GCC Logistics Market Report by Model Type (2 PL, 3 PL, 4 PL), Transportation Mode (Roadways, Seaways, Railways, Airways), End Use (Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, and Others), and Country 2026-2034

GCC Logistics Market:

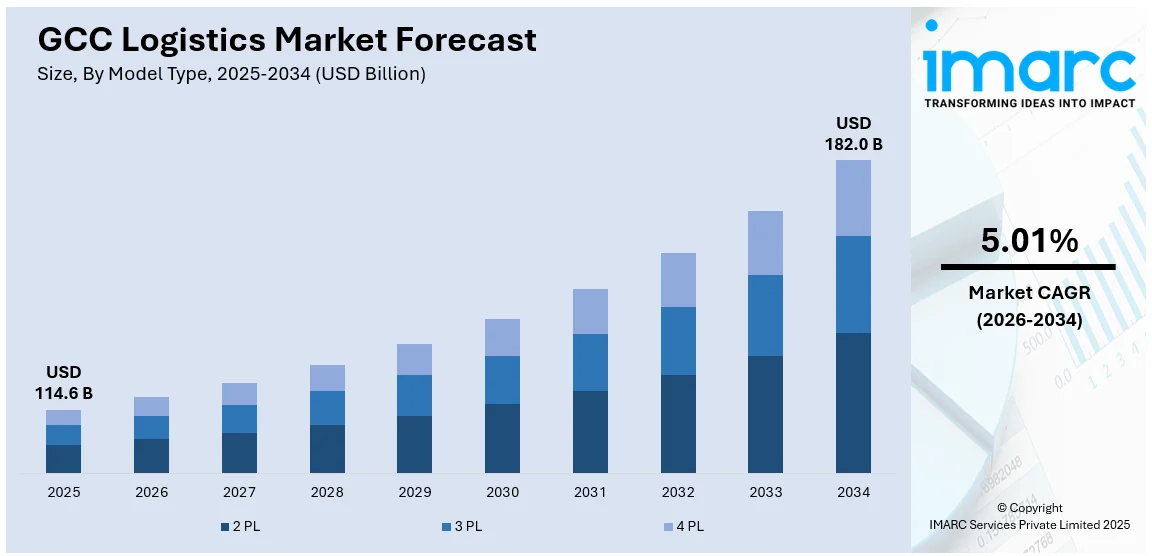

GCC logistics market size reached USD 114.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 182.0 Billion by 2034, exhibiting a growth rate (CAGR) of 5.01% during 2026-2034. Extensive economic development activities and the growing consumer demands are elevating the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 114.6 Billion |

|

Market Forecast in 2034

|

USD 182.0 Billion |

| Market Growth Rate 2026-2034 | 5.01% |

GCC Logistics Market Analysis:

- Major Market Drivers: The rising consumer inclination towards online shopping platforms is catalyzing the market. Besides this, strategic geographical location is also acting as a significant growth-inducing factor.

- Key Market Trends: The growing importance of special economic and free trade zones in the region has attracted foreign investments and stimulated trade activities, which is acting as a growth-inducing factor.

- Competitive Landscape: The report has provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: The widespread usage of digital supply chain solutions is one of the emerging trends fueling the market in Saudi Arabia. Moreover, the increasing need for transparency in logistics operations is also augmenting the market across the United Arab Emirates. Apart from this, the expanding infrastructure development activities are further propelling the market in Qatar. Furthermore, favorable government policies will continue to fuel the market in Oman over the forecasted period.

- Challenges and Opportunities: Regulatory inconsistencies across member states are hindering the market. However, fostering regional cooperation will continue to fuel the market in the coming years.

GCC Logistics Market Trends:

Trade Expansion and Regional Integration

The rising need for creating a more interconnected and efficient logistics network across member states is augmenting the market. Additionally, agreements, including the Gulf Cooperation Council Customs Union, facilitate faster and smoother cross-border movement of goods. In April 2024, the logistics sector across the GCC region expanded following the Saudi Cabinet’s approval of a land transport law within the region. The system is crafted to simplify procedures, enhance the organizational environment, and foster unity.

To get more information on this market Request Sample

Sustainability Initiatives

Government bodies and companies aim to minimize carbon footprints and meet environmental standards. The growing awareness towards climate change and the need for greener supply chains drive this trend. In July 2024, Odys Aviation and MWASALAT announced a partnership to develop aerial logistics programs in the GCC in 2025 by operating Odys’ hybrid-electric VTOL aircraft called Laila. It is a hybrid-electric VTOL aircraft designed in several configurations for cargo and capable of transporting payloads up to 60kg with a 400 km range. This is expanding the GCC logistics market share.

Expanding Digital Transformation

Digital transformation is stimulating the market, driven by the adoption of advanced technologies. These technologies enhance transparency, operational efficiency, and supply chain visibility. Machine learning and AI algorithms enable predictive analytics, thereby reducing delivery times. IoT devices provide real-time tracking of goods. In March 2024, BTR.tech, one of the players in robotics system integration within the Gulf Cooperation Council (GCC) region, collaborated with Quicktron to provide advanced robotics services and solutions to the logistics industry in the Middle East.

GCC Logistics Industry Segmentation

IMARC Group provides an analysis of the key trends in each segment of the market, along with the market forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on model type, transportation mode, and end use.

Breakup by Model Type:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on model type. This includes 2 PL, 3 PL, and 4 PL.

The market is evolving with a diverse range of service models, including 2PL, 3PL, and 4PL, each catering to different business needs. 2PL providers generally focus on asset-based transportation services. 3PL services include activities, including distribution, warehousing, and freight forwarding. 4PL acts as a strategic partner.

Breakup by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

The report has provided a detailed breakup and analysis of the market based on transportation mode. This includes roadways, seaways, railways, and airways.

Seaways are vital for international trade, with major ports like Dammam in Saudi Arabia and Jebel Ali in the UAE serving as key gateways for goods entering and exiting the region. Railways are an emerging mode of transport in the region. Airways are essential for high-value, time-sensitive goods, with airports in Doha and Dubai serving as major logistics hubs.

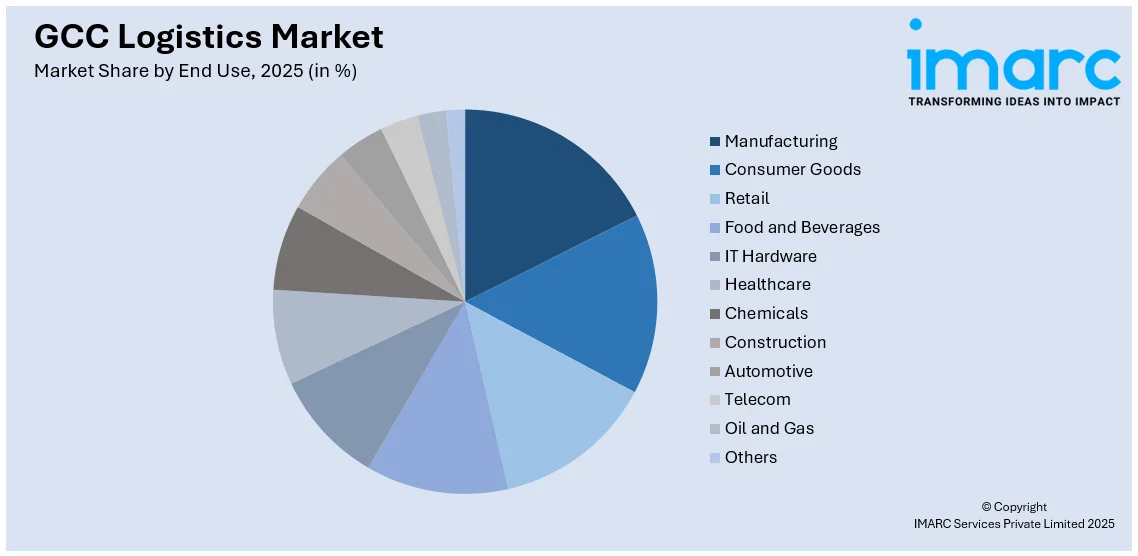

Breakup by End Use:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Manufacturing is a key sector, with logistics providers supporting the movement of raw materials. The consumer goods and retail industries have seen rapid growth, driven by the rise in e-commerce. The food and beverage sector also plays a significant role, requiring specialized logistics for temperature-controlled storage. IT hardware demands high-tech logistics solutions to manage the fast-paced turnover of electronics and components. The chemicals and automotive sectors need specialized handling and transportation due to the hazardous nature of chemicals. The construction industry, pivotal in the region's infrastructure development, requires the efficient transportation of heavy materials and machinery.

Breakup by Country:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

The GCC logistics market outlook varies significantly across the region. Saudi Arabia is undergoing rapid transformation driven by Vision 2030. The United Arab Emirates stands out as a leading logistics hub. The UAE's strategic location at the crossroads of Asia, Europe, and Africa further strengthens its position as a critical global logistics gateway. Qatar is expanding its logistics infrastructure. Kuwait is focusing on modernizing its logistics sector through significant investments in port expansions. Oman, with its strategic location outside the Strait of Hormuz, is enhancing its logistics profile by developing the Duqm Special Economic Zone.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive market price analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Logistics Market Recent Developments:

- July 2024: Odys Aviation and MWASALAT partnered to develop aerial logistics programs in the GCC in 2025 by operating Odys’ hybrid-electric VTOL aircraft called Laila.

- April 2024: The logistics sector across the GCC region expanded following the Saudi Cabinet’s approval of a land transport law within the region.

- March 2024: BTR.tech, one of the players in robotics system integration within the GCC region, collaborated with Quicktron to provide advanced robotics services to the logistics industry in the Middle East.

GCC Logistics Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC logistics market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC logistics market growth?

- What is the breakup of the GCC logistics market on the basis of model type?

- What is the breakup of the GCC logistics market on the basis of transportation mode?

- What is the breakup of the GCC logistics market on the basis of end use?

- What are the various stages in the value chain of the GCC logistics market?

- What are the key driving factors and challenges in the GCC logistics?

- What is the structure of the GCC logistics market, and who are the key players?

- What is the degree of competition in the GCC logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC logistics market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC logistics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)