GCC LED Lighting Market Report by Product Type (Panel Lights, Down Lights, Street Lights, and Others), Application (Residential, Commercial, Industrial, and Others), Import and Domestic Manufacturing (Imports, Domestic Manufacturing), Public and Private Sectors (Public Sector, Private Sector), Outdoor and Indoor Application (Indoor, Outdoor), and Region 2025-2033

Market Overview:

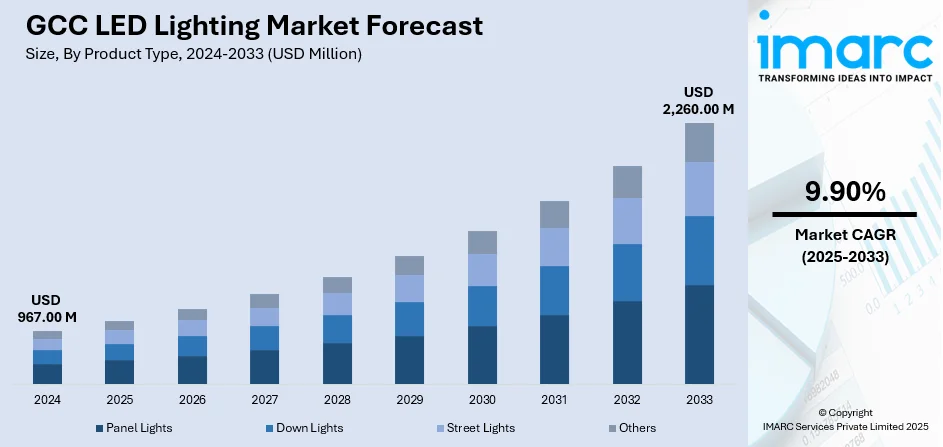

The GCC LED lighting market size reached USD 967.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,260.00 Million by 2033, exhibiting a growth rate (CAGR) of 9.90% during 2025-2033. The rising demand for LED lighting solutions in the commercial and industrial sector, the implementation of favorable initiatives and regulations to promote energy conservation, and significant technological advancement in LED technology are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 967.00 Million |

| Market Forecast in 2033 | USD 2,260.00 Million |

| Market Growth Rate 2025-2033 |

9.90%

|

Light emitting diode (LED) lighting or LED lighting is an advanced and energy-efficient lighting technology. It produces light by passing an electrical current through a semiconductor material, which generates light without the wasteful heat production seen in older technologies. It offers numerous benefits, including significantly lower energy consumption, longer lifespan, and reduced maintenance costs. Additionally, LED lighting's eco-friendliness and durability align well with the rising emphasis on energy conservation and environmental responsibility. Nowadays, LED lighting is gaining immense traction in residential and commercial applications across the region.

The market is primarily driven by the growing awareness of energy efficiency and sustainability practices. In addition, several governments and consumers in the gulf cooperation council (GCC) countries are prioritizing environment-friendly solutions, thus influencing the market growth. Moreover, rapid urbanization and infrastructural development in the GCC led to the escalating demand for light-emitting diode lighting solutions due to their versatility, durability, and ability to provide enhanced illumination for various applications, including street lighting, commercial spaces, and residential complexes, which represents another major growth-inducing factor. Besides this, supportive government initiatives and regulations, including incentives and subsidies, are encouraging the adoption of light-emitting diode lighting to minimize energy consumption and carbon emissions, thus accelerating the market growth. Along with this, the prices of LED products continue to decrease, and the cost-effectiveness and long-term savings associated with lower energy bills and reduced maintenance expenses are encouraging businesses and individuals to adopt light-emitting diode lighting solutions, thus augmenting the market growth.

GCC LED Lighting Market Trends/Drivers:

The rising demand for LED lighting in commercial and industrial sectors

The market is primarily driven by the demand for LED lighting solutions, particularly within the commercial and industrial sectors. In addition, the increasing product demand in the commercial sector, such as retail spaces, offices, and hospitality establishments is influencing the market growth. Moreover, it enhances the aesthetic appeal of the space and contributes to creating a more comfortable and engaging environment for customers and employees representing another major growth-inducing factor. Along with this, increasing usage of light-emitting diode lighting solutions in the industrial sector due to its strength and durability, makes it exceptionally well-suited for demanding industrial environments, ensuring consistent and reliable illumination even in challenging conditions, thus accelerating the sales demand. Also, the potential for substantial cost savings over the long term is a driving factor for businesses in the commercial and industrial sectors to make the transition to light-emitting diode lighting solutions. Besides this, the energy efficiency of LEDs leads to reduced electricity bills, while their extended lifespan significantly lowers maintenance and replacement costs. Furthermore, with the increasing emphasis on sustainability and efficient resource utilization, the rising demand for LED lighting solutions in the commercial and industrial sectors is enhancing operational performance and cost-effectiveness for businesses.

The implementation of several favorable initiatives

The market is driven by the implementation of several favorable initiatives and regulations aimed at promoting energy efficiency and sustainability. Additionally, governments are recognizing the essential role of light-emitting diode lighting solutions in reducing energy consumption and mitigating environmental impact, thus influencing market growth. They have established comprehensive frameworks that incentivize and mandate the adoption of energy-efficient lighting solutions. Also, these initiatives comprise numerous measures, including financial incentives, subsidies, and regulatory mandates. Moreover, financial incentives provide businesses and consumers with tangible benefits for transitioning to LED lighting, effectively offsetting the initial investment costs while subsidies lower the barriers to entry by reducing the upfront expenditure, making light-emitting diode lighting a more financially viable choice which represents another major growth-inducing factor. Besides this, the widescale adoption of light-emitting diode lighting solutions requires specific energy efficiency standards to be met that encourage manufacturers to produce LED lighting products adhering to stringent efficiency criteria and fostering consumer confidence in the technology's capabilities, thus accelerating the sales demand.

GCC LED Lighting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC LED lighting market report, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product type, application, import and domestic manufacturing, public and private sectors, and outdoor and indoor applications.

Breakup by Product Type:

- Panel Lights

- Down Lights

- Street Lights

- Others

Panel lights represent the most popular product type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes panel lights, down lights, street lights, and others. According to the report, panel lights accounted for the largest market share.

Panel lights, known for their sleek and flat design, offer a seamless integration into various settings, making them a preferred choice for commercial and residential spaces, their even and widespread illumination quality enhances visual comfort, making them suitable for office environments, educational institutions, and healthcare facilities, thus contributing to the market growth.

Moreover, the widespread adoption of panel lights is due to their appeal, and energy efficiency, while they consume substantially less energy compared to traditional lighting solutions represents another major growth-inducing factor.

Besides this, several technological advancements in LED panel lights led to improvements in color rendering, dimming capabilities, and smart controls which expanded their utility and attractiveness, enabling customized lighting experiences catering to numerous preferences and requirements, thus accelerating the sales demand.

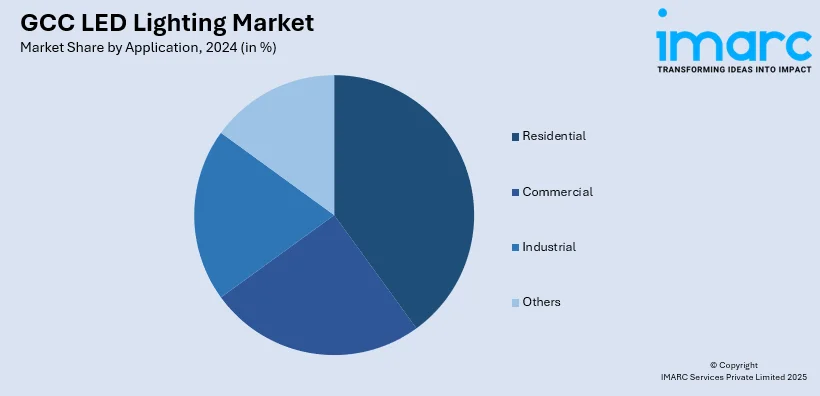

Breakup by Application:

- Residential

- Commercial

- Industrial

- Others

Commercial sector holds the largest share of the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes residential, commercial, industrial, and others. According to the report, the commercial sector accounted for the largest market share.

The commercial application segment comprises several spaces, including offices, retail outlets, hotels, restaurants, and public facilities. They prioritize efficient illumination, aesthetic appeal, and versatility in providing focused and customizable lighting solutions catering perfectly to these requirements.

Moreover, the long operational lifespan of LED lights significantly reduces maintenance efforts and costs, which are essential for businesses aiming to optimize operational budgets, thus representing another major growth-inducing factor. Along with this, the ongoing construction and urban development projects within the region are escalating the demand for lighting solutions in commercial spaces, coupled with the need for sustainable and cost-effective lighting solutions are augmenting the market growth.

Apart from this, the growing emphasis on energy efficiency aligns seamlessly with LED technology's inherent capabilities, while governments in the GCC region are encouraging energy conservation, allowing businesses to adopt lighting solutions that minimize power consumption, thus propelling the market growth.

Breakup by Imports and Domestic Manufacturing:

- Imports

- Domestic Manufacturing

A detailed breakup and analysis of the market based on imports and domestic manufacturing has also been provided in the report. This includes imports and domestic manufacturing.

The imported LED lighting products market is driven by technological expertise, cost competitiveness, and access to a numerous range of products. In addition, manufacturers are employing advanced innovations, making imported LED products attractive to consumers seeking quality and innovation, catering to numerous customer preferences and specialized applications, thus contributing to the market growth.

The domestic manufacturing market is driven by government support, localization initiatives, and the desire to boost local industries. Additionally, GCC countries are recognizing the strategic importance of fostering domestic manufacturing capabilities, leading to investments in research and development (R&D), infrastructure, and skill development, thus augmenting market growth. Along with this, the growing range of locally manufactured light-emitting diode lighting solutions catering to specific regional requirements and preferences, is propelling the market growth.

Breakup by Public and Private Sectors:

- Public Sector

- Private Sector

Private sector represents the most popular product type

The report has provided a detailed breakup and analysis of the market based on the public and private sectors. This includes the public sector and the private sector. According to the report, the private sector accounted for the largest market share.

Private sector enterprises comprise several industries including commercial, residential, and industrial that are recognizing the multifaceted benefits of light-emitting diode lighting. These benefits include energy efficiency, cost savings, improved lighting quality, and reduced maintenance requirements. As a result, private sector players are embracing light-emitting diode lighting solutions as an integral part of their operational strategies, thereby driving their competitive edge.

Moreover, the public sector is displaying a notable presence with their commitment to energy efficiency and sustainable practices are driving increased efforts to integrate LED lighting solutions into public spaces, infrastructure projects, and government buildings, thus representing another major growth-inducing factor. Besides this, the private sector market is driven by the prevailing trend wherein private sector entities wield a substantial influence over the adoption and proliferation of LED lighting solutions.

Breakup by Outdoor and Indoor Application:

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the outdoor and indoor applications has also been provided in the report. This includes indoor and outdoor.

Indoor LED lighting applications include numerous settings, including residential, commercial, and industrial spaces. Additionally, the escalating demand product demand for indoor lighting due to its energy efficiency, versatility, and aesthetic appeal are augmenting the market growth. It offers several types of customizable options, from ambient lighting to task-specific illumination, enhancing comfort and energy savings. Besides this, in commercial spaces such as offices, retail stores, and hospitality establishments, the lighting emitting diode lighting provides an attractive blend of functional lighting and ambiance creation, thus accelerating the sales demand. Also, the industrial sector benefits from the durability and focused lighting capabilities of LEDs, optimizing productivity and workplace safety.

Moreover, the outdoor application market is driven by the rising public infrastructure projects, urbanization, initiatives, and growing demand for architectural lighting. Along with this, the benefits of LED lighting such as durability, longevity, and energy efficiency make them an ideal choice for illuminating roads, highways, public spaces, and landmarks, thus propelling the market growth. Furthermore, the light-emitting diode technology's directional lighting attributes ensure minimal light pollution and effective light distribution, aligning with the GCC region's commitment to environmental sustainability, thus creating a positive market outlook.

Breakup by Country:

- Saudi Arabia

- UAE

- Others

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, UAE, and others (Qatar, Oman, Kuwait, and Bahrain). According to the report, Saudi Arabia accounted for the largest market share.

Saudi Arabia is driven by the growing infrastructural development activities. In addition, rapid urbanization, and the increasing building and construction activities are escalating the product demand rate across the region. Also, the evolving consumer preferences and the growing awareness regarding the benefits of LED lighting solutions are influencing the market growth.

Moreover, the country's proactive initiatives in fostering sustainable development and energy efficiency are significantly driving the market due to the Saudi government's commitment to diversify its economy and reduce energy consumption leading to the widespread adoption of LED lighting solutions across numerous sectors are propelling the market growth.

Competitive Landscape:

Nowadays, key players within the market are employing a range of strategic initiatives to fortify their positions and harness the ongoing opportunities within the industry. These endeavors reflect their commitment to innovation, market expansion, and customer-centric approaches. They are investing extensively in research and development (R&D) to introduce advanced lighting solutions by focusing on enhancing energy efficiency, lifespan, and customization options, catering to evolving consumer preferences and regulatory requirements. Moreover, companies are actively expanding their footprint beyond domestic borders through international distribution networks and localized marketing efforts. Besides this, key players are collaborating with other industry leaders, technology providers, and even governmental bodies to facilitate knowledge sharing, resource optimization, and the development of comprehensive lighting solutions. They are engaging in educational campaigns to inform consumers about the benefits of LED lighting to dispel misconceptions, highlight cost savings, and promote the positive environmental impact of LED technology.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

GCC LED Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Panel Lights, Down Lights, Street Lights, Others |

| Applications Covered | Residential, Commercial, Industrial, Others |

| Imports and Domestic Manufacturing Covered | Imports, Domestic Manufacturing |

| Public and Private Sectors Covered | Public Sector, Private Sector |

| Outdoor and Indoor Applications Covered | Indoor, Outdoor |

| Countries Covered | Saudi Arabia, UAE, Others (Qatar, Oman, Kuwait, Bahrain) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC LED lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC LED lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC LED lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC LED lighting market was valued at USD 967.00 Million in 2024.

We expect the GCC LED lighting market to exhibit a CAGR of 9.90% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations of GCC resulting in temporary closure of numerous manufacturing units of LED lights.

The rising infrastructural development across the retail, industrial, and commercial sectors, coupled with the increasing demand for energy-efficient lighting sources, is primarily driving the GCC LED lighting market.

Based on the product type, the GCC LED lighting market has been segregated into panel lights, down lights, street lights and others. Among these, panel lights currently exhibit a clear dominance in the market.

Based on the application, the GCC LED lighting market can be divided into commercial, industrial, residential, and other segments. Currently, the commercial sector accounts for the majority of the total market share.

On a regional level, the market has been classified into Saudi Arabia, UAE, and others, where Saudi Arabia currently dominates the GCC LED lighting market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)