to ultra-luxury tastes, reinforcing the brand’s commitment to exclusivity, and is strategically located in the heart of the city.

- July 2024: Geely launched the all-new Preface sedan in the UAE, combining advanced technology, luxury, and performance. Featuring a 2.0TD engine with 215 hp and 325 Nm torque, it accelerates from 0–100 km/h in 6.9 seconds while maintaining a fuel efficiency of 18.7 km/l.

GCC Luxury Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Travels and Hotels, Cars, Personal Luxury Goods, Food and Drinks, and Others |

| Genders Covered | Male, Female |

| Distribution Channels Covered | Mono-Brand Stores, Multi-Brand Stores, Online Stores, and Others |

| Regions Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC luxury market from 2019-2033.

- The GCC luxury market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC luxury industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury market in the GCC was valued at USD 16.93 Billion in 2024.

The GCC luxury market is growing due to rising disposable incomes, a young and brand-conscious population, expanding tourism, and high demand for premium experiences. Government initiatives promoting luxury retail, cultural events, and infrastructure developments, especially in Saudi Arabia and the UAE, are further attracting global luxury brands and boosting regional sales.

The luxury market is projected to exhibit a CAGR of 8.79% during 2025-2033, reaching a value of USD 37.55 Billion by 2033.

Cars accounted for the largest share of the market in 2024. High-income levels, strong preference for premium vehicles, tax-free imports, and advanced road infrastructure drive luxury car demand in the GCC, with brands offering region-specific models and after-sales services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)